Article Text

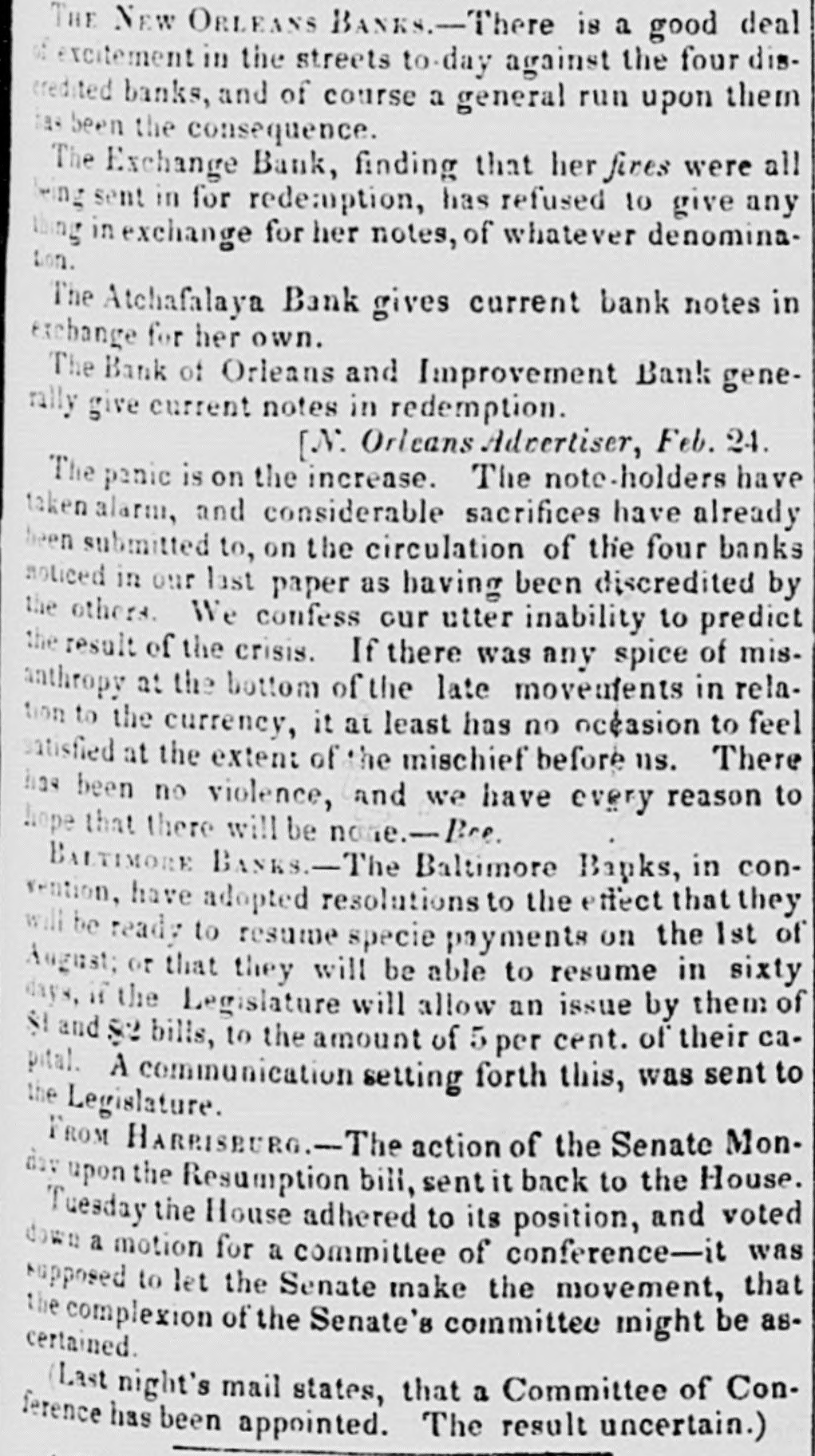

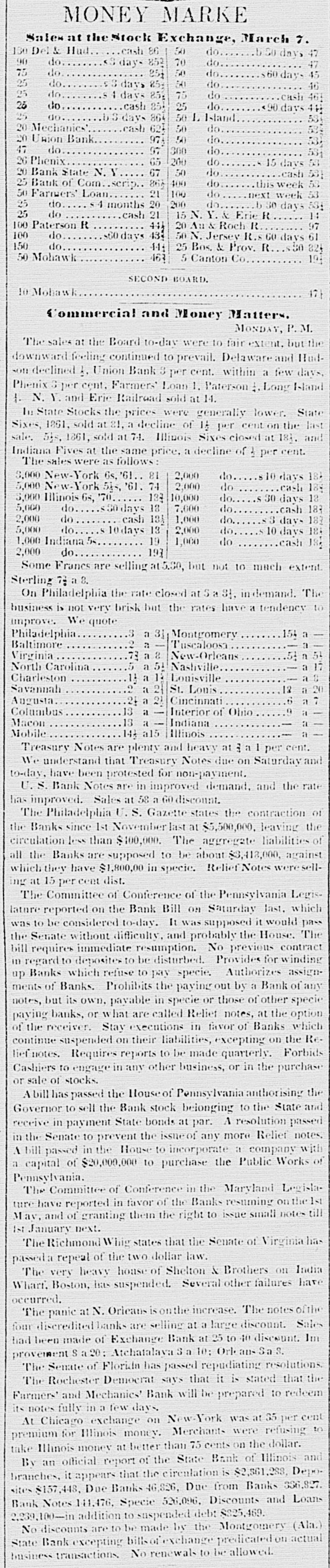

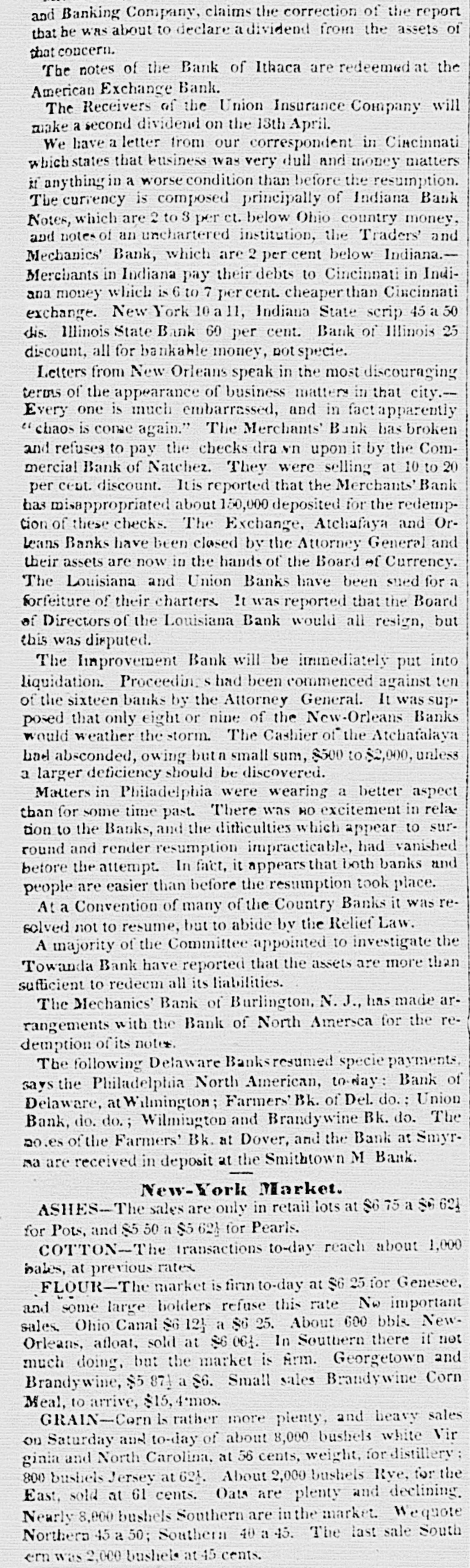

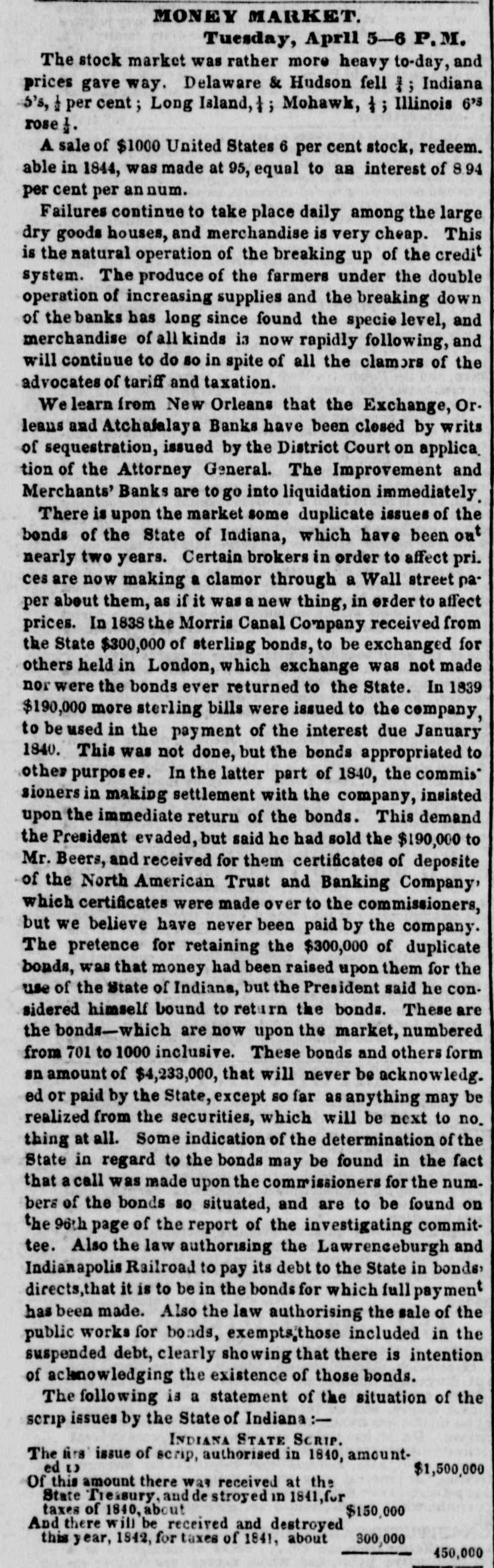

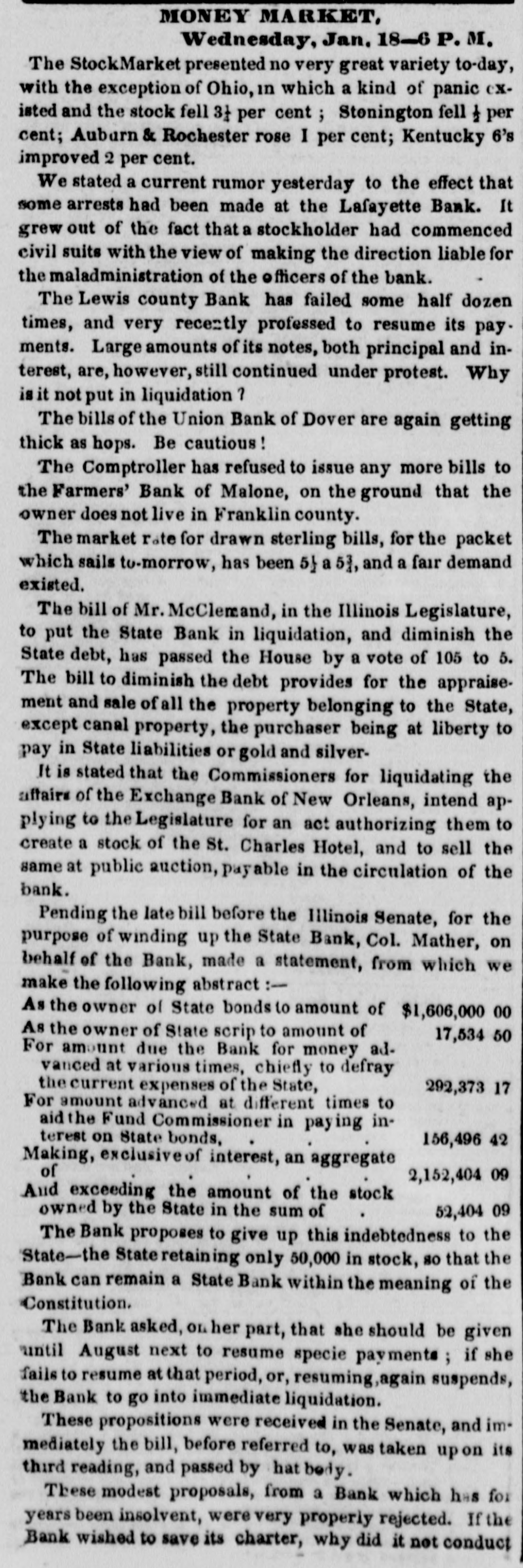

EXECUTIVE DEPARTMENT. New Orleans, 18th December 1841. Sta-1 have the honor to acknowledge the receipt of the letter which has been addressed to me yesterday, in the name of the Board of Directors over which you preside, to express their regret that, in my late annual mesange to the general assembly, "the Carrollton Bank has been classed an one of the institutotal which has encreased its liabilities during the last two years." No one could have experienced more uncasinces than I would, if through any error contained in the communication to which you allude, the Carrollton Bank, or any other, had been made undeservedly to suffer. I therefore feel happy in being able to stato and