Article Text

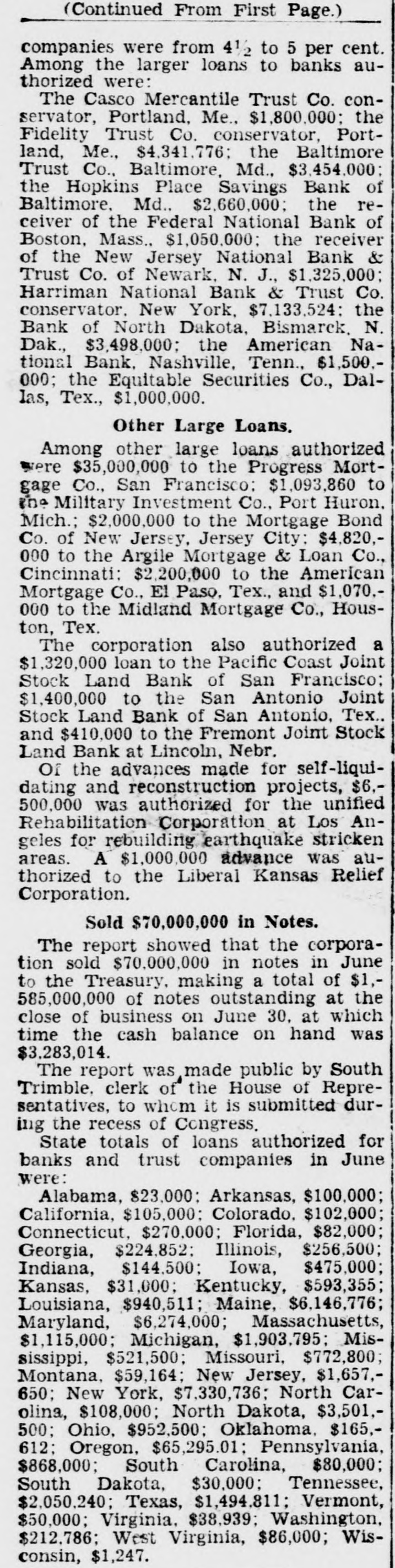

(Continued From First Page.) companies were from 41/2 to 5 per cent. Among the larger loans to banks authorized were: The Casco Mercantile Trust Co. conservator, Portland, Me., $1,800,000; the Fidelity Trust Co. conservator, Portland, Me., $4,341,776; the Baltimore Trust Co., Baltimore, Md., $3,454,000; the Hopkins Place Savings Bank of Baltimore, Md.. $2,660,000; the receiver of the Federal National Bank of Boston, Mass., $1,050,000; the receiver of the New Jersey National Bank & Trust Co. of Newark, N. J., $1,325,000; Harriman National Bank & Trust Co. conservator. New York, $7,133,524: the Bank of North Dakota, Bismarck N. Dak. $3,498,000: the American National Bank. Nashville, Tenn., $1,500.000: the Equitable Securities Co., Dallas, Tex., $1,000,000. Other Large Loans. Among other large loans authorized tere $35,000,000 to the Progress Mortgage Co., San Francisco: $1,093,860 to the Military Investment Co., Port Huron, Mich.; $2,000,000 to the Mortgage Bond Co. of New Jersey. Jersey City: $4,820,000 to the Argile Mortgage & Loan Co., Cincinnati: $2,200,000 to the American Mortgage Co., El Paso. Tex., and $1,070.000 to the Midland Mortgage Co., Houston, Tex. a The corporation also authorized $1,320,000 loan to the Pacific Coast Joint Stock Land Bank of San Francisco: $1,400,000 to the San Antonio Joint Stock Land Bank of San Antonio, Tex and $410,000 to the Fremont Joint Stock Land Bank at Lincoln, Nebr. Of the advances made for self-liquidating and reconstruction projects, $6,500,000 was authorized for the unified Rehabilitation Corporation at Los Angeles for rebuilding earthquake stricken areas. A $1,000,000 advance was authorized to the Liberal Kansas Relief Corporation. Sold $70,000,000 in Notes. The report showed that the corporation sold $70,000,000 in notes in June to the Treasury. making a total of $1,585,000,000 of notes outstanding at the close of business on June 30, at which time the cash balance on hand was $3.283,014. The report was made public by South Trimble. clerk of the House of Representatives, to whom it is submitted during the recess of Congress. State totals of loans authorized for banks and trust companies in June were: Alabama, $23,000: Arkansas, $100,000; California, $105,000; Colorado, $102,000; Connecticut, $270.000; Florida, $82,000; Georgia, $224,852; Illinois, $256,500; Indiana, $144,500; Iowa, $475,000; Kansas, $31,000; Kentucky, $593,355; Louisiana, $940,511; Maine, $6,146,776; Maryland, $6,274,000; Massachusetts, $1,115,000; Michigan, $1,903.795; Mississippi, $521,500; Missouri, $772,800; Montana, $59,164; New Jersey, $1,657,650: New York, $7,330,736; North Carolina, $108,000; North Dakota, $3,501.500; Ohio, $952,500; Oklahoma, $165,612; Oregon, $65,295.01; Pennsylvania, $868,000; South Carolina, $80,000; South Dakota, $30,000; Tennessee, $2,050,240; Texas, $1,494.811; Vermont, $50,000; Virginia, $38,939; Washington, $212,786; West Virginia, $86,000; Wisconsin, $1,247.