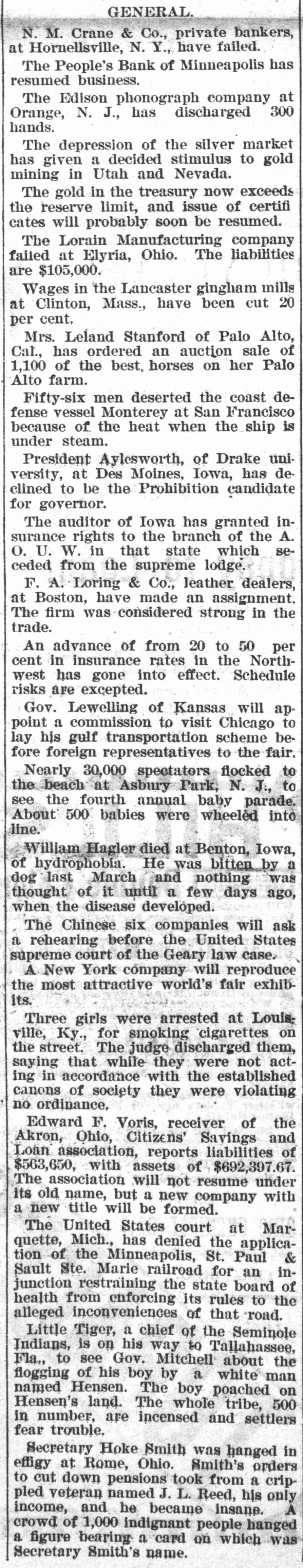

Article Text

TELEGRAPHIC BREVITIES. The People's bank of Minneapolis, Minn., suspended payment to-day. The rioting that broke out in renewed. Breslau on Saturday night, has been of Ex-Governor James E. Campbell, Ohio, says that he shall not be a candidate for renomination. James Gilbert, the dynamiter, recent- prison, discharged from an English ly arrived in New York this morning. The Plateau Valley, Col., sheep war are probably over the sheep men what is moving out of the valley, and is thus promised to be a serious conflict averted. By an edict issued by the school teach- commissioners yesterday all married have in the St. Louis public schools ers been dismissed. Nearly one hundred teachers were let out. No one was injured in the explosion the mine near Pittsburg yesterday. at The three missing men who were sup- last posed to be entombed turned up the evening. They had not gone into mine. A dispatch from Omaha quotes Mgr. Satolli as saying in regard to the Pope's "It of pronunciamento recently issued is unequivecally an indosement be Archbishop Ireland and there can no quibbling about it. Mrs. J. T. Ford died at her home, from Richmond, Mo., yesterday rat bite near blood poisoning, caused by a mother of days ago. She was the Ford, the ten notorious Bob and Charley who killed Jesse James. of The Manchester murder mystery River is cleared by the confession conof Fall Joseph Carriero. The lad murder has in fessed that he committed the by defense, being first attacked self Bertha with an axe over a dispute about wages. The will of Edwin Thomas Booth, filed actor, who died on June 7, was leaves the in New York to-day. Mr. Booth daughthe bulk of his property to his estate The value of the personal to be ter. which the actor left is estimated worth $605,000. The bodies of Tom Cordway and his of Pattrel, were found at the gate sister their home, eight miles from supposed LogansLa., yesterday. It is from port, one called Cordway sister his some house and shot him, and that also his shot. rushing to his assistance was at LoAn attempt was made to-day 75 miles southwest of Warsaw, Kunit- to dez, the residence of Julius of that destroy well known manufacturer for the zer, a in a spirit of revenge anarchists. discharge place, of a number of how None of the inmates were hurt, ever. Daniel Lord, jr., of New York, and aged Mrs. who was visiting Mr. while 22 H. years, R. McCormick, of Chicago, the last night, walked through to the asleep fourth story window, and falling such severe court below, received hour injuries stone that he died at an early this morning. size of the hand of Joe Butler, Jim of Philadelphia, The who is billed to fight Island of Buffalo, at the Coney is atDaly, Athletic Club, Thursday night, sportmuch attention among hand of tracting He has the biggest inches ing any pugilist men. living, measuring 144 around the knuckles. attempt was made yesterday Pullmorning An by Mike H. Robert Leitch, S. Browne, of Washn.. to kill Idaho, man, president of the Moscow, indebted to the Bank. Leitch is and after talking the turned and fired suddenly National bank cashier's with through desk. Browne The the screen bullet glanced over the over Browne's shoulder hitting him in the neck. & Vollers, wholesale the grocers oldest Adrian liquor dealers, one of N. and business houses in Wilmington, The C., assigned with preferences. of the failure have was precipitated by that few deof New Hanover. But at the Bank are calling for money Trust Compositors Savings and and some Wilmington banking house to-day, their money pany's those who withdrew returned it. of have already rain-maker, yesterday Jewell, the Rock Island causing C.B. on hand now which is great has populist scheme administration in Kansas yesterday a that the worry. He announced that he deal of to convince the people would go to he proposed bring down the rain and week in Sepcould during the Kansas great Chicago, flood and, the World's Fair with sattember, He said if that would know not what would. downpours. isfy the most stubborn, he did not STATISTICS.-The The Census publication, Bureau giving the statistics of the BAPTIST has issued an interesting Bap-