Click image to open full size in new tab

Article Text

OSCEOLA CONTRACTS FOR ROAD GRAVELING Sibley, meeting of the of supervisMonday contracts for graveling were let for miles. The lowest bid received from Bing Bros. of Sac City, The first male cents and each additional onehalf mile for cents, this Includes screening. crushing and haulThe stripping let at 20 cents per The roads to be graveled lic south Ocheydan, and west of Ashton, The total expenditure and the total county road $2,358.

BUYS ISLAND JUST FOR COON HUNTING hunters' paradise to established island in the South Skunk river. 20 miles south here. The Island, two miles long and rods wide. owned by Fred WagWaterloo, William Matthews, Detroit. Mich, and Clarence Gussford. Newton. The island was bought from Ross. This the second transfer since the time the owned the land. The of the owners of the island have place where their friends come for hound competition and the capture of coors.

ARE NO OTHERS LIKE THESE INDIAN VILLAGES Cherokee, lecture primitive Indian, high Monday, Charles Keyes, Cornell college, Mt. Vernon, stated that the village sites along the Little Bloux river and tribuCherokee, and Bucounties, and related near the Big Sloux in Woodbury county, unlike anything known The pottery Algonquin nor any heretofore Identified type the The plements and weapons distinct those found in eastern Iowa not closely with those found South The people in earth lodges, the number lodges any discovered village site having been which, Keyes supposes might have RCcomodated population 600 sons. Keyes disposed attribute the ruins to the Mandans, the which tribe cated Fort Berthold, North Dakota

HOWARD CLARK HAS EYES ON SENATE Des Moines, Howard Clark. republican candidate the last primary the office United States senator, candidate governor, he advised his close political friends. Mr. Clark informed those who sought his entry into the torial that he greatest opportunity for service in continuation efforts obtain national legislation favorable agriculture. This statement garded as meaning that Mr. Clark has aspirations to seek the office of United States senator in 1930.

CLOSED BANK PAY 35 PER CENT. Spencer. The money has from Washington to pay per cent. depositors the First NaMonal here. will released by this divipayment which will be paid against the bank. Receiver Frank Corrick states that authorized by the comptroller the currency about days after the affairs the bank checked him by the tional bank examiner.

INTEREST

THE DAIRY An dairyman who dehighest possible butter fat content says: that regularity in milking and for one the of found that practice very commonly How easy sleep for hour longer on Sunday morning to stay in town hour later Saturday afternoon, but this little break in regular routine of the dairyman will soon the dairy herd on the decline production. Cows creatures of habit and will become nervous and restless fed or milked at regular times every day. They will not produce milk good advantage when in this restless condition. have found that varieties ferent grain feeds mixed together will much better returns though the higher. seems that cows will have better appetite and be less liable to feed" when they fed variety. mixture of 300 pounds oats, 100 pounds barley and 100 pounds bran with alfalfa hay and corn silage has been with good success. scoopful feed be weighed Intervals and cows fed accordingly. small scoop for this purpose can be easily made from piece of tin, piece board, and of an fork handle. have found that the poor care and feeding of the calves and dairy helfers is also cause of poor production. Young cattle kept in cold sheds out doors and fed roughages only, cannot grow and develop properly to make the best of Anyone should know that easier for large cow produce large amount of milk and butterfat than for small one produce the amount. Heifers to freshen at too young an also cause of poor herds. the summer months well though the pastures are Cows fed some grain the summer months produce betduring flytime and the season of short, dry pastures and the cows will also be better condition for freshening. Cows good condition at time of freshening will produce more and keep up better than cows that thin in flesh. The keeping of too many to common fault with many dairymen. small herd, well fed cared for, will Invariably produce better returns and net profits than large herds cared for and fed in haphazard way. cups for the cows have proved to very good investment. Dairymen are quick to realize that large producing cows have plendrinking water and have often, which they do not have when watered in tank outside. The saving labor alone would pay for the cups. summary of my experiences would be: Cows should have feeding and care. (2) variety grains should used in the Cows should be fed according their requirements and producing ability. (4) Calves and young should be well fed cared for. (5) High producing should be fed some grain while pasture. Herds should be small enough to be and cared for to produce the greatest profits. (7) Drinking very equipment good dairy farm. Cream separators oftentimes the poor profits from dairy herd therefore should be tested regularly.

