1.

February 23, 1933

The Daily Times

Davenport, IA

Click image to open full size in new tab

Article Text

Immediate Payment Of by Detroit Banks Is Planned

DETROIT, Feb. ated Detroit News day says that payment 50 cent deposits in the First and the Guardian National Bank of Commerce Detroit is proposed under reorganization plans now being considered, contemplating the ganization Detroit of two new national banks. The Reconstruction Finance Corp., the News says, has been asked to advance in the neighborhood of to place the plans in effect, and further said that aid is expected from the Federal Reserve bank and New York banks. were understood to under way in New York and Washington concerning the plans under consideration, the paper The Guardian National Bank of Commerce the units the Guardian Detroit Union Group, Inc., some 20 banks operating trust companies in Michigan. other of the members the Guardian Group is the Union Guardian Trust Co., in which Governor William Comstock, in declaring banking holiday Michigan declared "acute financial existed. The bank has emergency" seven other units in the Detroit Metropolitan area. Rudolph Reichert, state banking commissioner, said that most banks were "doing business in the best possible and lated the state's bankers on their during the He said that most banks were cashing checks that had not ready been the depository percentage basis laid down the governor's second proclamation issued Tuesday. Generally, the banks were following plan under operation for the past week in Detroit, lowing depositors withdraw per cent of their deposits. In Detroit at the opening hour there were no lineups outside the banks and few instances of unusual numbers of customers inside. Silent Loan Feb. Couzens Vandenberg of Michigan day declined discuss reports the loan to two

2.

February 25, 1933

The Atlanta Constitution

Atlanta, GA

Click image to open full size in new tab

Article Text

MICHIGAN STUDIES NEW BANK PLANS

Organization of State Reserve Bank Proposed by Senator Orr.

DETROIT, Feb. plans designed aid in releasing billion and half dollars in bank deposits were under scrutiny in Michigan tonight, while bankers awaited and national legislation for the 530 banks operating restrictions. One plan, calling for the issuance of transferra certificates against the frozen deposits of banks, brought forward by Rudolph E. Reichert, state banking commissioner, who under legislation pending before the state legislature would come the virtual banking dictator Michigan. The other, favoring the organization of state reserve was proposed by State Senator HerOrr, Caro, (Mich.) banker. plans make available at once 50 per cent of all deposits by organizing two take over the liquid assets of the First NationDetroit and the Guardian National Bank of Detroit, the two largest in city, were under cussion. Further it appeared, action tomorrow by the house in Washington on the Couzens giving powers over national banks to the comptroller of the currency. The olution was approve imously day by the house committee. Reichert's plan drew state-wide today. He proposed, in effect, the issuance of ferable which would be acceptable in virtually all purposes the same as currency. They would be issued the total volume of deposits that the banks are unable to pay cash. The only limitation circulation, Reichert said, would be the willingness of creditors to accept certificates on their face value. The certificates, Reichert said, aftbeing employed to pay rent, buy food, and other essentials, could be turned into the banks at full face value in payment of obligations owed to the banks. State Senator Orr, declaring he is proceeding with plan for organization of a state reserve bank, said reof many outstate banks now are held in Detroit institutions. which are withdrawals on the same basis as that of other itors- per cent of the total deposited. Under his reserve funds would be carried in outside In most parts of the state today, banks continued to pay out five per cent to depositors.

3.

February 25, 1933

The Cincinnati Enquirer

Cincinnati, OH

Click image to open full size in new tab

Article Text

TWO PLANS STUDIED

Releasing Of Deposits In Banks In Michigan.

Detroit, February plans designed to aid in releasing billion and half dollars in bank deposits under scrutiny Michigan tonight, while bankers waited pending state and national legislation for the 530 banks One plan, for the issuance against frozen deposits of banks, brought by Rudolph Reichert, State Banking Commissioner, under legislation pending before the State Legislature would become the virtual banking dictator Michigan. other, favoring the organization State Reserve Bank, was State Senator Herbert Orr, Mich., banker plans to make available at once 50 per cent of all deposits by banks the liquid the First the Guardian National Bank Commerce, Detroit, the largest in the city, were In most parts of the state today banks continued to pay out per cent to depositors.

4.

February 26, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

BANKS OF DETROIT PLAN SCRIP ISSUE Clearing House Announces Step Pending End of State's Holiday. By the Associated Press. DETROIT, February 25.-The Detroit Clearing House Association tonight announced plans to issue scrip as a medium of exchange in the city pending termination of Michigan's banking holiday. Announcement of the scrip plan came shortly after it became known that further complications in the national bank situation have developed at Washington. threatening to delay resumption of normal business The scrip method was adopted as the most effective device for keeping up business and industrial activity. Details of the plan remained to be worked out. Merchants Seek Loosening. After eight days of almost complete inactivity in banking in Lower Michigan and three more days of operation under rigid limitations laid down by Gov. William A. Comstock, a group of merchants today made the first demands for 2 loosening of the restrictions proclaimed on February 14. Seventy-five Southeastern Michigan business men demanded of the Governor in Lansing that he use his newly acquired extraordinary powers to force the banks to open for more normal business. The group told the Governor they were unable to continue with their funds tied up in banks, and demanded that he require financial institutions to remove restrictions in commercial checking accounts while continuing to safeguard savings withdrawals. The Governor explained that reserves of many out-State banks are tied up in Detroit institutions, which are releasing only 5 per cent. He said that only Federal legislation could compel the Detroit banks to release more. detroit Parleys Continue. In Detroit, meanwhile, conferences continued between large depositors and officials of the First National-Detroit and the Guardian National Bank of Commerce on the proposed formation of two new banks. which. it was expected, will release between 40 and 50 per cent of deposits. Disfavor of the proposal came from one source. In Grand Rapids, Gilbert H. Daane, president of the Grand Rapids Savings Bank and a former president of the State Bankers' Association and two other bankers termed the reorganization plan "discriminatory" and said it "must ultimately work against the interests of out-State banking institutions."

5.

February 27, 1933

Chicago Tribune

Chicago, IL

Click image to open full size in new tab

Article Text

PUTS 8 MILLION INTO TWO NEW

Will Own and Run Both Institutions.

MITCHELL RESIGNS

Charles E. Mitchell resigns head of National City Bank of York on eve of reappearance fore senate banking which has been scrutinizing transactions by Mitchell as executive that bank and its affiliates. Page Seven Cleveland, O., banks and five Akron banks restrictions Dayton city three day bank holiday for city's three banks. Page 23. Indianapolis., Ind., clearing house withdrawals cent of net per ances against hoarding. Page 23.

