Article Text

ADVERTISING RATES

Foreign Advertising, per inch Display, Locals, per Reading notices, inches or more, Legal notices at legal rates.

Entered at the Bethany, Mo., post office for through the mails second class matter.

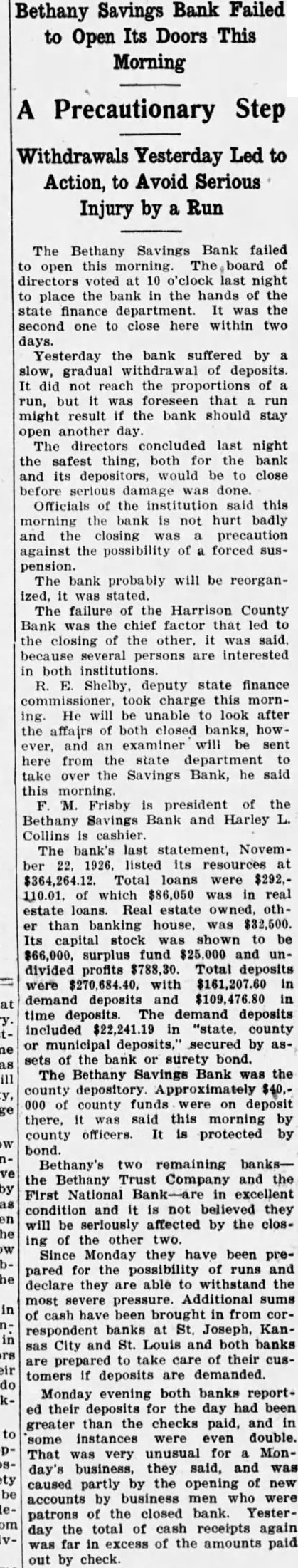

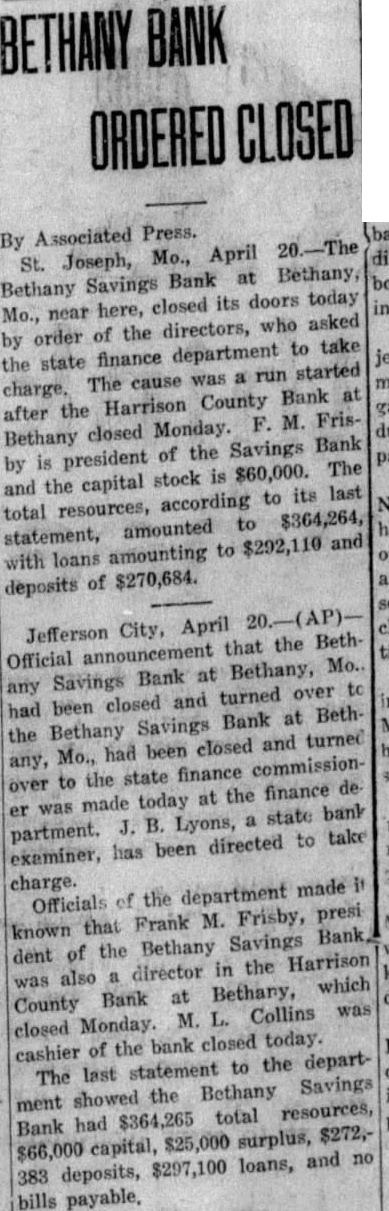

NOW LET'S HAVE SENSE. Right this time is Bethany and its sense, and not stories that ordinary times the children would be made fun for believing. These the days when man has been man his life might be listening with open mouth and full credence the vaporizings of another man who never any business in his life and never will. These days the curbpredictionist in his dreamed He had listen him, and believe, or believe, what he saying about what happen. Let's get now, positively and finally, to the days of good sense. There the story about the First National bank. The story was bank last Wednesday, which it handled without any worry at all, as known would. The story was to the effect that of the directors had withdrawn $16,000 from his bank that morning. matter fact, what this director did was deposit $1,600. Then the story after the Harrison County bank had closed, that its president had drawn out $5,000. As matter of fact, he drew out just $5 carry him the week end for pocket money, and was one of the heaviest depositors record at the time the bank closed. There was the story that Fox Butler had drawn out $6,000 from the Bethany Savings bank. was peddled all over town and had considerable the run that that bank. As matter fact, Butler's was there and "let ride.' still is there. Anybody can tell you just now. you wish stultify yourself swallowing it whole. But be yourself, and give matters logical thought. outlook for Bethany that our bank are over. They ought to be, for are strong and no man can truthfully say either one them unsafe. any man makes that talk, mark down his name and be checked squarely down forced to say what he thinks percan prove different. This not the time snakes the grass be petted: neither is the time to let unchallenged, persons innocently making statements may do harm. which ducted with vigor movement to if the directors of one some reduce its loans, and succeeded closes, are directors of another the bank the where, has been said, its bank, the of fur- was sound left alone There any steer its course. Had the truthful ther from the truth, and now an opinformation been carefully given out portune time to make the statement. and the prin- during the last few its Banks are corporations, that are condition was much better corporations they liable for the amount capital that year years ago, holds and possible- and stock, no matter extent. other words, confidence would have strong releases an indefinite personal or part- enough to prevent run of any consenership liability, and makes the poten- quence. which the By this time almost everybody tial liability sum, carries. knows the gossip that the of capital corporation like this: We run. This man, and that The man worth $100,000. named having made large withdraw suppose For he business as These stories were repeated 10 dividual, brokerage any other whispers about the streets and in the of time stores. Some of them true, it During that personal liability under suit, or claim, now appears, limited only by amount of his ones them, worth. On the pos- thinking the harm sible for him hide part of his doing but only interested in sets. losses though, some telling them through his negligence, may be liable the result that Bethany for the whole $100,000 which he without the use perhaps $200,000 that worth. During the 10 years, he otherwise doing its part now does keeping duly from the We Let this resolve: If someshall suppose incorporates his con- body is heard say that so-and-so has cern for $50,000 term 20 years. made withdrawal from some bank, He actually put that let us challenge the must and it is fixed and inflexible. that proof be made. That will the of the the talk, if any more though he may Take the the prinliability the $50,000 capital. His cipal the remaining $50,000 his and peated before Hit gossip with is separate from the funds of the cor- hammer encountered, and poration. remember that the who keeps That explains the difference fairly peating he hasn't any reason we believe, be for and whethone two illustrations. John true, the town Doe be any and its stockholder eligible director though he may not realize it at General Motors, which pays big time. dividends. He may have $25,000 ed in He also invested Old which goes The and the Motors not affected at The same thing would be he holder They are separate concerns entirely.

