Click image to open full size in new tab

Article Text

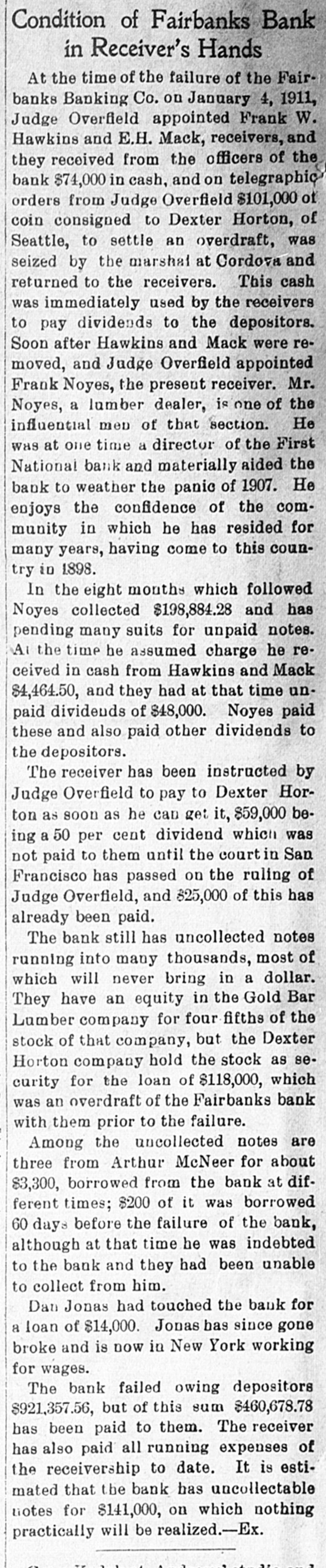

Condition of Fairbanks Bank in Receiver's Hands At the time of the failure of the Fairbanks Banking Co. on January 4, 1911, Judge Overfield appointed Frank W. Hawkins and E.H. Mack, receivers, and they received from the officers of the bank $74,000 in cash, and on telegraphic orders from Judge Overfield $101,000 of coin consigned to Dexter Horton, of Seattle, to settle an overdraft, was seized by the marshal at Cordova and returned to the receivers. This cash was immediately used by the receivers to pay dividends to the depositors. Soon after Hawkins and Mack were removed, and Judge Overfield appointed Frank Noyes, the present receiver. Mr. Noyes, a lumber dealer, is one of the influential men of that section. He was at one time a director of the First National bank and materially aided the bank to weather the panic of 1907. He enjoys the confidence of the community in which he has resided for many years, having come to this country in 1898. In the eight months which followed Noyes collected $198,884.28 and has pending many suits for unpaid notes. Ai the time he assumed charge he received in cash from Hawkins and Mack $4,464.50, and they had at that time unpaid dividends of $48,000. Noyes paid these and also paid other dividends to the depositors. The receiver has been instructed by Judge Overfield to pay to Dexter Horton as soon as he can get it, $59,000 being a 50 per cent dividend which was not paid to them until the court in San Francisco has passed on the ruling of Judge Overfield, and $25,000 of this has already been paid. The bank still has uncollected notes running into many thousands, most of which will never bring in a dollar. They have an equity in the Gold Bar Lumber company for four fifths of the stock of that company, but the Dexter Horton company hold the stock as security for the loan of $118,000, which was an overdraft of the Fairbanks bank with them prior to the failure. Among the uncollected notes are three from Arthur McNeer for about $3,300, borrowed from the bank at different times; $200 of it was borrowed 60 days before the failure of the bank, although at that time he was indebted to the bank and they had been unable to collect from him. Dan Jonas had touched the bank for a loan of $14,000. Jonas has since gone broke and is now in New York working for wages. The bank failed owing depositors $921,357.56, but of this sum $460,678.78 has been paid to them. The receiver has also paid all running expenses of the receivership to date. It is estimated that the bank has uncollectable notes for $141,000, on which nothing practically will be realized.-Ex.