Article Text

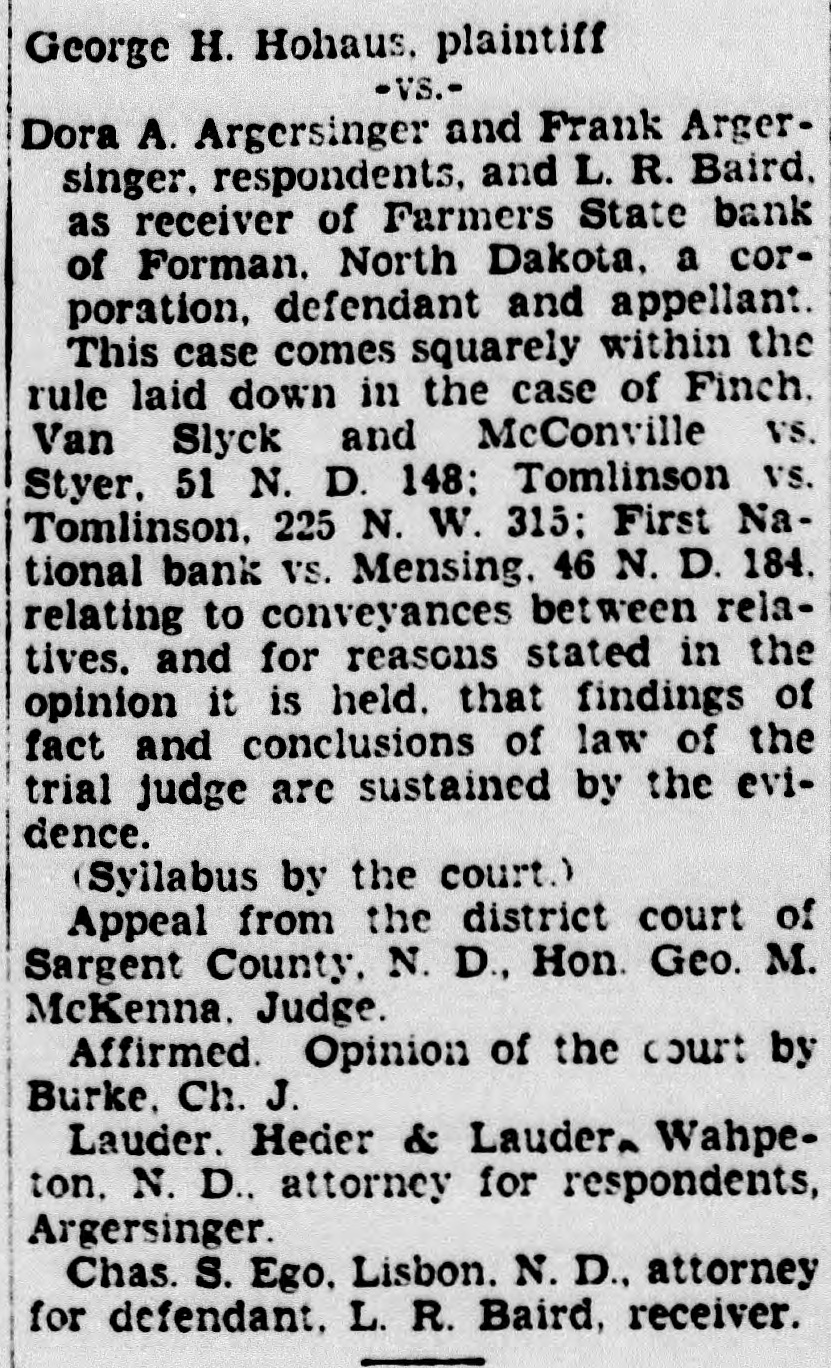

George H. Hohaus, plaintiff -VS.Dora A. Argersinger and Frank Argersinger, respondents, and L. R. Baird, as receiver of Farmers State bank of Forman. North Dakota, a corporation, defendant and appellant. This case comes squarely within the rule laid down in the case of Finch. Van Slyck and McConville vs. Styer. 51 N. D. 148: Tomlinson vs. Tomlinson, 225 N. W. 315; First National bank vs. Mensing. 46 N. D. 184. relating to conveyances between relatives. and for reasons stated in the opinion it is held. that findings of fact and conclusions of law of the trial judge are sustained by the evidence. (Syllabus by the court.) Appeal from the district court of Sargent County, N. D., Hon. Geo. M. McKenna. Judge. Affirmed. Opinion of the court by Burke, Ch. J. Lauder. Heder & Lauder. Wahpeton. N. D., attorney for respondents, Argersinger. Chas. S. Ego. Lisbon. N. D., attorney for defendant. L. R. Baird, receiver.