Article Text

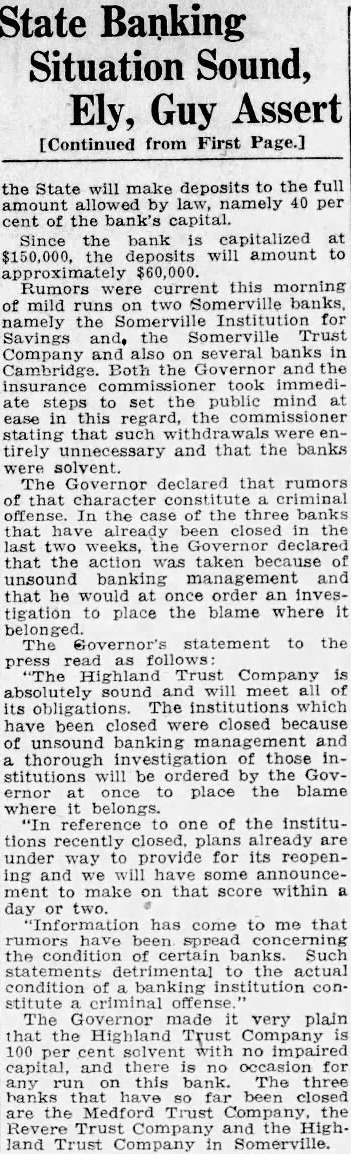

State Banking Situation Sound, Ely, Guy Assert [Continued from First Page.] the State will make deposits to the full by namely 40 per cent of the bank's Since the bank capitalized deposits will amount approximately $60,000. Rumors current this morning of mild runs two banks namely the Somerville Institution for Savings the Somerville Trust and, Company also on several banks in Cambridge. Both the and the insurance commissioner took ate steps set the public mind in the stating that such tirely unnecessary and that the banks were solvent. The Governor declared that rumors that character criminal offense. In the case of the three banks that have been closed the weeks, that the action taken because banking and that he would at order an investigation to place the blame where belonged. The statement to the press read as "The Highland Trust Company absolutely sound meet of its The which been closed closed because of unsound banking and thorough investigation of those institutions be ordered by the Governor at once to place the blame where belongs. reference to one of the institutions recently closed. plans already are under way to provide for its reopening and have some announcemake on that within day or two. has come to me that the condition certain banks. Such statements detrimental the actual condition banking institution constitute criminal offense The Governor made it very plain that the Highland Trust Company 100 cent with no and there for any this bank. The three banks have been closed are the Medford Trust Company, the Trust Company the Highland Trust Company in Somerville