1.

October 19, 1903

The Minneapolis Journal

Minneapolis, MN

Click image to open full size in new tab

Article Text

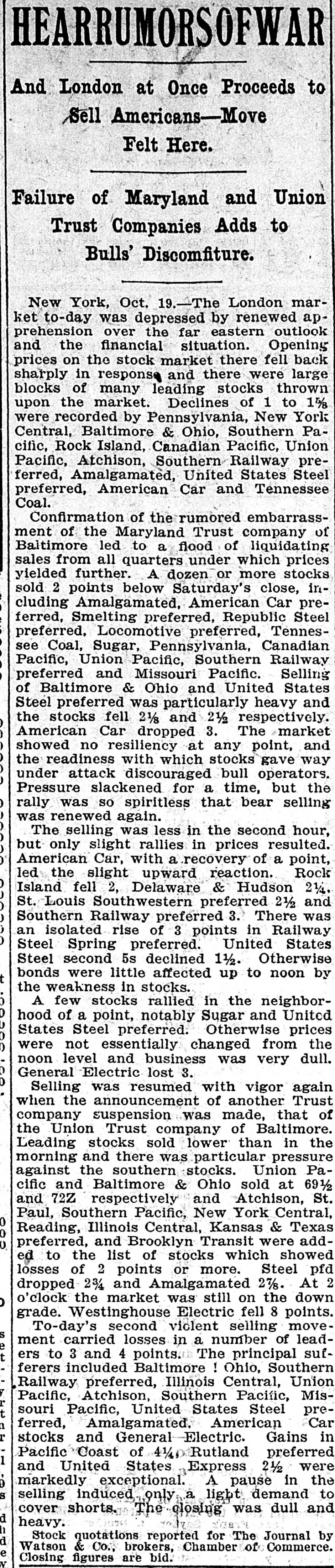

HEARRUMORSOFWAR And London at Once Proceeds to Sell Americans-Move Felt Here. Failure of Maryland and Union Trust Companies Adds to Bulls' Discomfiture. New York, Oct. 19.-The London market to-day was depressed by renewed apprehension over the far eastern outlook and the financial situation. Opening prices on the stock market there fell back sharply in response and there were large blocks of many leading stocks thrown upon the market. Declines of 1 to 1% were recorded by Pennsylvania, New York Central, Baltimore & Ohio, Southern Pacific, Rock Island, Canadian Pacific, Union Pacific, Atchison, Southern Railway preferred, Amalgamated, United States Steel preferred, American Car and Tennessee Coal. Confirmation of the rumored embarrassment of the Maryland Trust company of Baltimore led to a flood of liquidating sales from all quarters under which prices yielded further. A dozen or more stocks sold 2 points below Saturday's close, including Amalgamated, American Car preferred, Smelting preferred, Republic Steel preferred. Locomotive preferred, Tennessee Coal, Sugar, Pennsylvania, Canadian Pacific, Union Pacific, Southern Railway preferred and Missouri Pacific. Selling of Baltimore & Ohio and United States Steel preferred was particularly heavy and the stocks fell 2½ and 2½ respectively. American Car dropped 3. The market showed no resiliency at any point, and the readiness with which stocks gave way under attack discouraged bull operators. Pressure slackened for a time, but the rally was SO spiritless that bear selling was renewed again. The selling was less in the second hour, but only slight rallies in prices resulted. American Car, with a recovery of a point, led the slight upward reaction. Rock Island fell 2, Delaware & Hudson 21/4. St. Louis Southwestern preferred 2½ and Southern Railway preferred 3. There was an isolated rise of 3 points in Railway Steel Spring preferred. United States Steel second 5s declined 1½. Otherwise bonds were little affected up to noon by the weakness in stocks. A few stocks rallied in the neighborhood of a point, notably Sugar and United States Steel preferred. Otherwise prices were not essentially changed from the noon level and business was very dull. General Electric lost 3. Selling was resumed with vigor again when the announcement of another Trust company suspension was made, that of the Union Trust company of Baltimore. Leading stocks sold lower than in the morning and there was particular pressure against the southern stocks. Union Pacific and Baltimore & Ohio sold at 691/2 and 72Z respectively and Atchison, St. Paul, Southern Pacific, New York Central, Reading, Illinois Central, Kansas & Texas preferred, and Brooklyn Transit were added to the list of stocks which showed losses of 2 points or more. Steel pfd dropped 23/4 and Amalgamated 27/8. At 2 o'clock the market was still on the down grade. Westinghouse Electric fell 8 points. To-day's second violent selling movement carried losses in a number of lead-

2.