WHAT HAS DONE radio has made possible for every farm to in direct with the affairs of the world. the radio must mean more the farmer than any othcitizen. brings him music. formation concerning his business and discussions subjects of tional importance. advises him cerning weather, and brings storles and lullables to help send his young children to dreamland evident the farmer appreciates the radio for, to the United States department of there now farms equipped with radio receiving sets. On July there were little more than half million radio celving sets on the farm. At this

JUST SUPPOSIN' "Suppose that this here vessel." the skipper with groan, 'should lose her bearings, run away, and jump upon stone. Suppose she'd shiver and go down, save selves We couldn't. The mate blow eyes. suppose again shouldn't Us all adopt the mate's yell, when supposin' we're headed straight

Educate the young horses. Don't break them. bite often ruin the disposition horses. rate will not be many years before every farmer will have receiving and will be possible for person to talk the entire farm population of this country. The radio something that passes human and makes wonder what will be the next great invention. difficult to conceive anything that would be more value and than this invention which can pick music speeches from the We accept all this matter of course and to its mysteries and the enjoyment that brings to those who live on the farm. In survey made by the United Department of Agriculture gather facts concerning desires the farmer, was found that they prefer radio talks to music, nearly to formal answers dicate strong dislike for jazz. music, they want old time tunes and music. Aside from the educational farm programs, weather and market ports, political talks evidently popular and more current news grams are in demand.

KEEP HOGS An English stock journal mud baths for pigs. Contrary to the opinion voiced by several authorities this country, this English paper declares that "muddy water, of the right kind, better for plgs than that which clean and pure." of the advantages the mud bath that pigs which are permitted to enjoy the luxury will rarely troubled with vermin during the summer months. and will thrive all the bet. for being free of and other insects which likely to worry this paper continues. in fact, no more easy method attaining this desirable end than to provide the pigs with some sort shallow pool which can filled water and cleaned out periodically. In most the pigs will introduce clent mud for themselves. but, not this should be done for them." Our American pig have pretty much come to the conclusion that the reason pig appears to enjoy the in mudhole on account of the mud but on account the water, and that the average self respecting pig would prefer to have his wallow filled with, clean, pure water to having filled with mud. There may be such thing as "clean mud," but our obserhas been that all mud dirty and most of one another. for the vermin, hogman prefers to keep off the hogs rather than leave up to the hogs to drown them in mudhole. Some of these pests don't too the season here, hog should make point that their hogs have access to plenty of good clean, pure water. Hogs suffer from heat more than most other domestic animals, particularly fat. concrete hog wallow doesn't great deal, and an important feature of the hog Care should be taken to see that does not get filled with contaminated mud. An occasional cleaning and refilling with clean water portant. As far as the mud bath concerned, prefer to leave for those English hogs which according to the London authority. thrive on

