Article Text

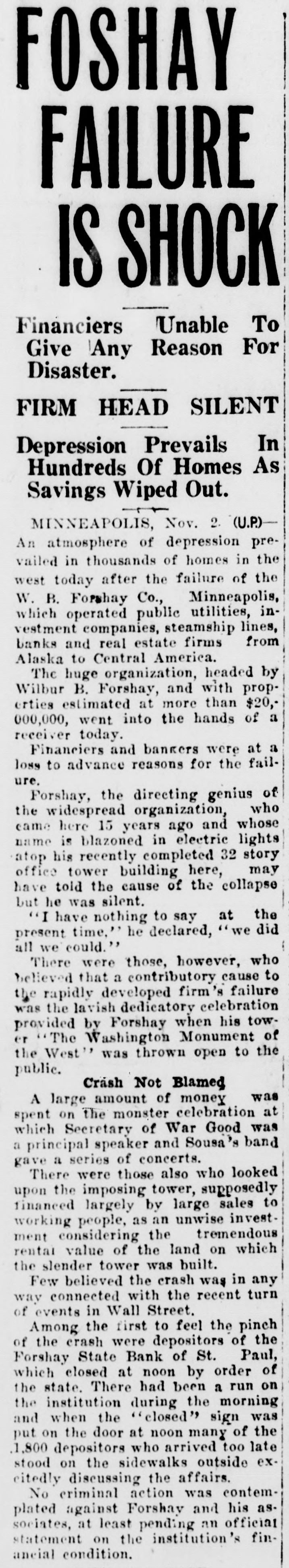

FOSHAY FAILURE IS SHOCK Financiers Unable To Give Any Reason For Disaster. FIRM HEAD SILENT In Depression Prevails Hundreds Of Homes As Savings Wiped Out. MINNEAPOLIS, Nov. 2. (U.P.) An atmosphere of depression prevailed in thousands of homes in the west today after the failure of the Co., W. B. Forshay Minneapolis, inwhich operated public utilities, vestment companies, steamship lines, banks and real estate firms from Alaska to Central America. organization, headed by The huge B. Forshay, with Wilbur and propcrities estimated at more than $20, 000,000, went into the hands of a receiver today. Financiers and bankers were at a loss to advance reasons for the failure. Forshay, the directing genius of the widespread organization, who came here 15 years ago and whose blazoned in lights his atop name is recently completed electric 32 story office tower building here, may have told the cause of the collapse but he was silent. "I have nothing to say at the present time," he declared, "we did all we could." those, however, who believed that a contributory cause There were firm's failure to the rapidly developed was the lavish dedicatory celebration by Forshay when his tower of provided "The Washington Monument the the West'' was thrown open to public. Crash Not Blamed A large amount of money was spent on the monster celebration at which Secretary of War Good was a principal speaker and Sousa's band gave a series of concerts. There were those also who looked upon the imposing tower, supposedly financed largely by large sales to working people, as an unwise investment considering the tremendous rental value of the land on which the slender tower was built. the crash was any Few believed the recent in way connected with turn of in Wall Street. the first to Among events feel the pinch the the crash were depositors of State Bank of at noon by had been a run of which Forshay the state. closed There the St. order morning Paul, on of the institution during and when the "closed" sign was put on the door at noon many of the 1,800 depositors who arrived too late stood on the sidewalks outside excitedly discussing the affairs. action was contemplated No criminal against Forshay and official his associates, at least pending an the finstatement on institution's aneial condition.