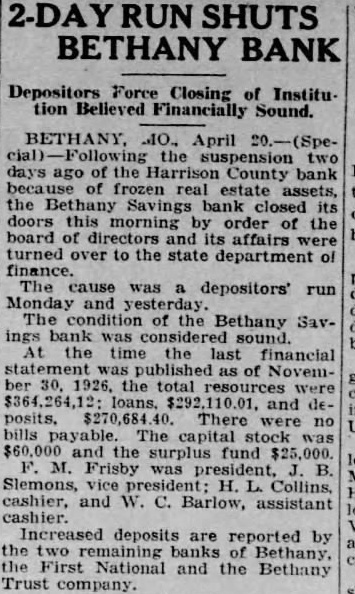

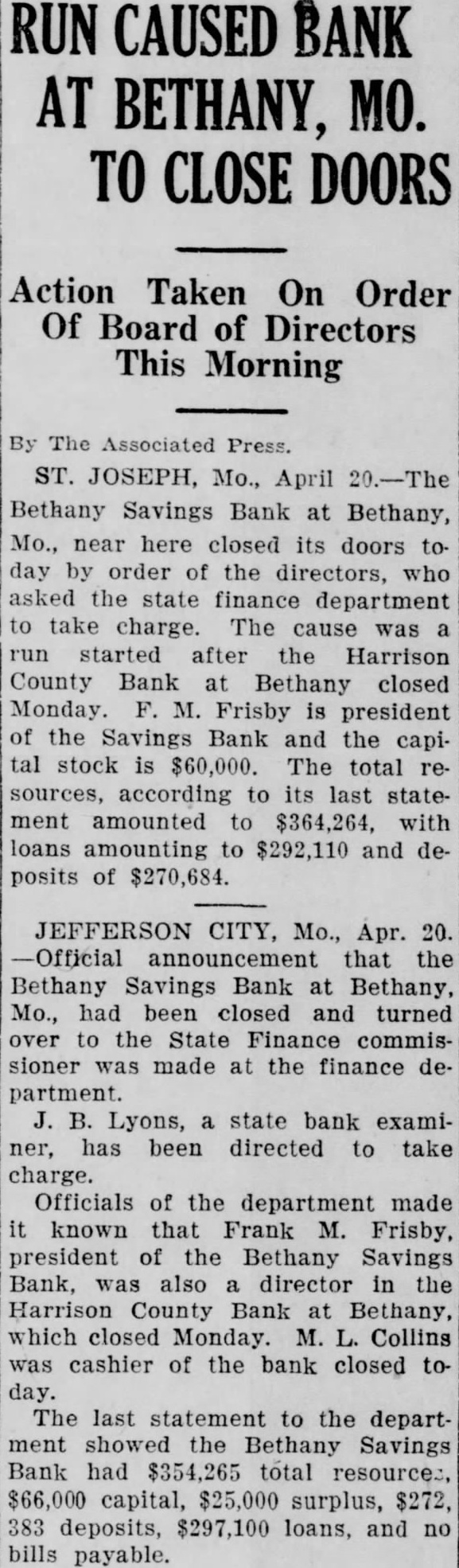

GONE WITHOUT CAUSE. What excitement can do bank situation injure shown here the first of last week, the Bethany Savings bank was closed down after run that showed signs ceasing. the must add that of talk All the with the financial situation Bethany are agreed the that Bethany Savings bank was sound, had been let There was no for had sat tight and stood her share the depositor has right to withdraw his money from bank he cares do but undeniable that when he does under excitement of run, the bank sound, the ship instead staying and help bail the water that Banks are the victims of propaganda, and of gossip. matter fact, they ought times of stress to give some attention propaganda for their own benefit. The matter that the run the Bethany Savings bank was predicated upon its condition of last week, but people generally had understood its condition been two years, The its condition greatthe last two years. had trenched, number of ways. was in better condition than had been SAME DIRECTORS DON'T AFFECT. concerns real estate. had been There seems somewhat to cut down its indebtedness other general impression about Bethany that banks until none was left. It had con-

THE TWO BUCK BILL The fretting the free and people the United use the two dollar bill the aforesaid treasury and attempts circulate. The department points out that the that piece would result in vast saving the taxpayers, inasmuch as the dollar bill wears out as the one twice the face value costs just much But the public does not like the twobuck bill. superstition tached to it by gamblers that has passed into notice, and which may help to retard the favor for the bill the greatest is the fact that the two-dollar paper from the onedollar and are luctant pay the barter and trade the one for the other. costs the government no more make the two than the that's but for those us who toil for our just don't print the two comes twice as high the The government is trying change our habits generally regards money. wants dollars more, too. says that vaults in Washington are with great numbers these that space costs less in the pockets of the people than the treasury. And sounds logical, too, but Uncle Sam had lug his change about the pocket his striped the form silver, he'd not silver daily concerns with the butcher, the baker and the candlestick maker when we were not irked weight wealth. We were strong back and our pockets rather liked the clink of silver our clothes, vulgar as that sound one's ориlence. could feel the attraction gravity upon it, and was certain satisfaction in having that continual idence its presence. Paper