Click image to open full size in new tab

Article Text

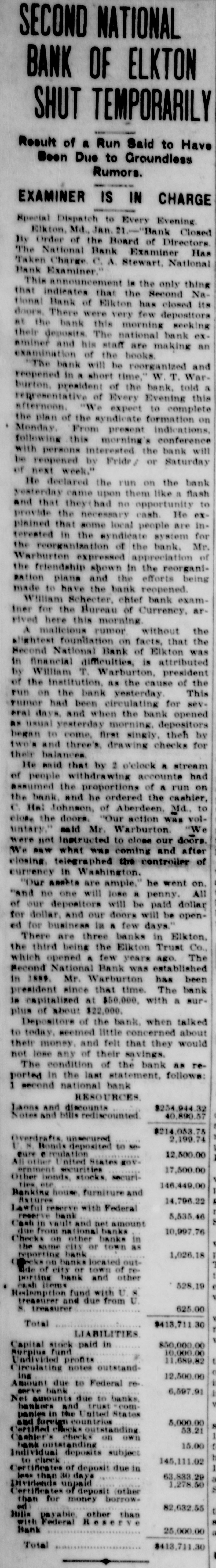

TOWN AND COUNTY. Short Paragraphs of Events in the County During the Past Week. LOCAL HAPPENINGS BRIEFLY NOTED Mrs. Ida Wilson, of Philadelphia, Rock fishing in the Susquehanna is visiting Mrs. G. R. Grason. river is reported better than for years. Mr. and Mrs. Isaac Newlin were recent guests of Mr. and Mrs. ClarA Ford car belonging to Clifford ence Ashby. Spotts was stolen in Elkton Saturday night. Mrs. M. E. Flounders and son are The Singerly Fire Company of spending some time with Wilming ton relatives. Elkton has decided not to hold a carnival this year. Mr. and Mrs. W. B. Cooney enjoyed a motor trip to Ocean City, According to report the wrecked N. J., last week. Second National Bank of Elkton Mr. and Mrs. Kirk and child, of will pay about fifteen cents on the Philadelphia, were guests this week dollar. of M. Ely and family. Ladies of St. John's Church, NewMr. and Mrs. Norman Pyle, of ark, Del., cleared upwards of $800 Philada.. were guests this week of from their recent lawn fete and Mr. and Mrs. Job W. Kirk. festival. Mrs. Ruth Ann Gilmore has reThe dwelling on West Main street, turned to Rising Sun after spending Elkton, owned by Harry M. Taylor, some months at Barnsley, Pa. has been purchased by A. F. Stanley, Mrs. E. C. Dixon, of Philadelphia, of that town. is spending some time with her A carnival will be held at Cherry parents, Mr. and Mrs. B. H. Brown Hill, July 12, 13, 14 and 15 by Little Charles Brown, of Baltimore, Elk Tribe of Red Men and the Despent the 4th with his parents, Mr. gree of Pocahontas, of Cherry Hill. and Mrs. N. C. Brown, in Hising Sun. The First and Fifth Regiments of Barclay Reynolds, of St. Luke's the Maryland National Guard will School faculty, Wayne, Pa., is spendencamp on the Edgewood Arsenal ing the summer vacation at his Reservation from July 22 to Aug. 5. home in Rising Sun. Weather conditions on the 4th of Mr. and Mrs. Albert L. Buffington July were anything but favorable and Mr. E. R. Buffington left this for outings or celebrations. There week for a two weeks' camp in the were drizzles and showers all day Adirondack mountains. that upset many a program for the Miss Emily K. Dryde, of Snow observance of the Natal Day. Hill, was the recent guest of Mrs. Work has been started on the Lawrence Sadler, Farmington. The new State road at Rowlandville. young tadies were school friends at About 6900 cubic feet of dirt and Western Maryland College. stone will be taken from the top and Mr. Frederick Loveless, of Chesaside of Rowlandville hill to get the peake City, and Miss Mary J. Shelgrade and reduce a sharp curve. ton were married at the bride's This section was swept with viohome at Barksdale on Wednesday, lent electrical storms and deluges of June 28. They will reside in Chesarain) on Saturday afternoon, about peake City. five o'clock, and Sunday afternoon Mr. Raymond Hamilton, of New about the same hour. The gutters York, and Miss Martha A. Walls, and streets literally ran rivers of were married Saturday, June 24, at water during the downpours. the home of the bride's mother, Mrs. The Free Masons have purchased Ella Walls, at Calvert, by Rev. J. C. the lot on North street in Elkton McCoy, of St. George's Del. They from Albert D. Mackey, sold at the left for New York, where they will receivers' sale of the real estate or reside. the late William T. Warburton. The a Mr. Ralph E. Morgan, of Chesaplans of the Masons are to build peake City, and Miss Julia B. McTemple in the future. Kenzie, of Providence, were marContractor S. Ralph Andrews be8 ried at Cherry Hill M. E. Parsonage gan preliminary work last week, in on June 21, by Rev. J. W. Gray. the town of Elkton, on concreting Miss Mabel McKenzie, of Germanthe bed of Delaware avenue from town, and Mr. John Rhodes, of A1the Mill Bridge to Main street, toona, Pa.) attended the couple who which will be continued west on the took a trip to Washington, D. C. latter to the crossing at Gonce's Lieut.