to prove that this has not been the case. In the discharge of what I considered a dutv. I have informed the legielature that the Board of Presidents have postponed the resumption of specie payments until November 1842, in order to enable the weak banks to change their position. It is not through any act of mine that your institution has been classed as a weak bank. It has been done by a resolution adopted by the Board of Presidenta in the following words: "Resolved, that the aid which may be necessary to enable the improvement, the Exchange, the Atchafalaya, the Orleans and the Carrollton Banks to resame payment in specie with the other banks, be furnished to said banks immediately, &c." Wishing to prove, by what had already taken place, that those weak banks could not expect to be benefited by a continuation of the suspension, I have given the position of each of them in October last, and in November, 1839, immediately after the second suspension; and I have shown that during the last two years, their collective cash liabilities have increased more than $780,000, and their collective cash assets have decreased $300,000. The statements on which my calculations were based, have been extracted from a document submitted officially by the Citizens' Bank to the Board of Presidents of the banks of this city, which has since been laid by that institution before the general assembly.These were the only data on which I could safely act, because the information on the situation of our monetary institutions which had requested officially from the Secretary of the Board of Presidents, could not be communicated to me, notwithstanding the willingness of that gentleman to do so, before the inceting of the legislature. In neither of the statements quoted in my message, can you find a cause of complaint, for in both of there your liabilities are smaller than those now given by yourself. Your classification with the institutions that have augmented their liabilities could not be avoided, for having undertaken to show the effect of srspension on all the banks which the Board of Presidents intended to relieve. I could not help classing you with them, without making a distinction which might appear invidious between the banks which they had thought proper to connect. I learn with much pleasure that the Carrollton Bank is preparing to resume specie payments, "at as early a period as a majority of the banks of this city may do so." I hope that the time is not far distant when the country shall be relieved from the calamities which necessarily follow the circulation of an irredeemable paper currency. Respectfully, Your obedient servant. A. B. ROMAN. (Signed) G.C. DUNCAN, President of the Carrollton Bank.