Article Text

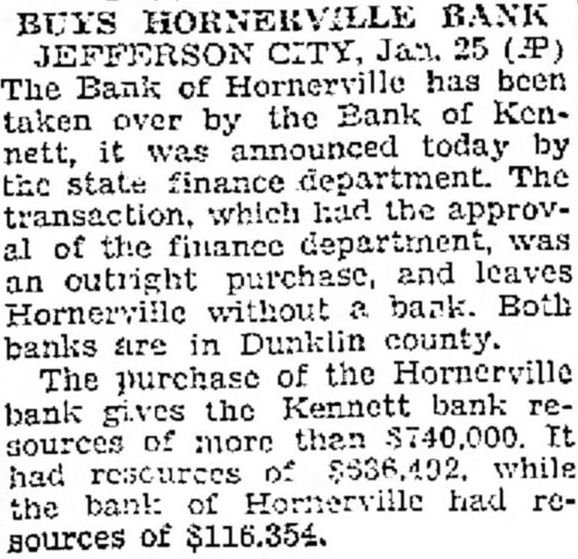

BUYS BANK of Hornerville has been The Bank the Bank of Kentaken by nett, today by the state department which had the of the department, was and leaves an outright purchase, without bank. Both Hornerville banks are Dunklin county. The purchase of the the Kennett bank bank than while had bank of had the of $116.354.