Click image to open full size in new tab

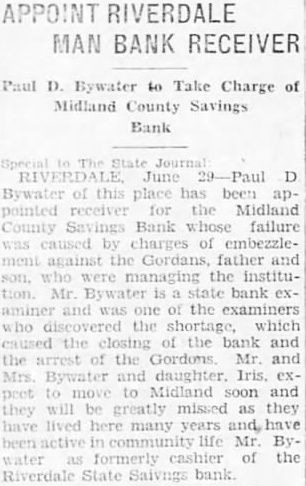

Article Text

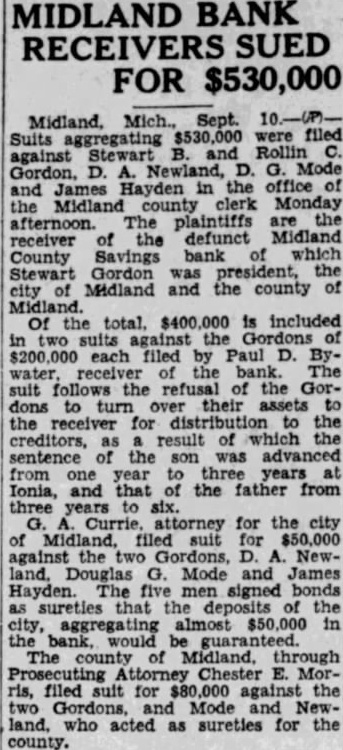

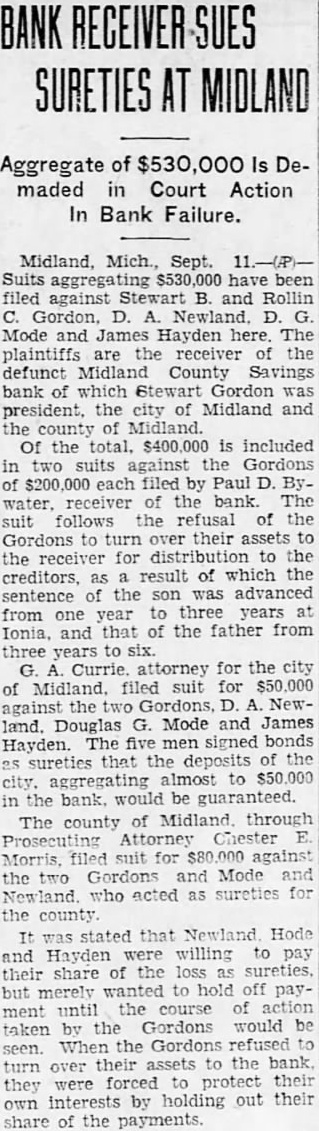

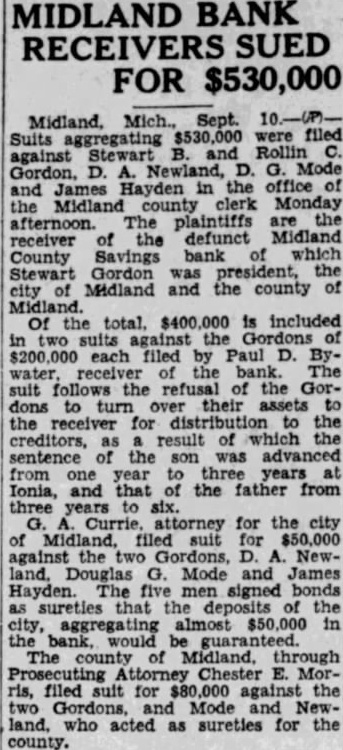

MIDLAND BANK RECEIVERS SUED FOR $530,000

Midland, Sept. $530,000 were filed Suits Stewart and Rollin against D. Newland, D. G. Mode Gordon, James Hayden in the office and the Midland county Monday afternoon. The plaintiffs are the of defunct Midland receiver County Savings bank of which Stewart Gordon president, the Midland and the county of Midland. Of the $400,000 is included suits the each filed D. the follows the refusal of the Gordons their assets the receiver for distribution creditors, result of which sentence the was advanced one year three and that the father from three years to six. Currie, attorney for the city filed for $50,000 against the two D. Newland, and James Hayden. The five signed as sureties that the the city, aggregating almost $50,000 in the bank, would be guaranteed. The county through Chester E. Morris, filed suit for against the Mode who acted as sureties for the county.