Article Text

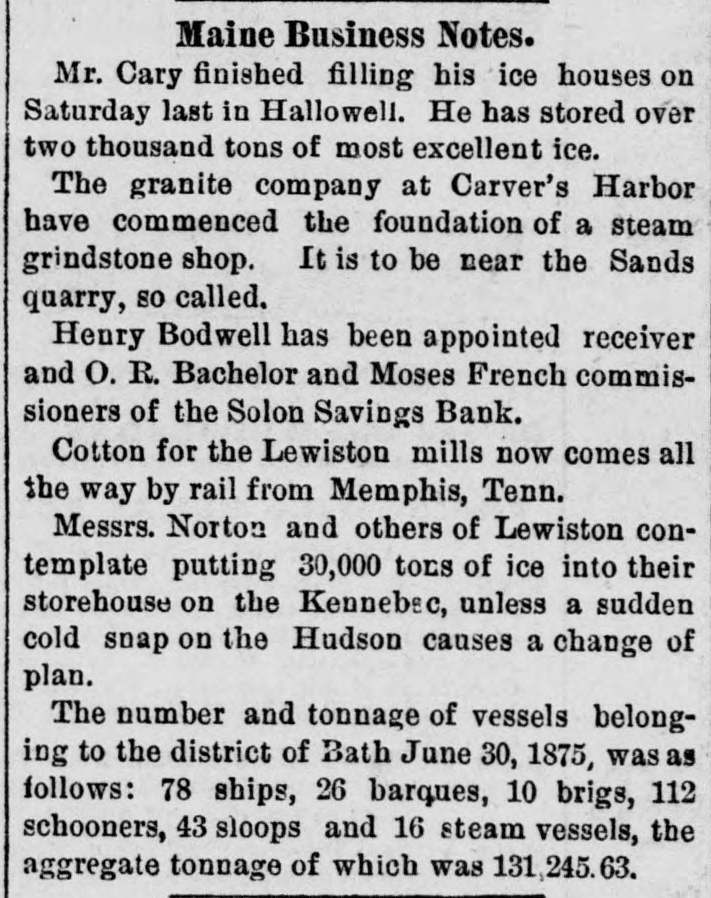

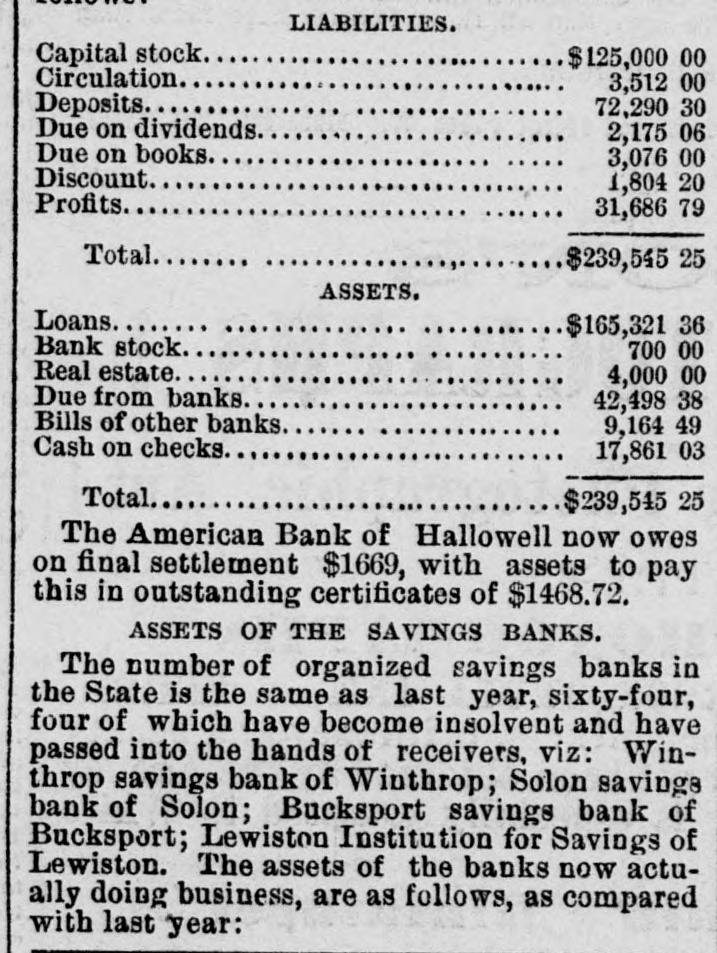

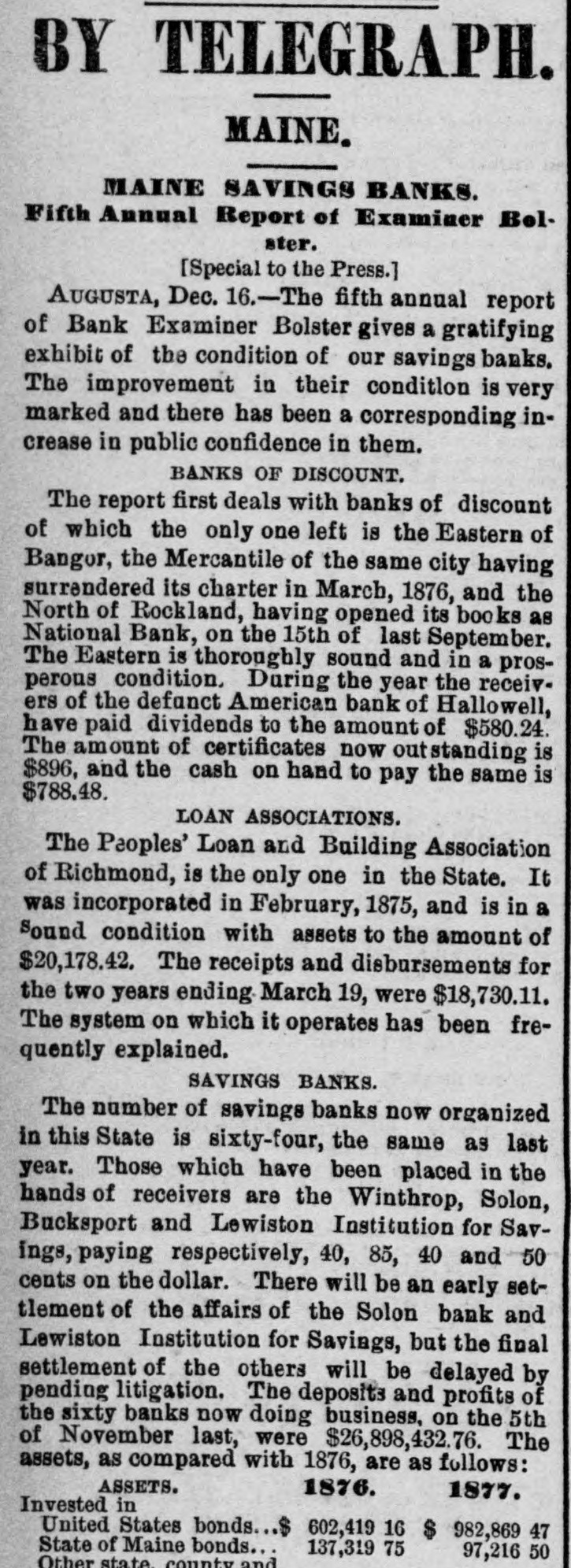

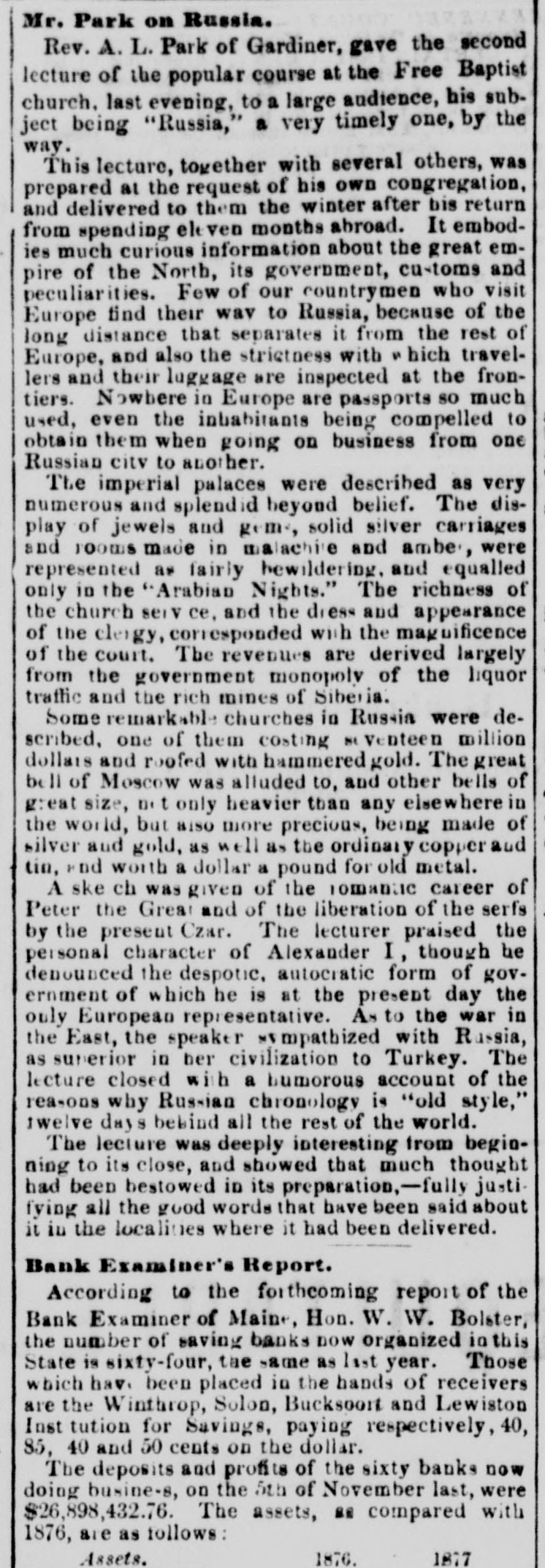

# STATE NEWS ANDROSCOGGIN COUNTY. The Lewiston Journal says that ice half an inch thick formed Tuesday night. The North Turner cheese factory has made the past season twenty tons of cheese, against eleven tons last year. This factory took the premium at the state fair for the best conducted factory in the state. The Mechanic Falls Herald says that typhoid fever is very prevalent in the town of Minot and Poland this fall. Mrs. Livermore lectures in Lewiston next Thursday. The Journal hears that surveys of the Augusta and Lewiston railroad are now in operation in that city. T. B. Thorne, a Lewiston builder, was severely injured by a fall from a building in Manchester, N. H. CUMBERLAND COUNTY. The News says next Monday Mr. George H. Cummings retires from the Cumberland House and will be succeeded by Mr. Tilton of Buckfield, an experienced landlord. The Baldwin and Sebago cattle show and fair will be held at East Baldwin, Tuesday, Oct. 12th. The News says that Hon. W. W. Cross started for Bridgton last week with a drove of 66 cattle, but disposed of them all on the way. He is buying another herd, which he will drive in a few weeks. The Bridgton News says that F. J. Littlefield has sold his music store and sewing machine business to Preston U. Hamlin and B. W. Stevens. The News urges all churches to abandon the use of fermented wine at the communion table, because there are 18,000 reformed men in the state, many of whom are now church members and liable to have the old appetite awakened by a mere taste of alcohol. FRANKLIN COUNTY. Mr. R. S. Morse of East