Click image to open full size in new tab

Article Text

By Donald F. Dearness Almost any way take the year 1930 surfeited with in Greater Cincinnati calambank failures, financial disasters, crime, unemployment, pestilence, miniature golf, and, depending on how you look at it, the rout ganization. the Republican orpall hung over Cincinnati the the bells and whistles new year, for less than hours before, death Charles Phelps Taft. publisher the and the city's out standing of the and patron Scarcely two months later. on March death laid low Cincinnati's most famous William Howard Taft. the only man who served his country both S. and justice of the Court On the first day 1930. death took two victims of auto accidents, the first of about 200 who succumbed during the year in injuries suffered in motor vehicle for Crime before got away to flying start, the year three hours old, Cincinnati Street Railway car barn and made off with $1134.

The day entirely itous, for the rose 52 the any Year's 1916 Russell Wilson sworn mayor by his Murray with Stanley Joseph Woeste, John Druffel Alex Pat terson. Julian Charles Rose Meredith and Edward Imbus business depression was when the began carried along which ranged more less approximately failures the Cosmopolitan Bank & Trust Co., the Brotherhood National Bank and numerous and business houses Two "other banks, the Bank "Trust Co., Bank Trust peril but were by the Cincinnati Clearing House Association and their by the Central Trust The year dealt knockout blow Republican organization the Citizens mittee cessful county elections 1926 and 1928, made clean Nov with the result that Robert Gorman become prosecutor Thursday and the following filled later by his Beckman: auditor, Robert Heuck: cororner, Dr. M. Scott Kearns.

Benjamin who figured sensational ne was cashier Madeira bank, was sentenced Feb. years in Ohio after he $2000 the bank's money weeks later Jack Kennedy, Dayton who been after his conviction on charges and the free Henderson had Kennedy falsely as one of his On 20. Dr. William H. Peters health in the Four days were fied of drilled Co. Fourth-st tied blew safe escaped with worth of February had the new Louis Eighth and opened Feb 26. and the next laid for the Cincinnati Suburban beautiful new building at Sevand Elm-sts. Calamity March for William Taft and Edward Dempsey mayor and Common the March witnessed the first major busifailure of the year when R. Beaman Co. with liabilities totaling $529,000 fires out March the Theater, Fountain-sq. James operator, was burned death in his booth The next day Christine Cincinnati leaped to from the story of York hotel. Her buried several days later in Spring Grove Cemetery Zwick. at least his name, reappeared March $7500 bank robbery Germantown. Other obtained $2500 March and $4000 March 29 from the Clifton branch of the Second National Bank Three men were killed March 28 when large Sixth-st and and two their March rocks the Bald Knob blasting State-av the middle the month first mention was made of Jamaica poisoning. the malady which sent and of women for relief paralysis legs and arms. Results of returns from Cincinnati in the Literary Digest nation prohibition poll showed the Queen six one in repeal or against of present

