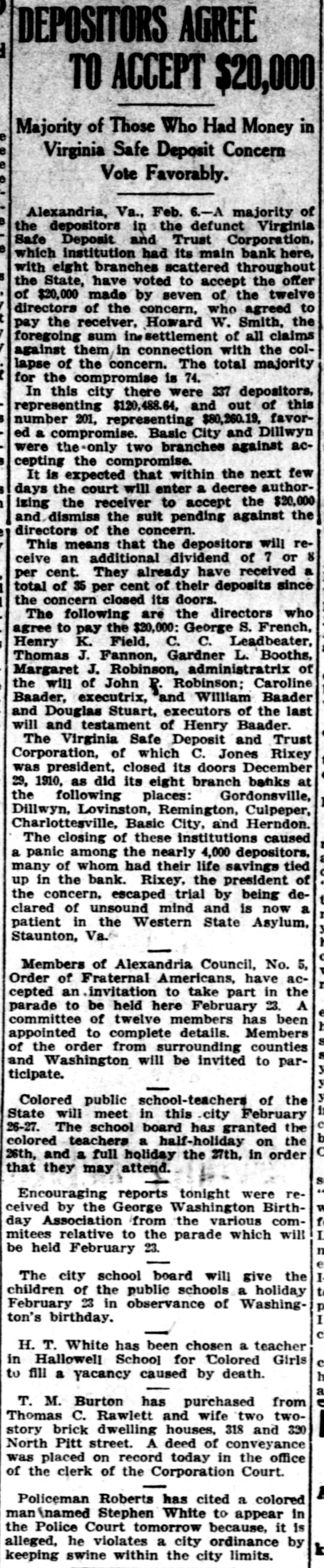

Article Text

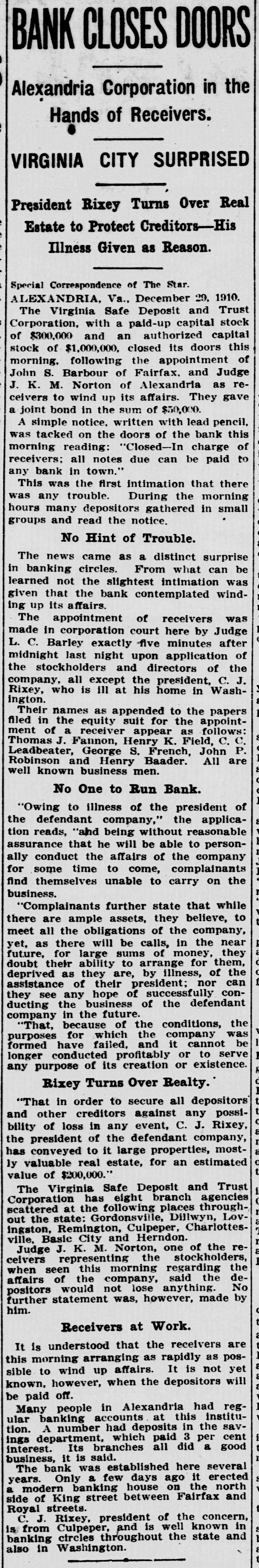

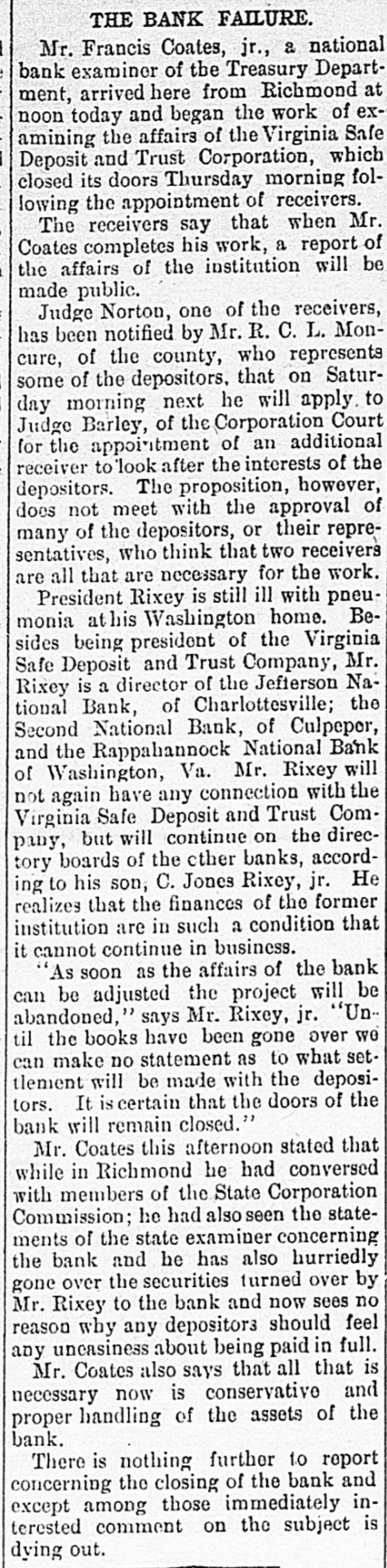

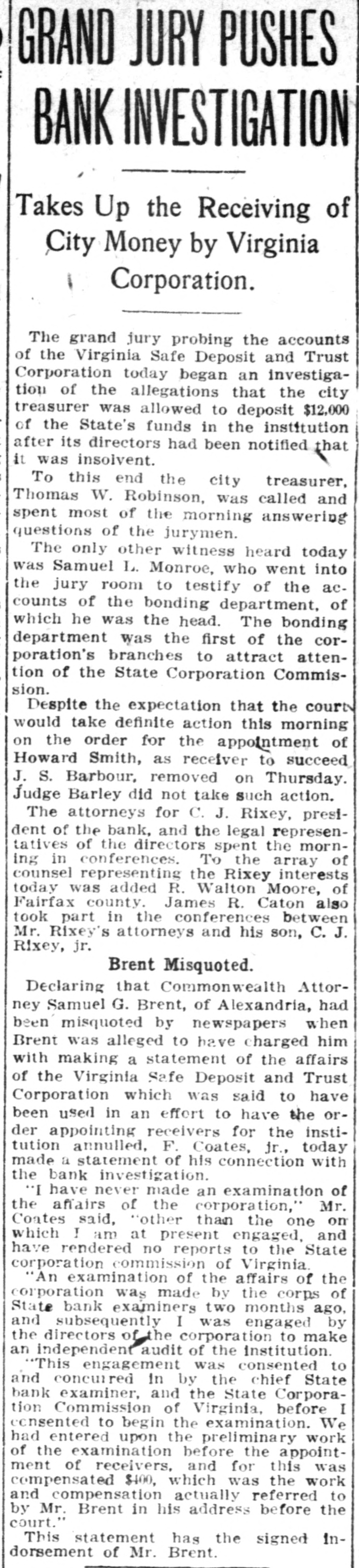

ALEXANDRIA BANK CLOSES ITS DOORS Receivers Appointed for Virginia Safe Deposit and Trust Company. WASHINGTON TIMES BUREAU. ALEXANDRIA, VA., DEC. 29. The Virginia Safe Deposit and Trust Corporation, incorporated under the laws of Virginia, suspended business this morning. Thomas J. Fannon, Henry K. Field, C. C. Leadbeater, George S. French, John P. Rebinson, and Henry Baader, directors, last evening entered suit in the corporation court for the appointment of receivers. In their application they say they believe the bank has ample assets and resources to meet all deposits and creditors, and all estates and trusts. Statement Made. It is also stated in the application that "owing to the illness of the president, and being without reasonable assurance that he will be able to personally conduct the affairs for some time to come the complainants find themselves unable to carry on the business of the defendant." Another section of the application states "that to secure all depositors and creditors C. J. Rixey, the president of the company, has conveyed to it large properties, mostly real estate estimated at about $20,000." Judge Earley appointed Judge J. K. M. Norton, of this city, and John S. Barbour, of Fairfax, receivers, and they gave bond in the sum of $50,000. The Virginia Safe Deposit and Trust Corporation was organized in 1904, has branches in the following Virginia towns: Gordonsville, Dillwyn, Lovingston, Remington, Culpeper, Charlottesville, Basic City and Herndon. It is understood the bank will pay all its obligations. While the petitioning directors express the belief that the bank and its branches will liquidate so as to pay depositors in full, there are others familiar with banking methods who are not SO sanguine. Capital Stock $300,000. The Virginia Safe Deposit and Trust Corporation was organized with a capital stock of $300,000, which has not been changed during the six years of operation. It was Mr. Rixey's idea that the bank could pay 6 per cent dividends on its capital right from the start, and this charge of $18,000 a year, is believed by bankers familiar with the situation in Virginia, to have been too great a strain upon the institution. The full board of directors consists of Messrs. C. J. Rixey, Henry Baader, John P. Robinson, Henry K. Field, George S. French, C. C. Leadbeater, J. K. M. Norton, and T. J. Fannon. C. J. Rixey is a well-known Virginian, and has stood in high esteem among the banking fraternity. The stock of the corporation has been closely held, and not traded in on the stock exchange. It has been quoted privately at par, or $100 a share. On the first of July, 1910, the Virginia Safe Deposit and Trust Corporation reported its condition as follows: