Article Text

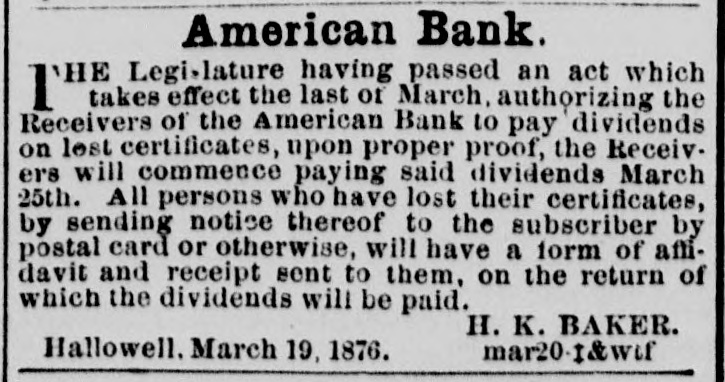

Supreme Judicial Court-Danforth J. Presiding. SATURDAY, August 15th. The court sat till one o'clock and then adjourned without day. The number of divorces granted this term is eighteen, thirteen of which were on the application of injured wives, the alleged causes being generally intemperance, neglect and abusive treatment, and desertion. Amount of fines and costs collected mainly on prosecutions under the liquor law, $617.05. It is understood that considerable more will be paid in in a few days. A matter of considerable interest came up late in the term in the case in equity brought by the Receivers of the American Bank, Hallowell, against the stockholders to compel them to contribute in proportion to the number of shares held by each a sum sufficient to make good to the bill holders and other creditors of the bank, the losses sustained by them on its failure. The case having been before the full court upon demurrer to the bill, which was overruled, the defendants moved the court for leave to file their answers, and thus reopen the case upon its merits. The motion was fully argued by counsel on both sides, J. Baker and Libbey for the Receivers, Bradbury and Titcomb for the Stockholders. The Judge having reserved his decision until the following morning, announced his opinion— denying the motion and giving the receivers judgment against the stockholders. The amount to be assessed will be about fifty per cent. of the par value of the shares.