Back Detroit, Henry Ford came the rescue troit's banks today when he offered his private all the capital stock up banks which are take over the liquid assets of the First National and the Guardian National Bank Commerce. action dramatic finish day tense conferences Detroit's leading bankers and their large depositors, had up o'clock this evening to reach ment they were obtain loans from the Finance cor poration which would enable them weather the storm. The stockholders and depositors during the day were unable to raise the required sum. proposal of the automobile man ufacturer immediately accepted by bankers and large stockholders and under the terms the new setup the banks will open for regular business Wednesday morning. Releases 30 Per Cent Deposits.

Bankers estimate about per cent the deposits the old banks will available in the new banks cash this amount will be obtained from the liquid assets of the old banks, the capital put up by Ford and loans approximating from the Reconstruction Finance corporation. The balance depositors will liquidated when possible. The in which this to be done has not been decided Meetings of the large depositors of the banks, which include more than of the city's leading mercantile and men, followed meetings of directors of both banks. The Ford proposal was to the positors by Wilson W. Mills, chairman the board of the First National bank. motion for its approval made Hutchinson, president of the Chrysler corporation. was immediately seconded and voted. It was explained one reason for Mr. Ford taking all the stock in the two banks that has definite ideas how banks should be run. He said to believe that should be made for productive and not speculative purposes." The for the two banks come from Ford's gigantic cash sources. He is to have the largest accumulation of cash and government securities individual in the United States.

Has Huge Cash Reserves.

The action taken tonight seen here which will improve general banking conditions throughout the state. Deposits the banks smaller cities and towns of Michigan have been considered ordinary deposits and drawal has not been permitted under the terms of the general holiday. Ford's expected to release the major part of these funds to the smaller

Statement by Ford.

The statement issued by Mr. Ford and Edsel B. Ford, the proposal follows: depositors and directors the First National of the Guardian National are ready to join in the [Continued on page column

6.

February 27, 1933

The Macon News

Macon, GA

Click image to open full size in new tab

Article Text

U. S. Moves to Strengthen Banks

NEW TREASURY HEAD TALKS TO MILLS

Woodin Called Into Conference as Federal Aid Is Extended Institutions

MONEY TO BE ADVANCED MICHIGAN ORGANIZATION

Feb. 27. The federal government Monday prepared to exert all available to strengthen weakened links in the country' banking system. William H. Woodin, secretary of the was here conference the outgoing are to act, not the said. With those words he turned aside all queries regarding the banking situations caused Michigan and Maryland to close their banks temporarily and led banks in number of Ohio cities limit withMills Sunday conferChairman Eugene Meyer of the federal reserve board assistance the treasury the banks could Directors the Reconstruction Finance corporation continued their study the They met in two protracted secret sessions Sun- m unusually authoritative sources was reported the R. F. has agreed to the two big Detroit banks reorganized new capital supplied by Henry Ford. said in the same quarter that an additional $40.would advanced by other financial institutions

FORD FINANCES two BANKS Detroit buttressed the lions Henry Monday came the of plans lead Michigan out of the difficulties which in the of statewide banking holiday two The banks whose capital will consist 250,000 furnished by Mr. and his are expected to open for business They be built from the of the First National Bank and the Guardian National Bank of whose depositors be able receive immediately about cent of their Disbursement remaining 70 per cent must await the Continued on Page

7.

March 21, 1933

Hickory Daily Record

Hickory, NC

Click image to open full size in new tab

Article Text

New Detroit Bank Formed With Capital; Aid

WASHINGTON, March formation bank, the National Bank Detroit, capital of twenty-five lions dollars was day by the Corporand Alfred Sloan, dent of the General Motors corSecretarv Woodin approved the The announcement was made treasury, where been for days solution Detroit banking problems. bank will take over part of the assets the First National bank and the Guardian National Bank Commerce Detroit and sume part the deposits. Half of the capital. will be form of subscription the common stock and has paid by General Motors Corporation. The balance has been supplied the United States government through the Reconstruction nance form subscription to the preferred

8.

March 21, 1933

The Niles Daily Star

Niles, MI

Click image to open full size in new tab

Article Text

Reconstruction Finance Corporation to Supply

March tional bank of Detroit, with capital millions dollars nounced today. by the Reconstruction corporation and Alfred Sloan, president of the General Motors corpora- approved the

The announcement made the toward solution of De the new bank the assets First National bank and the Guardian National Bank of of Detroit and assume part of the deposits, Half of the capital. will be in form of subscription the

The balance has been supplied by the United States through the Reconstruction Finance corporation in the and the joint statement make available bank with ample The statement issued by Jesse Jones, of the Finance that and old and out of legal per cent of their net deposits will be immediately made the the two old This, statement said, will be made quisition the more liquid assets and the GuardNational Bank of Commerce.

Officials of the Grand Rapids Savings bank today attempting to fulfill details of financing program out(Continued

9.

