Article Text

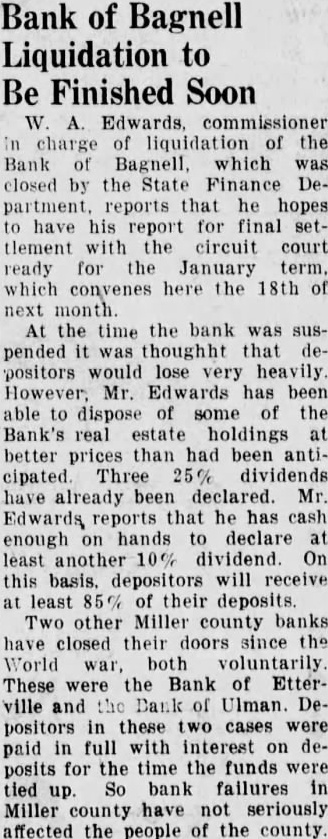

Bank of Bagnell to Be Finished Soon W. Edwards, commissioner charge of liquidation of the Bank of Bagnell, which closed by the State Finance Dereports that he hopes have his report for final settlement with the circuit court ready for the January term. which convenes here the 18th of next month. At the time the bank was suspended it was thoughht that depositors would lose very heavily However, Mr. Edwards has been able to dispose of some of the Bank's real estate holdings at better prices than had been anticipated. Three 25% dividends have already been declared. Mr. Edwards reports that he has cash enough on hands declare at least another 10% On this basis. depositors will receive at least 85% of their Two other Miller county banks have closed their doors since the World war, both voluntarily These were the Bank of Etterville and the of Ulman. Depositors in these two cases were paid in full with interest on deposits for the time the funds tied up. So bank failures in Miller county have not seriously affected the people of the county.