money could breeze when one pulled out his bandana, and its loss might not discovered until hope retrieving had passed. But too much silver bulges our pockets and pulls clothes space; awkward to handle bulks too All which like good argubut consistent with our rejection currency which cuts the Norage room required. Soon abandon argument and take stand choice. The may may urge no avail. do not like because is will not adopt the two-dollar bill doubles value the same Fairfield (Iowa)) Ledger.

HIS PAPER IS BARRED. The of (Mo.) Banner one who again accomodate advertiser wishes to get word the that which somebody will be awarded prize. This editor tried that few weeks was the government, result barred from the mails for two weeks. This meant that his town and community without newspaper for that length Bethany often are confronted the problem, and it does help make their paths easier for the merchant who wishes advertise drawing point to some newspaper "They in town, and get always are to admit that so far, some of the newspapers in other towns have but some one these days they will be reported to the government somebody with grudge, and they the same predicament the editor at Ash Grove found himself. said to have been the old New Orleans lottery that caused the ruling of the post office department made, which holds that newspaper print anything concerning drawaway except for the element luck enters, then, the post office department cannot done. legal provision. After scribing lotteries and drawings all Mother sorts imaginable, seems, Hubbard clause the which everything: if anything has been missed. This provides that the newspaper cannot mention anything connected with drawing, or lottery. other words, even after nothing said of Neither, under same clause, can anything be the general happening though what is printed does not mention lottery ing. Strictly interpreted, newspaper not describe crowd present though nothing of why the crowd gathered.

MRS. C. SHERER ENTERTAINS. Mrs. Sherer her cousin, Mrs. Margaret Emerson, entertained Echo Literary club last Tuesday afterthe Sherer on South Twentieth street. Mrs. William Roleke conducted timely lesson the topic "Flowers for the Cutting Garden. She gave some excellent hints and suggestions planting and growing flowers and furnished beautiful flower quotations for all present. She was assisted by Mrs. E. Stone, who gave an talk on bulbs. giving particular emphasis to Dutch present received Easter gift of collection of gladioli lovely little flower contest closed the program. Miss Dee Gardner of Monroe, Wis., welcome guest and made short, interesting talk on club work. The was in spring blossoms and luncheon was enjoyed.