October 19, 1903

The Topeka State Journal

Topeka, KS

Click image to open full size in new tab

Article Text

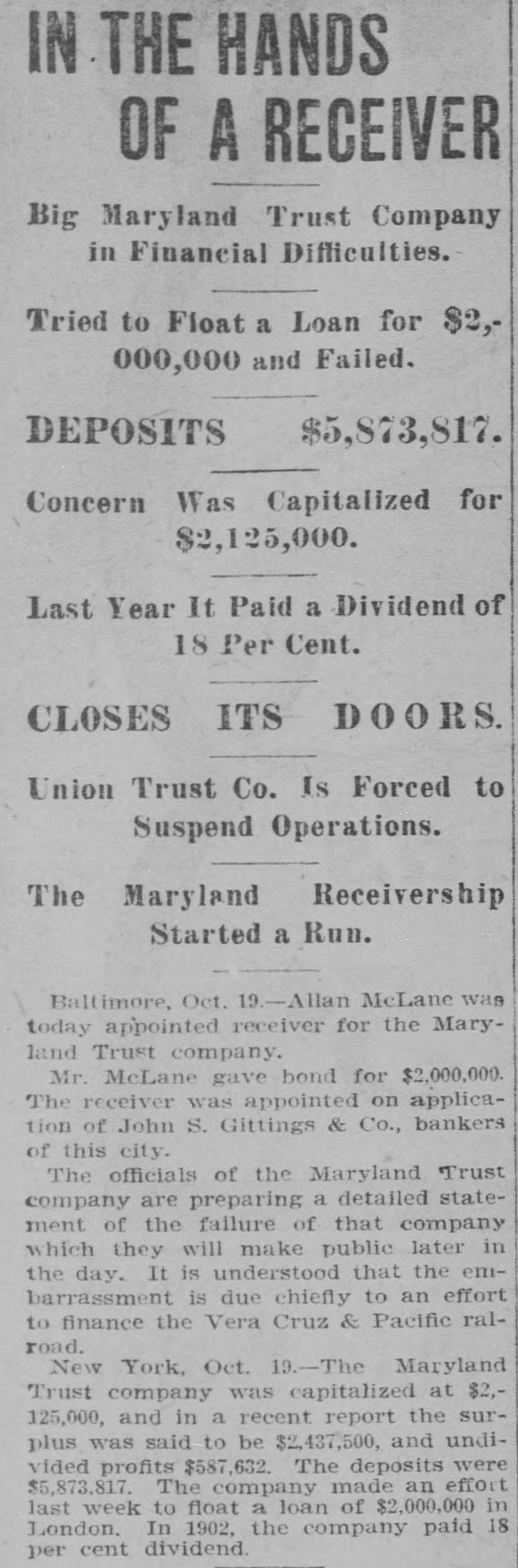

IN THE HANDS OF A RECEIVER Big Maryland Trust Company in Financial Difficulties. Tried to Float a Loan for $2,000,000 and Failed. DEPOSITS $5,873,817. Concern Was Capitalized for $2,125,000. Last Year It Paid a Dividend of 18 Per Cent. CLOSES ITS DOORS. Union Trust Co. Is Forced to Suspend Operations. The Receivership Maryland Started a Run. Baltimore, Oct. 19.-Allan McLane was today appointed receiver for the Maryland Trust company. Mr. McLane gave bond for $2,000,000. The receiver was appointed on application of John S. Gittings & Co., bankers of this city. The officials of the Maryland Trust company are preparing a detailed statement of the failure of that company which they will make public later in the day. It is understood that the embarrassment is due chiefly to an effort to finance the Vera Cruz & Pacific ralroad. New York, Oct. 19.-The Maryland Trust company was capitalized at $2,125,000, and in a recent report the surplus was said to be $2,437,500, and undivided profits $587,632. The deposits were $5,873,817. The company made an effort last week to float a loan of $2,000,000 in London. In 1902, the company paid 18 per cent dividend.

3.

October 19, 1903

The Fargo Forum and Daily Republican

Fargo, ND

Click image to open full size in new tab

Article Text

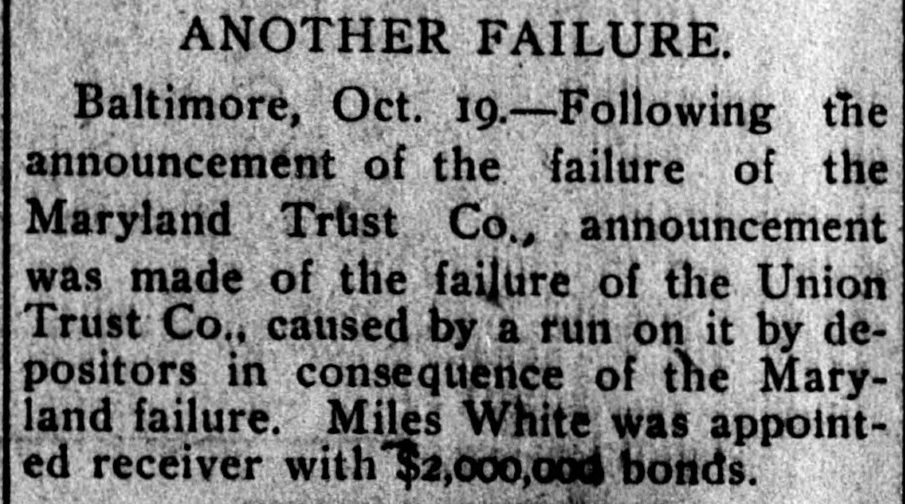

ANOTHER FAILURE. Baltimore, Oct. 19.-Following the announcement of the failure of the Maryland Trust Co., announcement was made of the failure of the Union Trust Co., caused by a run on it by depositors in consequence of the Maryland failure. Miles White was appointed receiver with $2,000,000 bonds.

4.

