Click image to open full size in new tab

Article Text

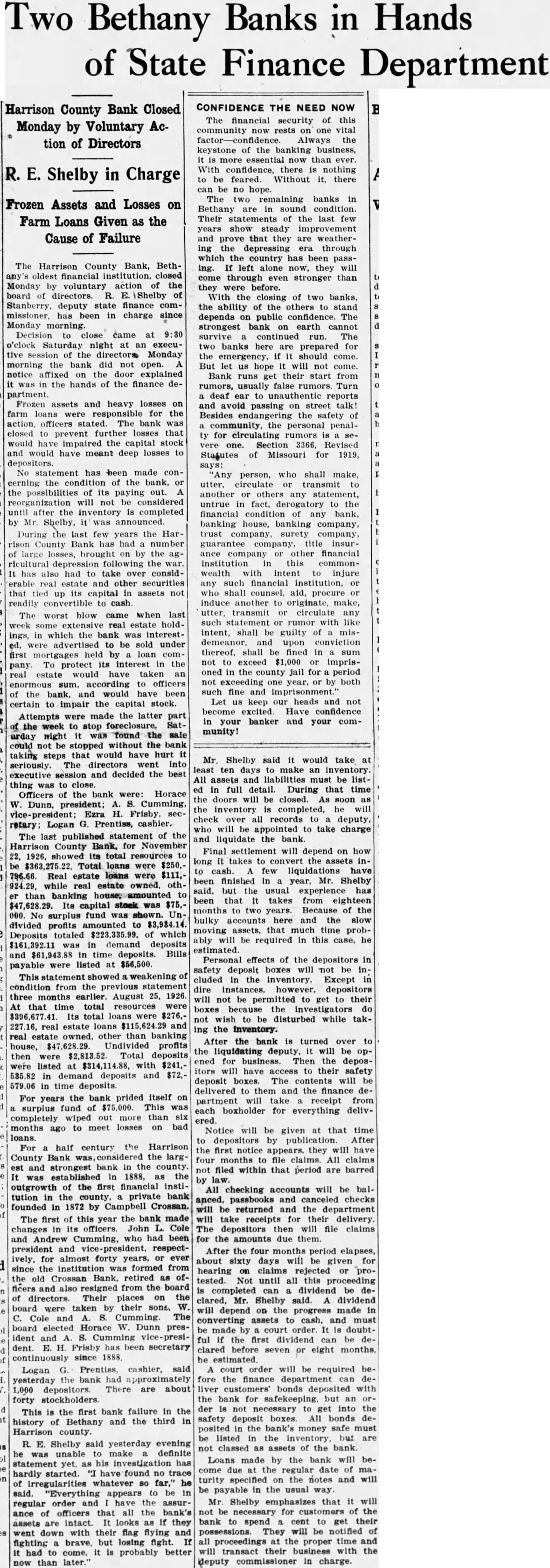

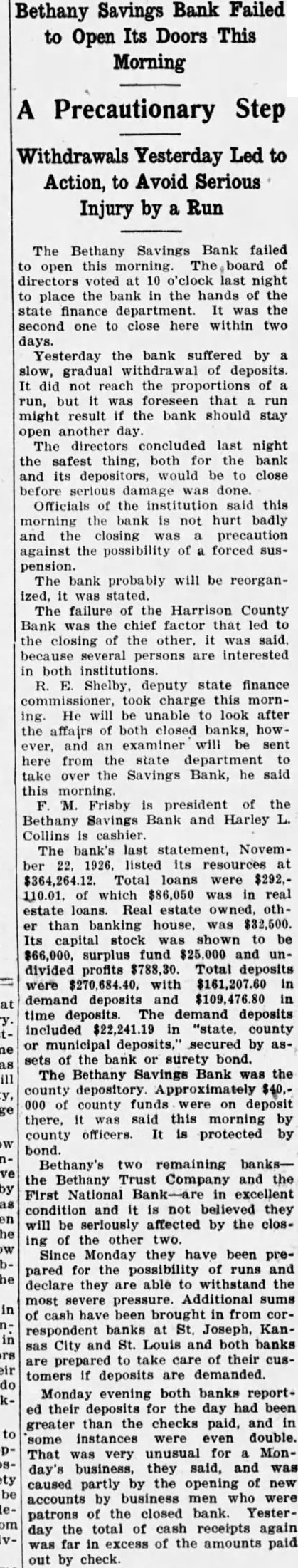

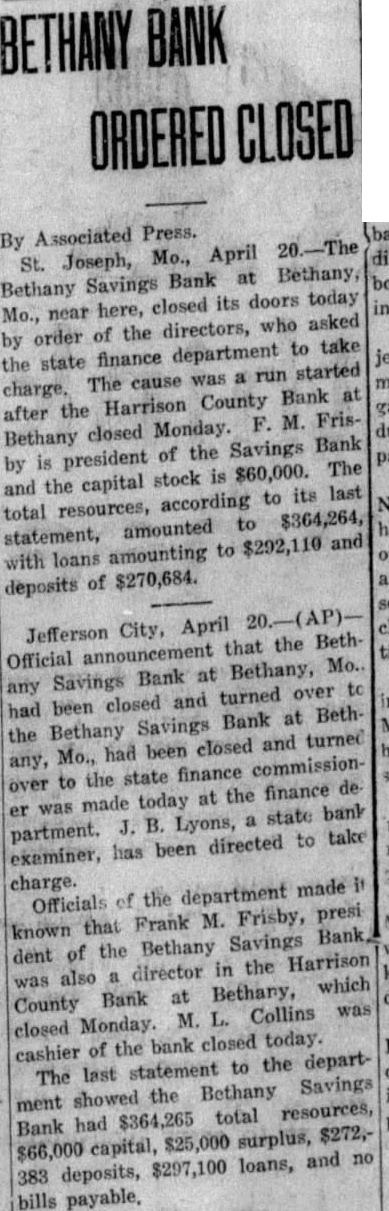

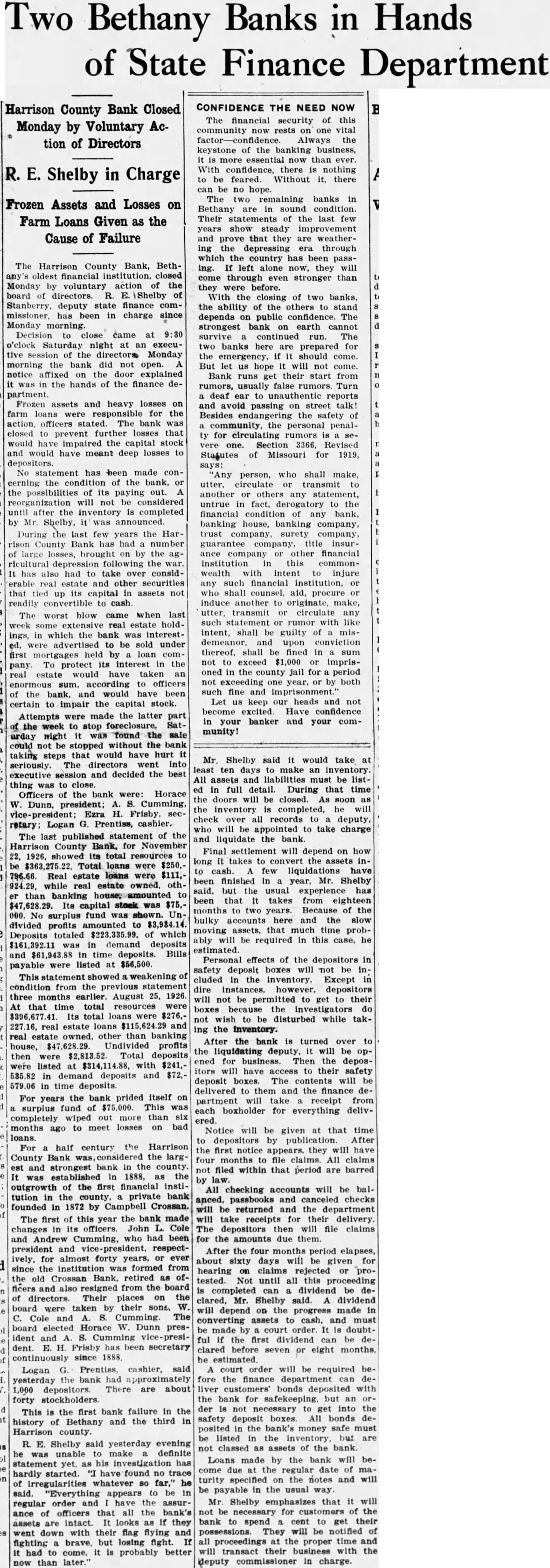

Bethany Banks in Hands of State Finance Department

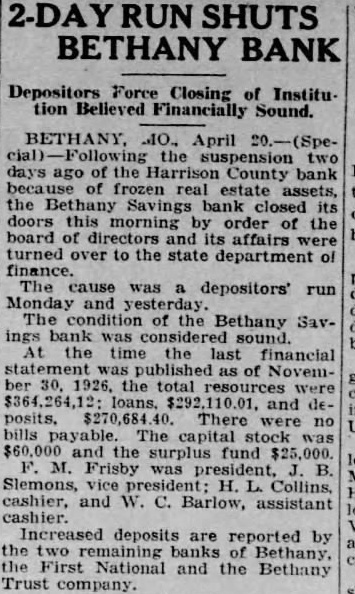

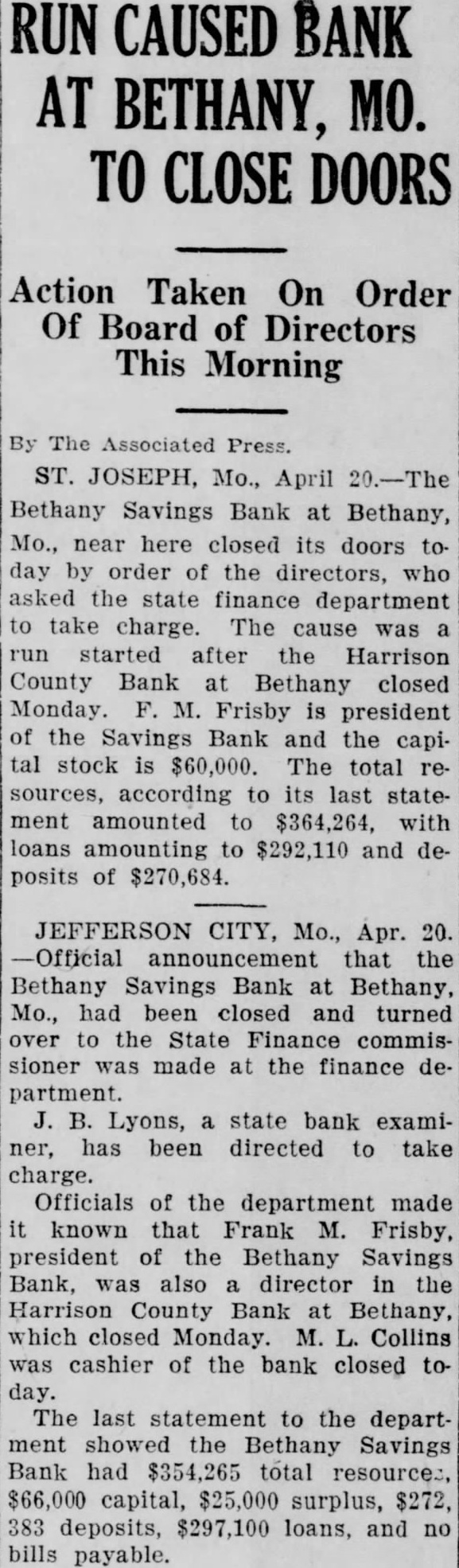

Harrison County Bank Closed Monday by Voluntary Action of Directors

Shelby in Charge

Frozen Assets and Losses on Farm Loans Given as the Cause of Failure

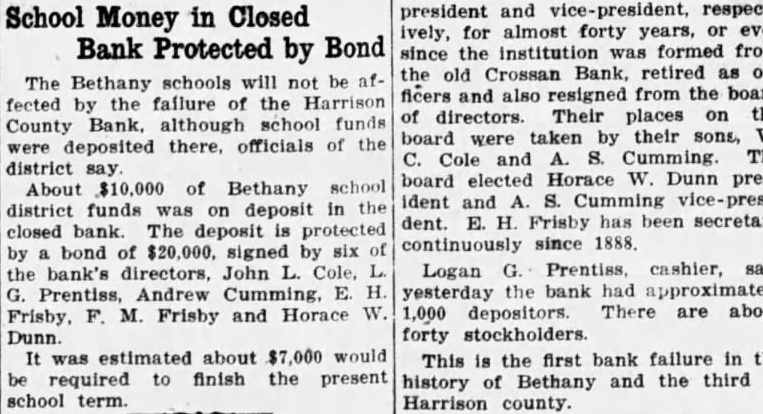

The Harrison County Bank, Betholdest financial institution, closed Monday voluntary action of the board R. of Stanberry, deputy state finance comhas been charge since Monday morning. Decision close came at o'clock Saturday night at executive session the directors Monday morning the bank did not open. notice affixed the door explained the hands of the finance partment. Frozen assets and heavy losses farm loans were responsible for officers stated. The bank closed prevent further losses that would have impaired the capital stock and would have meant deep losses depositors. No statement has been made cerning the condition of the bank, the possibilities of its paying out. reorganization will not be considered until after the inventory completed by Shelby, announced. During the last few years the Harrison County Bank has had number large losses, brought by the ricultural depression following the has had take over considerable real estate and other securities that tied its capital assets not readily convertible to cash. The worst blow came when last week real estate holdings, which the bank interestadvertised to sold under first mortgages held by loan To protect interest the pany. real estate would have taken an according officers the and would have been certain impair the capital stock. Attempts were made the part the