March 25, 1933

The Roanoke Times

Roanoke, VA

Click image to open full size in new tab

Article Text

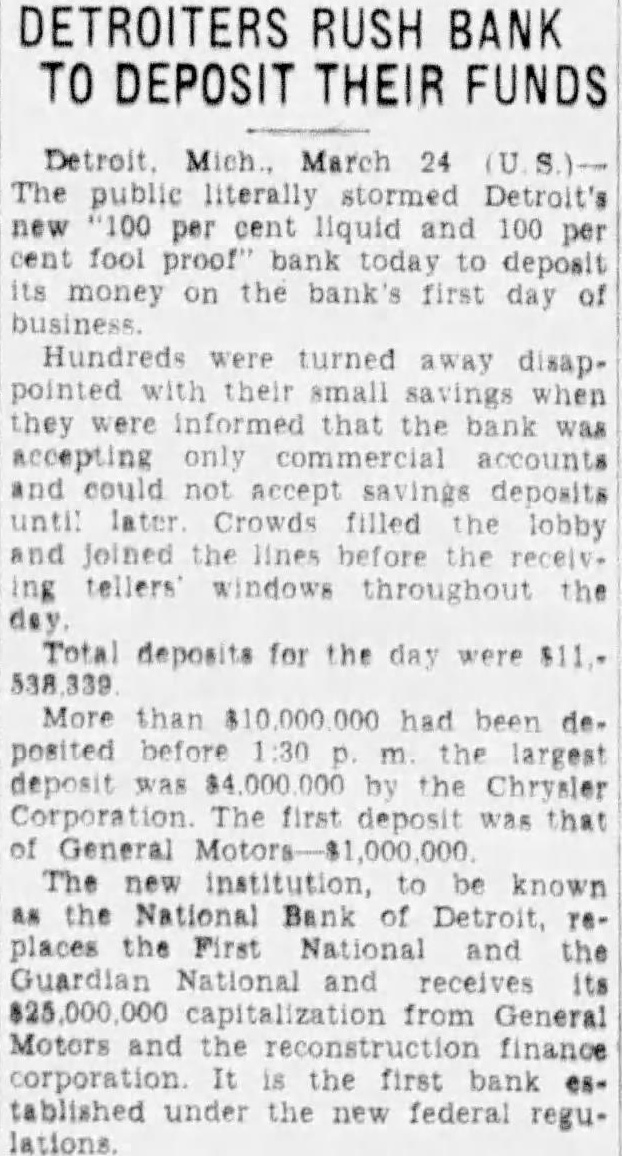

DETROITERS RUSH BANK TO DEPOSIT THEIR FUNDS

Detroit Mich. March 24 The per cent liquid and 100 fool deposit money on the bank's day turned away savings they that accepting only could deposits ing tellers the Total deposits for the day More than had been posited largest deposit was the deposit was that General The known the Guardian National and General Motors and the finance the tablished under new federal

10.

June 27, 1933

The Times Leader

Wilkes-Barre, PA

Click image to open full size in new tab

Article Text

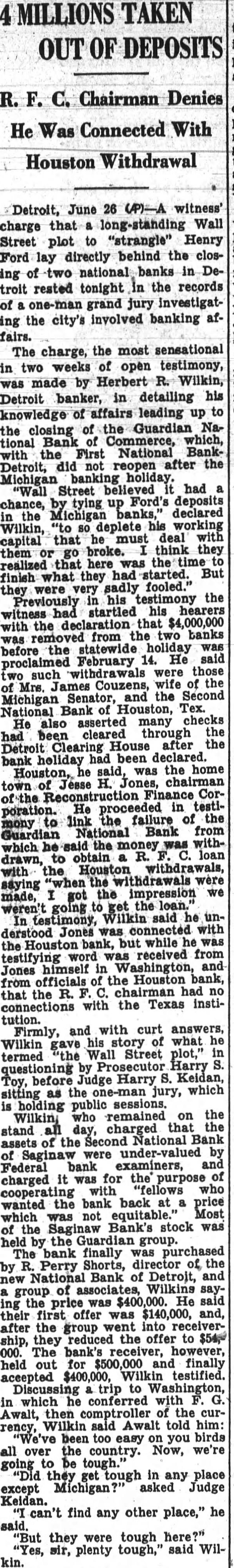

MILLIONS TAKEN OF DEPOSITS

Chairman Denies He Was Connected With Houston Withdrawal

Detroit, June 26 (P)-A witness' charge long-standing Wall Street plot to "strangle" Henry Ford lay directly behind the of two national banks in Detroit rested tonight in the records grand jury investigating the city's involved banking afThe charge, the most sensational in two weeks of open testimony, made by Herbert Wilkin, Detroit banker, in detailing his knowledge of affairs leading up to Guardian Naclosing Bank which, tional First National BankDetroit, did reopen after Michigan Street believed deposits had Ford's chance, declared Wilkin, deplete working capital that must broke. think they them was the time finish realized they fooled." But were sadly testimony the witness startled hearers the declaration that $4,000,000 banks from the statewide holiday before February 14. He proclaimed withdrawals those such and the Second Michigan National Bank Houston, asserted many checks He cleared through Detroit Clearing House after heliday had been declared. was the home Houston, Jesse Corin testiHe link the failure National Bank from Guardian which he said the loan drawn, to obtain Houston withdrawals, with the saying the the impression made, Wilkin said Jones with bank, while was received from testifying himself and Jones officials the Houston bank, from that the with the Texas connections with curt answers, Firmly, Wilkin what gave Wall Street termed Harry questioning Harry Keidan, before Judge the one-man jury, which sitting as public who remained on charged that stand assets of the day, National were under-valued Federal bank examiners, charged it for "fellows cooperating the bank back price wanted Most which not Saginaw Bank's stock was bank finally purchased Perry Shorts, director Bank of Detroit, and associates, Wilkins price He offer was $140,000, and, the group went into the offer to $54 bank's for and finally accepted testified. which conferred with Awalt, then comptroller of the curWilkin said Awalt told too all country. Now, they tough in any place except Judge Keidan. can't find any other place," "But they were tough plenty tough," said Wilkin.

11.

June 27, 1933

Reading Times

Reading, PA

Click image to open full size in new tab

Article Text

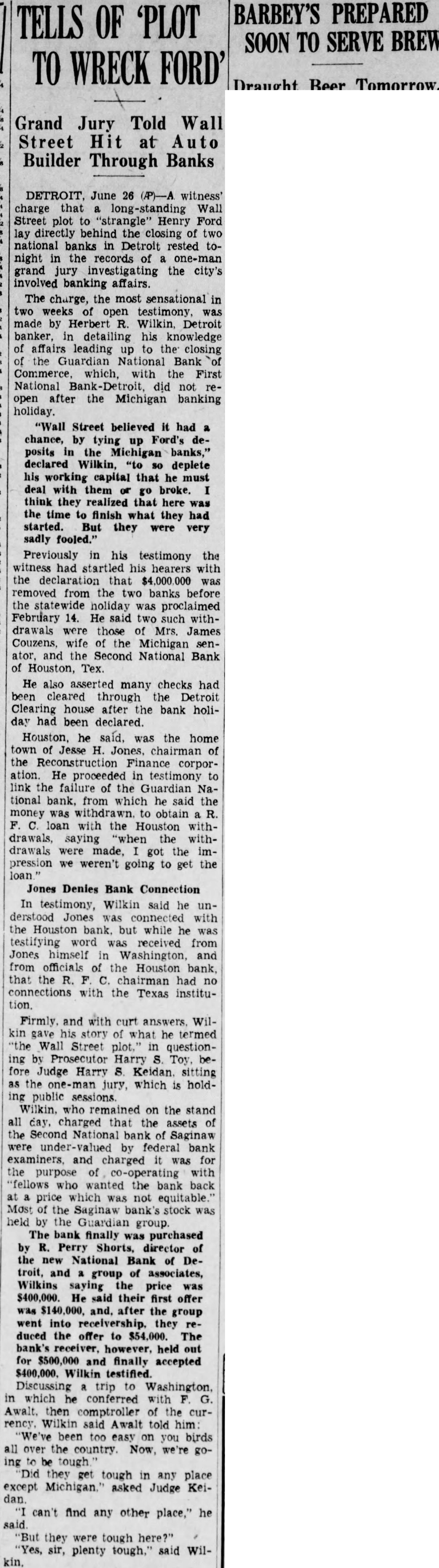

BARBEY'S PREPARED TELLS OF 'PLOT SOON TO SERVE BREW TO WRECK FORD' Draught Beer Tomorrow,

Grand Jury Told Wall Street Hit at Auto Builder Through Banks

DETROIT, June 26 (P)-A witness' charge that a long-standing Wall Street plot "strangle" Henry Ford lay directly behind the closing of two national in Detroit rested tonight in the records of grand jury investigating the city's involved banking affairs. The charge, the most sensational in two weeks of open testimony, was made by Herbert R. Wilkin, Detroit banker, in detailing his knowledge of affairs leading up to the closing of the Guardian National Bank Commerce which, with the First National Bank-Detroit, did not reopen after the Michigan banking holiday.