Dixfield, has purchased the farm of A. J. Hall, about six miles from Wilton village. The farm contains 450 acres of land, and Mr. Morse intends to convert it into a sheep farm. Maj. Seward Dill writes us from Phillips that the North Franklin Agricultural Society fair at that place, commencing Thursday, adjourned till Monday on account of the rain. KNOX COUNTY. The Gazette says that notwithstanding the general hard times throughout the country, we think Camden has suffered as little as most towns and villages in the Union. Our manufacturers, D. Knowlton & Co., Henry Alden, the Woolen Manufacturing Co., C. H. Barstow, W. G. & H. E. Alden, the Millers and others, are all running very nearly if not quite their full force. Besides this, there have been built, and completed, a large number of dwellings-near as we can now call to mind, sixteen-besides numerous additions and repairs. Maggie Mitchell appears in Fanchon at Rockland, Oct. 15. She has several other appointment in the state. KENNEBEC COUNTY. Charles Hallett, Esq, of West Waterville, one of the oldest and most respected citizens, died Tuesday night. The Journal says that Jepthah Encampment No. 8, I. O. O, F., was instituted in Augusta on Thursday afternoon and evening by M. W. Grand Patriarch O. G. Douglass of Lewiston, and the officers of the Grand Encampment. This encampment commences with eight charter members, and ten initiates were admitted and exalted to the R. P. Degree. Some 30 applications were reported for admission. LINCOLN COUNTY. Hon. Washington Gilbert of Bath, has been engaged to deliver the address before the Lincoln Agricultural Society at Waldoboro, Oct. 13th. The News says that the students of Newcastle Academy have instruction in music twice a week. PENOBSCOT