Article Text

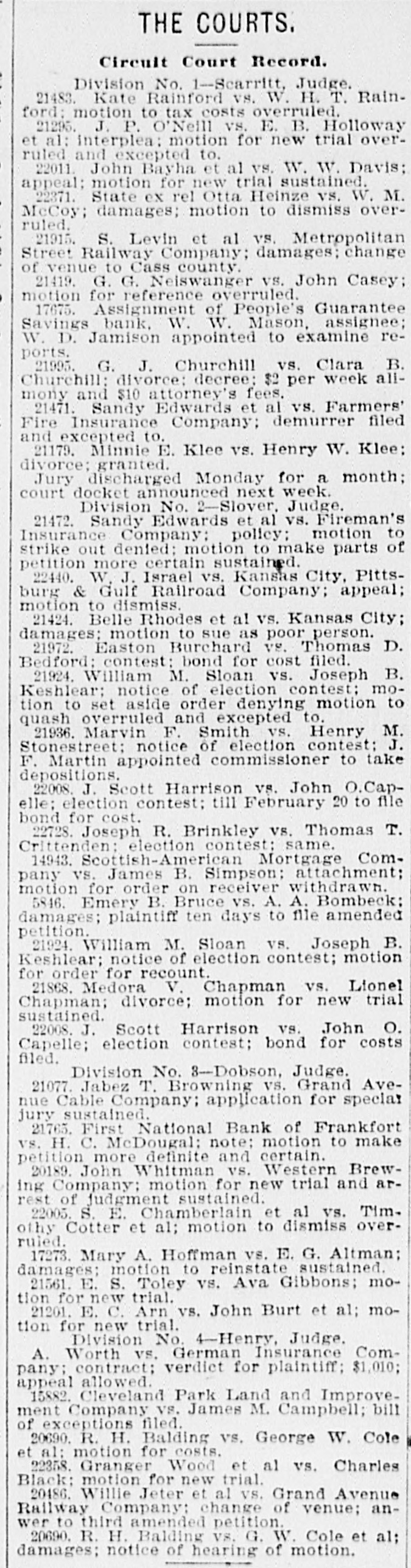

THE Circuit Court Record. Division No. 1-Scarritt, Judge. 21483. Kate Rainford VS. W. H. T. Rainford; motion to tax costs overruled. 21295. J. P. O'Neill VS. E. B. Holloway et al: interplea: motion for new trial overruled and excepted to. 22011. John Bayha et al vs. W. W. Davis: appeal; motion for new trial sustained. 22371. State ex rel Otta Heinze vs. W. M. McCoy; damages; motion to dismiss overruled. 21915. S. Levin et al vs. Metropolitan Street Railway Company: damages; change of venue to Cass county. 21419. G. G. Neiswanger VS. John Casey; motion for reference overruled. 17675. Assignment of People's Guarantee Savings bank, W. W. Mason, assignee; W. D. Jamison appointed to examine reports. 21995. G. J. Churchill VS. Clara B. Churchill: divorce: decree; $2 per week allmony and $10 attorney's fees. 21471. Sandy Edwards et al VS. Farmers' Fire Insurance Company: demurrer filed and excepted to. 21179. Minnie E. Klee vs. Henry W. Klee: divorce: granted. Jury discharged Monday for a month; court docket announced next week. Division No. 2-Slover, Judge. 21472. Sandy Edwards et al VS. Fireman's Insurance Company: policy: motion to strike out denied: motion to make parts of petition more certain sustained. 22440. W. J. Israel vs. Kansas City, Pittsburg & Gulf Railroad Company; appeal; motion to dismiss. 21424. Belle Rhodes et al vs. Kansas City: damages; motion to sue as poor person. 21972. Easton Burchard vs. Thomas D. Bedford: contest: bond for cost filed. 21924. William M. Sloan vs. Joseph B. Keshlear: notice of election contest: motion to set aside order denying motion to quash overruled and excepted to. 21936. Marvin F. Smith vs. Henry M. Stonestreet: notice of election contest: J. F. Martin appointed commissioner to take depositions. 22008. J. Scott Harrison vs. John .Capelle: election contest; till February 20 to file bond for cost. 22728. Joseph R. Brinkley vs. Thomas T. Crittenden: election contest: same. 14943. Scottish-American Mortgage Company vs. James B. Simpson: attachment; motion for order on receiver withdrawn. 5846. Emery B. Bruce vs. A. A. Bombeck: damages; plaintiff ten days to file amended petition. 21924. William M. Sloan VS. Joseph B. Keshlear; notice of election contest; motion for order for recount. 21868. Medora V. Chapman VS. Lionel Chapman; divorce; motion for new trial sustained. 22008. J. Scott Harrison vs. John O. Capelle; election contest; bond for costs filed. Division No. 3--Dobson, Judge. 21077. Jabez T. Browning vs. Grand Avenue Cable Company; application for special jury sustained. 21765. First National Bank of Frankfort vs. H. C. McDougal: note: motion to make petition more definite and certain. 20189. John Whitman vs. Western Brewing Company: motion for new trial and arrest of judgement sustained. 22005. S. E. Chamberlain et al vs. Timothy Cotter et al; motion to dismiss overruled. 17273. Mary A. Hoffman VS. E. G. Altman: damages; motion to reinstate sustained 21561. E. S. Toley vs. Ava Gibbons; motion for new trial. 21201. E. C. Arn vs. John Burt et al; motion for new trial. Division No. 4-Henry, Judge. A. Worth vs. German Insurance Company; contract: verdict for plaintiff; $1,010; appeal allowed. 15882. Cleveland Park Land and Improvement Company vs. James M. Campbell; bill of exceptions filed. 20690. R. H. Balding vs. George W. Cole et al: motion for costs. 22358. Granger Wood et al vs. Charles Black: motion for new trial. 20486. Willie Jeter et al vs. Grand Avenue Railway Company: change of venue; anwer to third amended petition. 20690. R. H. Balding vs. G. W. Cole et al; damages; notice of hearing of motion.