Article Text

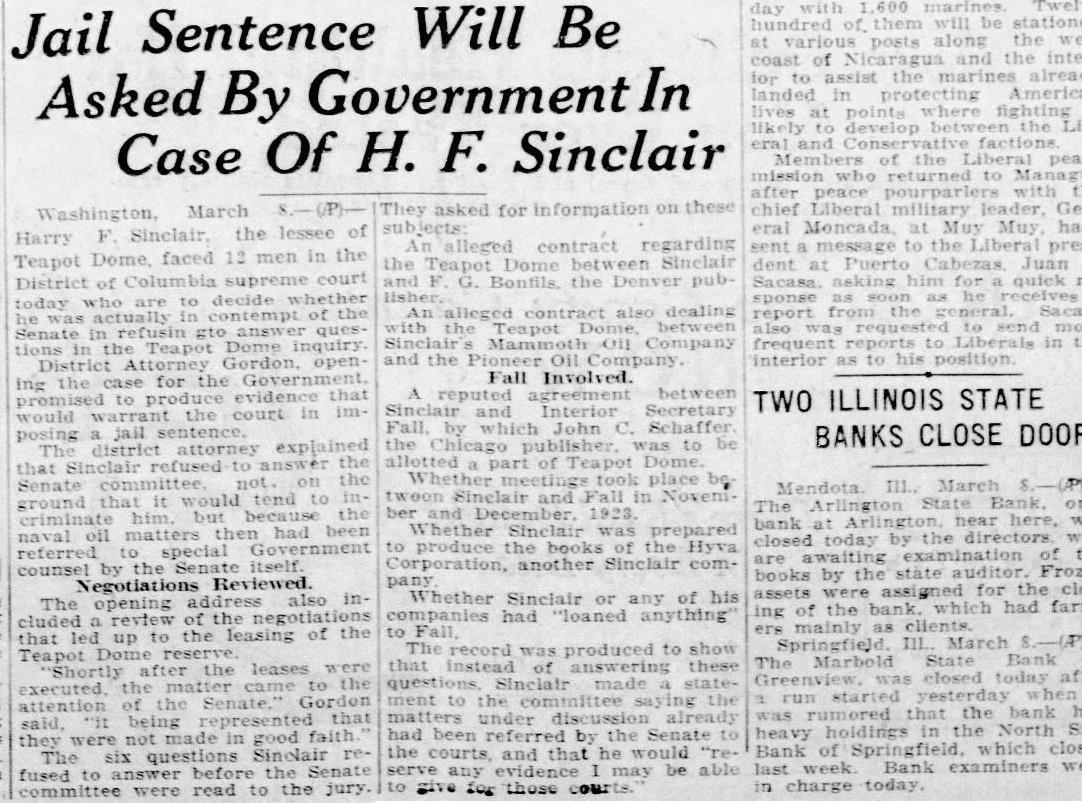

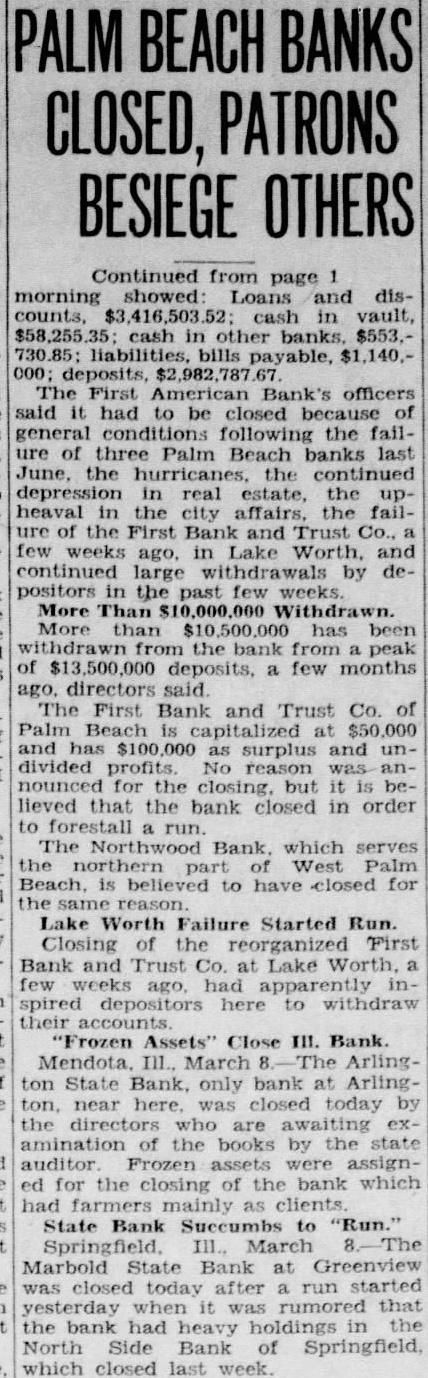

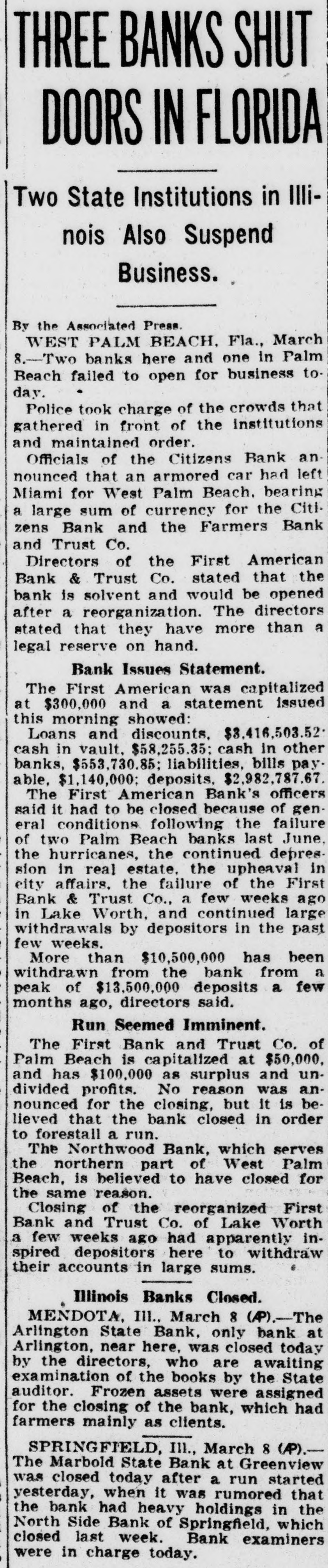

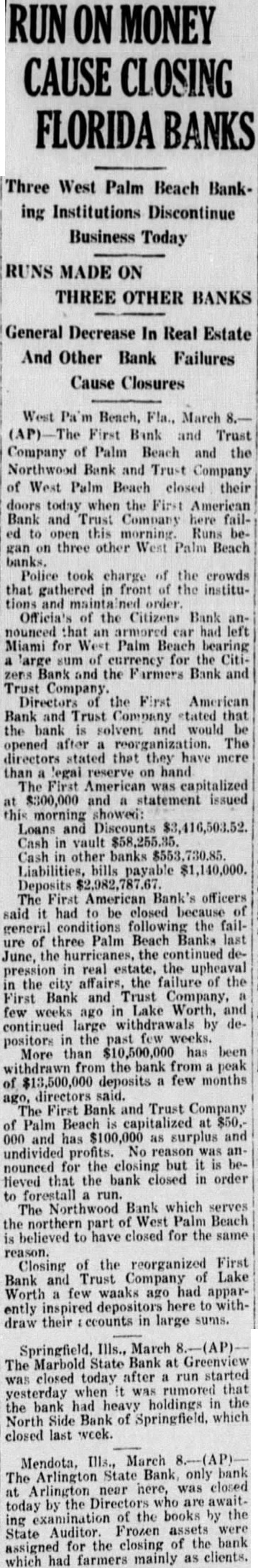

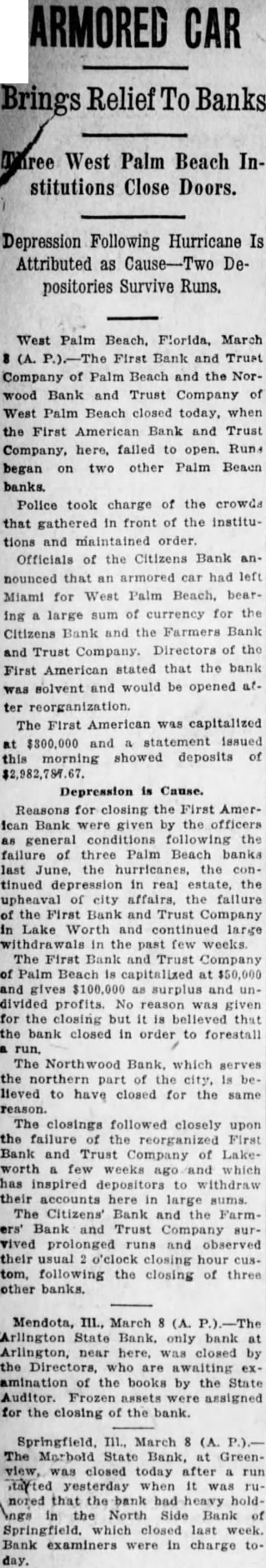

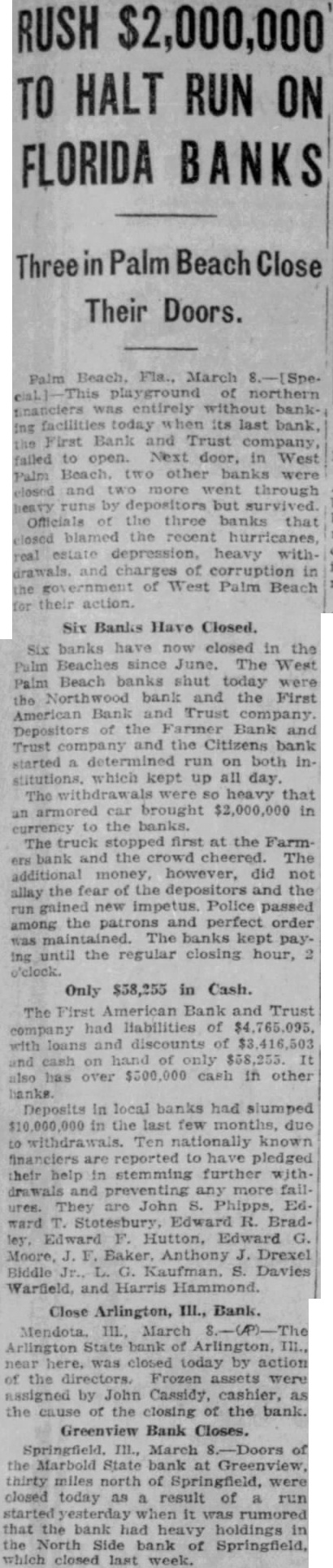

Jail Sentence Will Be Asked By Government In Case Of H. F. Sinclair March the lessee of 13 men in the court decide whether he contempt of the Senate in refusin questions in the Teapot Dome inquiry District Attorney Gordon open promised to evidence that would the court in imattorney explained to answer Senate committee not the would tend to because the naval oil matters then had been referred to special Government counsel by the Senate itself Negotiations Reviewed. The opening address also included a