Click image to open full size in new tab

Article Text

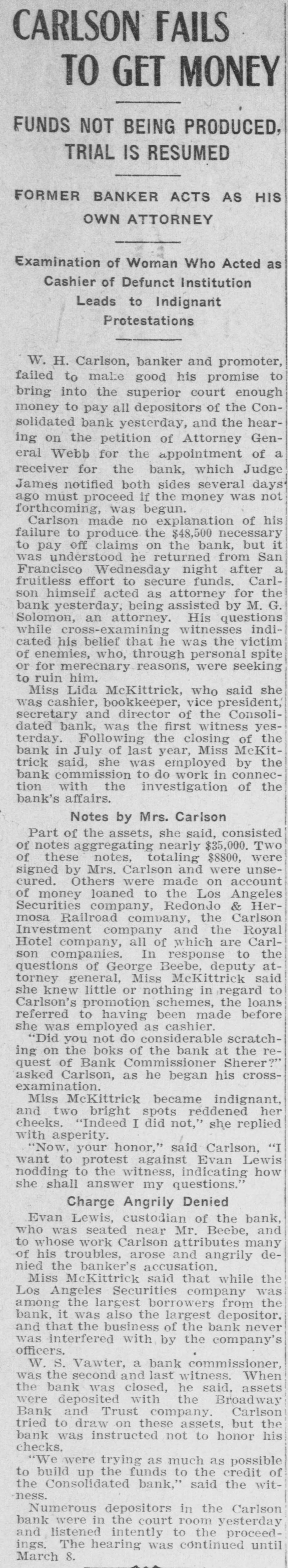

CARLSON FAILS TO GET MONEY FUNDS NOT BEING PRODUCED, TRIAL IS RESUMED FORMER BANKER ACTS AS HIS OWN ATTORNEY Examination of Woman Who Acted as Cashier of Defunct Institution Leads to Indignant Protestations W. H. Carlson, banker and promoter, failed to male good his promise to bring into the superior court enough money to pay all depositors of the Consolidated bank yesterday, and the hearing on the petition of Attorney General Webb for the appointment of a receiver for the bank, which Judge James notified both sides several days ago must proceed if the money was not forthcoming, was begun. Carlson made no explanation of his failure to produce the $48,500 necessary to pay off claims on the bank, but it was understood he returned from San Francisco Wednesday night after a fruitless effort to secure funds. Carlson himself acted as attorney for the bank yesterday, being assisted by M. G. Solomon, an attorney. His questions while cross-examining witnesses indicated his belief that he was the victim of enemies, who, through personal spite or for merecnary reasons, were seeking to ruin him. Miss Lida McKittrick, who said she was cashier, bookkeeper, vice president, secretary and director of the Consolidated bank, was the first witness yesterday. Following the closing of the bank in July of last year, Miss McKittrick said, she was employed by the bank commission to do work in connection with the investigation of the bank's affairs. Notes by Mrs. Carlson Part of the assets, she said, consisted of notes aggregating nearly $35,000. TWO of these notes, totaling $8800, were signed by Mrs. Carlson and were unsecured. Others were made on account of money loaned to the Los Angeles Securities company, Redondo & Hermosa Railroad company, the Carlson Investment company and the Royal Hotel company, all of which are Carlson companies. In response to the questions of George Beebe, deputy attorney general, Miss McKittrick said she knew little or nothing in regard to Carlson's promotion schemes, the loans referred to having been made before she was employed as cashier. "Did you not do considerable scratching on the boks of the bank at the request of Bank Commissioner Sherer?" asked Carlson, as he began his crossexamination. Miss McKittrick became indignant, and two bright spots reddened her cheeks. "Indeed I did not," she replied with asperity. "Now, your honor," said Carlson, "I want to protest against Evan Lewis nodding to the witness, indicating how she shall answer my questions." Charge Angrily Denied Evan Lewis, custodian of the bank, who was seated near Mr. Beebe, and to whose work Carlson attributes many of his troubles, arose and angrily denied the banker's accusation. Miss McKittrick said that while the Los Angeles Securities company was among the largest borrowers from the bank, it was also the largest depositor. and that the business of the bank never was interfered with by the company's officers. W. S. Vawter, a bank commissioner, was the second and last witness. When the bank was closed, he said, assets were deposited with the Broadway Bank and Trust company. Carlson tried to draw on these assets, but the bank was instructed not to honor his checks. "We were trying as much as possible to build up the funds to the credit of the Consolidated bank," said the witness. Numerous depositors in the Carlson bank were in the court room yesterday and listened intently to the proceedings. The hearing was continued until March 8.