Article Text

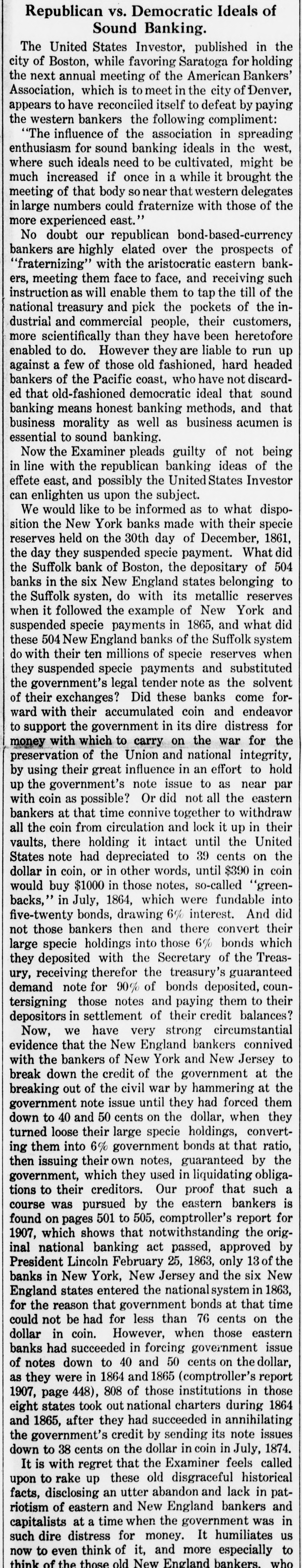

Republican vs. Democratic Ideals of Sound Banking. The United States Investor, published in the city of Boston, while favoring Saratoga for holding the next annual meeting of the American Bankers' Association, which is to meet in the city of Denver, appears to have reconciled itself to defeat by paying the western bankers the following compliment: "The influence of the association in spreading enthusiasm for sound banking ideals in the west, where such ideals need to be cultivated, might be much increased if once in a while it brought the meeting of that body SO near that western delegates in large numbers could fraternize with those of the more experienced east." No doubt our republican bond-based-currency bankers are highly elated over the prospects of with the aristocratic eastern bankthem face to face, and ers, "fraternizing" meeting receiving till of such instruction as will enable them to tap the the national treasury and pick the pockets of the industrial and commercial people, their customers, more scientifically than they have been heretofore enabled to do. However they are liable to run up against a few of those old fashioned, hard headed bankers of the Pacific coast, who have not discarded that old-fashioned democratic ideal that sound banking means honest banking methods, and that business morality as well as business acumen is essential to sound banking. Now the Examiner pleads guilty of not being in line with the republican banking ideas of the effete east, and possibly the United States Investor can enlighten us upon the subject. We would like to be informed as to what disposition the New York banks made with their specie reserves held on the 30th day of December, 1861, the day they suspended specie payment. What did the Suffolk bank of Boston, the depositary of 504 banks in the six New England states belonging to the Suffolk systen, do with its metallic reserves followed the example of New York and payments in 1865, did suspended when it specie Suffolk and what these 504 New England banks of the system do with their ten millions of specie reserves when they suspended specie payments and substituted the legal tender note as government's banks the solvent forof their exchanges? Did these come ward with their accumulated coin and endeavor to support the government in its dire distress for with which to carry on war of the Union and money preservation national the effort integrity, for to hold the by using their great influence in an up the government's note issue to as near par with coin as possible? Or did not all the eastern bankers at that time connive together to withdraw all the coin from circulation and lock it up in their vaults, there holding it intact until the United States note had depreciated to 39 cents on the dollar in coin, or in other words, until $390 in coin would buy $1000 in those notes, so-called "greenbacks," in July, 1864, which were fundable into five-twenty bonds, drawing 6% interest. And did not those bankers then and there convert their large specie holdings into those 6% bonds which they deposited with the Secretary of the Treasury, receiving therefor the treasury's guaranteed demand note for 90% of bonds deposited, countersigning those notes and paying them to their depositors in settlement of their credit balances? we have very strong Now, bankers circumstantial connived evidence that the New England with the bankers of New York and New Jersey to break down the credit of the government at the breaking out of the civil war by hammering at the government note issue until they had forced them down to 40 and 50 cents on the dollar, when they turned loose their large specie holdings, converting them into 6% government bonds at that ratio, then issuing their own notes, guaranteed by the government, which they used in liquidating obligations to their creditors. Our proof that such a course was pursued by the eastern bankers is found on pages 501 to 505, comptroller's report for 1907, which shows that notwithstanding the original national banking act passed, approved by President Lincoln February 25, 1863, only 13 of the banks in New York, New Jersey and the six New England states entered the nationalsystem in 1863, for the reason that government bonds at that time could not be had for less than 76 cents on the dollar in coin. However, when those eastern banks had succeeded in forcing government issue of notes down to 40 and 50 cents on the dollar, as were in 1864 and 1865 (comptroller's report 808 of those 1907, they page 448), institutions in those states took out national 1864 and after they had succeeded eight 1865, charters in its annihilating during note issues the government's credit by sending down to 38 cents on the dollar in coin in July, 1874. It is with regret that the Examiner feels called upon to rake up these old disgraceful historical facts, disclosing an utter abandon and lack in patriotism of eastern and New England bankers and capitalists at a time when the government was in distress for money. It us such to dire even humiliates especially now think of it, and more to think of the those old New England bankers. who