October 19, 1903

Evening Times-Republican

Marshalltown, IA

Click image to open full size in new tab

Article Text

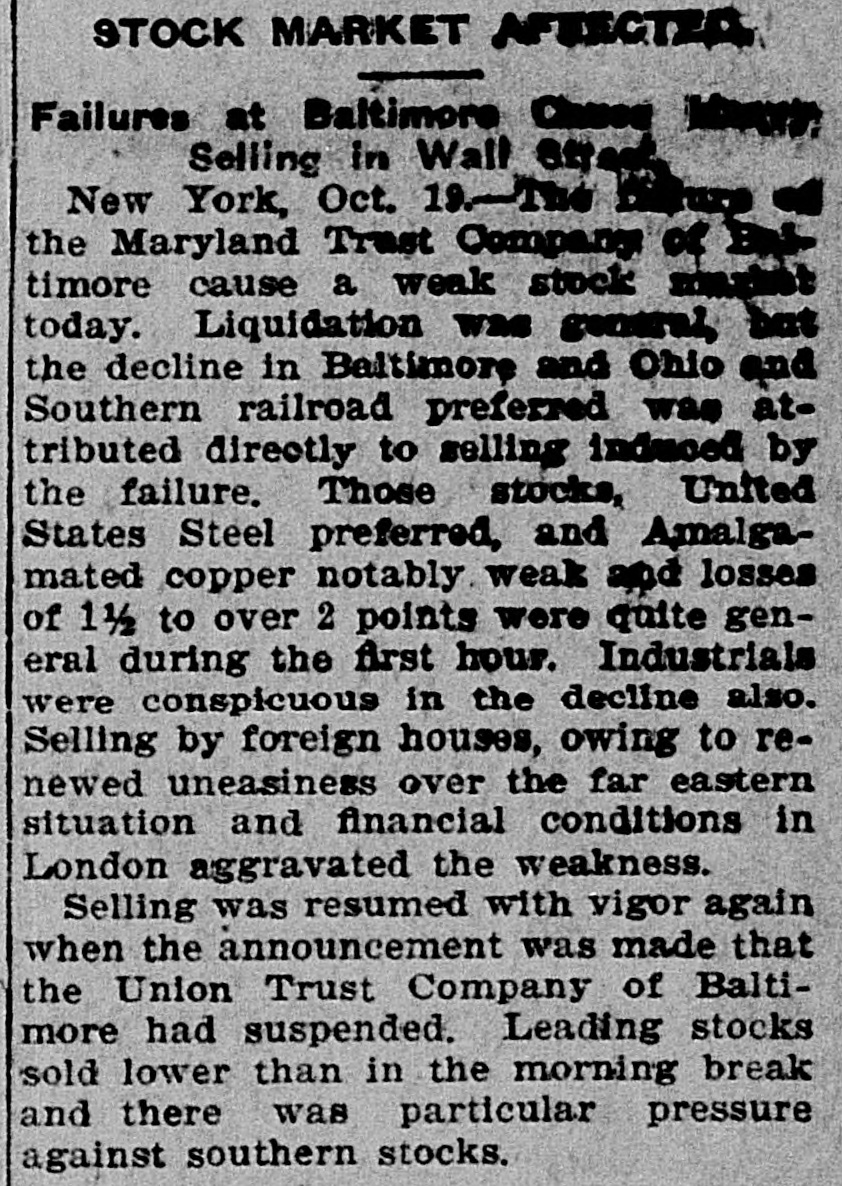

STOCK MARKET Failures at Baltimore Selling in Wall New York, Oct. 19.The the Maryland Trust Company timore cause a weak stock today. Liquidation was general the decline in Baltimore and Ohio and Southern railroad preferred was attributed directly to selling induced by the failure. Those stocks, United States Steel preferred, and Amalgamated copper notably weak and losses of 1 1/2 to over 2 points were quite general during the first hour. Industrials were conspicuous in the decline also. Selling by foreign houses, owing to renewed uneasiness over the far eastern situation and financial conditions in London aggravated the weakness. Selling was resumed with vigor again when the announcement was made that the Union Trust Company of Baltimore had suspended. Leading stocks sold lower than in the morning break and there was particular pressure against southern stocks.

5.

October 19, 1903

The Roswell Daily Record

Roswell, NM

Click image to open full size in new tab

Article Text

TRUST COMPANY QUITS. Another Baltimore Concern Closes Its Doors. Baltimore, Md., Oct. 19.-The Union Trust Co. closed its doors this afternoon. Miles White, Jr., is appointed receiver. The Union Trust Co. had a paid up capital of $1,000,000, surplus $250,000 and undivided profits 259,000. The Union Trust Co. had on deposit at last statement, $1,935.000; loans were $1.418.000. Gorge W. Blackstone is president of the company. Receiver White said closing was due to a run of depositors in consequence of the failure of the Maryland Trust company. There were no business connections between the companies.

6.

October 20, 1903

Arizona Republican

Phoenix, AZ

Click image to open full size in new tab

Article Text

There Was a Financial Crash in Baltimore GAME WITHOUT WARNING Two Trust Companies Overladen With Securities Go to the Wall. Great Anxiety in Financial Circles for the Future. Baltimore, Md.. Oct. 19.-This has been a day of marked excitement and subdued anxiety in the financial and business circles of Baltimore. Luckily a dozen reports well calculated to start a wholesale run on the banks did not reach the great army of depositors throughout the city, thus giving ample time for conservative leaders of business to allay popular apprehension before it reached dangerous proportions. The day began with the announcement of the failure of the Maryland Trust company, and except to a few the news came as a bolt out of the sky, spreading consternation in all directions. To these few it was known that the trust company had long been struggling with "undigested securities," that it had sustained heavy withdrawais of deposits and that, finally, on Satruday last it had failed in its efforts to negotiate a $2,000,000 loan in London. The suspension of the Union Trust company which happened at a late hour in the day, gave an impetus to many baseless rumors as to other financial institutions, which might well have created a panic had they been given currency early in the day. It was agreed among leaders and so given out that there is nothing alarming in the general financial situation in this city and that the mere fact that temporary difficulties overtook one or two concerns is no reason why the other institutions should be regarded with suspicion. One of the most prominent bankers in Baltimere said: "It all depends on how the people of Baltimore act. If they don't lose their heads the trouble will blow over in time and nobody will be hurt; but if they become panic stricken the consequences will be serious. This is a time for calm judgment." Allan McLane, third vice president of the Maryland Trust company, was appointed to take charge of the affairs of that company. Miles White, jr., first vice president of the Union Trust company, was appointed receiver of that institution. Mr. McLane gave bond in the sum of $2,000,000 and Mr. White gave bond in the sum of $1,000.000. The last statement of the Maryland Trust company. issued on June 30, 1903, showed a capital stock of $2,125,000, a surplus of 2,437,500 and undivided profits of $677,998.86. The company has demand and time deposits amounting to $5,773,817.15. The Union Trust company had deposits amounting to nearly $2,000,000. The filing of the first applications for

7.

October 20, 1903

Rock Island Argus

Rock Island, IL

Click image to open full size in new tab

Article Text

MILLIONS NEEDED To Set Two Defunct Baltimore Institutions on Their Feet.i RECEIVERS NOW IN CHARGE Carrying Too Many Railway Projects Cause of Disaster. Baltimore, Oct. 20.-Excitement and anxiety marks the feeling in financial and business circles of Baltimore, Luckily a dozen reports well calculated to provoke a wholesale run on banks got no further than the precincts of South and German streets, Baltimore's Wall street distric t, and did not reach the great army of depositors throughout the city, thus giving ample time for the conservative leaders of business to allay popular apprehension before it reached dangerous proportions, The trouble began with the announcement of the failure of the Maryland Trust company. No Necessity for a Panic. It was agreed among the leaders, and so given out, that there is nothing alarming in the general financial situation in this cty, and the mere fact that temporary difficulties overtook one or two concerns should be regarded with suspicion. As one of the most influential bankers in Baltimore put it: "Our financial institutions are strong and have placed themselves in position to withstand any assaults upon their credit standing." Depends on the Baltimore People. Or as another leading banker, perhaps the most prominent in Baltimore, put it: "It all depends upon how the people of Baltimore act. If they do not lose their heads the trouble will blow over in time and nobody will be hurt; but if they become panie-stricken the consequences will be serious. This is a time to use calm judgment."

8.

October 20, 1903

Daily Kennebec Journal

Augusta, ME

Click image to open full size in new tab

Article Text

sale of those securities were it not for the fact that I find it has a large line of demand deposits subject to withdrawal on call and that during the past week two large withdrawals were made upon it. This rendered it absolutely necessary for the conduct of the business upon an honorable basis to obtain a temporary loan upon certain of the investments owned by the company.

"This latter loan was in process of negotiation with prospects of a favorable result, when on Saturday, last, the third vice president, who owing to the illness and absence the past six weeks of the president and first vice president had been compelled to take up the entire management of the company discovered that the obtaining of such a temporary loan, when taken into connection with the proposed loan on the Vera Cruz and Pacific securities, fell far short of enabling the Maryland Trust Co. to continue to conduct business was only putting off the evil day upon the chance of effecting a sale of the Vera Cruz and Pacific road, in order to make itself absolutely solvent.

"In view of this condition of affairs, I went to New York, Saturday night and withdrew the application for the temporary loan, and called together the members of the executive committee who could be reached, to meet me Sunday night, upon my return from New York, at which meeting I laid before them the situation of the company discovered by me for the first time the day previous and told them that in my opinion, we could not run the risk of waiting until Tuesday for action by the directors, at their quarterly meeting, as should large withdrawals take place, Monday, the company would manifestly be unable to meet them and we would have to suspend.