"Wall Street believed it had a chance, by tying up Ford's deposits in the Michigan banks," declared Wilkin, "to deplete his working capital that he must deal with them go broke. think realized that here was the time to finish what they had started. But they were very sadly fooled." Previously in his testimony the witness had startled his hearers with the declaration $4,000.000 was removed from the two banks before the statewide holiday was proclaimed February 14. He said two such withdrawals were those of Mrs. James Couzens, wife of the Michigan senand the Second National Bank Houston, Tex. He also asserted many checks had cleared through the Detroit Clearing house after the bank holiday had been declared. Houston, he said, was the home town of Jesse H. Jones, chairman of the Reconstruction Finance corporation. He proceeded in testimony to link the failure of the Guardian National bank, from which he said the money was withdrawn. obtain R. with the Houston withdrawals, saying "when the withdrawals were made, got the impression we weren't going to get the

Jones Denies Bank Connection

In testimony, Wilkin said he understood Jones connected with the Houston bank. but while he was testifying word was received from Jones himself in Washington, and from officials of the Houston bank, that the R. F. chairman had no connections with the Texas institu-

Firmly. and with curt answers, Wilkin gave his story of what he termed "the Wall Street plot,' in questioning by Prosecutor Harry S. Toy. before Judge Harry S. Keidan. sitting as the one-man jury, which is holdpublic sessions. Wilkin. who remained on the stand all day, charged that the assets of the Second National bank of Saginaw were under-valued by federal bank examiners, and charged it was for the purpose of co-operating with 'fellows wanted the bank back at price which was not equitable Most of the Saginaw bank's stock was held by the Guardian group. The bank finally was purchased R. Perry Shorts, director of the new National Bank of Detroit, and group of associates, Wilkins saying the price was $400,000. He said their first offer was $140,000. and, after the group went into receivership. they reduced the offer to $54,000. The bank's however, held out for $500,000 and finally accepted $400,000. Wilkin testified. Discussing trip to Washington, in which he conferred with F. G. Awalt. then comptroller of the currency. Wilkin said Awalt told him We've been too easy on you birds all over the country. Now, we're gobe tough Did they get tough in any place except Michigan." asked Judge Kei- can't find any other place," he "But they were tough here?" "Yes, sir, plenty tough,' said Wil-

12.

June 27, 1933

The Tribune

Scranton, PA

Click image to open full size in new tab

Article Text

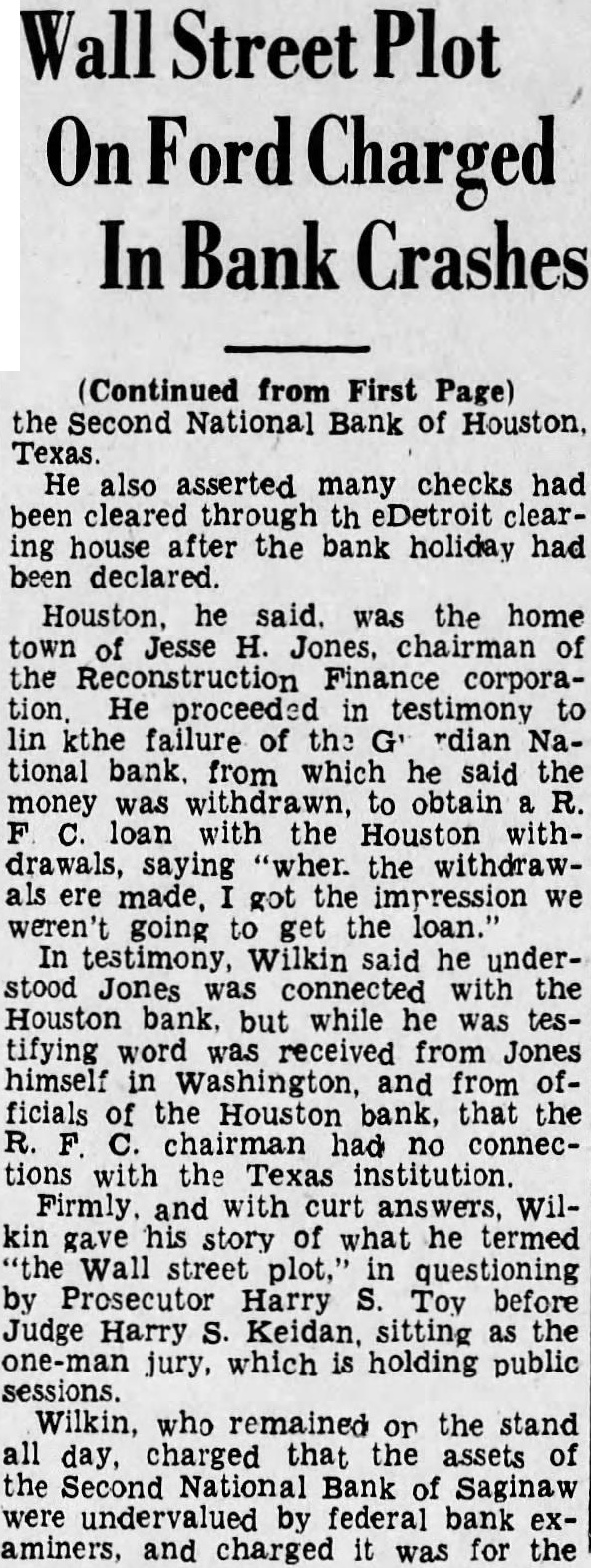

Wall Street Plot On Ford Charged In Bank Crashes

(Continued from First Page) the Second National Bank of Houston, He also asserted many checks had been cleared through eDetroit ing house the bank holiday had been declared. Houston, he said. was the home town of Jesse H. Jones, chairman of the Reconstruction Finance corporation He proceeded in lin kthe failure of the G' rdian National bank. from which he said the money was withdrawn, to obtain loan with the Houston withdrawals, saying "wher. the withdrawals ere made, got the impression we going get the loan. In testimony, Wilkin said he understood was connected with the Houston bank. but while he was testifying word was received from Jones himself Washington, and from officials of the Houston bank, that the chairman had no connections with the Texas institution Firmly and with answers, Wilkin his story of what he termed "the Wall street plot,' in questioning by Prosecutor Harry S. Toy before Judge Harry Keidan, sitting as one-man jury, which is holding public sessions. Wilkin, who remained the stand all day, charged that the assets of the Second National Bank of Saginaw were undervalued by federal bank examiners, and charged was for the

13.

