Article Text

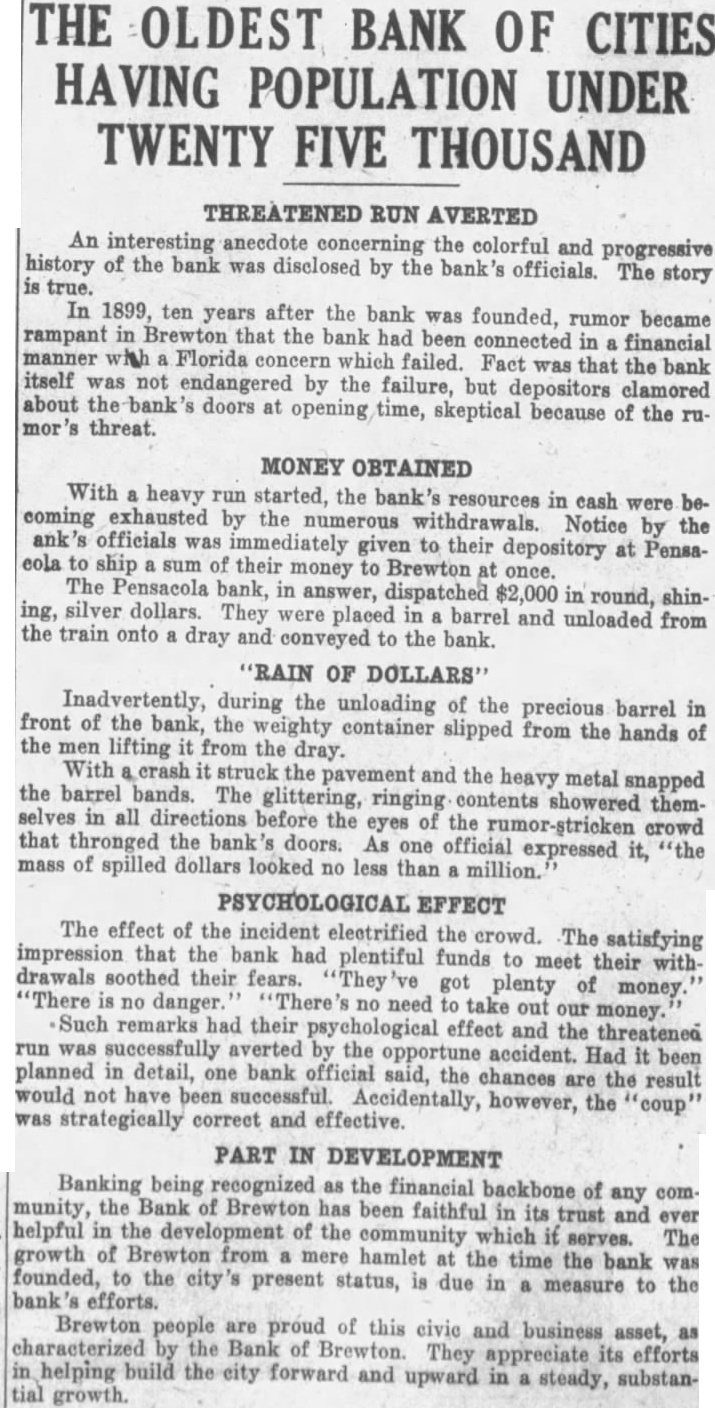

THE OLDEST BANK OF CITIES HAVING POPULATION UNDER TWENTY FIVE THOUSAND THREATENED RUN AVERTED An interesting anecdote concerning the colorful and progressive history of the bank was disclosed by the bank's officials. The story is true. In 1899, ten years after the bank was founded, rumor became rampant in Brewton that the bank had been connected in a financial manner wh Florida concern which failed. Fact was that the bank itself was not endangered by the failure, but depositors clamored about the bank's doors at opening time, skeptical because of the rumor's threat. MONEY OBTAINED With a heavy run started, the bank's resources in cash were becoming exhausted by the numerous withdrawals. Notice by the ank's officials was immediately given to their depository at Pensacola to ship a sum of their money to Brewton at once. The Pensacola bank, in answer, dispatched $2,000 in round, shining, silver dollars. They were placed in a barrel and unloaded from the train onto a dray and conveyed to the bank. "RAIN OF DOLLARS" Inadvertently, during the unloading of the precious barrel in front of the bank, the weighty container slipped from the hands of the men lifting it from the dray. With crash it struck the pavement and the heavy metal snapped the barrel bands. The glittering, ringing contents showered themselves in all directions before the eyes of the rumor-stricken crowd that thronged the bank's doors. As one official expressed it, "the mass of spilled dollars looked no less than a million. PSYCHOLOGICAL EFFECT The effect of the incident electrified the crowd. The satisfying impression that the bank had plentiful funds to meet their withdrawals soothed their fears. They've got plenty of money. "There is no danger. "There's no need to take out our money. Such remarks had their psychological effect and the threatened run was successfully averted by the opportune accident. Had it been planned in detail, one bank official said, the chances are the result would not have been successful. Accidentally, however, the "coup" was strategically correct and effective. PART IN DEVELOPMENT Banking being recognized as the financial backbone of any community, the Bank of Brewton has been faithful in its trust and ever helpful in the development of the community which it serves. The growth of Brewton from a mere hamlet at the time the bank was founded, to the city's present status, is due in a measure to the bank's efforts. Brewton people are proud of this civic and business asset, as characterized by the Bank of Brewton. They appreciate its efforts in helping build the city forward and upward in a steady, substantial growth.