Article Text

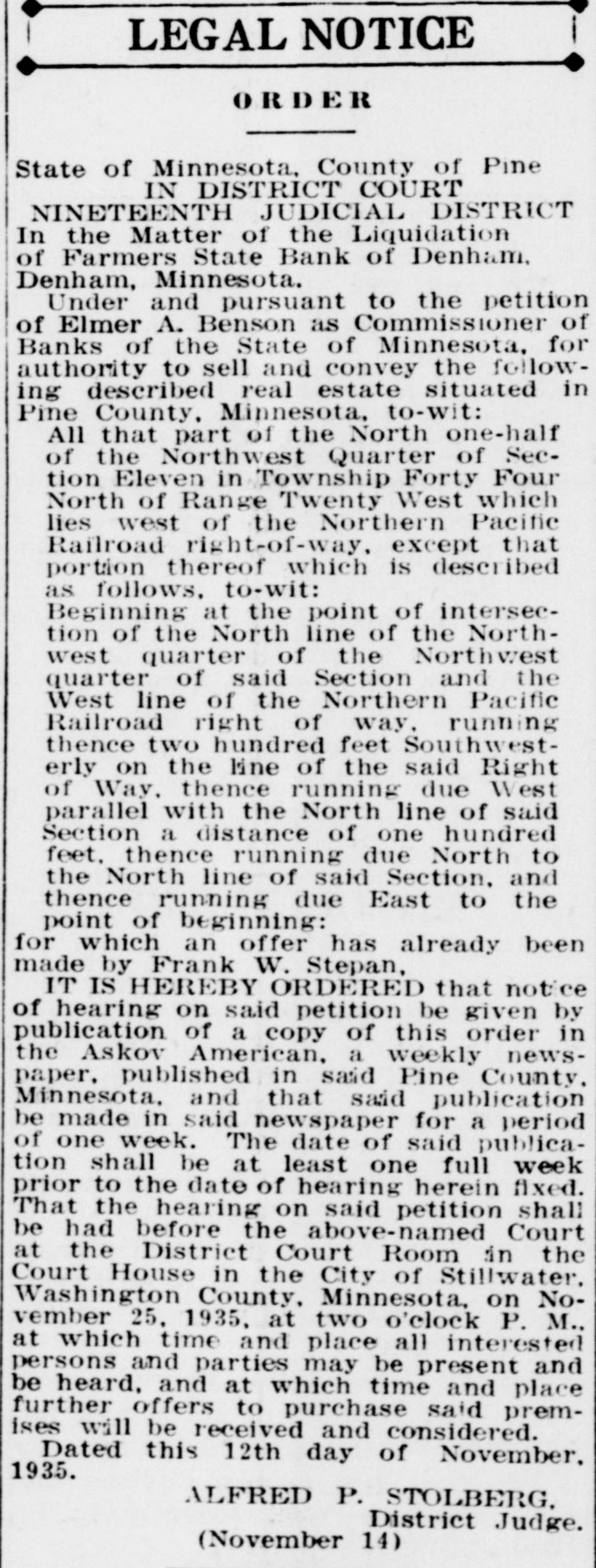

LEGAL NOTICE ORDER State of Minnesota, County of Pine IN DISTRICT COURT NINETEENTH JUDICIAL DISTRICT In the Matter of the Liquidation of Farmers State Bank of Denham, Denham, Minnesota. Under and pursuant to the petition of Elmer A. Benson as Commissioner of Banks of the State of Minnesota, for authority to sell and convey the following described real estate situated in Pine County. Minnesota, to-wit: All that part of the North one-half of the Northwest Quarter of Section Eleven in Township Forty Four North of Range Twenty West which lies west of the Northern Pacific Railroad right-of-way, except that portion thereof which is described as follows, to-wit: Beginning at the point of intersection of the North line of the Northwest quarter of the Northwest quarter of said Section and the West line of the Northern Pacific Railroad right of way, running thence two hundred feet Southwesterly on the line of the said Right of Way, thence running due West parallel with the North line of said Section a distance of one hundred feet, thence running due North to the North line of said Section, and thence running due East to the point of beginning: for which an offer has already been made by Frank W. Stepan, IT IS HEREBY ORDERED that notice of hearing on said petition be given by publication of a copy of this order in the Askov American, a weekly newspaper, published in said Pine County. Minnesota, and that said publication be made in said newspaper for a period of one week. The date of said publication shall be at least one full week prior to the date of hearing herein fixed. That the hearing on said petition shall be had before the above-named Court at the District Court Room in the Court House in the City of Stillwater. Washington County, Minnesota, on November 25, 1935, at two o'clock P. M., at which time and place all interested persons and parties may be present and be heard, and at which time and place further offers to purchase said premises will be received and considered. Dated this 12th day of November, 1935. ALFRED P. STOLBERG. District Judge. (November 14)