Article Text

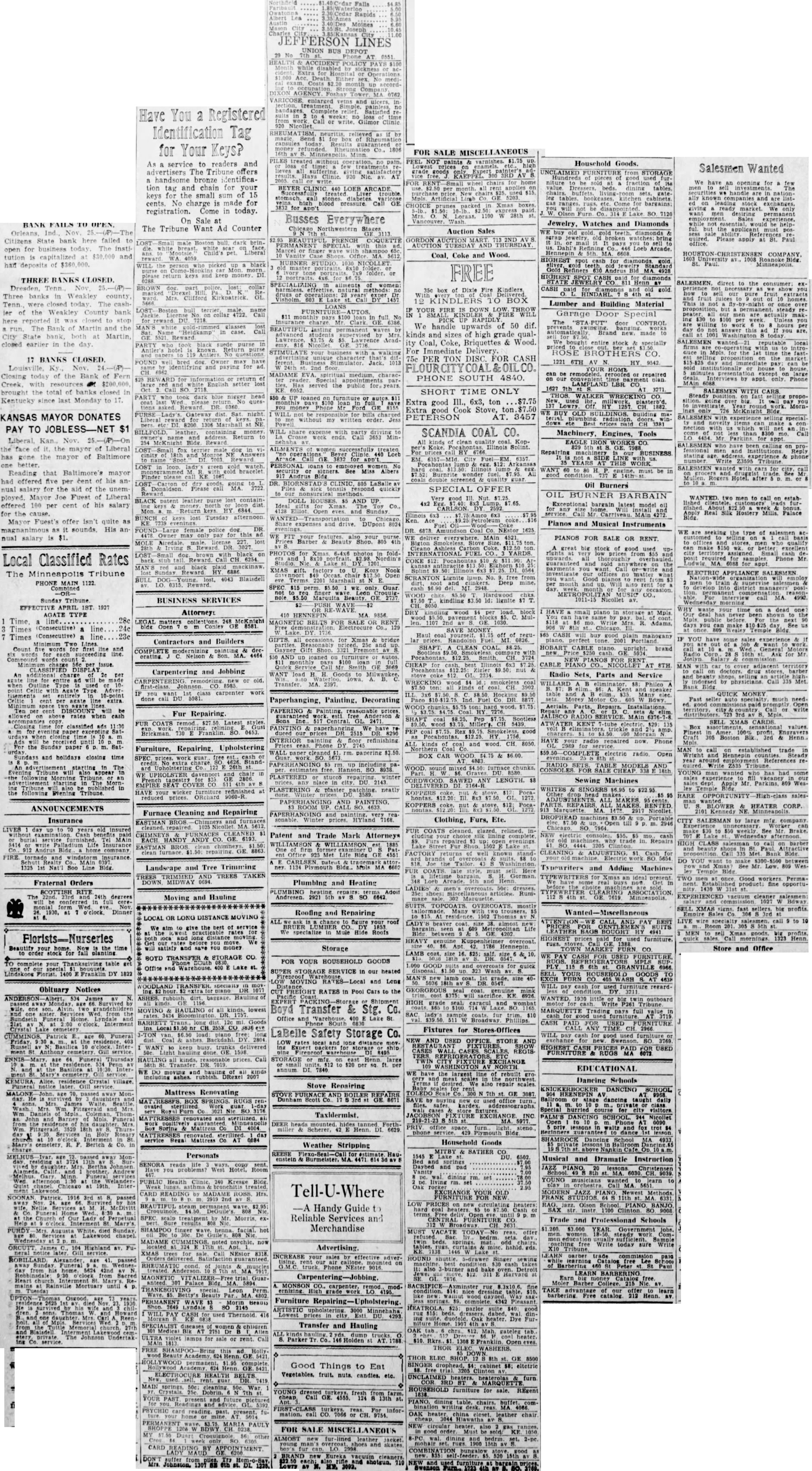

Have You a Registered Identification Tag for Your Keys? As a service to readers and advertisers The Tribune offers a handsome bronze identification tag and chain for your keys for the small sum of 15 cents. No charge is made for registration. Come in today. On Sale at The Tribune Want Ad Counter BANK FAILS TO OPEN The Citizens State bank here failed to open for business today. The institution is capitalized at and had deposits of picked keys DI THREE BANKS CLOSED. Nov. BROWN Three in Weakley were today The cashBoston of the Weakley County bank here closed The Bank of Martin the City both at Martin, GE closed earlier in the day PARTY black 17 BANKS CLOSED. Closing today of the Bank of Fern with resources brought the total of banks closed in PARTY nigger Kentucky since last Monday to 17. PURSE KANSAS MAYOR DONATES PAY TO JOBLESS-NET $1 Return Liberal Nov. face of it. the mayor of Liberal LOST has gone mayor of Baltimore one LOST Reading that Baltimore's mayor had offered five per cent of his an nual salary for the aid of the ployed. Mayor Joe Fuest of Liberal BLACK offered 100 per cent of his salary for the cause. keys Mayor Fuest's offer isn't quite as His DR nual salary $1. MOLE LOST Local Classified Rates The Minneapolis Tribune 4043 PHONE MAIN 1122. Sunday APRIL 1927 AGATE TYPE 28c Times (Consecutive) (Consecutive) line 23c Times Minimum Two Count and line. An be above rates when cash classified the Sunday Sundays and holidays closing time ertisement starting The Morning Carpentering and Jobbing CARPENTERING IF work done call Falls Rapids Moines JEFFERSON LINES UNION BUS DEPOT enlarged and BEYER 440 GE Busses Everywhere COQUETTE 3 $11 MADAME the 8155 and 8024 XMAS SPEC $15 FOR SALE for $50 ANNOUNCEMENTS Fur Repairing FUR Latest 730 0453. Phone Furniture, Upholstering rm. PLASTERED EMPIRE COVER neatly your Furnace Cleaning and Repairing Insurance EASTMAN LIVES $1 Patent and Trade Mark Attorneys ANDY CO. company Bldg tornado and Soo Landscape and Tree Trimming Fraternal Orders SCOTTISH RITE The 24th degrees monial Dinner TREES TRIMMED AND TREES TAKEN DOWN MIDWAY Moving and Hauling LOCAL OR LONG DISTANCE MOVING We give the best of service We satisfy and save BOYD TRANSFER & STORAGE CO. Office and Lake Plumbing and Heating PLUMBING Andresen. heating 6642 Roofing and Repairing ALL roof We specialize Mule Hide Roofs FOR YOUR HOUSEHOLD GOODS in our heated MOVING Local and Lens RATES in Pool Cars to the Boyd Transfer & Stg. Co. Office Lake St. LaBelle Safety Storage Co. 8495 STORAGE or per DI 7840 Obituary Notices of lowest Goods Call WE Stove Repairing Mattress Renovating RUGS Dunham Scott work DEER 6629 day service Regal Mattress Weather Stripping Personals REESE enstein SENORA Room Bldg Tell-U-Where CARD Hrs. $2.95 -A Handy Guide to Reliable Services and Merchandise now INCREASE your by on G.M.C Rainville Mortuary MONSON work Furniture 2145 ARTISTIC 3000 416 Transfer and Hauling Johnson Undertak Call Co. Good Things to Eat ELECTROCURE HEALTH BELTS Vegetables. fruit. nuts. candies. etc. springs YOUNG dressed fresh Call FIRST FOR SALE MISCELLANEOUS ALMOST young CARD Mrs. 710 FOR SALE MISCELLANEOUS PEEL NOT paints FOR Auction Sales GORDON AUCTION Coal, Coke and Wood. box Dixie Fire Kindlers KINDLERS TO BOX FIRE DOWN LOW YOUR PICK RAPIDL We handle upwards of 50 dif. kinds and sizes of high grade quality Coal, Coke, Briquettes & Wood Immediate Delivery. PER TON DISC. FOR CASH LOURCITY COAL & OILCO. PHONE SOUTH 4840. SHORT TIME ONLY Extra good III., 6x3, ton $7.75 Extra Cook Stove, ton PETERSON AT. 3457 SCANDIA COAL CO. All kinds of clean KopIllinois Splint. HY SPECIAL OFFER good III. 4x2 8x3 $7.95 1625 Ashless SCRANTON WOOD Id: DRY wood SHAFT CHEAP wood. 8050 $6.00 WOOD LENGTH. LAMB 40HIGH Fixtures for Stores-Offices NEW USED STORE the also INC Goods MITBY SATHER and Oak LOW terms MUST beds KE SACRIFICE OAK THOR SHOP 8500 UNCLAIMED furn furniture REgent PIANO OAK leather chair NEW rugs NEW Household Goods. UNCLAIMED from STORAGE tables. 7120 Jewelry, Watches and Diamonds WE buy us. Loeb HIGHEST SPOT diamonds CASH gold Lumber and Building Material Garage Door Special The door CONTROL Brand We stock specially ROSE CO 1221 6TH 9542 HOME repaired LAMPLAND LBR 1627 WRECKING Lowry BUY OLD building ma dows Machinery Engines, Tools EAGLE IRON WORKS CO Repairing BUSINESS WANT good Oil Burners OIL BURNER BARBAIN Exceptional bargain latest model Pianos and Musical Instruments PIANOS FOR SALE OR RENT great stock no you day small $65 mahogany CABLE PIANO Parts and now. Phone Open 95 MAKES and Adding CASH 3769 HIGHEST USED EDUCATIONAL Dancing Schools KNIC DANCING 904 stage taugh Special Musical and Dramatic Olson BANJO Trade Professionad Write today sure X10 LEARN EARN Barber TAKE catalog Henn. SALESMEN direct This call reputable firms LESMEN WE Phone APPLIANCE $10-$25 QUICK MONEY CARDS RARE HEATER CORP CITY SALESMAN large HIGH on DO YOU Xmas 809 Good once fine opportuvacuum SELL XMAS LIVE Store and Office