-Col. N. T. Kirk and family, store. of Walter Reed Hospital, WashingMillard F. Bayless, a farmer or ton, D. C., paid a visit to the formStepney, Harford county, has filed er's brother, Job W. Kirk, and an involuntary petition in bankfamily, last week. Col. Kirk, who ruptcy in the United States Court, is a Rising Sun boy and is in charge Baltimore. The Harford Bank, of of Walter Reed Hospital, was enBel Air is the complainant, and the route to Montank, Long Islana, assets are listed at $9,677.25, and where he will spend a month's valiabilities as $24,888.86. cation. Oxford Electric Co. lost thousands Announcement has been made of of dollars by the storm Saturday the wedding of Miss Gene La Motte, afternoon. Transformers in Oxford, of Bayside, L. I., and Arlington W. Nottingham and Colora, were burnPorter, of New York, formerly of ed out. Our town was without elecElkton. The wedding took place at tric light Saturday night. Lamps Bayside on June 3. The bride is a and candles were resorted to in New York journalist. Mr. Porter is dwellings and places of business. a son of Mrs. Martha M. Porter, During the storm of Saturday 1203 West Ninth street, Wilmington, Del. Mr. and Mrs. Porter will afternoon lightning struck one ot make their home in New York. the large silver maple trees in the front yard of the Barclay Reynolds Lightning struck the blacksmith property, west of town, shattering shop at Rowlandville, during the one side of the tree and also breakstorm Saturday afternoon. The ing and badly damaging the conbarn on the property of Strawbridge crete retaining wall recently erected Gerry was also struck. The damage along the front of the property. done was slight, About 1800 Boy Scouts of AmerOne of the workmen at the Cecil ica from different States, under Paper Mill, near town, had four Chief Scout Master Greenhawk, will fingers of his right hand badly camp at Red Point and call their crushed and lacerated en Friday camp the "Caesar Rodney Camp," last, by getting the hang caught in this summer, The grounds have the calendar rolls. The heavy rolls been prepared for them. and they had to be pried apart with iron bars will come in groups of 50 to 200, before the injured man could be each group remaining a week. Any released, registered Scout has the privilege of The North East Star reports the attending at a cost of $4.50. first installment of sixty young girls The Fourth of July was very from Coatesville, Pa.. arrived at quietly observed in our town. There Wilson's shore last week for two was hardly any "noise," and threatweeks' camping out, Following their ening weather put a damper on alcustom for several years the girls most all outdoor celebrations. and boys from the Pennsylvania city The festival and celebration planwill come in installments during the ned by the Sunday school was one of summer, for health giving outing the things that was almostly comtrips. pletely spoiled, that is the celebraThe Board of Education for Cecil tion end of it, but the ladies and county has awarded to John W. their helpers stuck bravely to their Black, of Cecilton, a recent graduate cake tables and ice cream cans, deof the George Biddle High School, a spite the showers, and did a fair four-year scholarship at the Univeramount of business, the receipts sity of Maryland, amounting to over $100.