week to stop found the sale could not be stopped without the bank taking steps that would have hurt seriously. The directors went into executive session and decided the best close. Officers the bank were: Horace Dunn, Cumming, Ezra Frisby. retary: Logan Prentiss, cashier. The last published statement of the Harrison County for November 22, 1926, its total Total loans were $250,Real estate loans were while real estate oththan banking Its capital stock was No surplus fund shown. divided profits amounted Deposits totaled which demand deposits and time deposits. Bills were listed $56,500. showed weakening condition from the previous three months earlier. August 25, At that time total resources Its total loans real estate loans and real estate owned, other than banking house, Undivided profits then were Total deposits listed $314,114.88, with $241,in demand deposits and $72,579.06 in time deposits. For the bank prided itself years surplus fund of $75,000. This was completely wiped out more than meet losses on bad ago to loans. For half century the Harrison County Bank the largand strongest bank in the 1888, the outgrowth of the first financial institution private founded in 1872 by Campbell Crossan. The first of this year the bank made changes its officers. John Cole Andrew Cumming, who been president and respectively, almost forty years, since the institution formed from old Crossan Bank, retired The said Shelby said yesterday evening unable make definite statement has hardly started. have found no trace irregularities whatever so said. "Everything appears regular order and have the assurance of officers that all the bank's assets are looks they down with their flag fighting brave, but losing fight. had probably better than

