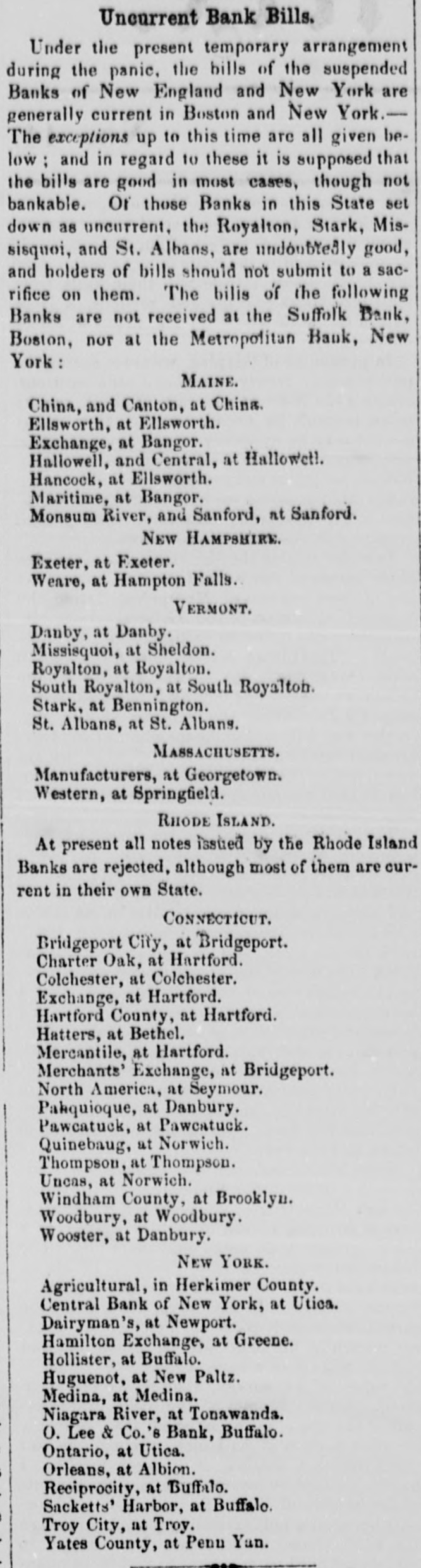

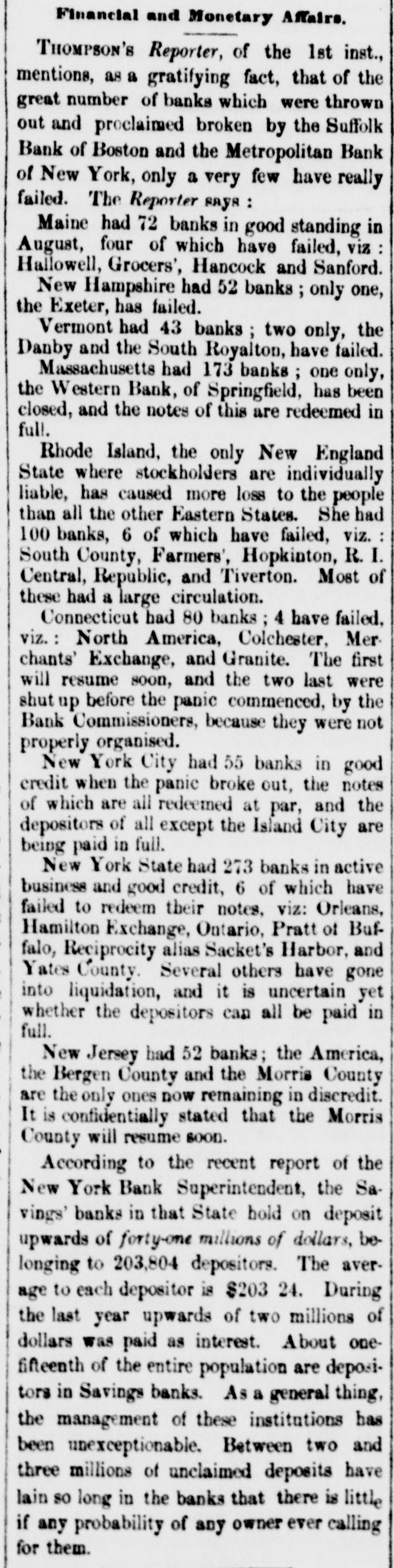

Click image to open full size in new tab

Article Text

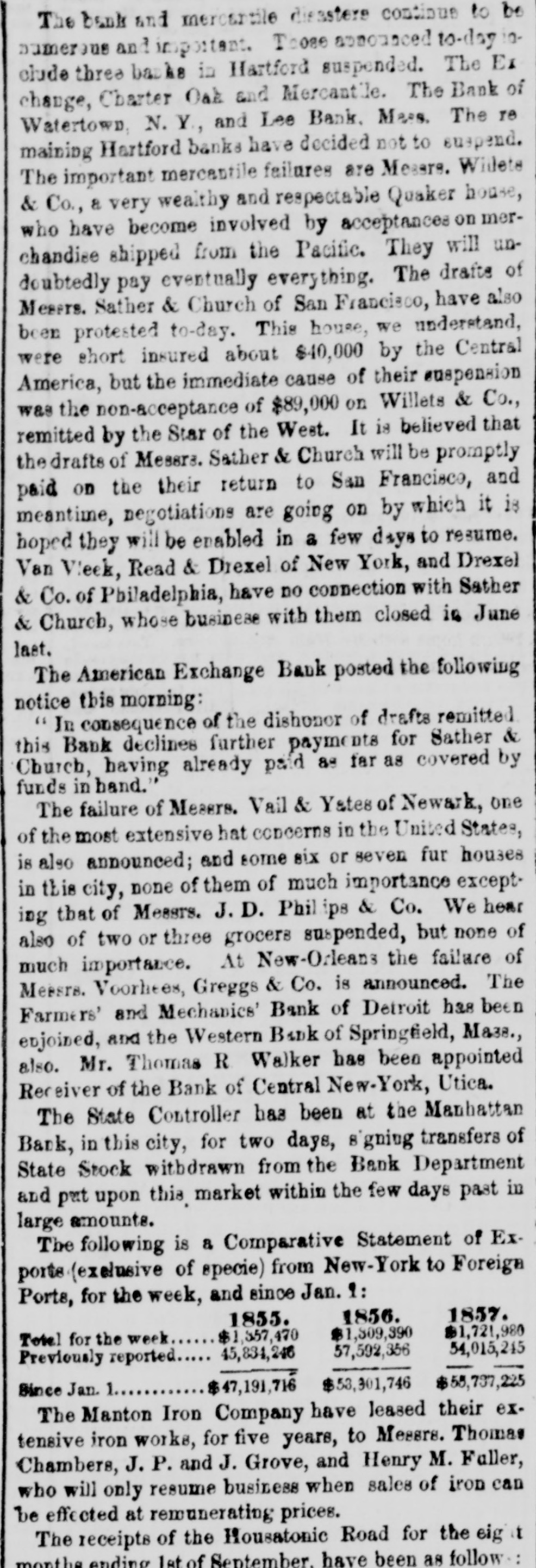

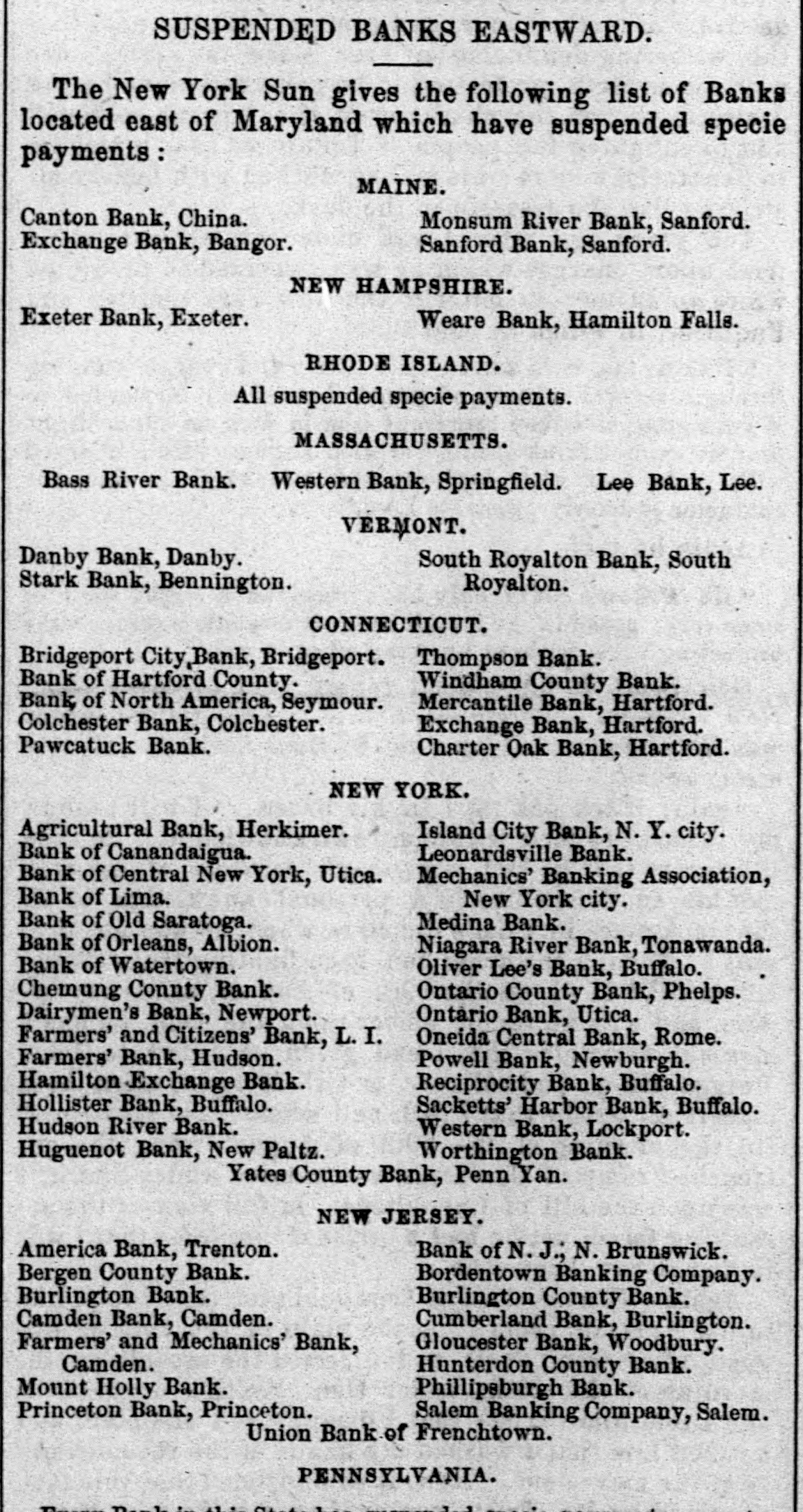

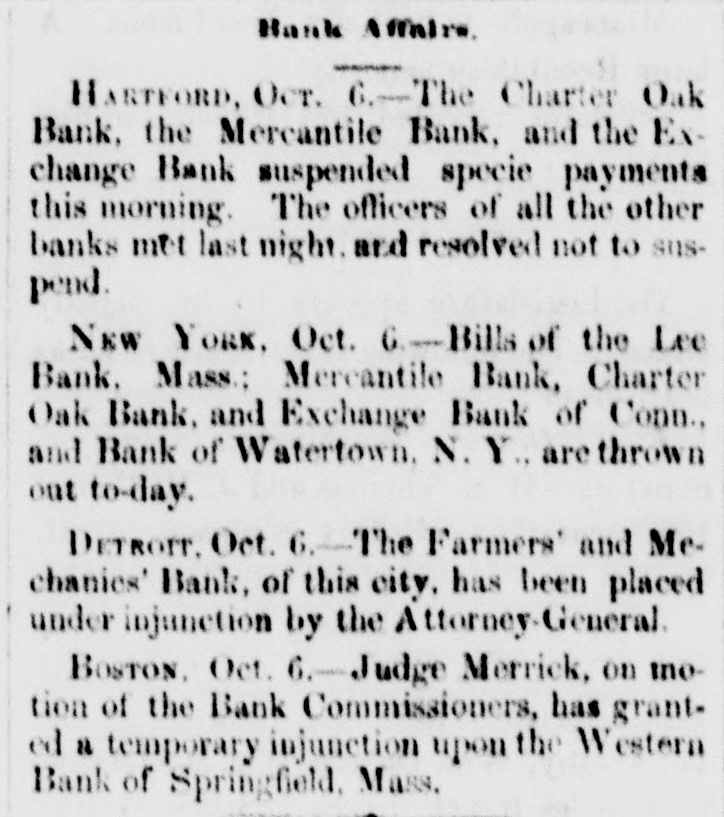

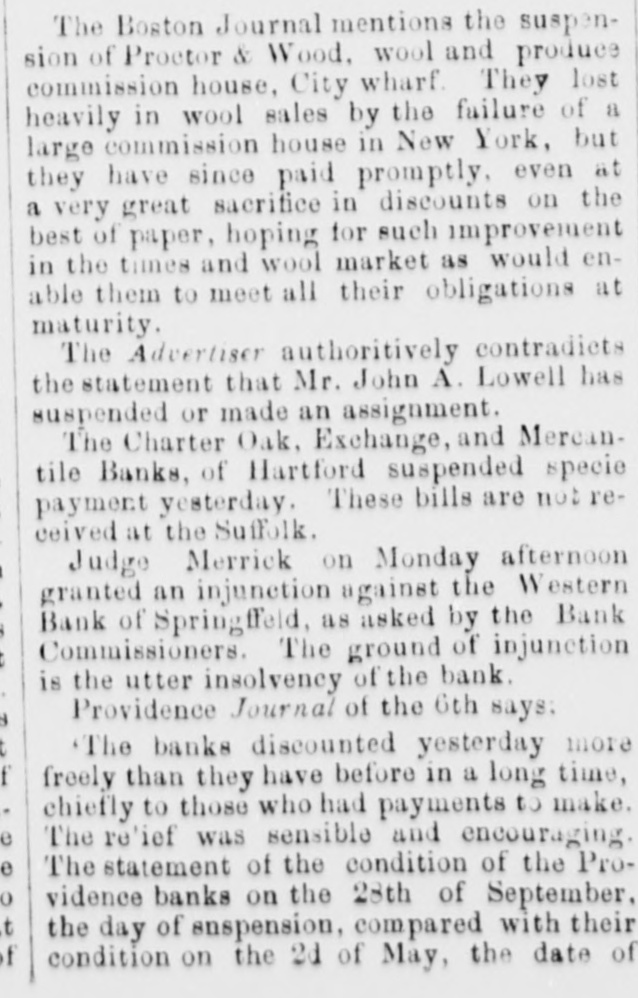

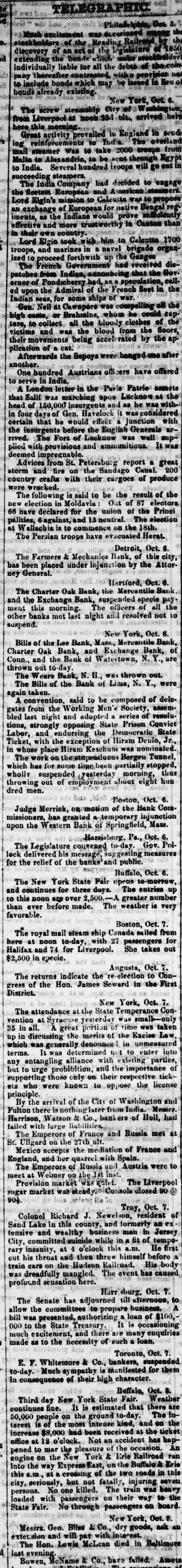

TELEGRAPHIC. 5. Philad liphing Un Much stockholders legislature discovery bonds the extending a individually liable for all the debts of the pany thereafter with provision use of include bonds which may be issued in He bonds alrea dy existing New York, Oct. 6. The screw unship City of from Liverpool noots:28-1 use. arrived here here morning this Great activity prevailed in zland in send ing. reinforce to India. The overland mail stramer Was 10 take 2000 troops from Malta to Alexandria, to be sent through Egy of to India. Several hundred iroops will go out in succeeding steamers. The India Company had decided to engag American and Europeas the fleetent Lord Elgin's mission to Calcutan was to propose exchange of European for native Bengal reg iments, as the Indiana would prove effective and more trustworthy is Cantos than in their own country. Lord Elgin took with him to Calentia 1700 troops, and marines in naral brigade organized to proceed forthwith up the Ganges received dishad Government French The patches from