Article Text

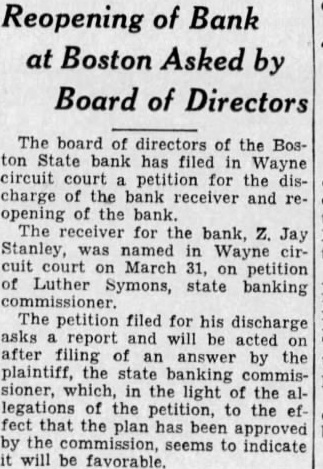

Reopening of Bank at Boston Asked by Board of Directors The board directors the Boston State bank filed circuit court petition for the charge bank receiver and opening the The for the bank, was named Wayne cuit March petition Luther Symons, state banking The petition filed for his discharge report and be acted after filing answer the state banking sioner, which, the light the legations the petition, fect that the plan has been approved the commission, seems indicate will favorable.