CONFIDENCE THE NEED NOW The financial security of this community now rests one vital Always the keystone the banking business, now than With confidence, there nothing feared. Without there be no hope. The two remaining banks in Bethany in sound condition. Their statements of the last few years show steady and prove that they are weathering depressing through which country has been ing. left alone now, they will come through even stronger than they were before. With the closing of two banks, the ability of the others stand depends public confidence. The strongest bank earth cannot survive continued The banks here prepared for the emergency, should come. But let hope will not come. Bank runs get their start from rumors, usually false rumors. Turn deaf to unauthentic reports and avoid passing on street talk! Besides endangering the safety community, the personal penalfor circulating rumors one. Section 3366, Revised Statutes of Missouri for 1919, person, shall make, utter, circulate transmit to another others any statement, untrue in fact, derogatory the financial condition any bank, banking house, banking company, trust surety company, guarantee company title insurcompany other financial institution this commonwealth with intent injure any such financial institution, shall counsel, aid, procure induce another originate, make, utter, transmit circulate any such statement rumor with like intent, shall guilty misand upon conviction shall fined sum not exceed $1,000 imprisoned in the county jail for period exceeding year. by both such fine and imprisonment." Let keep our heads and not become excited. Have confidence your banker and your community!

Mr. Shelby said would take least ten days make an inventory. All assets and liabilities must be listed full detail. During that time the doors be closed. As soon the inventory completed, will check over records to deputy, who will be appointed to take charge and liquidate the bank. Final settlement will depend on how long takes to convert the assets cash. few