COUNTY. The Whig says that late Wednesday evening as Mr. Geo. Wright was returning to his vessel he was obliged to cross the schooner H. L. Doe before he could reach his own schooner, the Annie Wilder. The hatch of the H. L. Doe was open, and not noticing it he fell headlong about ten feet in her hold, striking upon his head and severely fracturing his skull. Elmore Saunders of Brewer, while working on the barque Herbert at Oakes' lower yard, fell from one of the stagings last Tuesday, striking on the hard beach, breaking several ribs and receiving severe internal injuries. He fell a distance of 35 feet, and his injuries are so serious that he may never be able to work again. PISCATAQUIS COUNTY. In response to the suggestion of the Dexter Gazette, the Piscataquis Observer extends an invitation to the editorial fraternity of the state to be present at the fiftieth anniversary-the golden wedding-of Mr. Geo. V. Edes, the vetern editor of the Observer, the oldest printer in the state. SAGADAHOC COUNTY. Young Trott, who was so severely injured in the Topsham paper mill, Tuesday, by falling into a revolving wheel, died Thursday. SOMERSET COUNTY. The Reporter says that the Selon Savings Bank has failed, or at least suspended. The bank had invested largely in European and North American Railway bonds, and in Western city and railroad bonds. These bonds have recently much depreciated in value, hence the difficulty. It is thought that the stockholders will lose little or nothing. Mr. S. D. Greenleaf of Starks, has gathered about 100 bushels of eranberries, also 1000 bushels of onions. Prof. L. A. Torrens will hold a musical convention at Skowhegan Oct. 26th. At the Supreme Court, George Mack plead guilty to one case of horse stealing, and