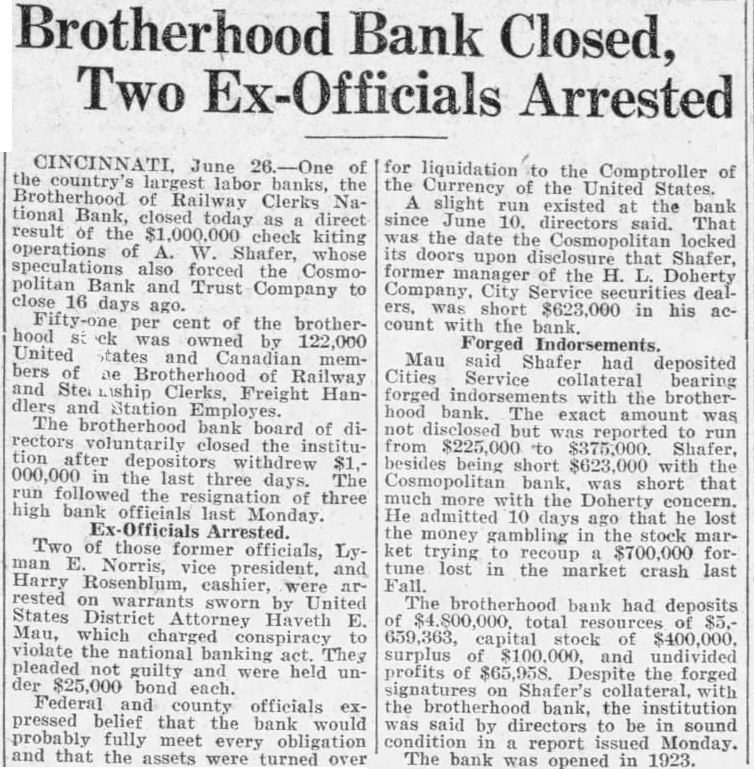

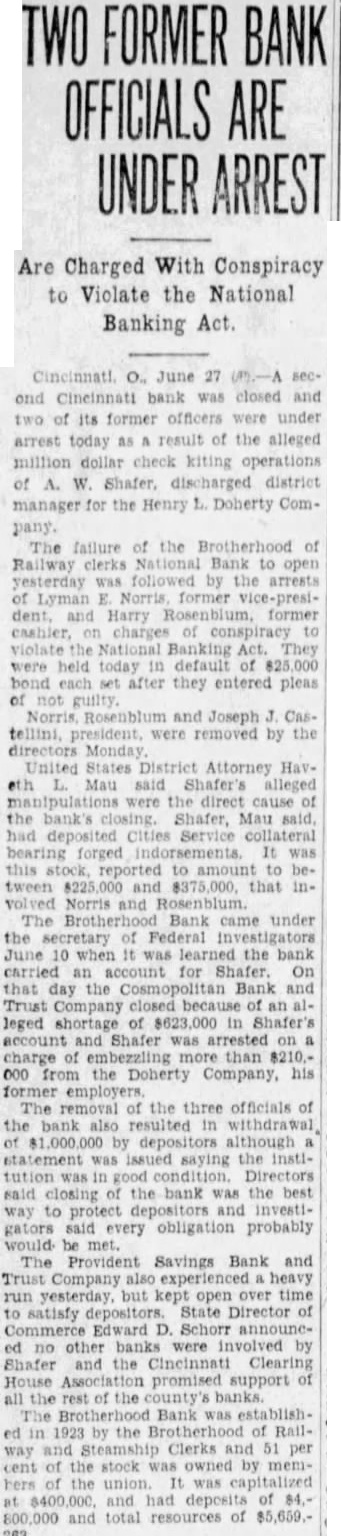

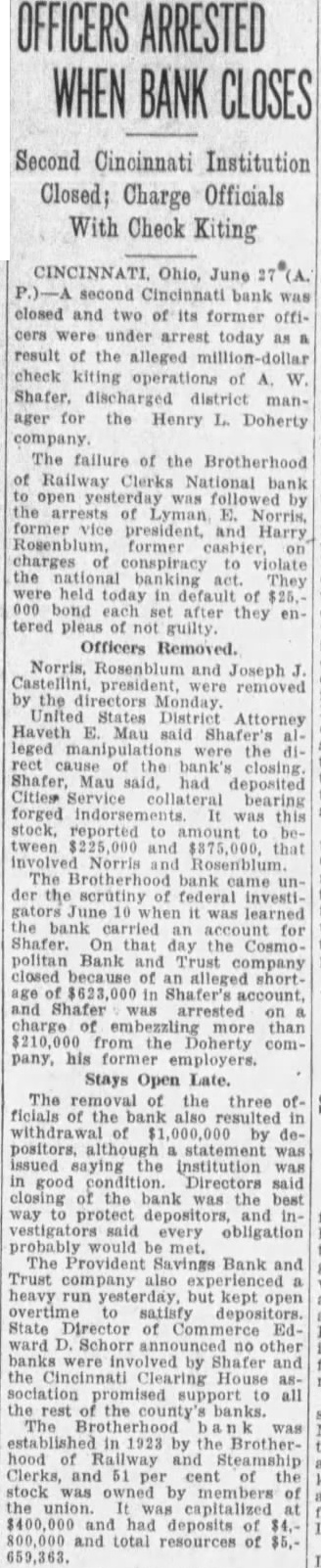

The major business announce. March was that Albert H. was elected president Kroger Grocery Baking Co. succeed William H. became chairman the board. the first important event April the reappearance Zwick's name in connection with robberies April which the same was reported $50,000 and short time later $8418 The day the Brotherhood National stirred the public's interest and invoked other banks announced would pay per interest on savings banks continued to per The which played considerable part in year's made take notice throwing few August days The rose 90 ting an April heat record in Probably the most important busof the month was the sale of most the Libson theatrical Louisville and Dayton the RKO the Albee, Capitol, Strand, Family, Palace and treaters On April about 25,000 of the faithful witnessed the opening Nabaseball game, the Reds Pirates. one of the defeats that landed team in seventh place, just ahead of some obscure club fgrom the east. On April 22 Sherrill, city manager, to become the Kroger The day Cincinnati looked with desperate concern the nation's greatest disaster the year occurred the Ohio penitentiary fire About 36 Cincinnati were among the 322 lives out. The month of May was the properiod of calm that preceded days of when the the stormy Cosmopolitan and Brotherhood and temporarily danger real and May Day troubles failed materialize the city At Christ Church Episcopal dignitaries from thruout the country for the consecration Rev On May which in the Republican debacle was started meeting at Hotel. On the the Heberle was the 28th the Church began its General Assembly in Taft Auditorium. its total contributions about $35,000 short of the $2,076,894 quota. few days later the Census Bu1930 population was 447,650. On June 10. about 37,000 depositors of Bank and its seven branches were thrown into by the news that the had failed and had been seized by the state banking department milled the Dorger holder and the bank's dominating Amor W. Shafer district manafor Henry Doherty on charges money ed Shafer's had drained the Cosmopolitan Bank forced its closing. Subsequent showed the deficit to be about $2,000, 000.

