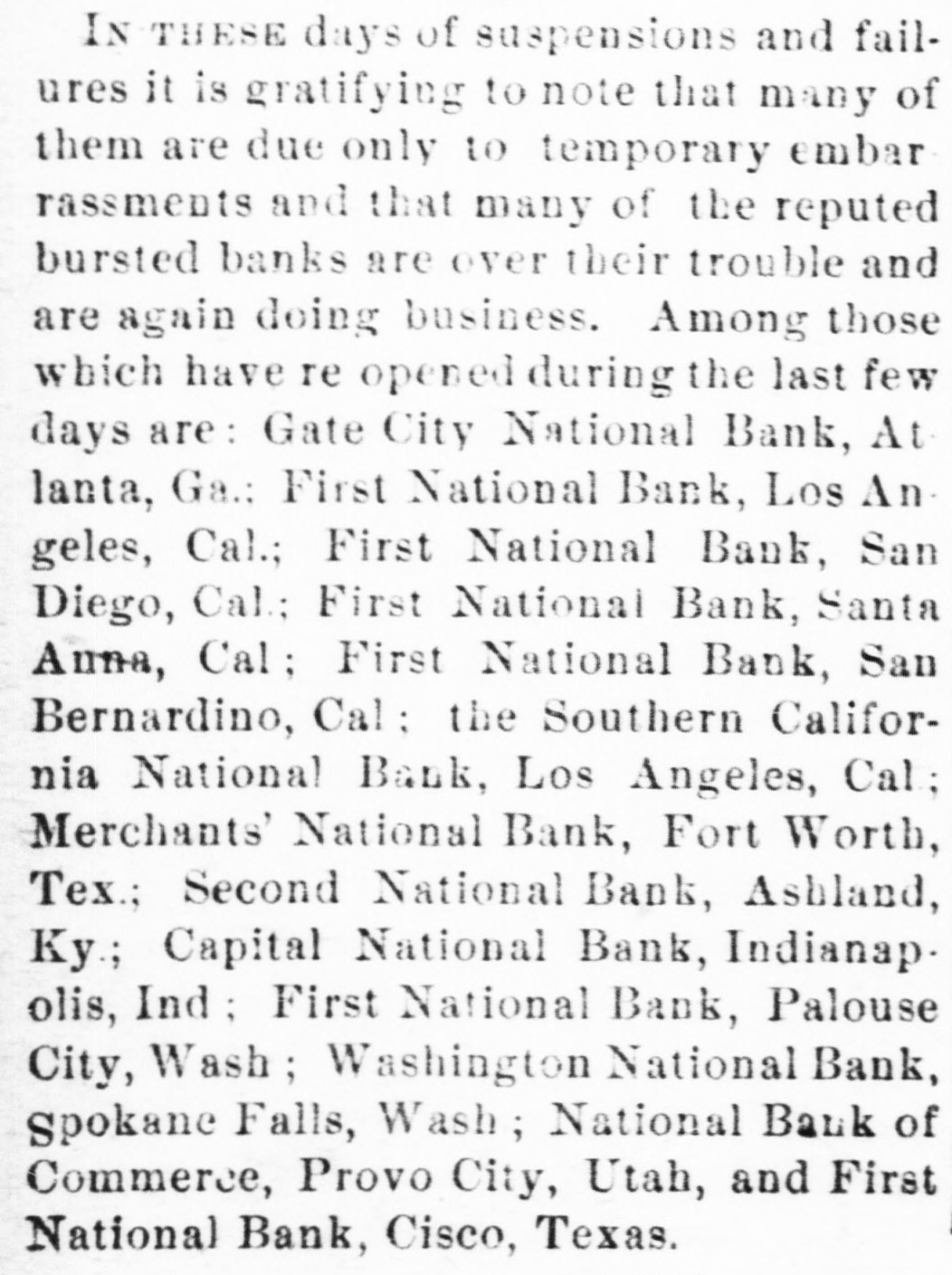

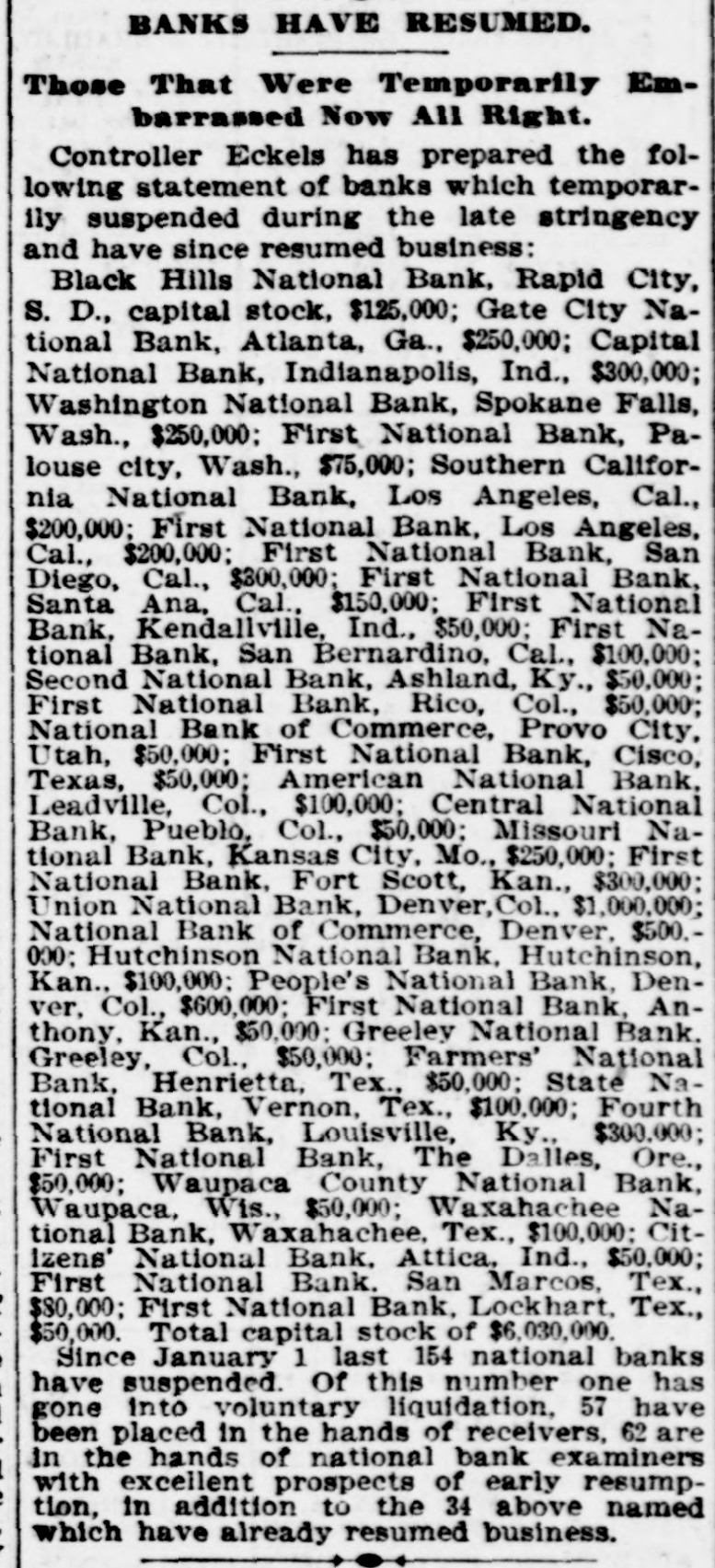

Article Text

CONDENSED DISPATCHES. An order was issued on June 20 for the cruiser Atlanta to return from Nicaragua, the trouble there being at an end. The business transacted at the Trans-Missouri congress at Denver on June 20 was contined to reading rules ad opted at Chicago. Those distillers fighting the whisky trust are preparing s history of that institution to aid the attorney general of Illinois to fight it. An elaborate banquet was given at the Auditorium in Chicago on June 20, in honor of Gov. Markham, of California, by Californians in "ex. ile." "The Consolidated National bank and the First National bank. of San Diego, suspended payment yesterday. Both banks are expected to resume shortly. Three privates of the Queen Victoria" Life Guards, who came to Chicago to take part in the British military touruament, have been sent to the poorhouse, owing to some misun. derstanding about their passage and their inability to take care of themselves. The conference at Pittsburg on June 20, of the joint committee of the Amalgamated Association of Iron and Steel Workers and the manu. facturers to fix a scale of wages, failed to agree, the manufacturers refusing to grant a 10 per cent advance for rolling steel. Another conference is to be held