Article Text

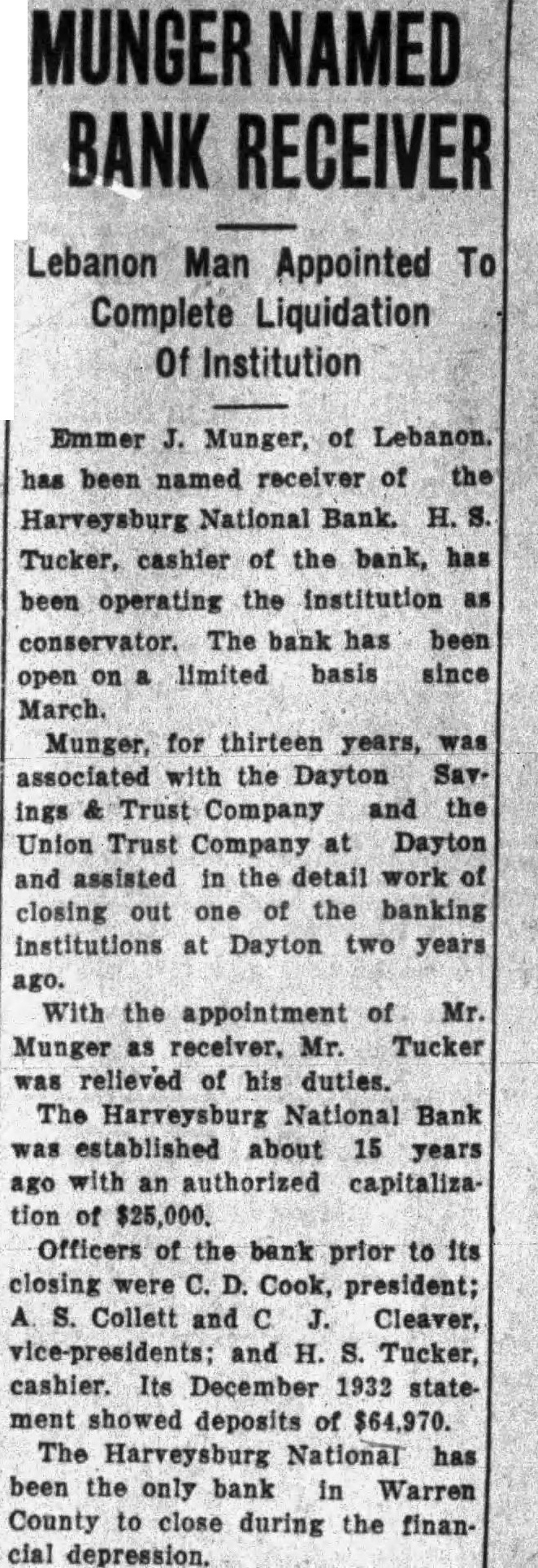

MUNGER NAMED BANK RECEIVER Lebanon Man Appointed To Complete Liquidation Of Institution Emmer J. Munger, of Lebanon. has been named receiver of the Harveysburg National Bank. H. S. Tucker, cashier of the bank, has been operating the institution as conservator. The bank has been open on a limited basis since March. Munger, for thirteen years, was associated with the Dayton Sav. ings & Trust Company and the Union Trust Company at Dayton and assisted in the detail work of closing out one of the banking institutions at Dayton two years ago. With the appointment of Mr. Munger as receiver, Mr. Tucker was relieved of his duties. The Harveysburg National Bank was established about 15 years ago with an authorized capitalization of $25,000. Officers of the bank prior to its closing were C. D. Cook, president; A. S. Collett and C J. Cleaver, vice-presidents; and H. S. Tucker, cashier. Its December 1932 state. ment showed deposits of $64,970. The Harveysburg National has been the only bank in Warren County to close during the financial depression.