June 27, 1933

Richmond Times-Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

Banker Alleges Wall St. "Plot" Against Ford

Heavy Withdrawals Were Made Before Holiday to Tie Up Deposits, Charge

DETROIT June 26-(P)-A witness' charge that long-standing Wall Street plot to "strangle" Henry Ford financially lay directly behind the closing of two national banks in Detroit tonight rested in the records of one-man grand jury investigating the city's involved banking afThe charge, the most sensational in two weeks of open testimony, was made by Herbert R. Wilkin. Detroit banker, in detailing his knowledge of affairs leading up to the closing of the Guardian National Bank of Commerce which, with the First National Bank-Detroit, did not reopen after the Michigan banking holiday "Wall Street believed it had chance, by tying up Ford's deposits in the Michigan banks declared Wilkin to so deplete his working capital that he must deal with them

14.

July 6, 1933

The Flint Journal

Flint, MI

Click image to open full size in new tab

Article Text

Says Only Lack of Unity in Detroit Was in G. M. and Chrysler Wanting to Play by Themselves.

July today one-man Detroit that charge he reopen two closed to national here, the declaration companying the government deposibanks could and return tors 100 their investment part stockholders. in said The upward trend counsel Thomas National Bankthe closed would be of great in and the closed Guardian tional of Commerce His tional Bank added similar stateto half dozen other made by ments jury in the past pay per on the adjournment today witness previously attribdenied charges to of among lack and depositors ers of plans. out lack he right from the said, start group of played witnesses officials from the motor declared companies did not agree reorganization plans for the Judge Harry charge of the today president of General Mott. and promiMotors corporation will nent Mott connection the mentioned Guardian Detroit Union in reference to his to 30 Page Column 2)

15.

July 7, 1933

The Saginaw News

Saginaw, MI

Click image to open full size in new tab

Article Text

PLANS IGNORED. BANK JURY TOLD

Abrupt Appointment of Receivers in Midst of Conference Detailed.

(By Associated Press.)

DETROIT. July .-Donald A of the closed First National Bank-Detroit. told the one-man Detroit bank jury to. day that the appointment of fedreceivers for First Naeral tional and the Guardian National Bank of Commerce with unexplained abruptness. the midst Washington on plan for re-opening the banks Sweeney detailed the conference before the jury after Charles Mott, vice-president General Motors and former Flint banker. had defended before the jury his transfer ian Union Group stock another Guardian official Mott stated firmly that he felt justified legal means' to avoid using stockholder's assessment on the 30,000 shares. transferred before the state banking Waited 3 Days for Appointment. Describing the Washington Sweeney said Leo M Butzel. Detroit Col. Frederick M Emory W Clark. representing the First Na tional Col. James Walsh. rep. resenting the Guardian National bank. ending their third day in finally obtained then comptroller of the currency to discuss their plan for re-opening the two banks He said had been unable to see Secretary of the Treasury liam H. Woodin. and Mr. Butzel began to outline the which the approval the both said Sweeney had been bout an hour and had plan when the rang asked he had been requested to see his secretary

All Very Dramatic. went the gone 30 We waiting back Without he pressed and orodered the Make for Paul Keyes as the Detroit banks Send telegrams to that effect to on Page Column

16.

July 14, 1933

Jackson Citizen Patriot

Jackson, MI

Click image to open full size in new tab

Article Text

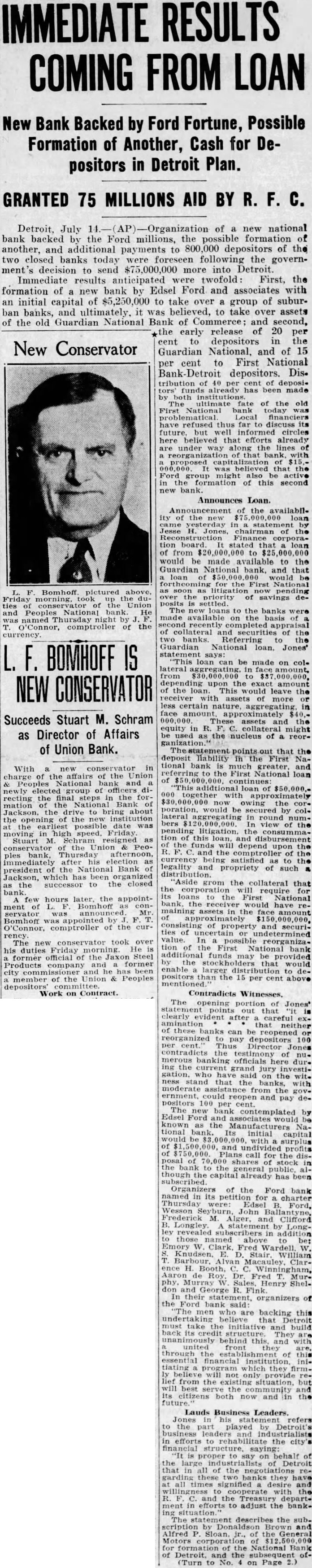

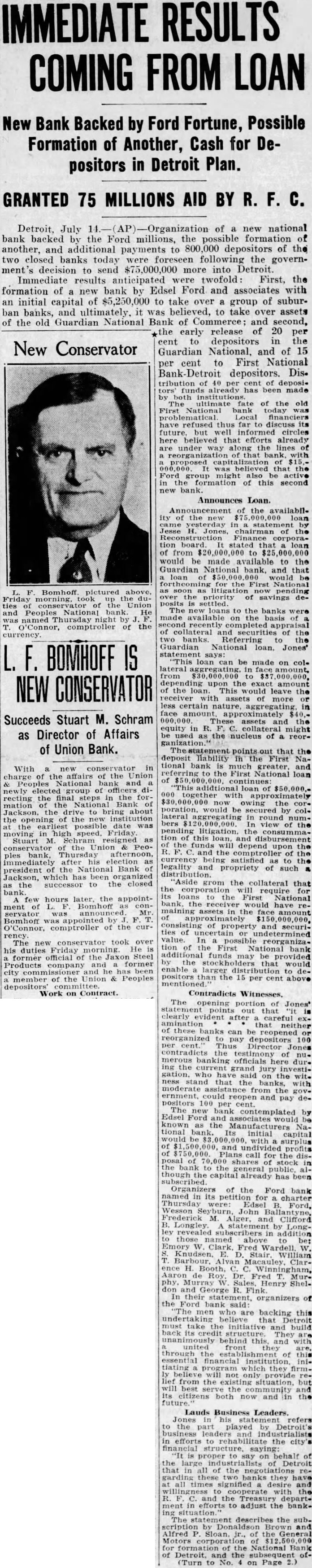

IMMEDIATE RESULTS COMING FROM LOAN

New Bank Backed by Ford Fortune, Possible Formation of Another, Cash for Depositors in Detroit Plan.

GRANTED 75 MILLIONS AID BY R. C.

Detroit, July of new national bank backed the Ford millions, the possible formation of another, and additional payments to 800,000 of the two closed banks today were foreseen following government's decision to send $75,000,000 more into Immediate results anticipated were twofold: First, the formation of new bank by Edsel Ford and associates with an initial capital $5,250,000 to take over group of suburban banks, and it was believed, to take over assets of the old Guardian National Bank of Commerce: and second, the early release of 20 cent to depositors in the New Conservator Guardian National. and of 15 cent First National per Bank depositors. Dis. tribution of deposialready made by ultimate of the old bank Local financiers have thus far discuss informed circles believed that efforts already under along lines the Ford group active formation this second

Announces Loan.

Announcement the availability of the came Finance tion board. that of from to would be made available to the Guardian National bank, and that loan would National of to the banks were made available basis of collateral securities of banks. Guardian National Jones' statement says: loan be made on colfrom upon the exact amount of the loan This would leave the receiver assets more certain nature, aggregating. in assets equity used the nucleus of a reorpoints out that the deposit liability First tional much greater. First National loan of adidtional loan with owing poration, would be secured by collateral round view the pending litigation. tion this loan, and the funds will depend upon the comptroller the currency satisfied legality propriety such "Aside grom the collateral that the its loans the First National bank, would have of property securiof undetermined value. In possible reorganizathe First National bank may be provided the that would enable larger positors the 15 per cent above Contradicts Witnesses.

The opening portion Jones' statement points that clearly after careful that neither can reorganized pay depositors 100 Thus Director contradiets banking officials here ing current grand jury investithe ness that moderate the could reopen pay per cent. Edsel new contemplated by known tional bank. the initial capital would with and undivided for shares bank general though already has the Ford bank named in charter Thursday Wesson Frederick John Clifford Longley. statement Longaddition those be: Knudsen, William Alvan Clarence H. Booth, Dr. Fred Henry Sheltheir statement, organizers of the Ford bank said: are backing Detroit build back its structure. this front through of financial tiating which not provide from the community its citizens both now and the

Lauds Business Leaders the part played business leaders efforts to rehabilitate the city's saying: on of the garding they times signified desire cooperate Treasury efforts adjust the bankThe describes the by Donaldson Alfred the Motors the National Bank and the of(Turn to on Page

17.

July 14, 1933

The Flint Journal

Flint, MI

Click image to open full size in new tab

Article Text

LOAN SPURS DETROIT BANK CONSIDERATION together with owing the would collateral aggregating round numIn view of the litigation, loan, disburseof funds depend satisfied the propriety of distribution. the collateral that corporation require loans to First National bank, the have in securities undetermined of First National bank. would the 15 per cent Neither Can Pay All"

The opening Jones' careful examination these reopened reordepositors officials during investigation, witness and pay depositors bank contemplated by Manufacturers Its capital call for shares bank the although the has Organizers of the Ford bank named petition Edsel John M. Alger, and Clifford B. Longley statement by Longley subscribers addition to those named above Clark, Fred Emory Knudsen, Stair, William Barbour, Macauley, Clarence H. Winningham, De Roy, Fred Henry Shelden and George organizers the Ford backing this are undertaking believe that Detroit must initiative and build credit structure They back are unanimously behind with united front through this essential itiating they firmly will not vide existing tion, will best serve munity citizens both now and Jones in his statement the part by and efforts financial on behalf of troit that all of the negotiations banks all times signified and with the Treasefforts just the banking situation. Subscriptions

The describes by Donaldson and Alfred Sloan, for formation of the National of the stock for Ford and others were vited that time part the Walter Chrysler felt and positors the National made through The Ford statement the and the Dearborn another the and industry the general should understood there the big bank and Bank Motors Mr. Chrysler made that desire engage in only giving possible the Charter Application Mailed mailed today the Longley the new bank possible the application approved. for asGenNational Guardian independent of proposed depositors cleanchairthe First today brandthe statement Jesse H. Jones, the effect the of made effort bank banks to the by 'Never, the bank holiday did government begged do and, matter at 10 o'clock the night the issued his bank holiday Jones, asking of First National," he said, given for penny even the solitary cent. gotten the R. the First National would the the the plan up. But when we asked for the down though loan to our the grand Judge Keldan, but would testify government failed before the granting the loan from the five the for the closing the First Nasaid they believed the grand jury would reopen others that Couzens, gate the world has that his the bank Sees Quick "Payoff" Schram, federal receiver of Guardian National bank, the bank payoff, obstacles, would stand in the tion. He not on the the Emory former director of the First National, and Edsel follows of Jones, the feature of the Jones the standpoint of the working for the in the willingness the and stockholders the two instiwhich will permit the reorganiza banks basis. does not mean 100 release deposits but rather that the may be lifted property to the people "Following the his Jones the his tention co-operate to that will be possible the comptroller announce completed plans for reorganization.' next stage of the flight to squadron which yesterday got Montreal scheduled before Italian visitors Fascist planes arrived from here. the armada the fleet about six ten what better than average 130 istered far the cruise Orbetello, Italy. happy. the young. five of the and sister Bennett: Dr. Murray minister pensions and TilBurnswick Shediac gay British and and thousands the the the the who kissed him cheeks. little but squadron landing perfectly.

Invited to Mt. Clemens

Mt. Italo Balbo and Italian armada, route Chicago, today to Selfridge field for luncheon invitation by Frank mandant the Mt. Clemens Balbo care of the Italian counsel Montreal.

Lindy Flies North

July Lindbergh Mrs. Lindbergh arrived morning their aerial mapping tour northland afternoon for Cartwright, Labrador.

Chicago, July Despite and the exposure followed crash his plane Siberia, Jimmie Mattern decomplete alone flight around the world cable his today where he was strandNome, Alaska. Nome would obtain plane taken relief William AlexanAnadyr that point about the globe trip.

July Tass (Russian) agency today Pilot Levanoff from Khabarovsk ing for Anadyr pick the stranded Ameraviator.

