Click image to open full size in new tab

Article Text

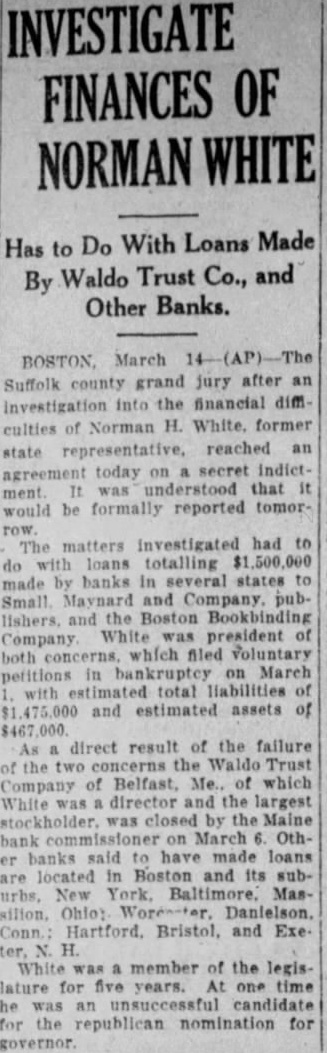

Indictment Is Returned by Grand Jury

LOANS TOTAL MILLIONS

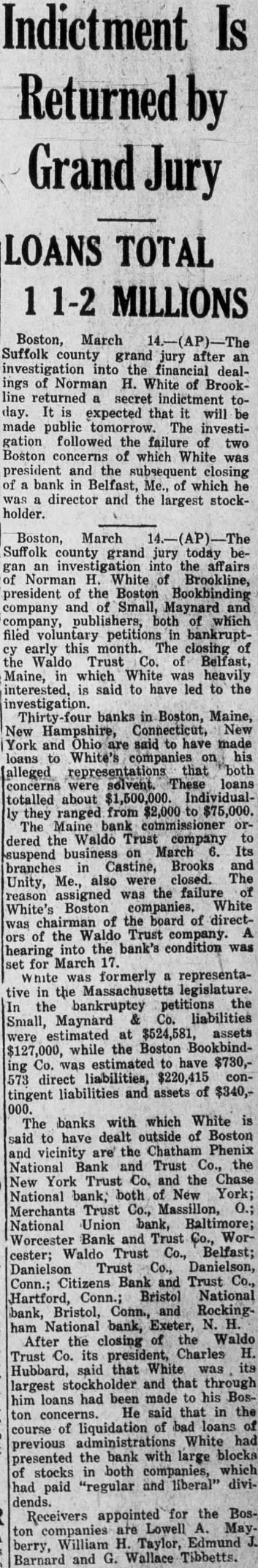

Boston, March Suffolk county grand after jury into financial dealings of Norman H. White of Brookline returned secret indictment day. It is expected that will made public tomorrow. The investigation followed the failure of two Boston concerns of which White president and the subsequent closing bank Belfast, Me., of which director and the largest stockholder.

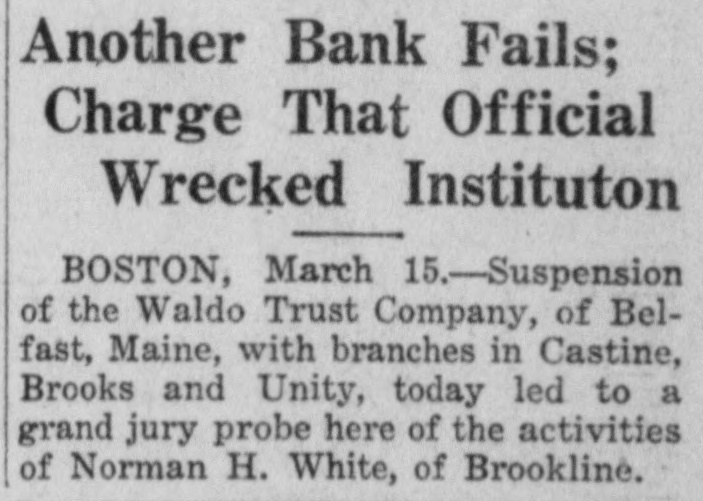

Boston, March Suffolk county grand jury today gan an investigation into the Norman White of Brookline, president of the Boston Bookbinding company and Small, Maynard publishers, which filed petitions bankruptearly this The closing of Waldo Trust Co. Belfast, Maine, in which White was heavily interested, is said to have led to the investigation. banks in Boston, Maine, New Hampshire, Connecticut, New York and said to have made loans to White's his that both concerns solvent. These loans were totalled about Individualthey ranged from $2,000 to $75,000. The Maine bank dered the Waldo Trust company business March Its suspend on Castine, Brooks and branches Unity, Me., also were closed. The was the failure reason assigned White White's Boston of the board of directthe Waldo Trust company. of hearing into the bank's condition set for March 17. formerly representawas tive in the Massachusetts legislature. bankruptcy petitions the Co. liabilities Small, Maynard estimated $524,581, assets while the Boston BookbindCo. was estimated have $730,direct liabilities, $220,415 contingent liabilities and assets of $340,banks with which White The to have dealt outside of Boston are the Chatham Phenix and vicinity National Bank and Trust the New York Trust Co. and the Chase National bank; both of New York; Merchants Trust Co., Massillon, National Union bank, Baltimore; Worcester Bank and Trust WorWaldo Trust Belfast; cester; Danielson Trust Co., Danielson, Conn.; Citizens Bank and Trust Bristol National Hartford, Conn.; bank, Bristol, Conn., Rockingham National bank, Exeter, the the Waldo After closing its Charles H. Trust president, Hubbard, said that White its largest stockholder and that through him loans had been made to his Bossaid that in the ton of bad loans of course liquidation previous administrations White had presented the bank with large blocks stocks both companies, which and liberal" divihad paid "regular dends. appointed for the BosReceivers Lowell Maycompanies William Taylor, Edmund berry, and Wallace Tibbetts. Barnard