Article Text

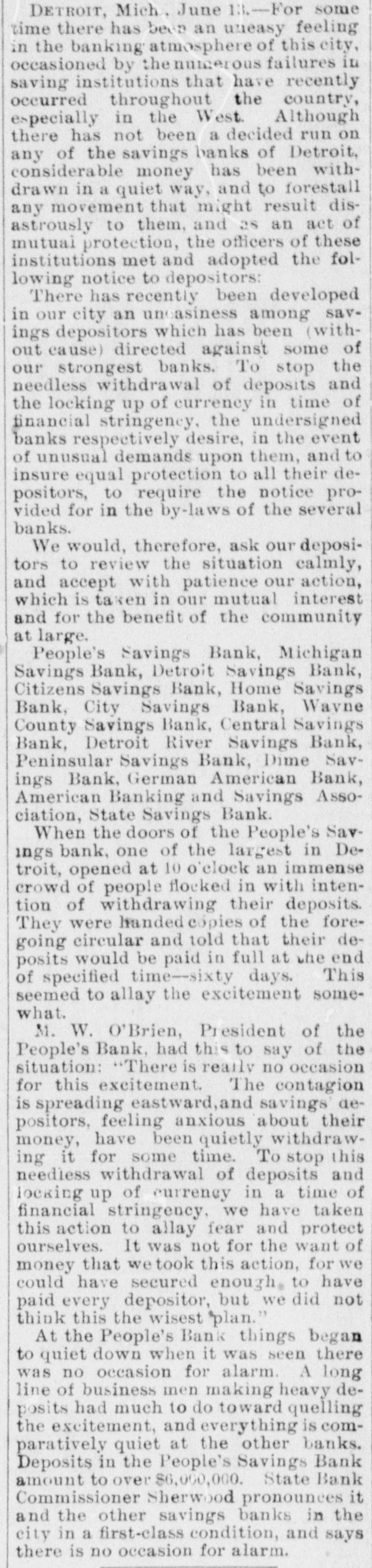

DETROIT, Mich. June 1:4-For some time there has been an uneasy feeling in the banking atmosphere of this city, occasioned by the nutgerous failures in saving institutions that have recently occurred throughout the country, especially in the West Although there has not been a decided run on any of the savings banks of Detroit, considerable money has been withdrawn in a quiet way, and to forestall any movement that might result disastrously to them, and as an act of mutual protection, the officers of these institutions met and adopted the following notice to depositors: There has recently been developed in our city an un asiness among savings depositors which has been (without cause) directed against some of our strongest banks. To stop the needless withdrawal of deposits and the locking up of currency in time of financial stringency, the undersigned banks respectively desire, in the event of unusual demands upon them, and to insure equal protection to all their depositors, to require the notice provided for in the by-laws of the several banks. We would, therefore, ask our depositors to review the situation calmly, and accept with patience our action, which is taken in our mutual interest and for the benefit of the community at large. People's Savings Bank, Michigan Savings Bank, Detroit Savings Bank, Citizens Savings Bank, Home Savings Bank, City Savings Bank, Wayne County Savings Bank, Central Savings Bank, Detroit River Savings Bank, Peninsular Savings Bank, Dime Savings Bank, German American Bank, American Banking and Savings Association, State Savings Bank. When the doors of the People's Savings bank, one of the largest in Detroit, opened at 10 o'clock an immense crowd of people flocked in with intention of withdrawing their deposits. They were handed cópies of the fore= going circular and told that their deposits would be paid in full at the end of specified time-sixty days. This seemed to allay the excitement somewhat. M. W. O'Brien, President of the People's Bank, had this to say of the situation: There is really no occasion for this excitement. The contagion is spreading eastward, and savings depositors, feeling anxious about their money, have been quietly withdrawing it for some time. To stop this needless withdrawal of deposits and locking up of currency in a time of financial stringency, we have taken this action to allay fear and protect ourselves. It was not for the want of money that wetook this action, for we could have secured enough. to have paid every depositor, but we did not think this the wisest "plan." At the People's Bank things began to quiet down when it was seen there was no occasion for alarm. A long line of business men making heavy deposits had much to do toward quelling the excitement, and everything is comparatively quiet at the other banks. Deposits in the People's Savings Bank amount to over $6,000,000. State Bank Commissioner Sherwood pronounces it and the other savings banks in the city in a first-class condition, and says there is no occasion for alarm.