Article Text

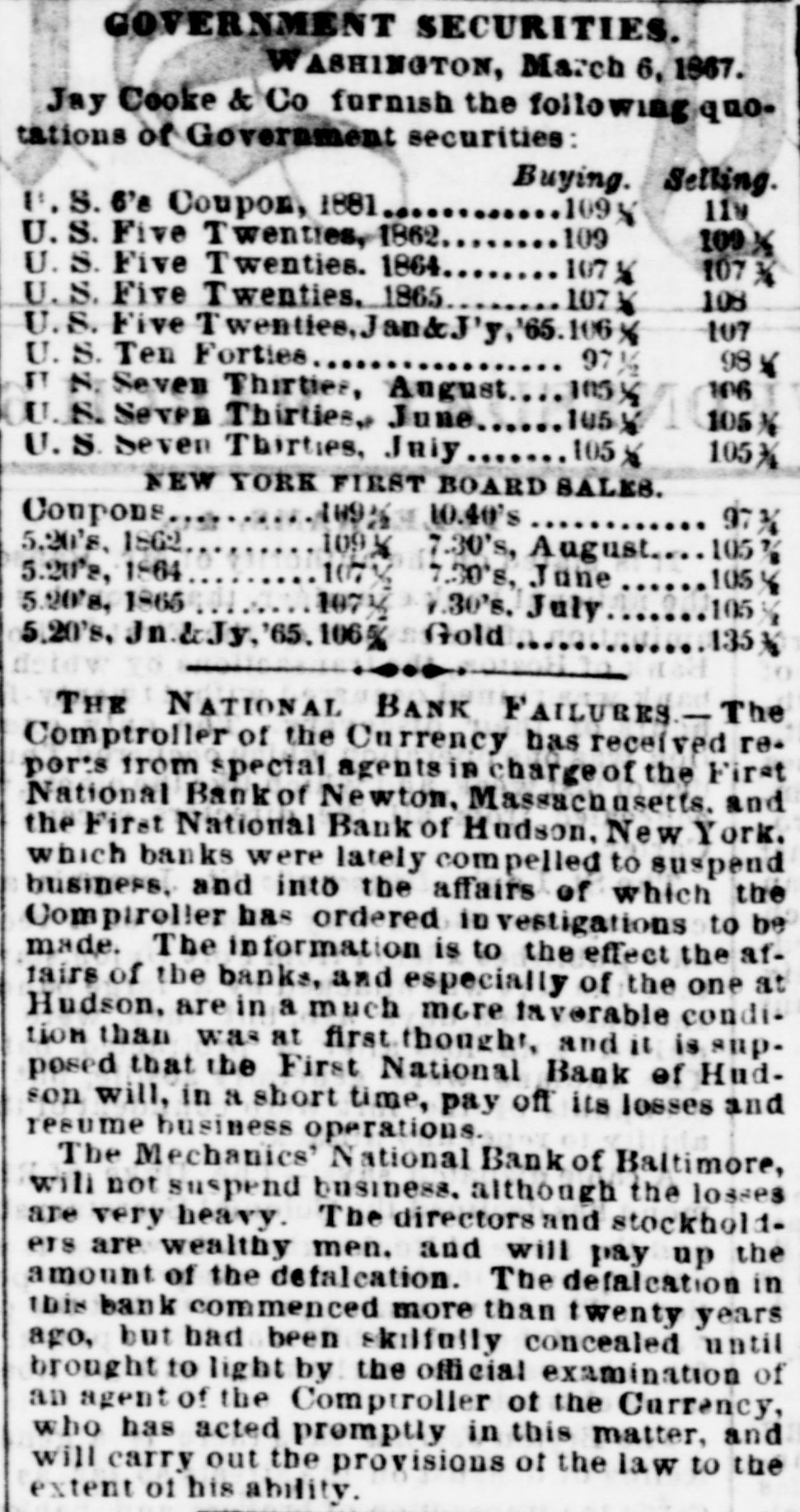

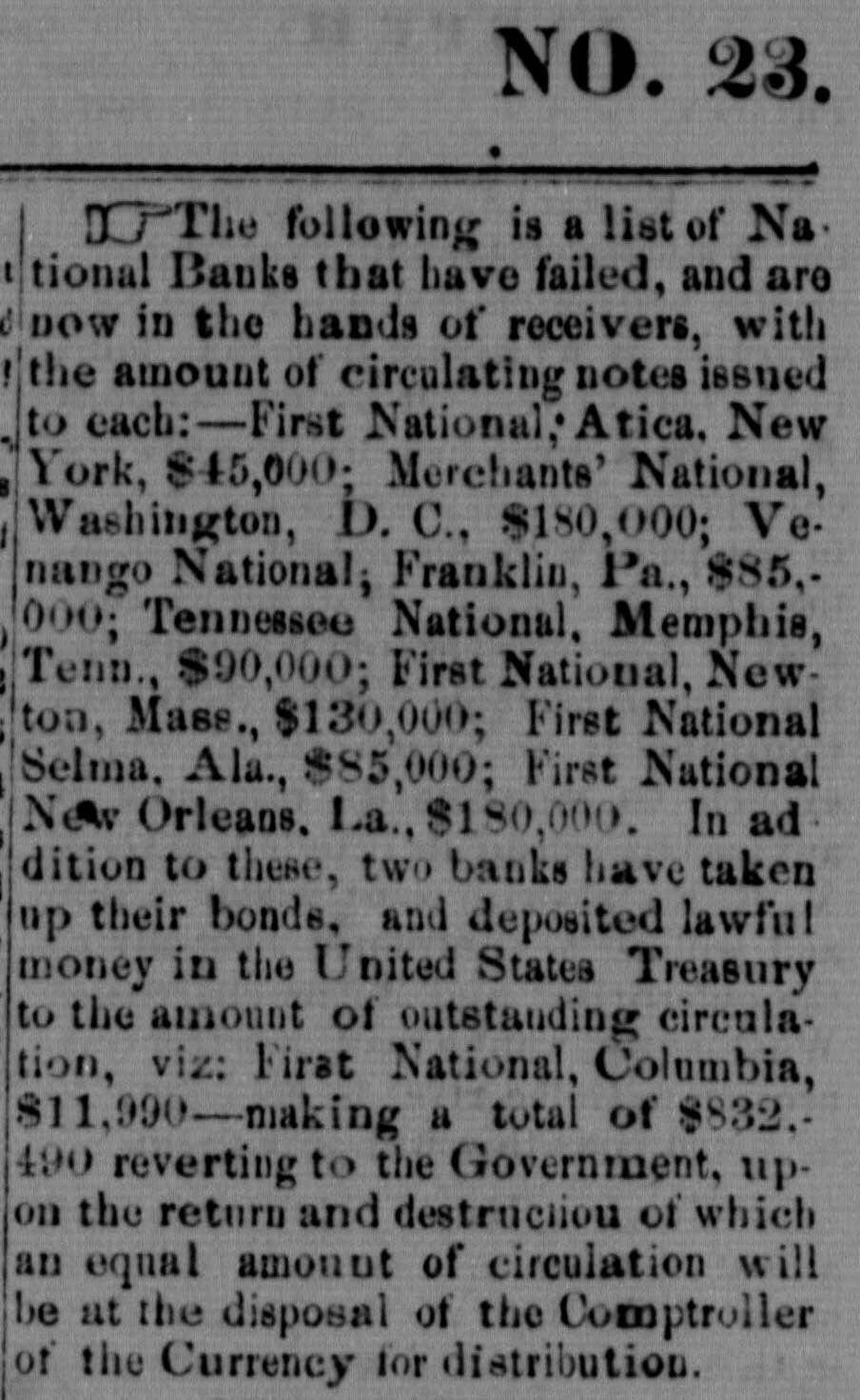

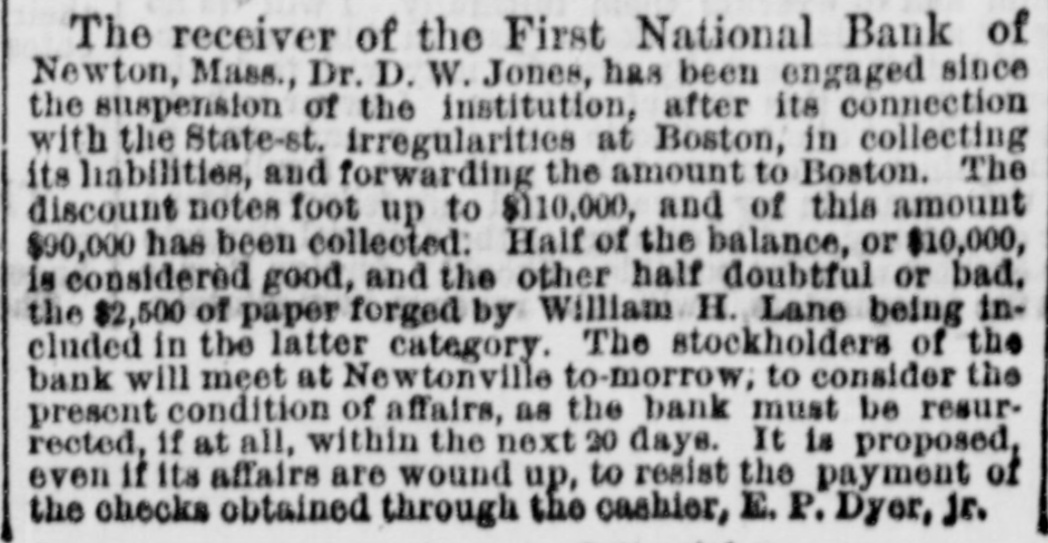

BANK TROUBLES, DEFALCATIONS AND ERAUDS. First National Bank of Hudson. N. Y. HUDSON, N. Y., March 2, 1867. The First National Bank of this city was closed to day for examination of accounts, it being alleged that Peter S. Wynkoop, the cashier, is a defaulter to a large amount. The directors of the bank are investigating the matter, and will report the amount of deficiency as soon as ascertained. The cashier makes a clean breast of it, and acknowledges that he has lost heavily by speculations in fancy stocks. The following notice was posted on the doors of the bank to-day:The board of directors of the First National Bank of Hudson are pained to inform the public that owing to known defalcations of the cashier of that institution they are compelled to close its doors until a full examination of its condition can be made. Notwithstand. ing the frank confession of the late cashier it is impossible at this moment, from the absence of proper data, and the state of the cashier's mind, to determine what is the actual amount of the defalcations; but from present appearances they are thought to be such as to imparir only a minor part of the capital. The board have every confidence in assuring depositors that they are amply secured. Bill holders, of course, have nothing to fear. Valuables deposited for safe keeping are believed to be untouched. Every means in the power of the board will be used to relieve depositors from their unfortunate situations. At the earliest mement a statement of the affairs of the bank will be made. J. W. FAIRFIELD, President. An investigation into the affairs of the bank shows as embezzlement of about $50,000. A further examina. tion will doubtless increase the amount. Hasbrouck, the defaulting cashier, was taken into custody this evening at the instance of the president of the bank and lodged in jail. The above bank has a paid in capital of $200,000, and power to increase to half a million. Its notes are no. deemed at the Ninth National Bank of New York city. First National Bank of Newton, Mass. BOSTON, March 2, 1867. There is great trouble in financial circles here. E. Porter Dyer, Jr., the cashier of the First National Bank of Newton, Mass., is short $110,000 The President of the bank gave notice that the cashier came to Boston yesterday at eleven o'clock and has not since been heard of. The paid in capital of the bank is only $150,000, but it has authority to increase its stock to $300,000. It redeems in New York at the National Park Bank. Swindling the Dollar Savings Bank of Pitte. burg, Pa. Relative to the embezzlement of some $15,000 CODEmitted by A. V. H. Elder, general bookkeeper of the Dollar Savings Bank at Pittsburg, the Post of that city has the following:The occasion of the discovery of the fraud was as follows:-A gentleman, whose name we forbear making public, received a small patrimony, amounting to some $700, which he deposited in the Dollar Savings Bank for safe keeping. The sum was correctly entered upon the depositor's bankbook, but upon the credit book in the bank it was set down $200, the bookkeeper pocketing the other $500. In a short time the depositor wished to check for $200, whereupon the teller asked him if he would not have his account balanced. He replied in the negative, stating that he still had some $500 on deposit, when be was requested to leave his book for settlement. This was done. The discrepancy was discovered and suspicion aroused. The directors were informed, other pass books were sent for and accounts settled, in which similar errors were found to exists. A thorough investigation took place, and deficits to the above amount were found. State Bank of Massachusetts-Over Half a Million Dollars Involved. BOSTON, March 2, 1867. There was considerable excitement in State street this morning occasioned by the development of the irregularities in transactions of the cashier of the State Bank in regard to certification of checks as "good" bearing the name of Mellen, Ward & Co., brokers, who suspended payment yesterday. These checks were presented at the Clearing House at the morning settlement by the various banks holding the same and were thrown out by the State Bank, on which certifications were made. The directors of the institution declare that they never entered into, or agreed to any arrangement made with the city banks for the certification of checks, and such action of their cashier was wholly unauthorized by them. The sum involved in these transactions is upwards of half a million dollars. Other parties besides those mentioned are also implicated in these diffculties.