18.

September 2, 1933

The Washington Times

Washington, DC

Click image to open full size in new tab

Article Text

U. S. Receiver Raps Detroit Bank Chiefs DETROIT, Mich., Sept. 2 (U. S.).-A vehement statement by the Federal receiver of the Guardian National Bank, accompanying suits to collect stock assessments against four directors, stole the limelight here today from the bank grand jury. B. C. Schram, receiver, said: "We came here to collect assets, and to distribute them to their owners, the depositors. We feel the time has come to act. From now on there will be plenty of action."

19.

December 18, 1933

Battle Creek Moon-Journal

Battle Creek, MI

Click image to open full size in new tab

Article Text

$540,000,000 AVAILABLE TO PAY DEPOSITS

R. Authorizes Money For Freeing Assets Of Closed Banks.

(Continued from Page One.) plan to expected to approve within the next $5,000,000 few vance days to the Guardian National Bank of Commerce in Detroit in deposits under order that be paid off 100 would cent.

Money By Christmas Jones said that expected this money into the hands of now the small depositors and Christmas Jones said that the big Guard ian depositors holding 52 per cent of the total deposits agreed subordinate their interests so that the payment could go to small depositors. He expressed the hope that the First National Bank of Detroit would work out similar plan as many of the large Guardian depositors also are depositors in the First National Subordinate Deposits. Among the large Guardian National bank which the have agreed to subordinate their deposits were understood to be Henry Ford, the General Motors corporation. and the Packard Motor Car company In the First National bank. was estimated today that depositors in the bank had deposits of less than In connection with the progress in banking troubles. Jones said that repayments to the Reconstruction Finance corporation from past loans had now crossed the mark and were com ing in the rate of daily He said that total of $2 282,000,000 in RFC securities had been sold the treasury in car rying out RFC activities

20.

December 19, 1933

Detroit Free Press

Detroit, MI

Click image to open full size in new tab

Article Text

RFC Hopes to Relea All of $1,000 Accou

Assets Held Certain to Cover with $500 or Less, but Go Is the Higher Figure

(From the Press Bureau) WASHINGTON, Dec. 18-Jesse H. Jones, ch the board of the RFC, and Comptroller of the Curr T. O'Connor were working together today in paving for a full payoff to First National Bank small deposi Mr. Jones ordered a recheck of the bank's asset to decide to what extent the Government may go undertaking. He said that he believed the collateral pledged to pay in full depositors with $500 or less in the ba time of closing, but added that he was anxious to m sufficient to pay those who had up to $1,000. A 100 per cent payoff to depositors who had $1,000 in the Guardian National Bank of Commerce has alr made possible through the com-* bined efforts of Jones, CompGuardian troller O'Connor and the large depositors. Jones said that the RFC had made available the necessary and that Ready for O'Connor had informed him that the payoff would be expedited. Bank Inquiry The RFC has made total commitments of $83,600,000 the First Tuesday in o National, part of which has not been drawn and part repaid, so that the bank's receiver owes the By Clifford A. P RFC approximately $60,000,000. No exact figures available, mer officials of the but that additional troit Union Group, holdi loans about $19,000,000 will the closed Guardi required to make full payoff Bank depositors $500 and Tuesday morning to $6,000,000 more do the same the Senate Banking for those had up to $1,000. whether Frank 5-Million Loan to Guardian board chairman of

The payoff is being ac. through an RFC $5,000,000 which about $2,000,000 being by big provide 100 per cent dividend for the small question in my mind is that whether be too much of the large depositors to extend the to had less in the bank, Mr. Jones said. large depositors in the Guardian Bank Cam did splendid thing when they agreed freeze their help the little felunderstand that they same large depositors in the National Bank The latter institution means that they make the sacrifice The $19,000,000 the the case may vanced to make further disbursement cent to all First Na. tional depositors. Longley Sees Success

The larger depositors would then agree to freeze their share order that the smaller depositors might paid in full Clifford B. ley. for Ford Motor today that positive larger would sign up the payoff to the smaller take the position that the RFC in the depositors can perform service by advancing funds for the additional Jones believe that these large depositors, Detroit's largest doing much the the plan they accepted in the tional Bank of We are hopeful similar plan for the First National. The RFC chairman added that heard similar plan the United States He all credit which agreed make the sist small Through the pledging their deposit the large depositors assure small depositors of payment in Otherwise they wait for period with chances that would never receive full payment.

Ample Leeway for New Loan Under the RFC law the corporation limited loans of not more than $100,000,000 instiThere ample for the further the First at the RFC and Mr. Jones previously had stated that the pledged was assure the Government of payment in full for the advances Still another whereby would be ganized liquidate the remaining assets of the Guardian National, being considered by Comptroloffice. Under this plan the of

21.

December 23, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

(Continued From First Page.) far beyond the point of conservatism and losses were not taken in the banks. "They have always been extremely reluctant to charge off losses and have always desired that they be taken from earnings, but the record of earnings of most of these banks is most unsatisfactory and this plan would not permit the elimination of many losses. "The Guardian Detroit Co.'s condition is very unsatisfactory." Commenting on Lord, Leyburn continued: "It is very apparent that Mr. Lord of the Guardian group is not a banker and he never was and never will be one. He is more of the 'glad-hand' promotion type and he always chooses the path of least resistance, which has now created the present problem with the group." Payments on Loans. In his defense, Lord said that of more than $4,000,000 loans to directors, which brought criticism from the committee, $2,100,000 had been paid up to last Summer, and that $1,250,000 had been paid on loans which directors had indorsed or guaranteed. He said of the $3,700,000 of directors' loans to corporations $2,100,000 had been paid up to last Summer. He insisted the actions by the group had in fost "if not all cases" been taken to "protect the interests of the depositors against the effect of a panic on the part of a few." Citing payments that have been made by the Guardian National Bank of Commerce since it has been closed, Lord said "as evidence of its soundness" it had paid more than $105,000,000 with the aid of the Reconstruction Finance Corporation and that he believed it would eventually pay "100 cents on the dollar." Pecora replied that "I will have some evidence when this session is resumed with regard to the condition of these banks when they were closed."

22.

February 13, 1934

The Muskegon Chronicle

Muskegon, MI

Click image to open full size in new tab

Article Text

BUILDING IN VIENNA HOUSING FAMILIES SOCIALISTS SHELLED

Austria Government Artillery Smashes Greatest Apartment Edifice in World as Civil War Grips Country; No One Knows How Many Persons Were Killed.

