Article Text

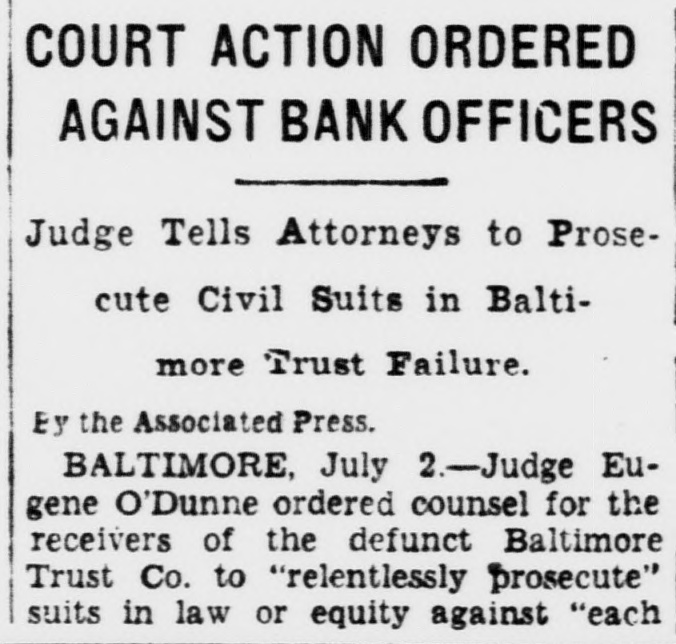

Jan. Stores. Cities. + 7 Total 480 237 Reserve districts: 29 51 8 Boston 9 25 50 New York 6 13 27 Philadelphia 22 5 11 Cleveland 11 55 27 Richmond 10 19 33 Atlanta + 3 59 27 Chicago + 5 33 18 St. Louis + 37 19 6 Minneapolis + 8 18 12 Kansas City 8 19 15 Dalias 76 8 29 San Francisco *January figures preliminary; in most cities the month had the same number of business days this year and last year January sales in Washington stores, as noted yesterday, were 14.1 per cent ahead of January, 1935. Banks Asessed $17,345,000. First computations by the Federal Deposit Insurance Corp. of certified statements submitted by its insured banks show that their total average daily deposits for the three closing months of 1935 were approximately $41,629,000,000. On the basis of that figure the 14,208 banks which are members of the F. D. I. C. will pay as insurance assessment for the first six months of 1936 the sum of $17,345,000. Except for 219 banks the payment took the form of a deduction from credits standing on the books of the corporation from the period of the temporary insurance fund, terminated August 23, 1935. Actual remittances by the 219 banks whose credit had been exhausted amounted to a little more than $4,700,000. The present assessment was based on average daily deposits for the months of October November and December, 1935, less items in process of collection and certain other allowable deductions. Declined Reserve Positions. Discussion revolving around appointment of the new Federal Reserve Board has brought out the fact that F Gloyd Awalt. who is leaving his post as deputy controller of the currency, to practice law. and Leo T. Crowley of the Federal Deposit Insurance Corp., were both offered posts on the new Federal Reserve Board, but declined the offers. The salary of the Reserve Board governors is $15,000 a year The Bond Club of Washington held its first luncheon of the present year at the Racquet Club on Sixteenth street this noon, President James H. Lemon presiding. The guest speaker was James M. Landis, chairman of the Securities Exchange Commission. The attendance was said to be the largest in the history of the club. bankers and Government officials in addition to the regular members being present. Telephones in Maryland have increased nearly twice as fast in 35 years as have telephones in the United States Maryland is now served by more than 212.000 telephones as compared with 6,278 in 1900. During the same period telephones in the United States have increased from 1,000,000 to 17,000,000. Banks Prefer Newspapers. Development of a policy of co-operation with newspapers was advocated as one of the most effective methods for banks to build public confidence in an address by Robert W. Sparks, vice president of Bowery Savings Bank, New York, at the Midwinter trust conference of the American Bankers' Association. He said that a survey just completed by the Financial Advertisers' Association showed that newspapers are still the preferred advertising media for banks in the United States and Canada, and that 98 per cent of the banks replying to a questionnaire sent out by the association said that they will use newspaper advertising in 1936. M. P. Callaway, president of the Trust Division, said increasing costs and decreasing income are rapidly producing a crisis which will force many trust institutions to get out of the trust business or continue trust service in the interest of the public at loss He sees little hope in reducing expenses which even may go higher. The character of service cannot be reduced, he said. In his opinion the way out is in an increase in rates of compensation. Most of the present rates are of long standing, dating back to a time when the investment of trust funds was a comparatively simple matter. when an investment once made in good bonds, good mortgages or sound stocks required no great amount of watching or changing Heard in Financial District. Following yesterday's holiday, the New York Stock Exchange offices were very popular today, particular interest centering in the steel stocks. The usual amount of talk was heard on the possibility of a T. V. A. ruling by the Supreme Court next Monday Predictions are becoming less and less positive. It is reported here that the receiver for the Baltimore Trust Co. is to make another distribution of 5 per cent to depositors and creditors, involving $1,208,969 Depositors have already received 31.6 per cent The R. F. C. Mortgage Co., effective February 15. will purchase insured mortgages at a discount of onehalf of 1 per cent. The discount rate now is 1 per cent. The reduction was announced in a letter from R. F. C. Chairman Jones to Stewart McDonald, Federal housing administrator. Fred C. Moffatt was unanimously re-elected president of the New York Curb Exchange by the board of governors at a special organization meeting. Charles S. Leahy and Mortimer Landsberg were re-elected vice president and treasurer. respectivly.