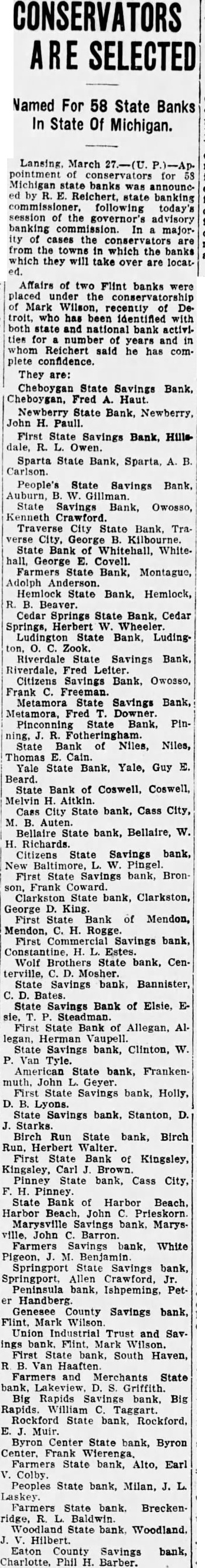

Article Text

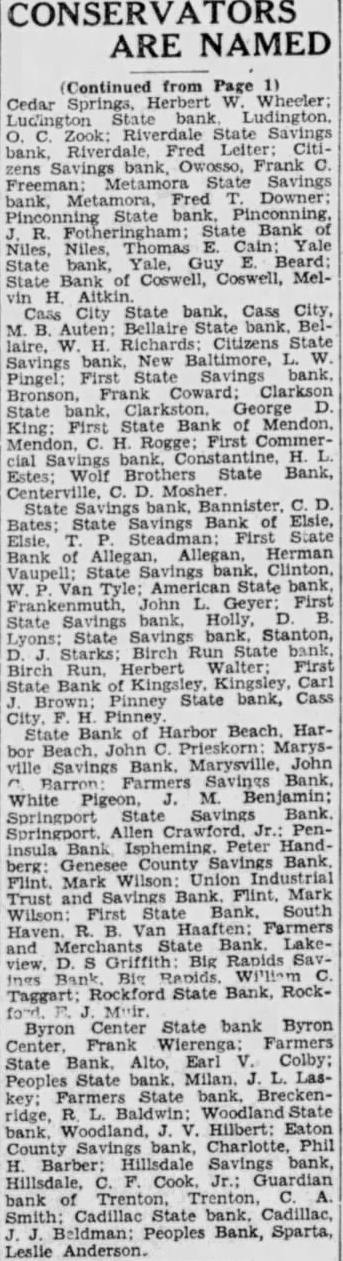

CONSERVATORS SELECTED Named For 58 State Banks In State Of Michigan. Lansing, March pointment of conservators for Michigan state banks was announcby Reichert, state banking commissioner, following today's session of the governor's advisory banking commission. In majority of cases the conservators are from the towns in which the banks which they will take over are locat- Affairs of two Flint banks were placed under the Mark Wilson, recently of Detroit, who has been identified with both state national bank activities for number of years and in whom Reichert said he has complete confidence. They are: Cheboygan State Savings Bank, Cheboygan, Fred Haut. Newberry State Bank, Newberry, John H. Paull. First State Savings Bank, Hillsdale, R. Owen. Sparta State Bank, Sparta, Carlson. People's State Savings Bank. Auburn, W. Gillman. State Savings Bank, Owosso, Kenneth Crawford. Traverse City State Bank, Traverse City, George B. Kilbourne. State Bank Whitehall, White. hall, George E. Covell. Farmers State Bank, Montague, Adolph Anderson. Hemlock State Bank, Hemlock, R. Beaver. Cedar Springs State Bank, Cedar Springs, Herbert Wheeler. Ludington State Bank, Zook. Riverdale State Savings Bank, Fred Leiter. Citizens Savings Bank, Owosso, Frank Freeman. Metamora State Savings Bank, Metamora, Fred Downer Pinconning State Bank, Pinning, Fotheringham. State Bank of Niles, Niles, Thomas Cain. Yale State Bank, Yale, Guy Beard. State Bank of Coswell, Coswell, Melvin H. Aitkin. Cass City State bank, Cass City, Auten. Bellaire State bank, Bellaire, W. H. Richards Citizens State Savings bank, New Baltimore, Pingel First State Savings bank, Bronson, Frank Coward. Clarkston State bank, Clarkston, George King. First State Bank of Mendon, Mendon, H. First Commercial Savings bank, H. Estes. Wolf Brothers State bank, Centerville, State Savings Bannister, C. Bates. State Savings Bank of Elsie. sie, First State Bank of Allegan, Allegan, Herman Vaupell. State Savings bank, Clinton, W. Van Tyle. American State bank, Frankenmuth, John Geyer. First State Savings bank, Holly, Lyons. State Savings bank, Stanton, Starks. Birch Run State bank, Birch Run. Herbert Walter. First State Bank of Kingsley, Kingsley, Carl Brown. Pinney State bank, Cass City, Pinney. State Bank of Harbor Beach, Harbor Beach. John Prieskorn. Marysville Savings bank. Marysville. John Barron. Farmers Savings bank, White Pigeon. M. Benjamin. Springport State Savings bank, Springport, Allen Crawford, Peninsula bank, Ishpeming, PetGenesee County Savings bank, Mark Wilson Union Industrial Trust and Savings bank. Flint. Mark Wilson. First State bank, South Haven, Van Farmers and Merchants State bank, Lakeview, Griffith. Big Rapids Savings bank, Big Rapids. William Taggart. Rockford State bank, Rockford, Muir. Byron Center State bank, Byron Frank Farmers State bank, Alto, Earl Colby. Peoples State bank, Milan, Laskey Farmers State bank. Breckenridge, Baldwin. Woodland State bank, Woodland. Hilbert. Eaton County Savings bank, Charlotte, Phil H. Barber.