liquidations have been finished year, Mr. Shelby but the usual experience has been that takes from months two years. Because of the bulky accounts here and the slow moving that much time probably will required in this estimated. Personal effects of the depositors safety deposit boxes will not be cluded the inventory. Except dire instances, however, depositors will not be permitted to get to their boxes the not wish disturbed while takthe inventory. After the bank turned over the liquidating will be business. Then the depositors will have access to their safety deposit boxes. The contents will delivered to them and the finance partment take receipt from each boxholder for everything delivered. Notice will given that time depositors by After the first notice they will four months file claims. All claims filed within that period are barred by law. All checking accounts will be anced, passbooks and canceled checks will returned and the department will take receipts for their delivery. depositors then will file claims the amounts due them. After the four months period elapses, about sixty days will given hearing claims rejected tested. Not until all this proceeding completed can dividend be clared, Mr. Shelby said. dividend depend on the progress made converting assets cash, and must made court order. doubtthe first dividend clared before seven eight court order will required fore the finance department liver bonds the bank for safekeeping, but der not necessary into the safety deposit boxes. All bonds posited the bank's money safe must listed the but not classed assets of the Loans made by the bank will regular date turity the notes and payable in the usual way Mr. Shelby emphasizes that will not customers of the necessary bank spend cent to their possessions. They will be notified all proceedings the proper time and transact their business with the commissioner in charge.