"The committee approved of this view and the same evening, at the same place a conference with representatives of some of the largest and most responsible financial institutions in this city, who had been invited to meet there. I laid before them the entire state of the case. After a protracted conference lasting into, Monday morning, it was unanimously decided by all present with great regret that there was nothing to do but follow the course proposed.

"At this time without a more accurate examination of the books and exact knowledge of the various figures I shall not attempt to give figures to the press, but will do so at the earliest practicable opportunity. In the meantime prompt and earnest efforts will be made to advise with the leading creditors of the company with a view to preparing plans for realizing to the best advantage the various assets."

9.

October 20, 1903

The Daily Morning Journal and Courier

New Haven, CT

Click image to open full size in new tab

Article Text

opportunity. In the meantime prompt and earnest efforts will be made to advise with the leading creditors of the company with a view to preparing plans for realizing to the best advantage the various assets." The Union Trust company failed becuase of a run on its banking department, about $150,000 having been withdrawn by depositors to-day, but the real troubles of the company had their origin in the organization of the South and Western Railway of Virginia, in which a capitalization of about $11,000,000 was contemplated. The Union company was the fiscal agent for the Virginia enterprise just as the Maryland company was the fiscal agent for the Mexican railway. Though these two failures followed so closely it can be stated on unquestioned authority that there was no connection whatever between teh two. They were not jointly interested in any enterprise, so that the suspension of one had no direct bearing upon the 'other. It may also be stated that neither company managed trust estates. There have been other financial troubles in Baltimore within a recent period, involving, first the City Trust and Banking company and coincidentally the Hammond Ice company and then William J. Middendorf & Co., but it is not believed that they were in any manner the forerunners of to-day's suspensions. J. W. Middendorf speaking for his firm and J. L. Williams & Sons of Richmond said to-day: The difficulties of the Maryland Trust company have no relationship to ours. That institution has never been identified with Seaboard interests, nor does it own, nor has it ever owned so far as our knowledge goes, a share of Seaboard stock. Neither my firm nor Mr. Williams owes a dollar to the Maryland Trust company nor does that company owe us anything." The city of Baltimore has $30,000 invested with the Maryland Trust company, and this is secured by three bonding companies of this city, the finance commissioners report. While the events of to-day have provoked inevitable uneasiness, the feeling in financial circles at the close of business was one of confidence and that there will be no more failures in this city, and that after a brief period of unrest, business will settle down to its accustomed channels of security.

10.

October 20, 1903

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

New-York Daily Tribune

TUESDAY, OCTOBER 20, 1903.

THE NEWS THIS MORNING.

FOREIGN.-A draft of the decision reached by the Alaska Boundary Commission was signed by a majority of the commissioners, Mr. Aylesworth and Sir Louis A. Jetté refusing to adix their names: the award of the tribunal will be read in public to-day.

John Morley, speaking at Manchester, made a spirited attack on the policy of protection, and upheld the measures of Cobden and Bright; Sir Robert Finlay, the Attorney General, spoke in opposition to Mr. Balfour's plans.

A dispatch from Yokohama said that the Russo-Japanese negotiations had again temporarily ceased; a majority of the Russian warships left Port Arthur, and the Japanese squadron sailed from Masanpho.

An indictment against Alonzo Cruzen, Collector of Customs at San Juan, P. R., was made of no effect by the action of the District Attorney.

The freedom of the city of Waterford was bestowed on Andrew Carnegie.

A satisfactory trial of M. Santos-Dumont's new dirigible balloon was held near Paris.

The British battleship Prince George, injured in a collision with the Hannibal, was beached at Ferral.

DOMESTIC.-The Maryland Trust Company and the Union Trust Company, both of Baltimore, went into the hands of receivers; there were also failures of two banks in Wisconsin and one in Washington State and one in California.

President Roosevelt is expected to issue his proclamation to-day calling Congress to meet in extraordinary session on November 9.

The President has directed that men removed from the Philadelphia Mint for political reasons be reinstated.

The Immigration Bureau has discovered evidence of extensive violations of the Contract Labor law, by which hundreds of Welsh miners are being brought to this country.

Eight men were killed and five seriously injured by an accident at the new Wabash Bridge in Pittsburg.

William Carthew was arrested in California charged with embezzling $100,000 from a bank in this city.

CITY.-Stocks were down 1 to 3 points.

"Boss" McLaughlin triumphed over Senator McCarren at the meeting in Brooklyn of the Kings County Democracy General Committee.

W. S. Devery intimated that Charles F. Murphy was receiving protection money from a disorderly house.

Mayor Low was enthusiastically received at four fusion meetings which he addressed on the East Side.

Colonel McClellan spoke at two Democratic meetings in Brooklyn, at one of which Controller Grout told how his bargain was made with Tammany, and at one meeting in Manhattan.

THE WEATHER.-Indications for to-day: Fair, fresh southwest winds. The temperature yesterday: Highest, 58 degrees; lowest, 44.

11.

October 21, 1903

Daily New Dominion

Morgantown, WV

Click image to open full size in new tab

Article Text

Poured Into Baltimore by Banking Houses Throughout the Country. FINANCIAL CRISIS IS PASSED Maryland Trust Company Will in Time Pay Dollar for Dollar-Union Trust Company to Resume Business Soon. Other Institutions All Right. Baltimore, Oct. 21.-Four millions of dollars which arrived here by express from New York, Philadelphia and Washington cleared the financial atmosphere and at the closing time of the various monetary institutions there was every confidence that the crisis in the financial district of the city had been safely passed. Every incoming train during the late afternoon and evening brought packages of money to the banks and trust companies, and it is estimated that there is at least $8,000,000 of currency in the vaults of the financial institutions of the city. Conferences were held between various interests and it was stated by a prominent banker that no further trouble among the banks or financial institutions of the city was probable. The directors and the receiver of the Maryland Trust company, the first to close its doors on Monday, held a conference and discussed ways and means, but Receiver Allan McLane said he nothing to make public, although he expressed the opinion that the company would in the near future be in position to pay dollar for dollar to all its depositors and creditors. The directors of the Union Trust company also held a long session. While the statement of assets and liabilities of this company is not ready to be presented to the courts, Receiver White expressed the opinion that the company will in a few days resume business. Other banking and trust companies have been well fortified with currency and no further trouble is expected from any quarter.

12.