Indian. lag that the Gov ernor of Pondicherry ha called upon the Admiral of the French fleet in the Indian seas. for some ships of war. Gen. Neil at Cawnpere the high caste, or Brahmann, whom be could cap. ture, to collect all the bloody clothes of the victims and was the blood from the floors, their movements being accel rated by the ap plication of cat. Afterwards the Sapoys were hanged one after another. One hundred Austrians offi ers have offered to serve India. London letter in the Puris Patrie asserts that Salif was marching upon Lucknow at the head of 150,000 insurgents and as he was with. in four days of Gen. Havelock was considered certain that he would effect junction with the insurgents before the English General arrived. The Fort of Lucknow was well supplied with provisions and ammu mitious. It was deemed impregnable Advices from St. Petersburg report a great storm and fire on the Sandago Canal. 200 country crafts with their rgoes of produce recked. The following is said to be the result of the new election in Moldavi Out of 87 electors 66 have declared for the union of the Princi palities, against, a neutral. The election at Wallachia is to commence on the 18th. The Persian troops have evacuated Herat. Detroit, Oct. 6. The Farmers & Mechanics Bank, of this city. has been placed under in junction by the Attor ney General Hartford, Oct. 6 The Charter Oak Bank, the Mercantile Bauk and the Exchange Bank, suspended specie pay ment this morning The officers of all the other banks met last night and resolved not to suspend. New York, Oct. 6 Bills of the Lee Bank, Mass, Mercantile Bank Charter Oak Bank, and Exchange Bank, of Conn., and the Bank of W atertown, N.Y. are thrown out to day The Weare Bank N. H. was thrown out. The Bills of the Bank of Lima, N.Y., were again taken. convention, said to be composed of dele gates from the Working Men's Society, assem bled last night and adopte series of resolutions, strongly opposing State Prison Convic Labor, and endorsing the Democratic State Ticket, with the exception of Hiram Denio, Jr in whose place Hiram Ketchum was nominated The work on the sto pendioous Bergeu Tunnel which has for some time been partially stopped, wholly suspended yesterday morning, thus throwing out of employment about eight hun dred men. 6. Oct. Boston, Judge Merrick, on motion of the Bank Com missioners, has granted temporary injunction upon the Western Bank of Sp ringfield, Mase. Harrisburg, Pa Oct. 6. The Legislature courened to-day. Gov. Polmeasures lock delivered his message suggesting for the relief of the banks and public. Buffalo, Oct. 6. opens to-morrow The New York State Pair The entries up and continues for three days. greater number to this noon are over 2.500.than ever before made. The