Click image to open full size in new tab

Article Text

MADDEN BANK RECORD SHOWS SIGNS OF ERASURES for Larry Brunk Attorney Charges Alterations in Ledger Sheets of the Aurora Bank.

RECORDS EXHIBITED BY BANK RECEIVER

Number of Deposits Carried on Sheet Labeled "Contingent Fund," Says Young Lawyer.

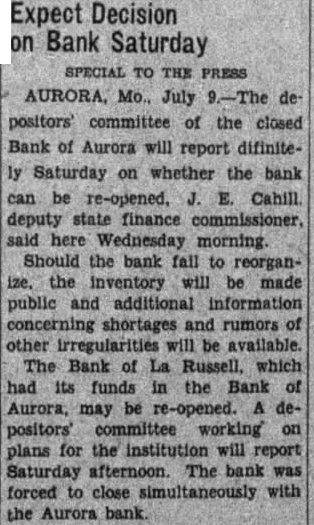

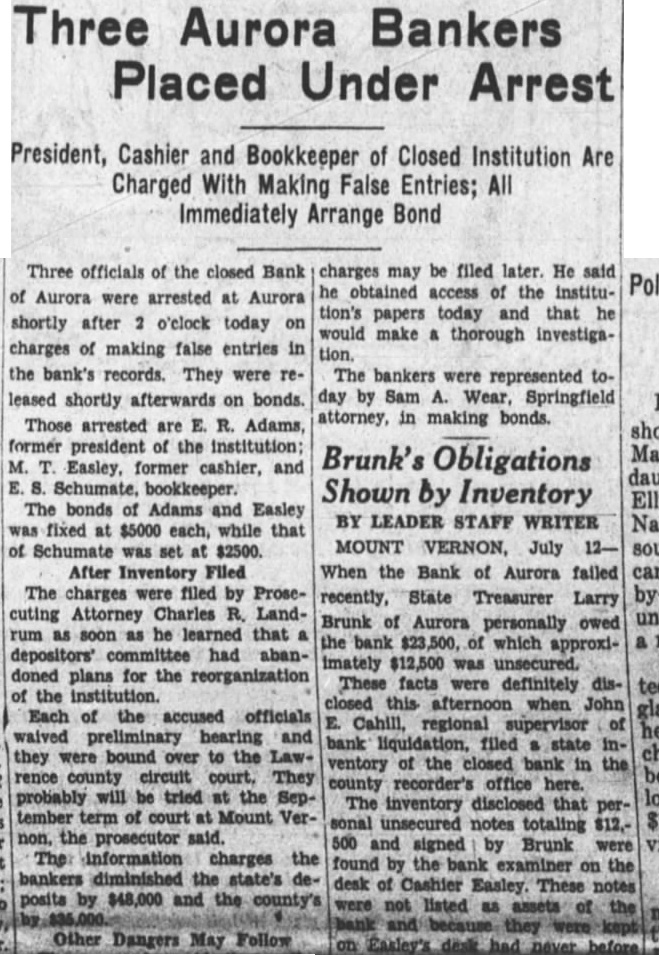

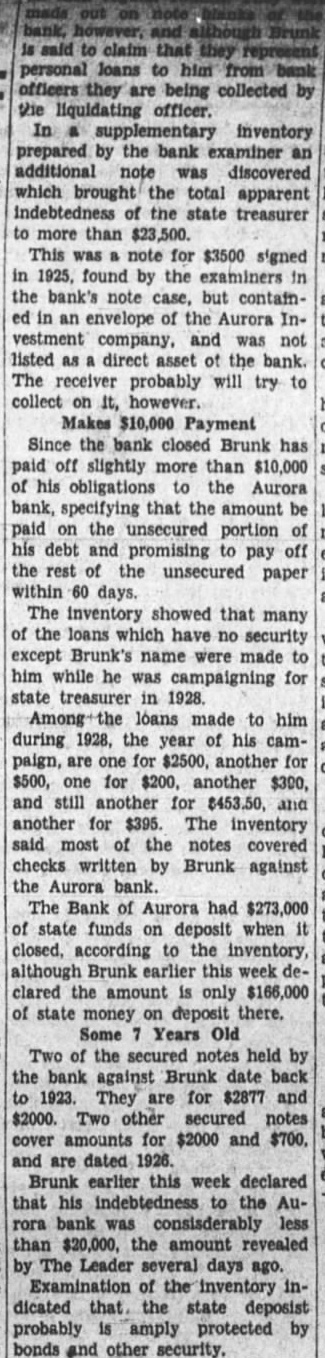

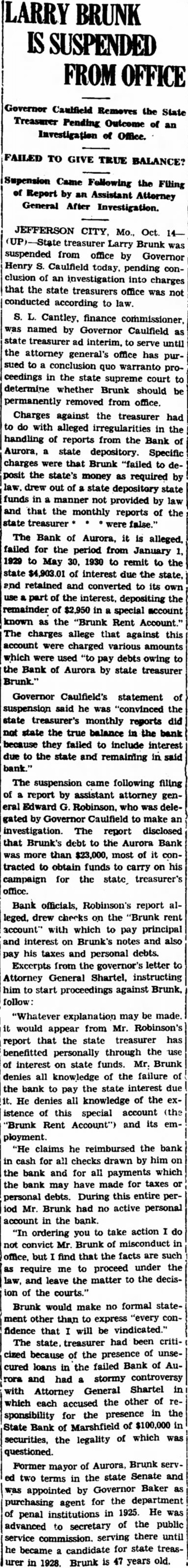

By The Associated Press. Jefferson City, Mo., May amination of the first witnesses the impeachment trial in the Missouri Senate of Larry Brunk, suspended state treasurer, began today with Charles Becker, secretary state, and Cahill, Springfield, special deputy state finance commissioner, the first to testify. Becker testified merely as Brunk's election as treasurer 1928, his suspension Oct. 14 last, by Gov. Caulfield, his reinstatement Dec. 31 last, when supreme court held the suspension illegal, and second suspension May after the House voted impeachment charges. Told of Records. Cahill, who was placed in charge the liquidation of the defunct Bank of Aurora, the state depository Brunk's home town which irregularities in state deposit interest accounts are alleged to have been manipulated by Brunk and the bank officers, told the records he found when he took charge, the Brunk, and the alleged discrepancies in accounts. Ledger sheets, deposit slips, checks, etc., were offered exhibits. Cahill, who testified he was pointed by L. Cantley, state finance commissioner, who was named temporary treasurer by Governor Caulfield Oct. 14 last, when Brunk was first suspended, told of discovery by auditors of the bank of the Brunk rent account, into which state deposit interest money was alleged to have been placed to and of conference here about Oct. with Governor Caulfield. Brunk summoned and was "excited and Cahill said. Bank President There. At another conference the second day, Brunk and R. Adams, president of the Bank of Aurora, were present. Adams said, according to the testimony, that the Brunk rent account would "get us in trouble," when he learned of it, but said Easley assured him he need not worry, that was "fixed Cahill also testified that short time after he took charge of the bank, which closed June 14 last, Brunk came to Aurora and discussed his obligations to the bank and payment the notes. John Madden, Kansas City, Brunk's in his opening attorney, inferred Brunk statement yesterday, (Continued Page