October 21, 1903

The Barre Daily Times

Barre, VT

Click image to open full size in new tab

Article Text

NEW YORK MARKET DOWN. Baltimore Failures Seriously Affect All Stocks. New York, Oct. 20.-The failure 0. the Maryland Trust company of Bal timore caused a weak stock market Liquidation was general, but the de cline in Baltimore and Ohio and South ern railway preferred was attributed directly to selling induced by the fail ure. Those stocks, United States Stee preferred and Amalgamated Copper were notably weak, but losses of 1½ to over 2 points were quite general dur ing the first hour. The industrials were conspicuous in the decline also. Selling was resumed with vigor agair when the announcement of another trust company suspension was madethat of the Union Trust company 0) Baltimore. Leading stocks sold lower than in the morning, and there was particular pressure against the com mon stocks. Union Pacific and Balti more and Ohio sold at 69½ and 72% respectively, and Atchison, St. Paul Southern Pacific, New York Central Reading, Illinois Central, Kansas and Texas preferred and Brooklyn Transit were added to the list of stocks which showed losses of 2 points or more Steel preferred dropped 28/4 and Amal gamated 2½. At 2 o'clock the market was still on the down grade. Westing house Electric fell 8 points.

13.

October 22, 1903

Iowa County Democrat

Mineral Point, WI

Click image to open full size in new tab

Article Text

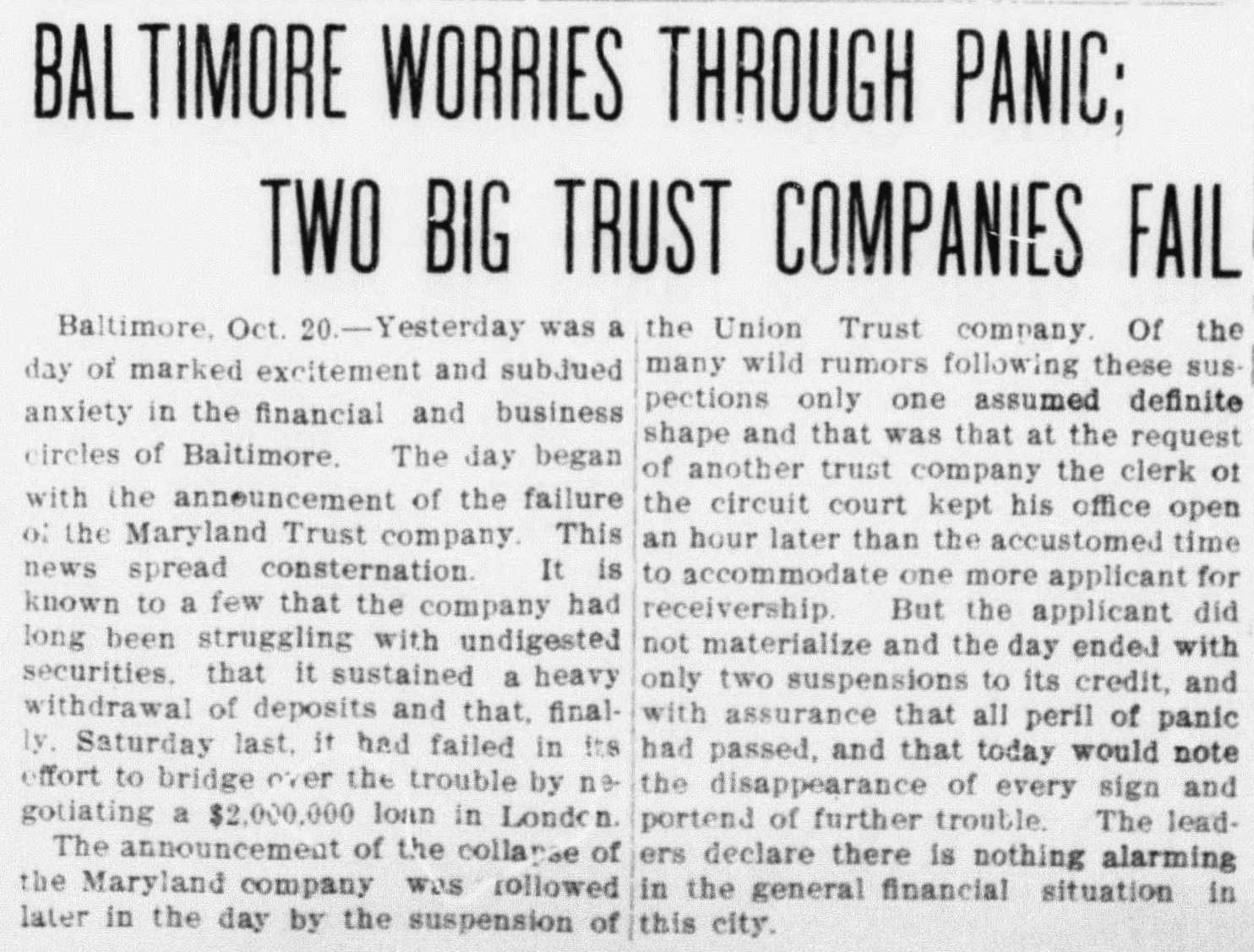

BALTIMORE WORRIES THROUGH PANIC; TWO BIG TRUST COMPANIES FAIL Baltimore, Oct. 20.-Yesterday was a the Union Trust company. Of the many wild rumors following these susday of marked excitement and subjued pections only one assumed definite anxiety in the financial and business shape and that was that at the request circles of Baltimore. The day began of another trust company the clerk ot with the announcement of the failure the circuit court kept his office open of the Maryland Trust company. This an hour later than the accustomed time news spread consternation. It is to accommodate one more applicant for known to a few that the company had receivership. But the applicant did long been struggling with undigested not materialize and the day ended with securities. that it sustained a heavy only two suspensions to its credit, and withdrawal of deposits and that, finalwith assurance that all peril of panic ly. Saturday last, it had failed in its had passed, and that today would note effort to bridge over the trouble by nethe disappearance of every sign and gotiating a $2,000,000 loan in Londo n. portend of further trouble. The leadThe announcement of the collanse of ers declare there is nothing alarming the Maryland company was rollowed in the general financial situation in later in the day by the suspension of this city.

14.

