Article Text

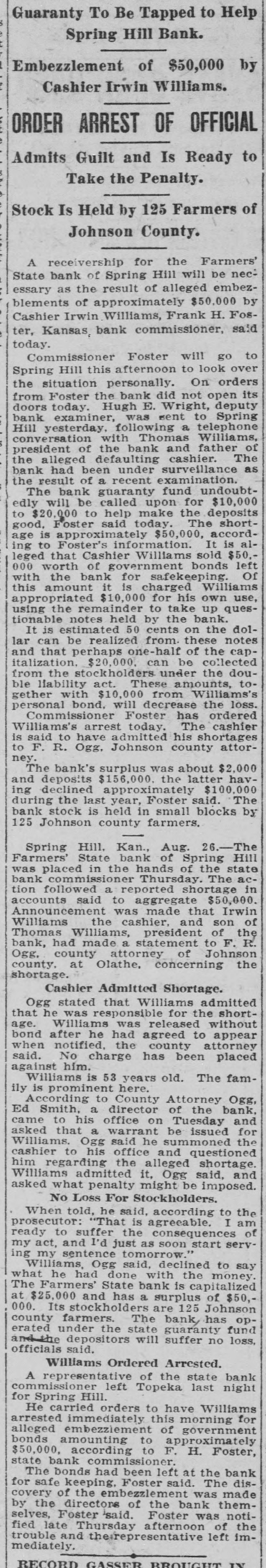

Guaranty To Be Tapped to Help Spring Hill Bank. Embezzlement of $50,000 by Cashier Irwin Williams. ORDER ARREST OF OFFICIAL Admits Guilt and Is Ready to Take the Penalty. Stock Is Held by 125 Farmers of Johnson County. A receivership for the Farmers' of Hill will State bank Spring be necessary as the result of alleged embezblements of approximately $50,000 by Cashier Irwin Williams, Frank H. Foster, Kansas, bank commissioner, said today. Commissioner Foster will Hill look go to Spring this afternoon to over the situation personally. On orders the bank did not Hugh E. from bank doors Foster today. Wright, open deputy its examiner, was sent to Spring Hill yesterday, following a telephone conversation with Thomas Williams, president of the bank and father of the alleged defaulting cashier. The bank had been under surveillance as the result of a recent examination. The bank guaranty fund undoubtedly will be called upon for $10,000 to $20,000 to help make the deposits good, Foster said today. The shortage is approximately $50,000, according to Foster's information. It is alleged that Cashier Williams sold $50.000 worth of government bonds left with the bank for safekeeping Of this amount it is charged Williams appropriated $10,000 for his own use, using the remainder to take up questionable notes held by the bank. It is estimated 50 cents on the dollar can be realized from these notes and that perhaps one-half of the capitalization, $20,000. can be collected from the stockholders under the double liability act. These amounts, together with $10,000 from Williams's personal bond, will decrease Foster arrest today. The Williams's Commissioner has the ordered cashier loss. to have admitted his Ogg, Johnson to is said F. R. county shortages attorney. The bank's surplus was about $156,000. the and ing declined deposits latter $2,000 havapproximately $100,000 last year, is held in small by during bank stock the Foster said. blocks The 125 Johnson county farmers, Kan., Farmers' Spring Hill. Aug. 26.-The State bank of Spring Hill was placed in the hands of the state bank commissioner Thursday. The action followed a reported shortage in accounts said to aggregate $50,000. Announcement was made that Irwin Williams the cashier. and Williams, made a Thomas Ogg. bank, had statement president to of son F.R. the of county attorney of Johnson county. at Olathe, concerning the shortage. Cashier Admitted Shortage. Ogg stated that Williams admitted that he was responsible for the shortage. was released he had agreed to bond when after Williams notified, without appear the county attorney said. No charge has been placed against him. Williams is 53 years old. The family to County According is prominent here. Attorney Ogg, Ed Smith, a director of came his office on a warrant be asked to that Tuesday issued the bank. and for Ogg said he to his office and the cashier Williams him Williams. regarding alleged summoned questioned shortage. the admitted it, Ogg said, and asked what penalty might be imposed. No Loss For Stockholders. When told, he said, according to the prosecutor: "That is agreeable. I am ready to suffer the consequences of servmy act, and I'd just as soon start ing my sentence tomorrow.' Williams, Ogg said, declined to say what he had done with the money The Farmers' State bank is capitalized at $25,000 and has a surplus of stockholders are 125 The has county 000. erated Its under farmers. bank Johnson $50,- opthe state guaranty fund and the depositors will suffer no loss, officials said. Williams Ordered Arrested. A representative of the state bank commissioner left Topeka last night for Spring Hill. He carried orders to have Williams arrested immediately this morning for alleged embezziement of government bonds amounting to approximately $50,000. according to F. H. Foster, state bank commissioner. The bonds had been left at the bank for safe keeping, Foster said. The discovery of the embezzlement was made by the directors of the bank themselves, Foster said. Foster was notified late Thursday afternoon of the trouble and the/representative left immediately. RECORD GASSER BROUGHT IV