Article Text

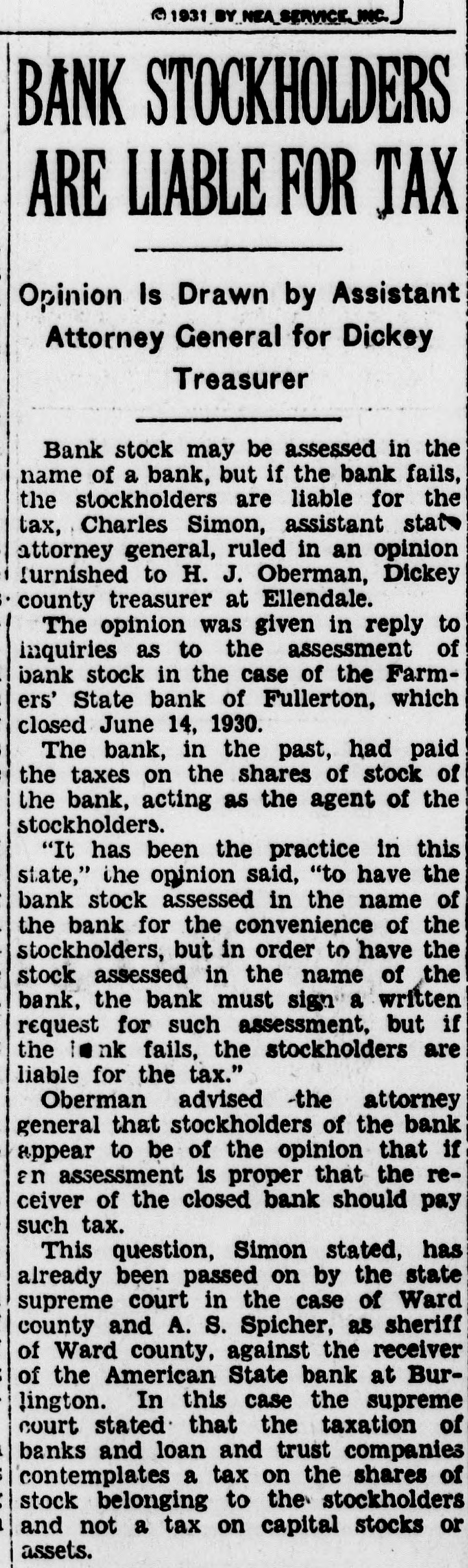

BANK STOCKHOLDERS ARE LIABLE FOR TAX Opinion Is Drawn by Assistant Attorney General for Dickey Treasurer Bank stock may be assessed in the name of a bank, but if the bank fails, the stockholders are liable for the tax, Charles Simon, assistant stat attorney general, ruled in an opinion furnished to H. J. Oberman, Dickey county treasurer at Ellendale. The opinion was given in reply to inquiries as to the assessment of bank stock in the case of the Farmers' State bank of Fullerton, which closed June 14, 1930. The bank, in the past, had paid the taxes on the shares of stock of the bank, acting as the agent of the stockholders. "It has been the practice in this state," the opinion said, "to have the bank stock assessed in the name of the bank for the convenience of the stockholders, but in order to have the stock assessed in the name of the bank, the bank must sign a written request for such assessment, but if the in nk fails, the stockholders are liable for the tax." Oberman advised -the attorney general that stockholders of the bank appear to be of the opinion that if an assessment is proper that the receiver of the closed bank should pay such tax. This question, Simon stated, has already been passed on by the state supreme court in the case of Ward county and A. S. Spicher, as sheriff of Ward county, against the receiver of the American State bank at Burlington. In this case the supreme court stated that the taxation of banks and loan and trust companies contemplates a tax on the shares of stock belonging to the stockholders and not a tax on capital stocks or assets.