October 22, 1903

The Saint Paul Globe

Saint Paul, MN

Click image to open full size in new tab

Article Text

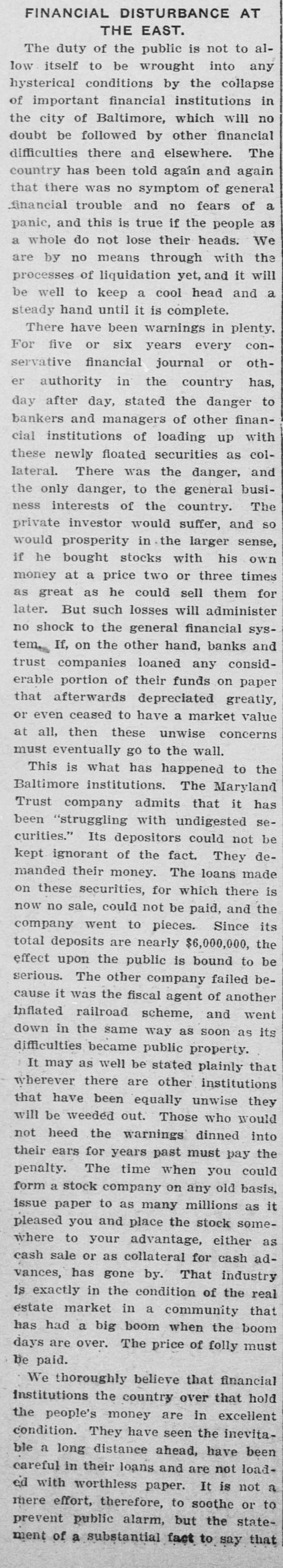

FINANCIAL DISTURBANCE AT THE EAST. The duty of the public is not to allow itself to be wrought into any hysterical conditions by the collapse of important financial institutions in the city of Baltimore, which will no doubt be followed by other financial difficulties there and elsewhere. The country has been told again and again that there was no symptom of general financial trouble and no fears of a panic, and this is true if the people as a whole do not lose their heads. We are by no means through with the processes of liquidation yet, and it will be well to keep a cool head and a steady hand until it is complete. There have been warnings in plenty. For five or six years every conservative financial journal or other authority in the country has, day after day, stated the danger to bankers and managers of other financial institutions of loading up with these newly floated securities as collateral. There was the danger, and the only danger, to the general business interests of the country. The private investor would suffer, and so would prosperity in the larger sense, if he bought stocks with his own money at a price two or three times as great as he could sell them for later. But such losses will administer no shock to the general financial system If, on the other hand, banks and trust companies loaned any considerable portion of their funds on paper that afterwards depreciated greatly, or even ceased to have a market value at all, then these unwise concerns must eventually go to the wall. This is what has happened to the Baltimore institutions. The Maryland Trust company admits that it has been "struggling with undigested securities." Its depositors could not be kept ignorant of the fact. They demanded their money. The loans made on these securities, for which there is now no sale, could not be paid, and the company went to pieces. Since its total deposits are nearly $6,000,000, the effect upon the public is bound to be serious. The other company failed because it was the fiscal agent of another inflated railroad scheme, and went down in the same way as soon as its difficulties became public property. It may as well be stated plainly that wherever there are other institutions that have been equally unwise they will be weeded out. Those who would not heed the warnings dinned into their ears for years past must pay the penalty. The time when you could form a stock company on any old basis, issue paper to as many millions as it pleased you and place the stock somewhere to your advantage, either as cash sale or as collateral for cash advances, has gone by. That industry is exactly in the condition of the real estate market in a community that has had a big boom when the boom days are over. The price of folly must be paid. We thoroughly believe that financial Institutions the country over that hold the people's money are in excellent condition. They have seen the inevitable a long distance ahead, have been careful in their loans and are not loaded with worthless paper. It is not a mere effort, therefore, to soothe or to prevent public alarm, but the statement of a substantial fact to say that

15.

April 30, 1904

The St. Louis Republic

Saint Louis, MO

Click image to open full size in new tab

Article Text

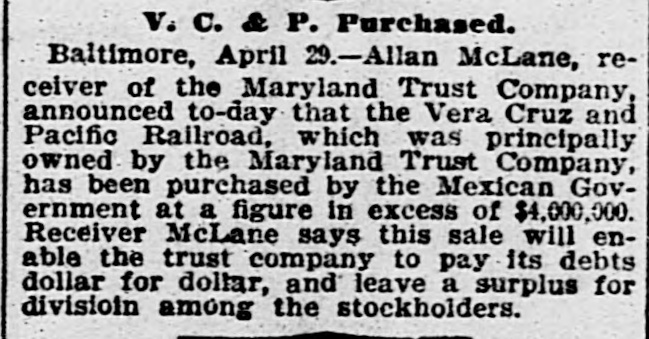

V. C. & P. Purchased. Baltimore, April 29.-Allan McLane, receiver of the Maryland Trust Company, announced to-day that the Vera Cruz and Pacific Railroad, which was principally owned by the Maryland Trust Company, has been purchased by the Mexican Government at a figure in excess of $4,000,000. Receiver McLane says this sale will enable the trust company to pay its debts dollar for dollar, and leave a surplus for divisioin among the stockholders.

16.