review of the negotiations leasing of the "Shortly after leases were executed the the attention of the Senate, Gordon said, "it being represented that they were not made in good faith The six questions Sinclair rethe read to the jury. They asked for information on these Liberal military Gensubjects eral at Muy Muy An alleged contract regarding to the Liberal presi the Sinclair dent Puerto Juan at and F. G. the Denver pub- quick sponse he alleged contract also dealing report from general. Sacasa with the Dome requested send frequent to in and the Oil interior as to his position Fall Involved. A reputed agreement between TWO ILLINOIS STATE Interior Secretary Fall, by which John C. Schaffer BANKS CLOSE DOORS the publisher, was to be a part of Teapot Dome place be March and in NovemThe Arlington State and bank at Arlington, near here, Whether Sinclair was prepared today by the closed to produce the books of the Hyva awaiting examination Corporation, another Sinclair combooks by the state Frozen assets assigned for the closWhether Sinclair or any of his ing of the bank. which had farmhad loaned anything ers mainly The record was produced to show The Marbold State Bank that instead of answering these Greenview, closed today after questions Sinclair made statestarted ment to the committee the was rumored that the bank matters under discussion already heavy North Side had been referred by the Senate the courts and that he would "re- Bank of Springfield, which closed be able last Bank examiners any to give for those in charge today.