Article Text

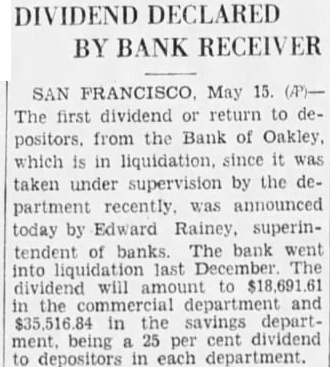

DIVIDEND DECLARED BY BANK RECEIVER SAN FRANCISCO. May 15. The first dividend return to depositors. from the Bank of Oakley, which is in liquidation, it was taken under supervision the department recently. announced today by Edward Rainey, superintendent of banks bank went last will to the and the savings department. being 25 per dividend to depositors in each department.