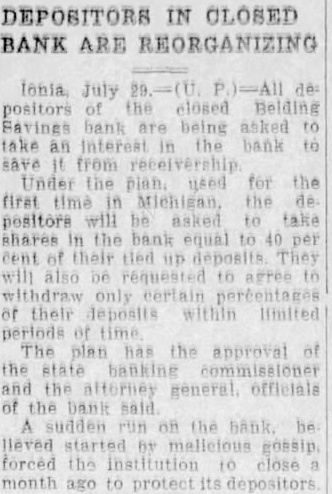

Article Text

DEPOSITORS IN CLOSED BANK ARE REORGANIZING positors of the closed Belding Savings bank are being asked to take an Interest in the bank to save from receivership Under the plan, used for the first time in Michigan the de positors will he asked to take shares in the bank equal to 40 per also be requested to agree to withdraw only certain percentages of their deposits within limited periods time The plan has the approval of the state banking commissioner and the attorney officials of the bank said A sudden run on the bank. be forced the institution to close month ago to protect its depositors