Article Text

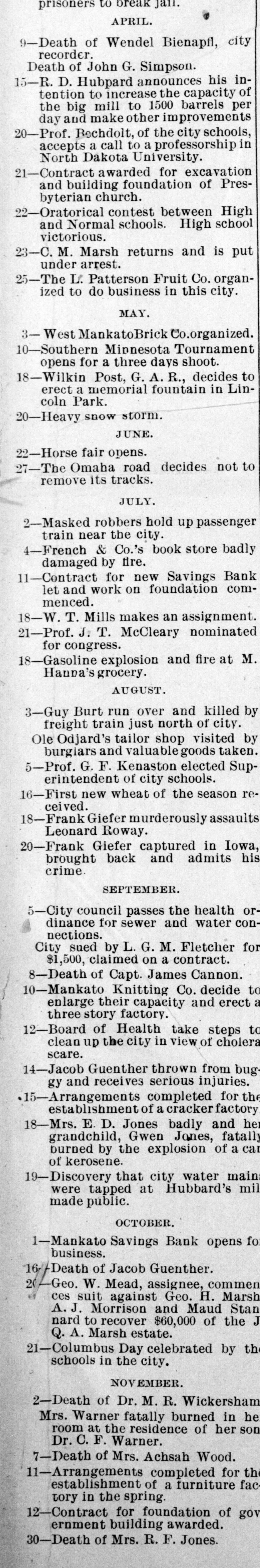

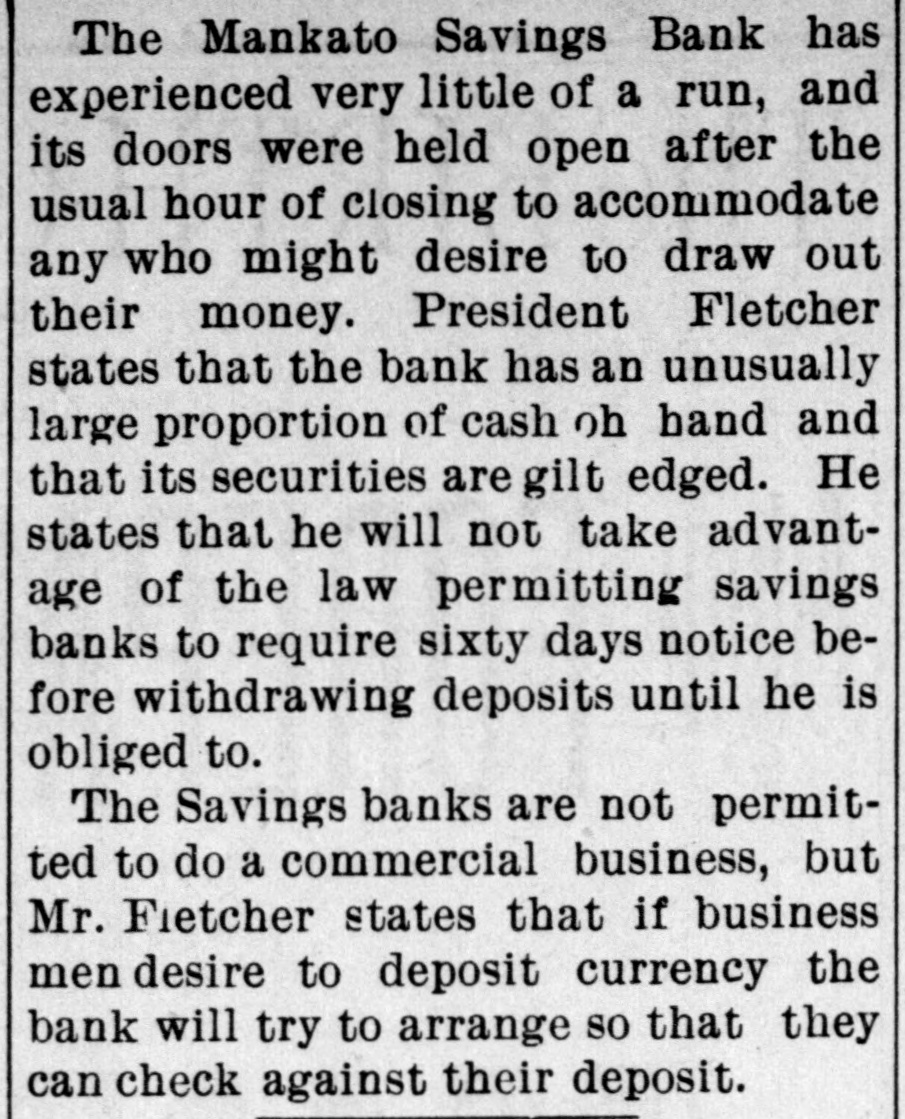

prisoners to break Jail. APRIL. 9-Death of Wendel Bienapfl, city recorder. Death of John G. Simpson. 15-R. D. Hubpard announces his intention to increase the capacity of the big mill to 1500 barrels per day and make other improvements 20-Prof. Rechdolt, of the city schools, accepts a call to a professorship in North Dakota University. 21-Contract awarded for excavation and building foundation of Presbyterian church. 22-Oratorical contest between High and Normal schools. High school victorious. 23-C. M. Marsh returns and is put under arrest. 25-The - If. Patterson Fruit Co. organized to do business in this city. MAY. West MankatoBrick Co.organized. 0-Southern Minnesota Tournament opens for a three days shoot. 18-Wilkin Post, G. A. R., decides to erect a memorial fountain in Lincoln Park. 20-Heavy snow storm. JUNE. 22-Horse fair opens. 27-The Omaha road decides not to remove its tracks. JULY. 2-Masked robbers hold up passenger train near the city. 4-French & Co.'s book store badly damaged by fire. 11-Contract for new Savings Bank let and work on foundation commenced. 18-W. T. Mills makes an assignment. 1-Prof. J. T. McCleary nominated for congress. 18-Gasoline explosion and fire at M. Hanna's grocery. AUGUST. 3-Guy Burt run over and killed by freight train just north of city. Ole Odjard's tailor shop visited by burgiars and valuablegoods taken. 5-Prof. G. F. Kenaston elected Superintendent of city schools. 16-First new wheat of the season received. 18-Frank Giefer murderously assaults Leonard Roway. 20-Frank Giefer captured in Iowa, brought back and admits his crime. SEPTEMBER. 5-City council passes the health ordinance for sewer and water connections. City sued by L. G. M. Fletcher for $1,500, claimed on a contract. 8-Death of Capt. James Cannon. 10-Mankato Knitting Co. decide to a enlarge their capacity and erect three story factory. 12-Board of Health take steps to clean up the city in view of cholera scare. 14-Jacob Guenther thrown from buggy and receives serious injuries. 15-Arrangements completed for the establishment of a cracker factory 18-Mrs. E. D. Jones badly and he grandchild, Gwen Jones, fatally burned by the explosion of a ca of kerosene. 19-Discovery that city water mains were tapped at Hubbard's mil made public. OCTOBER. 1-Mankato Savings Bank opens foi business. 16-7 Death of Jacob Guenther. 20 -Geo. W. Mead, assignee, commen ces suit against Geo. H. Marsh A.J Morrison and Maud Stan nard to recover $60,000 of the J Q.A. Marsh estate. 21-Columbus Day celebrated by th schools in the city. NOVEMBER. 2-Death of Dr. M. R. Wickersham Mrs. Warner fatally burned in he room at the residence of her son Dr. C. F. Warner. 7-Death of Mrs. Achsah Wood. 11-Arrangements completed for th establishment of a furniture factory in the spring. 12-Contract for foundation of gov ernment building awarded. 30-Death of Mrs. R. F. Jones.