Simple Problem An architect doesn't need to be exact. If he has little corner left over he can call It closet or breakfast Sun.

IN MEMORY OF CALEB HALLINGTON SMITH.

1884-1927

What terrible sensation of loss and one those precede that land eternal and it seems times though there is solace the terrible agony endure when their dear voice forever stilled and we come realize they are from this life forever. But helpful thought comes to in these lines, sweet year by year lose friends out sight muse how grows in paradise our store.' We must cling to that faith and conviction and live our life just as live through long bleak winter, when spring we shall loved ones sunny land of love, peace and contentment. Death has again invaded our commutaken from us one eryone He entered happy home, the family chain, the strongest link there, and leaving behind heartbroken and daughters mourn the going of kind husband and father. "Hallie," son of Lucilious and Mary county, Nebraska, March 1884. of five children, Maude, Hallie, William Lee, Nora Nova. He came to Harrison county, Missouri, the age years, four Eagleville. He was united in marriage December 25, 1907 Miss Ina Johnson, neighbor girl niece of Mr. and Mrs. James Hunsicker, farmers with she had made her home resided farm Blythedale for one after their marriage, they bought farm near their old homes, which they soon converted into one the most little homes the country. From his parents he had had been trained from to apply both labor and intelligence the business of therefore, with the help of his faithful wife they were enabled live in children, Ruby Thelma and Lucy Marie, came this the pleasant, peaceful afforded them by these kind, indulgent parents. Hallie Smith lived life straightforward and one over which falls shadow wrong and his inwill and He united with the Christian the age this church until few after marriage when he with his placed their membership in the E. church Liberty, where he remained member until death claimed He enjoyed church health permitted attend. His death occurred the family home April 1927, an ness eleven days pneumonia, which followed of measles. He had for years with asthma which his physical causing him be resist the ravages Besides the immediate family he is survived by his mother, Mrs. Mary Smith, and two sisters, Mrs. Bert Martin and Miss Nova Beeks, all of Mo. One brother, Lee, and one ter, Nora, with the him death. Mrs. Mrs. Susan Hunsicker Eagleville, also survives mourn the going of loved dearly, being the home continuously all through his illness assist his loved ones in him. Other relatives and mourn his going, for had no enemies and he had the good will Funeral services were held the church of Eagleville on Wednesday afternoon, the Rev. Wallace the Christian church of that place, well words spoke tenderly the departed. large crowd was present, which spoke the high esteem held for Prof. Davidson son and the high school students attended body and floral tribute from them lay the casket, pressed sympathy for their pupils and classmates, Ruby and Marie. Other silent tokens of sympathy that entirely covered beautiful casket were lovely creations from the family,

Mr. and Mrs. John Souders, the mother and Mr. Mrs. Anderson, the M. Sunday school and coming from sister of Mrs. Mrs. Abram Elliot and family in her far away home at Tanmoth, Colo., who was unable to be present. were Henry Brooks, Charles Hart, Bert tin, Raymond Martin Harry Milligan. Those attending from distance were Mr. Mrs. John Souders (mother and stepfather of Mrs. Smith) of Colo., Mrs. Flora Mock New Hampton, Mrs. Maggie Young Mrs. Pearl Bethand Clelland Mock of Martinsville. Burial the cemetery at Eagleville, where the father and ter are lying. The sympathy of the entire extended the rowing ones in their hour of sorrow.

"One less at home! The circle broken. One dear face missed day day place, But cleansed, saved and perfected by One more in heaven. One more at home!

Where separations cannot be: That where all will dwell eternally. Lord Jesus, grant us all place with thee. At home in heaven! friend and neighbor, MYRTLE RICHARDSON.

We wish express gratitude to the kind neighbors and friends who 80 kindly assisted us during the illness and death of our dear and father, for the beautiful flowers. Your kindness will ever be remembered and cherishd. MRS. HALLIE SMITH AND DAUGHTERS, RUBY AND MARIE.

GUARDIAN'S NOTICE. Notice is hereby given that the undersigned was day April, 1927, the person and estate of Ida Webb, of unsound mind, the Probate court Harrison county, Missouri, and that certificate of appointment was granted said guardian date. All persons having claims against said estate are required to exhibit them