Article Text

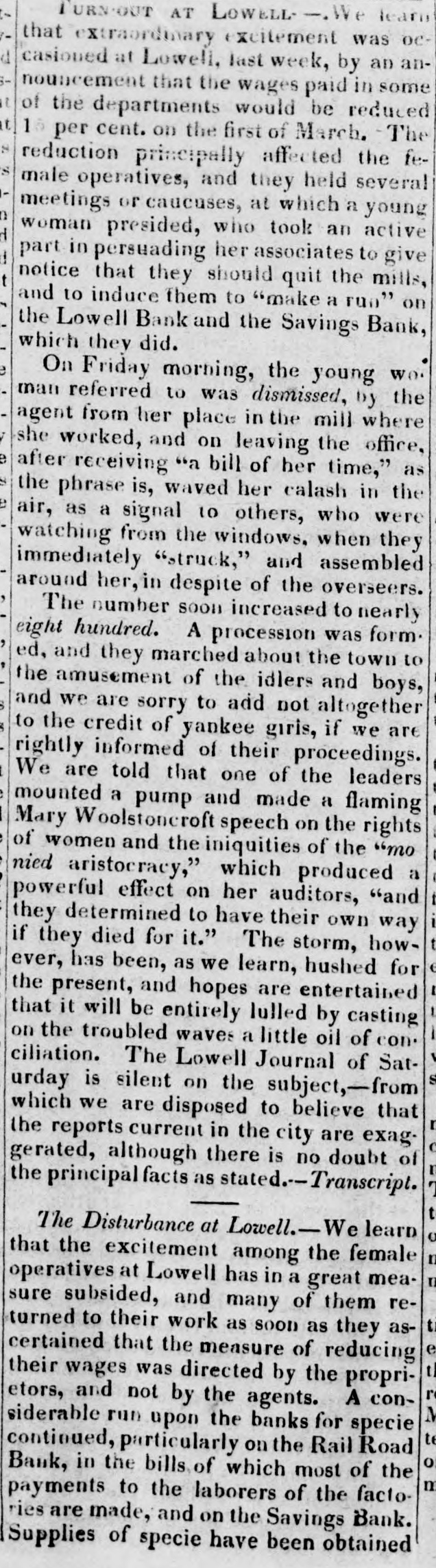

TURN-OUT AT LOWELL- We that extraordinary , xcitement was OCcasioued at Lowell, last week, by an announcement that the wages paid in some of the departments would be reduced per cent. on the first of March. The reduction principally affected the female operatives, and they held several meetings or caucuses, at which a young woman presided, who took an active part in persuading her associates to give notice that they should quit the mills, and to induce them to "make a run" on the Lowell Bank and the Savings Bank, which they did. On Friday morning, the young WO. man referred to was dismissed, by the agent from her place in the mill where she worked, and on leaving the office, after receiving "a bill of her time," as the phrase is, waved her calash in the air, as a signal to others, who were watching from the windows. when they immediately "struck," and assembled around her, in despite of the overseers. The number soon increased to nearly eight hundred. A procession was form. ed, and they marched about the town to the amusement of the idlers and boys, and we are sorry to add not altogether to the credit of yankee giris, if we are rightly informed of their proceedings. We are told that one of the leaders mounted a pump and made a flaming Mary Woolstoncroft speech on the rights of women and the iniquities of the "mo nied aristocracy," which produced powerful effect on her auditors, "and they determined to have their own way if they died for it." The storm, however, has been, as we learn, hushed for the present, and hopes are entertained that it will be entirely lulled by casting on the troubled waves a little oil of con. ciliation. The Lowell Journal of Saturday is silent on the subject,-from which we are disposed to believe that the reports current in the city are exaggerated, although there is no doubt of the principal facts as stated.-Transcript. The Disturbance at Lowell.-We learn that the excitement among the female operatives at Lowell has in a great measure subsided, and many of them returned to their work as soon as they ascertained that the measure of reducing their wages was directed by the proprietors, and not by the agents. A considerable run upon the banks for specie continued, particularly on the Rail Road Bank, in the bills of which most of the payments to the laborers of the factories are made, and on the Savings Bank. Supplies of specie have been obtained