December 19, 1905

Evening Times-Republican

Marshalltown, IA

Click image to open full size in new tab

Article Text

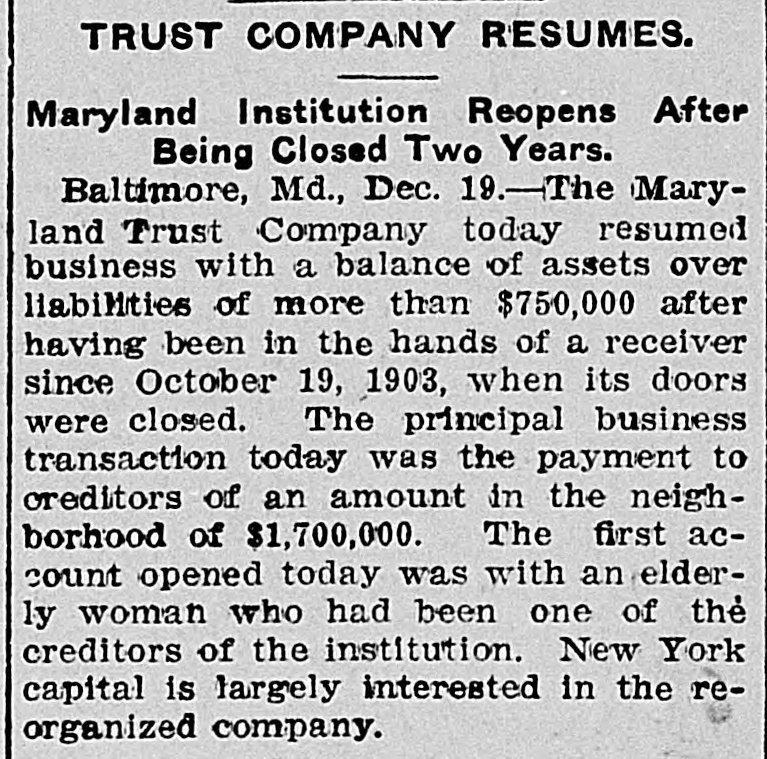

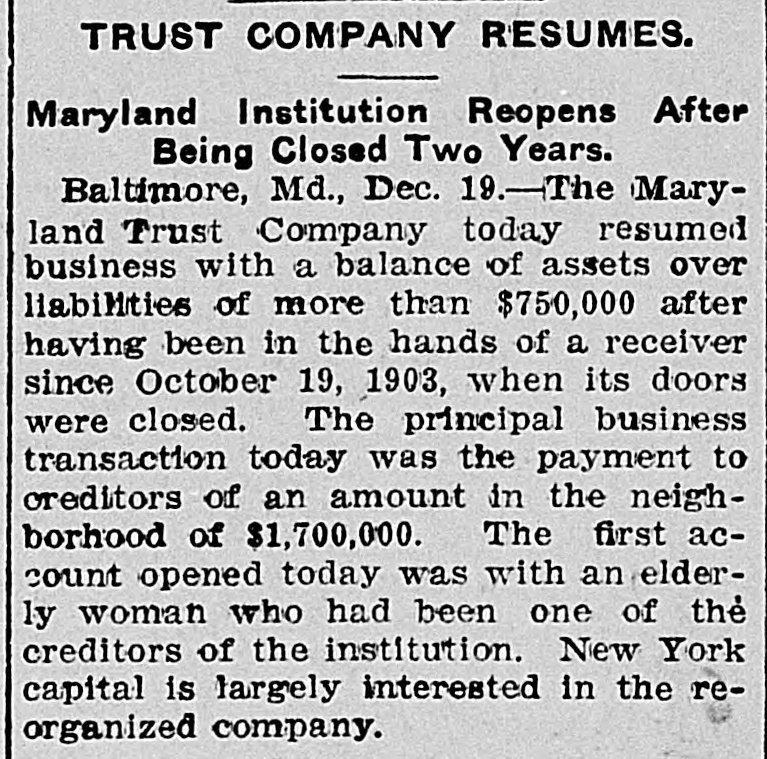

TRUST COMPANY RESUMES. Maryland Institution Reopens After Being Closed Two Years. Baltimore, Md., Dec. 19.-The Maryland Trust Company today resumed business with a balance of assets over liabilities of more than $750,000 after having been in the hands of a receiver since October 19, 1903, when its doors were closed. The principal business transaction today was the payment to creditors of an amount in the neighborhood of $1,700,000. The first account opened today was with an elderly woman who had been one of the creditors of the institution. New York capital is largely interested in the reorganized company.

17.

December 22, 1905

Milford Chronicle

Milford, DE

Click image to open full size in new tab

Article Text

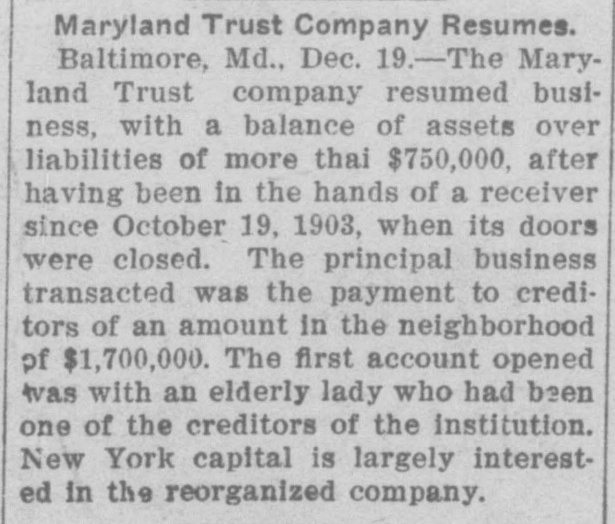

Maryland Trust Company Resumes. Baltimore, Md., Dec. 19.-The Maryland Trust company resumed business, with a balance of assets over liabilities of more thai $750,000, after having been in the hands of a receiver since October 19, 1903, when its doors were closed. The principal business transacted was the payment to creditors of an amount in the neighborhood of $1,700,000. The first account opened Avas with an elderly lady who had been one of the creditors of the institution. New York capital is largely interested in the reorganized company.

18.

December 23, 1905

Richmond Planet

Richmond, VA

Click image to open full size in new tab

Article Text

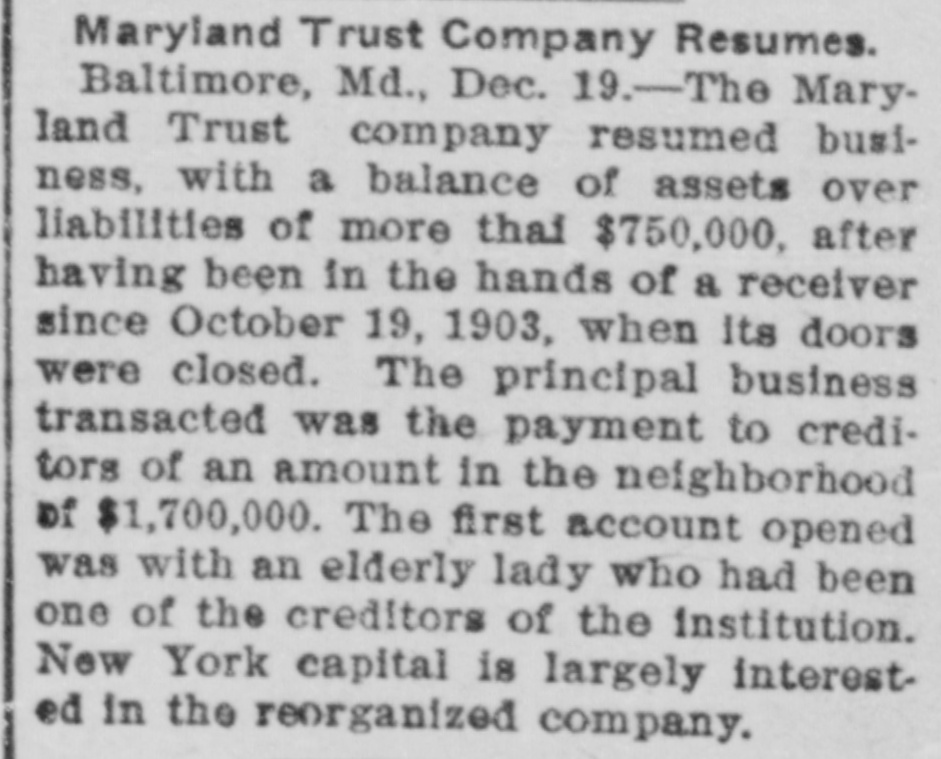

Maryland Trust Company Resumes. Baltimore, Md., Dec. 19.-The Maryland Trust company resumed business, with a balance of assets over liabilities of more thai $750,000, after having been in the hands of a receiver since October 19, 1903, when its doors were closed. The principal business transacted was the payment to creditors of an amount in the neighborhood of $1,700,000. The first account opened was with an elderly lady who had been one of the creditors of the institution. New York capital is largely interested in the reorganized company.