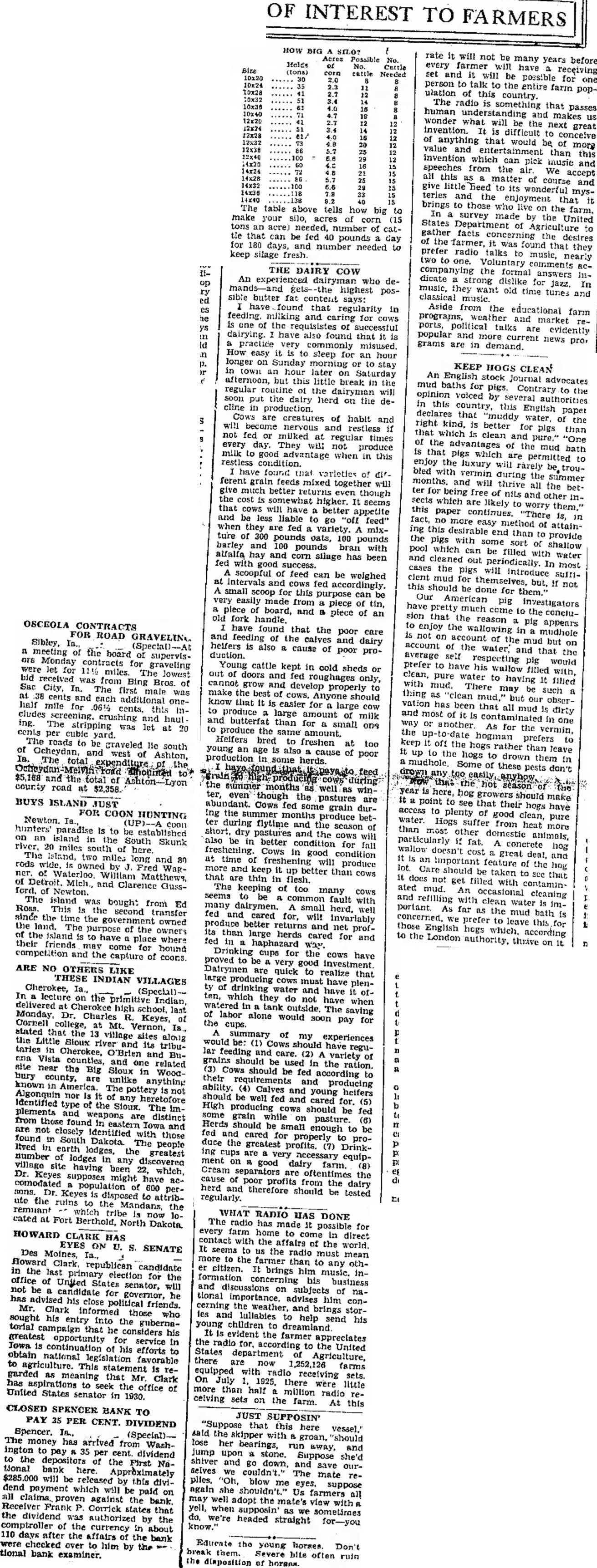

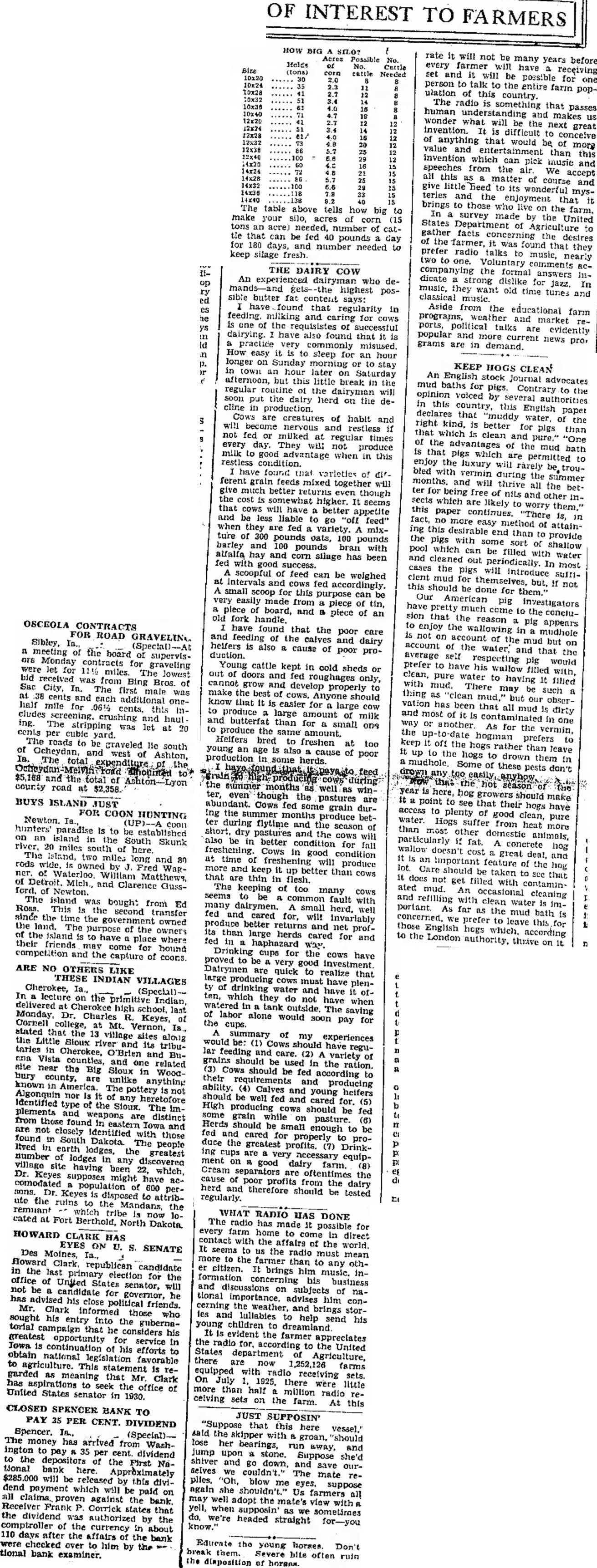

Holds The table above how big make your silo, acres of (15 tons needed, number that can be fed pounds day for 180 days, and number needed keep silage fresh.