Click image to open full size in new tab

Article Text

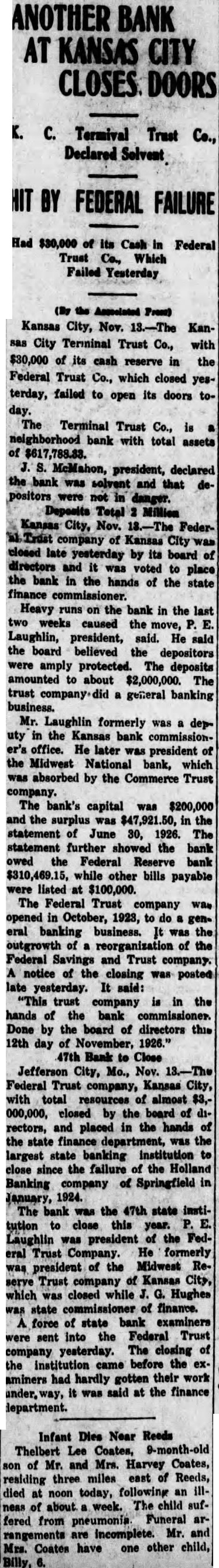

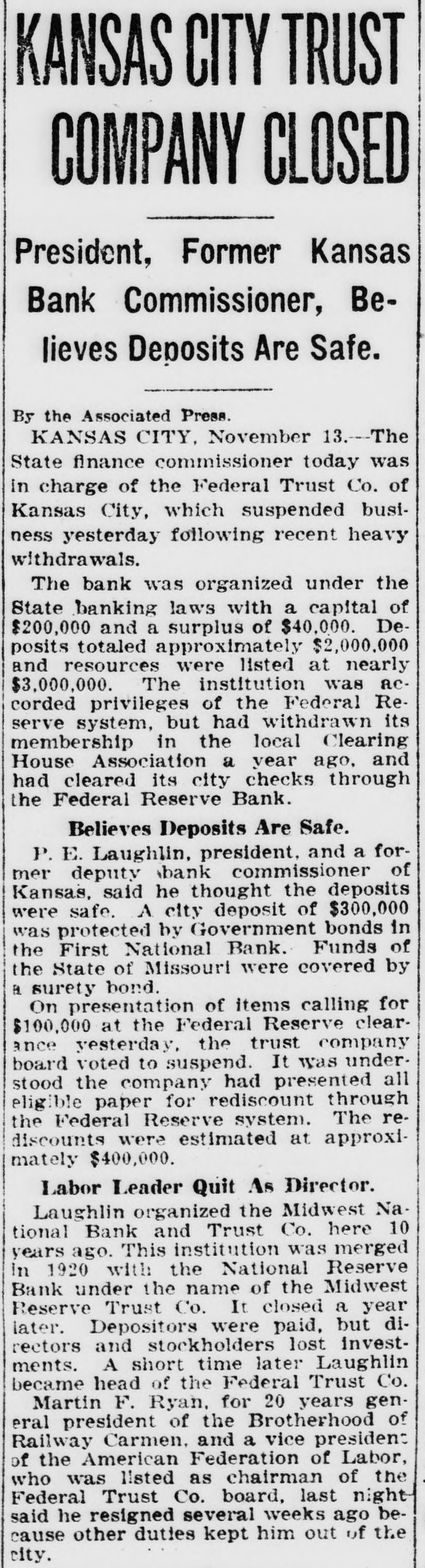

ANOTHER BANK KANSAS CITY

C. Termival Trust Declared Selvent

FEDERAL FAILURE

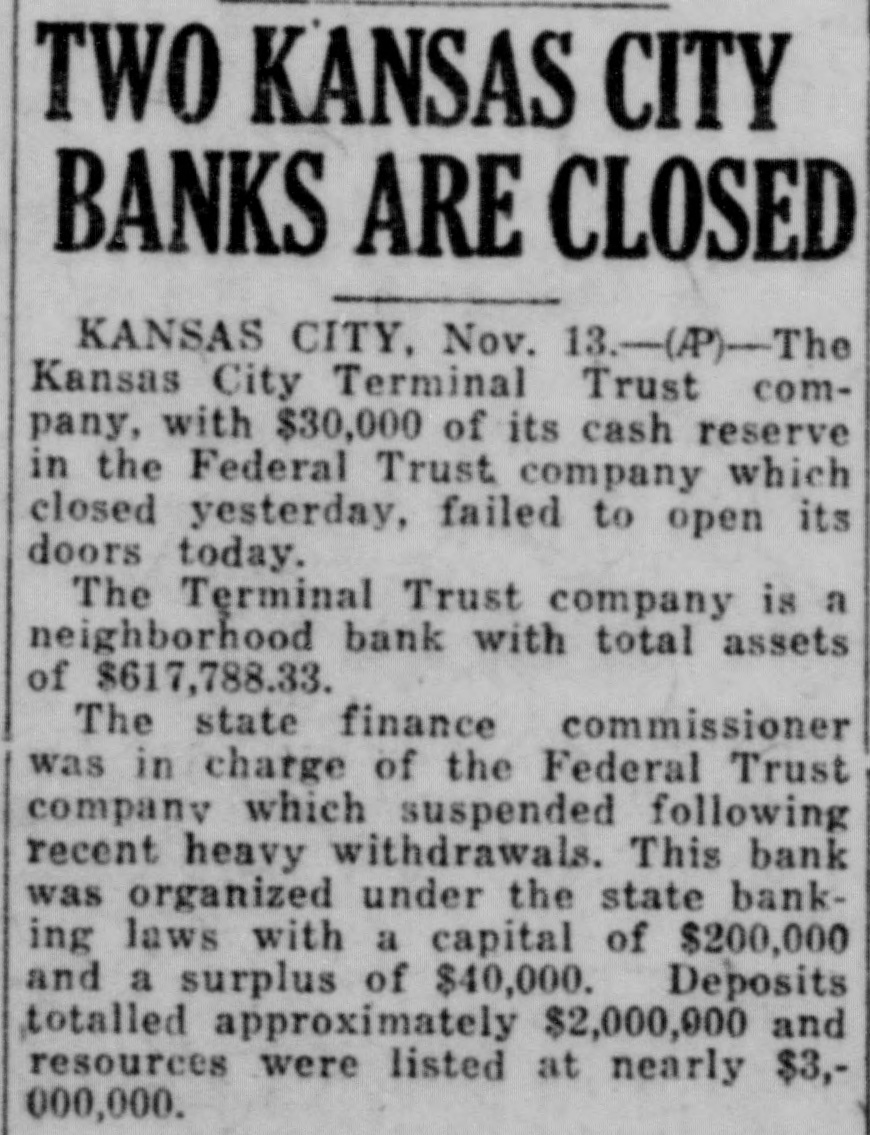

Had $30,000 of its Cash in Federal Trust Co., Which Failed Yesterday

(By the Associated Press)

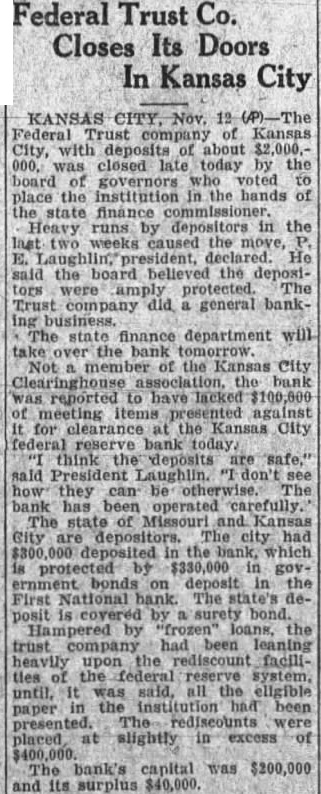

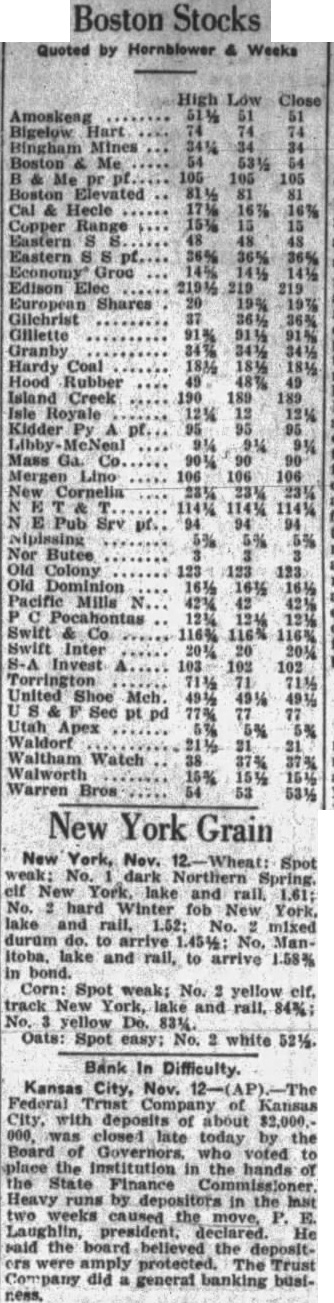

Kansas City, Nov. Kansas City Terminal Trust Co., with $30,000 of its cash reserve in the Federal Trust Co., which closed yesterday, failed to open its doors today. The Terminal Trust Co., is neighborhood bank with total assets of S. McMahon, president, declared the bank was solvent and that positors were not in danger. Deposits Total Million Kansas City, Nov. Federcompany of Kansas City closed late yesterday by its board of directors and it voted was to place the bank in the hands of the state finance commissioner. Heavy runs on the bank in the last two weeks caused the move, Laughlin, president, said. He said the board believed the depositors were amply protected. The deposits amounted to about $2,000,000. The trust general banking business. Mr. Laughlin formerly was deputy in the Kansas bank commissioner's office. He later was president of the Midwest National bank, which was absorbed by the Commerce Trust company. The bank's capital was $200,000 and the surplus was $47,921.50, in the statement of June 30, 1926. The statement further showed the bank owed the Federal Reserve bank $310,469.15, while other bills payable were listed at $100,000. The Federal Trust company was opened in October, 1923, to do a general banking business. was the outgrowth of reorganization of the Federal Savings and Trust company. notice of the closing was posted late yesterday. It said: "This trust company is in the hands of the bank commissioner. Done by the board of directors this 12th day of November, 1926." 47th Bank to Close Jefferson City, Mo., Nov. Federal Trust company, Kansas City, with total resources of almost $3,000,000, closed by the board of rectors, and placed in the hands of the state finance department, was the largest state banking institution to close since the failure of the Holland Banking of Springfield in company January, 1924. The bank was the 47th state institution to close this year. Laughlin was president of the Federal Trust Company. He formerly was president of the Midwest Reserve Trust company of Kansas City, which was closed while G. Hughes was state commissioner of finance. force of state bank examiners were sent into the Federal Trust company yesterday. The closing of the institution came before the examiners had hardly gotten their work it was said at the finance department.

Infant Dies Near Reeds Thelbert Lee Coates, 9-month-old son of Mr. and Mrs. Harvey Coates, residing three miles east of Reeds, died at noon today, following an illness of about week. The child suffered from Funeral arpneumonia. rangements are incomplete. Mr. and Mrs. Coates have one other child, Billy,