weather very favorable. Boston, Oct. 7 The royal mail steam ship Canada sailed from here at noon to-day, with 27 passengers for She takes out Halifax and 74 for Liverpool. $2,500 in specie. Augusta, Oct. 7 The returns in ddicate the re election to Congress of the Hon. James Seward in the First District. 7. Oct. New York, The attendance at the State Temperance Con vention small only 35 in all. great portion of time was taken up in discussing the merits of the Excise Low which was generally denounce in unmeasured to into enter It determined was terms any entangling alliance with existing parties but to urge prohibition, and the importance of supporting those only on their respective tick ets who were known to oppose the license principle. By the arrival of the City of Wash ington and Fulton there nothing later from India. Messra Harrison. Watson & Co., bank ers of Hull, had with failed large The Emperors of France and Russia met at ult the 27th St Ullgard Mexico accepts the mediation of France and England, and with Spain. The Emperors of Russia Austria were to Weimer on note The Liverpool Provision market sugar market was steady Consols closed 90 @ 901 Troy, Oct. 7 Colonel Richard J. Newelson, resident of Sand Lake in this county, and formerly an ex tensive and wealthy business man in Jersey City, committed suicide while in a fit of tempo rary insanity, at 4 o'clock this a.m. He first cut his throat and then threw himself before train cars on the Hudson Railroad. His body caused has event was dreadfully mangled. The profound sensation here. Harr burg. Oct. T to The Senate has adjourned till afternoon A allow the committees to propar business. bill was presented, authorizing a loan of $100, It occasioning 000 to the State Treasur much excitement, and there many enquiries made as to the necessity of such loan. Toronto, Oct. 7 E. Whitemore & Co., bankers, to-day Much BY mpathy manifested for them in consequence of their high character. 8. Oct. Buffalo, Third day New York State Fair. eather continues fine. It is estimated that there are 50,000 people on the ground to-day. The interest is of the most intease kind, and on the $8,000 had been received at the ticket office at 12 o'clock. Not an accident has hap the occasion. mar the to pened engine on the New York & Erie Railroad ran into the way Express East, the Buffalo & Erie this at crossing of the two in this city, seriously, but not fatally injuring seven persons. No one killed. The train was heavy loaded with passengers on their way to the State Fair. No through passengers on board. New York, Oct. 8. Messrs. Geo. Blies & Co., dry goods, ask an extension and will par with interest. The Hon. Le wis McLean died in Baltime a last evening. Bowen, Name & Co. hare failed. Amets