was sentenced to five years in the state prison. Fred Jones was found guilty of rape. WALDO COUNTY. The autumn session of the Grand Lodge of Good Templars will commence at Belfast next Tuesday morning, and continue two days. The members of the Order may obtain tickets for half fare on the boats and cars. A large attendance is anticipated, and some of the leading speakers of the day will be present and address the public meetings. WASHINGTON COUNTY. The Advertiser learns that Mr. Benjamin Shattuck of Red Beach, Calais, lest, a few nights ago, by the frost, some 200 bushels of cranberries, worth between $300 and $400, on his upland meadows. Those on the marsh land were not injured. The cranberry crop is about the best crop raised in this section. The Sentinel says that a bold smuggler was chased while going through Cobsock Falts, by the Lubec customs officer, one last week. Finding he was likely to be caught the smuggler commenced throwing overboard kegs and cases of liquor, jugs, etc.; thinking these of more value than the boat that contained them the officer picked up all he could, which amounted to several hundred dollars worth. The boat has since been seized. The Falls is a dangerous place to go through. The Sentinel states that a small boy, only child of Mrs. W. H. Sears of Pembroke, was drowned by the upsetting of the boat in a whirlpool. YORK COUNTY. Mr. Frank Norton of York, a laborer in the construction department, met with a serious accident Wednesday, the 29th. He was employed in taking a rope from a steam windlass, when his right arm was caught by the machinery, and before the engine could be stopped, most of the flesh from the elbow down was torn off. The armless child recently born in Biddeford died last week.