Article Text

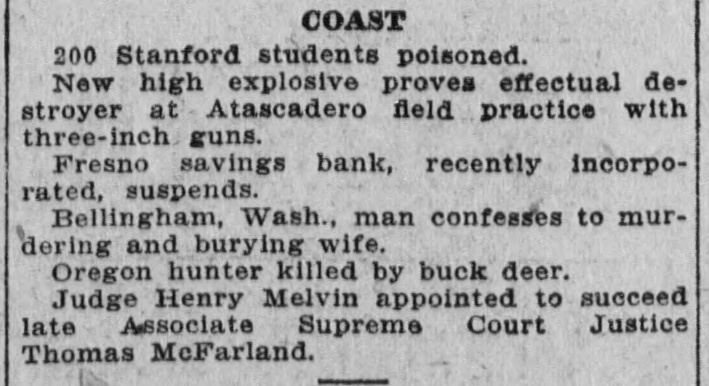

COAST 200 Stanford students poisoned. New high explosive proves effectual destroyer at Atascadero field practice with three-inch guns. Fresno savings bank, recently incorporated, suspends. Bellingham, Wash., man confesses to murdering and burying wife. Oregon hunter killed by buck deer. Judge Henry Melvin appointed to succeed late Associate Supreme Court Justice Thomas McFarland.