Word soon around that ShaBank and that uneasy forced the bank June 26. Harry cashier, and Lyman H. Norris, by charges conspiring violate the national banking Depositors in other anks became and worried. Several banks the House the tide and the other banks' The again set record in June. On the temperature to Three persons died of the effects of the heat. Otherwise the month was more except the 12th. when C. Dykstra took as city and on the river Greene, the Ann from Fernbank Dam Coney Island.

July saw the Central Trust Co. take over Brotherhood Bank and the Fifth Third Union Trust Co. the Thruout the month Hamilton-co suffered the wrought parts the nation Record was reported July Lack water in many the territory became acute July The month also witnessed the beginning legal troubles for Dorger family. On July Gilbert sued Frank Dorger his Clardaughters, Ruth and Martha various double liability on their Cosmopolitan stock. During hearings before Judge Stanley Struble Common Pleas Court Frank and Martha Dorger filed in bankruptcy and was placed the charge the Western Ruth Dorger promised to pay her asOn July 21 Frank and Clarence Dorger, Russell mopolitan cashier, and Herbert were dicted on and other charges relating to the bank's failure. After the Brotherhood Bank was taken without loss depositors, Dominick recover given the bank in payment for forged worthless disposed of by Shafer. Other July events robthe Loveland Bank, which bandits about and the would build $8,000,000 freight terminal on the site bounded Fourth John and Mill streets During July the $33,000,000 Starat Fifth, Race and the phone except interiors and the finishing touches outside Considerable progress also had been made union railroad terminal project. August brought chiefly more trouble for the Dorgers, more weather drought and the sweeping county and Robert four other Democratic candidates for United States in the Aug 12 primary election. On Aug. the Dorgers were named more score ditional Other Cosmopolitan officials and employes named. On the 25th Shafer pleaded guilty to the was sentenced to ten years in Ohio penitentiary. During the month the G. A. R. held its annual and the American Legion its state Many Cincinnatians were shocked Aug. 12 by the news that Samuel Lipp. and former state legislator, had death from near Little Falls,

On Sept. the city sounded off and the bell in Hall tower rang for first in years Costes and Maur Bellonte, French Cincinnati had about end of the month when Ford reliability thundered across city visited Lunken Airport Earlier in the Cincinnati was the focal the American Chemical Society The city suffered another shock Grover Smith committed suicide. October was featured by the beginning the Frank and Clarence Dorger on the another freakish weather the 20th, when the fell 26 degrees, low record for that of the On Oct. 30, Dr. Frederick T. Vall known opthalmolo gist, died election Nov. 5. brought about the the county and Democratic victory which Y. Cooper the governorship and

Bulkley overwhelmed Roscoe Republican candidate for senator.

Two days later investigation trregularities here began. On heels the announcement Nov. banks would an increase to savings decame the news that banks identified with had closed and others, includthe Bank Trust Covington, the Market & Trust the Co., CinHouse Association came these rescue the Central Trust Co. took over the Brighton and the and Clarence Dorger were found counts of Nov. 22, after week' On Nov. William J. Williams, of the Western & SouthInsurance died in Johns Baltimore. Day phenomena, official temperature and the defeat of the Miami University football team by the University of Cincinnati Bearcats opened with the holdup Railway Co. truck three robbers and their with about $14,000. Two later the Commercial Tribune publication. On Dec. 10 four Republican election officials were indicted on elecfraud Frank and Dorger 15 Judge Charles Bell Criminal Court to 10 in Ohio penitentiary and fined $5000 each. On Dec. 10. street car and CinRailway Co. bus near the end Eighth-st Viaduct, injuring 19 perAnnouncement was made Dec. 19 that Fritz had resigned director the Cincinnati Symphony Orchestra, effective at the close of the and that Eugene would replace him year and in direct the May Festival spring.