19.

January 3, 1906

Perth Amboy Evening News

Perth Amboy, NJ

Click image to open full size in new tab

Article Text

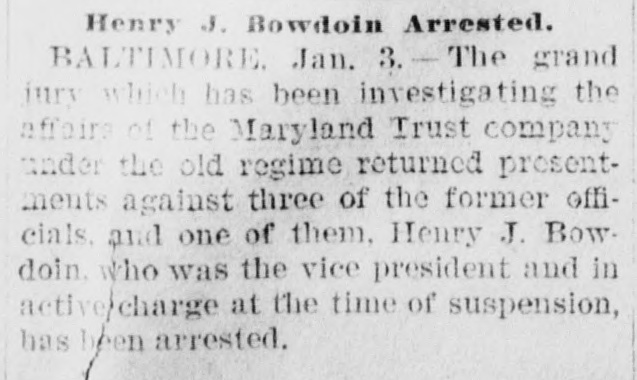

# Henry J. Bowdoin Arrested.

BALTIMORE, Jan. 3. - The grand jury which has been investigating the affairs of the Maryland Trust company under the old regime returned presentments against three of the former officials, and one of them. Henry J. Bowdoin, who was the vice president and in active charge at the time of suspension, has been arrested.

20.

January 3, 1906

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

BAIL FOR FINANCIER. Grand Jury Presents Officers of Maryland Trust. [By Telegraph to The Tribune.] Baltimore, Jan. 2--A stir was caused in financial circles this afternoon by the grand jury presenting J. Wilcox Brown, ex-president; Henry J. Bowdoin, ex-vice-president, and J. Bernard Scott, ex-treasurer of the Maryland Trust Company, which went into the hands of a receiver two years ago. It was recently reorganized, the Speyers and other New York capitalists financing it. The three former officers are charged with violating a law prohibiting the issuing of "false or fraudulent statements regarding the financial condition of any corporation." The penalty is a fine of not less than $1,000, or imprisonment. Warrants were issued for the arrest of the three men. Mr. Bowdoin, a well known lawyer, was released on $10,000 bail. Brown is at his estate at Afton, Va., and Scott is in Georgia. Mr. Brown is the plaintiff in the proceedings now pending in NewYork for a receiver for the Equitable Life Assurance Society on the ground of fraud.

21.

January 3, 1906

The Providence News

Providence, RI

Click image to open full size in new tab

Article Text

# FORMER MARYLAND TRUST CO.

# OFFICIALS UNDER INDICTMENT

Baltimore, Jan. 3. -The grand jury, which has been investigating the affairs of the Maryland Trust company under the old regime, yesterday returned presentments against three of the former officials. One of them, Henry J. Bowdoin, who was the vice president, and in active charge at the time of suspension, was arrested on a capias from the criminal court and released under a bond of $10,000. The other two have not been arrested, and their names are withheld by the state's attorney's office.

It is stated unofficially, however, that they are J. Wilcox Brown, formerly president of the company and now residing at Afton, Va., and J. Bernard Scott, formerly the company's treasurer, and now, it is said, a resident of Georgia.

The presentments charge violation of the law prohibiting the issuing of "false or fraudulent statements regarding the financial condition of any corporation." No specific offence is cited and the Maryland Trust company is not named.

22.

January 5, 1906

The Havre Herald

Havre, MT

Click image to open full size in new tab

Article Text

# INDICTED BY GRAND JURY.

True Bills Found Against Former Officials of a Trust Company.

Baltimore, Jan. 3.-The grand jury which has been investigating the affairs of the Maryland Trust company under the old regime during the day returned presentments against three of the former officials. One of them, Henry J. Bowdoin, who was vice president and in active charge at the time of suspension, was arrested on a capias from the criminal court and released under a bond of $10,000. The other two have not been arrested and until they are taken into custody their names are withheld.

It is stated unofficially however that they are J. Wilcox Brown, formerly president of the company and now residing at Afton, Va., and J. Bernard Scott, formerly the company's treasurer and now, it is said, a resident of Georgia.

The presentments charge violations of the law prohibiting the issuing of "false and fraudulent statements regarding the financial condition of any corporation."

23.

January 5, 1906

The Stark County Democrat

Canton, OH

Click image to open full size in new tab

Article Text

BIG FINANCIERS WERE PLACED ON THE CARPET TO TESTIFY Presentments Grand Jury Finds Against Former Officials of the Maryland Trust Company. Baltimore, Md., Jan. 2-The grand jury has found presentments against three former officers of the Maryland Trust Company serving at the time their company went into the hands of 1 receiver. one of these, Henry I Bowdoin, was arrested this afternoon. Mr. Bowdoin was the vice president of the company at the time of its failure. The presentment is based on alleged negngence in the management of the company's affairs in that department over which he had juriadiction. The greater. secrecy is being maintained as to the identity of the other officials accused. The grand jury has been investigating the affairs of the company for the last month. Prominent financiers, brokers, officials and employes of the company have been ordered before the body to test.fy concerning the management of the company prior to its failure. The Maryland Trust company went into the hands of a receiver on October 19, 1903. The company has been reorganized and a few days ago re. opened its doors with a capital of $1, 000,000.

24.

January 10, 1906

The Miller Sun

Miller, SD

Click image to open full size in new tab

Article Text

# ALLEGED FRAUD IN BANKING

Officials of the Old Maryland Trust Company Are Indicted.

The grand jury, which has been investigating the affairs of the Maryland Trust Company under the old regime, at Baltimore Tuesday returned presentments against three of the former officials. One of them, Henry J. Bowdouin, who was the vice president and in charge at the time of the suspension, was arrested on a capias from the criminal court and released under a bond of $10,000. The other two have not been arrested, and until they are taken into custody their names will be withheld.

25.

January 13, 1906

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

Maryland Trust Won $281,447 Suit.

By a decision of the Maryland court of appeals at Baltimore yesterday the Me-chanics' National Bank of Baltimore loses its suit against the Maryland Trust Com-pany for $281,447, the case arising out of a deal which netted Mr. John B. Ramsay, president of the bank, a commission of $100,000. The deal occurred before the Maryland Trust went into a receiver's hands, and arose out of the absorption by that company of the Guardian Trust Com-pany. According to the opinion of the court Mr. Ramsay was acting as agent for the Maryland Trust, one provision of the deal being that the Maryland Trust was to buy up a large share of its own stock, the money for that purpose to be advanced by the Mechanics' National Bank. The amount thus advanced, with interest, aggregates