Vienna, Feb. and children were fed to the flames of civil war today as government artillery smashed the Karl Marx apartment building housing 2,000 Socialist families. No one knows how many were killed. The howitzers apparently smashed the third and fourth floors of the greatest apartment building in Europe, the middle arch collapsed. The shelling of the $4,000,000 structure only one corner DEPOSITORS TO of the aspect of Austria today while the forces of Chancellor Engelbert Dollfuss struggled through bloody streets to put BE PAID OFF down the rebellion of the Socialist party. Apparently at least 200 have been killed. 136,000 with $1,000 or Forces of Socialists were in possession of the great munitions plant. forces charged Less in Detroit Guardthe repeatedly desperate attempt take position ian to Get All Men fell. dead and wounded. but there was no time nor opportunity count the Detroit. one The Karl Marx buildday the anniversary Michigan's ing was horrible some momentous bank holiday. veterans fought had seen in notice issued that 136,000 days the World depositors less the Machine blazed from the winGuardian dows the homes laborers at the merce when closed, be paid soldiers sought in through plan believed to found unique banking history. grenades, and tear just ago tomorrow insufficient batter the that Comstock resistance. So they request howitzers. the state's banking associaThe ripped into the ordering bank functions concrete Cement rose suspended eight Before Whole corners of the that period had the building disappeared. holiday had spread Following the artillery attack. up government forces swarmed into the presidential proclamation all banks country. 200 Waive Claims Socialists continued their firing Today's announcement told of comarrangements whereby 200 was against the also larger depositors Guardian Na- tackers. tional waive their claims any share Hand grenades fighting developed in eight cent financed to close the combatants Reconstruction Finance quarters. tion loan, make broke Heavy fighting out (Continued on Page 9. Column 1) again, after hours comparative calm, Floridsdorf factory Man in Critical Socialists, lost fight for Condition Following possession of their captured. Bite by Pet Dog Eleven reported dead in this engagement. same time. defenders Raymond Wheater. 23 years Muskegon Heights, critically the big municipal flat the complex with blood poisoning which developed Schlingerhof, bite by his had been handed an sultation of doctors held afternoon. artillery opened Mr. Wheater. who employed by against the buildings. Field howitmers the Garnaat was suffer- used. minor illness when his dog The held off with ararmy bit was not tillery for hours. The big guns finaltime and were trained into day his fever ascended 106. with machine stationed He the Wheater, corners building former Muskegon Heights police pouring deadly fire into the sergeant. 885 Alberts Field artillery shells great Jean who fragments one corner of fered broken week. building moved hospital his Amelia 1044 socialist nest was home Church. Wood street, who fracture blown Elsewhere, whole hip surface the moved from the hospital to big only an airplane photo capable giving complete The condition Frank Steiner. 508 pockmarked by Amity street, brought For hours, the attackers confined Hackley hospital Saturday themselves machine gun and rifle Clock suffering (Continued on Page 9, Column 3) stroke, reported as

23.

February 13, 1934

Beatrice Daily Sun

Beatrice, NE

Click image to open full size in new tab

Article Text

DEPOSITORS WAIVE RIGHTS

DETROIT. Feb. 13. one day the anniversary of Michigan's momentous bank holiday, official notice was issued today that depositors with $1,000 or less in the Guardian National Bank of Commerce when it closed, will be paid in full through a plan believed to be unique in banking history. It was just one year age tomorrow that Governor William Comstock signed proclamation, at the request of the state's major banking associations, ordering all bank suspended for eight days. Before that period had elapsed, the bank holiday movement had spread to other states, to be climaxed on March by presidential proclamation closing all banks in the Today's announcement told of arrangements where200 larger depositors in the Guardian National waive their claims to any share in an eight per cent financed py Reconstruction Finance loan, to make it possible for smaller depositors get all of their money. All depositors already have shared in payments totalling 60 per cent. The new the announcement said, will begin about February 23. This payment will amount to about $8,000,000.

24.

March 1, 1934

The Norfolk Press

Norfolk, NE

Click image to open full size in new tab

Article Text

The announcement that Ponzi, the get-rich-quick wizard, who sold stock in a bogus scheme that netted him a million dollars, has served his 11 years in prison, and is discharged, calls to mind the fact that Ponzi's plan was no different from that of a hundred other plans promoted by recognized "going concerns," but who robbed innocent people just the same. They have not been molested, notwithstanding use of the U. S. mails to sell their worthless goods. There was a gentleman named Kreuger who did some extraordinary things, particularly in selling his scheme to some of our greatest financiers and inducing them to participate in anticipation of abnormal profits. A certain Mr. Lowenstein, who committed suicide by dropping from an airplane while crossing the channel, was another. Mr. Insull, now a fugitive in Greece, was another. Mr. Wiggins of the Chase National bank and representatives of several other banks and promoters were all in the same game. Today we have hundreds of concerns whose capital issue, on which they demand dividends, is from 2 to 10 times the actual value of the business. Hundreds of them have squeezed some of the water out. The late Edward Baker was said to be the largest holder of railroad stocks in the nation— estimated at 200 millions in 1928. When he died and the water was squeezed out, auditors and appraisers reported his entire estate at 75 millions. Then we have the Teapot Dome, the Sinclair deals, the airmail and steamship grabs. During the lifetime of the late Bob LaFollette, ranking member of the Interstate Commerce commission, he always held that the actual value of the railroads was not more than 15,000 millions, a large part of which had been donated by communities as "rights of ways." After LaFollette's death the roads manipulated a new valuation plan on which they demanded rates that would pay dividends. The new plan was based on what it would cost to purchase all the land donated, and what it would cost to replace with new, every building, car, engine and shop equipment. Result: the valuation was increased about 10,000 millions, and rates were increased more than 30 per cent. But the real object was to issue more bonds-and more stock. Billions of bonds were negotiated and millions of stock sold to employes under promises of holding their jobs. Today the bond issues of the railroads are equal to the "replacement costs"-and the stock is not considered. In this matter the President of the American Bankers association denounced the railroads as the only big business that had no sinking fund for bond redemption, yet had the nerve to ask banks to buy their bonds. Poor Ponzi, like Dr. Cook, the

IT NEVER HAPPENS By ART THOMAS

Arctic nagivator sent to the penitentiary for 20 years for being connected with a fake ofl company, was the goat in a free-forall field of get-rich-quick Wal- bank functions suspended for eight days. Before that period had elapsed, the bank holiday movement had spread to other states, to be climaxed on March 4 by a Presidential proclamation closing all banks in the country-and what a deplorable condition was revealed! On Feb. 13, just one year later, announcement was made that, with the assistance of the federal government, and the consent of 200 of the larger depositors, the 136,000 depositors with $1000 or less in the Guardian National Bank of Commerce of Detroit when it closed will be paid in full.