Article Text

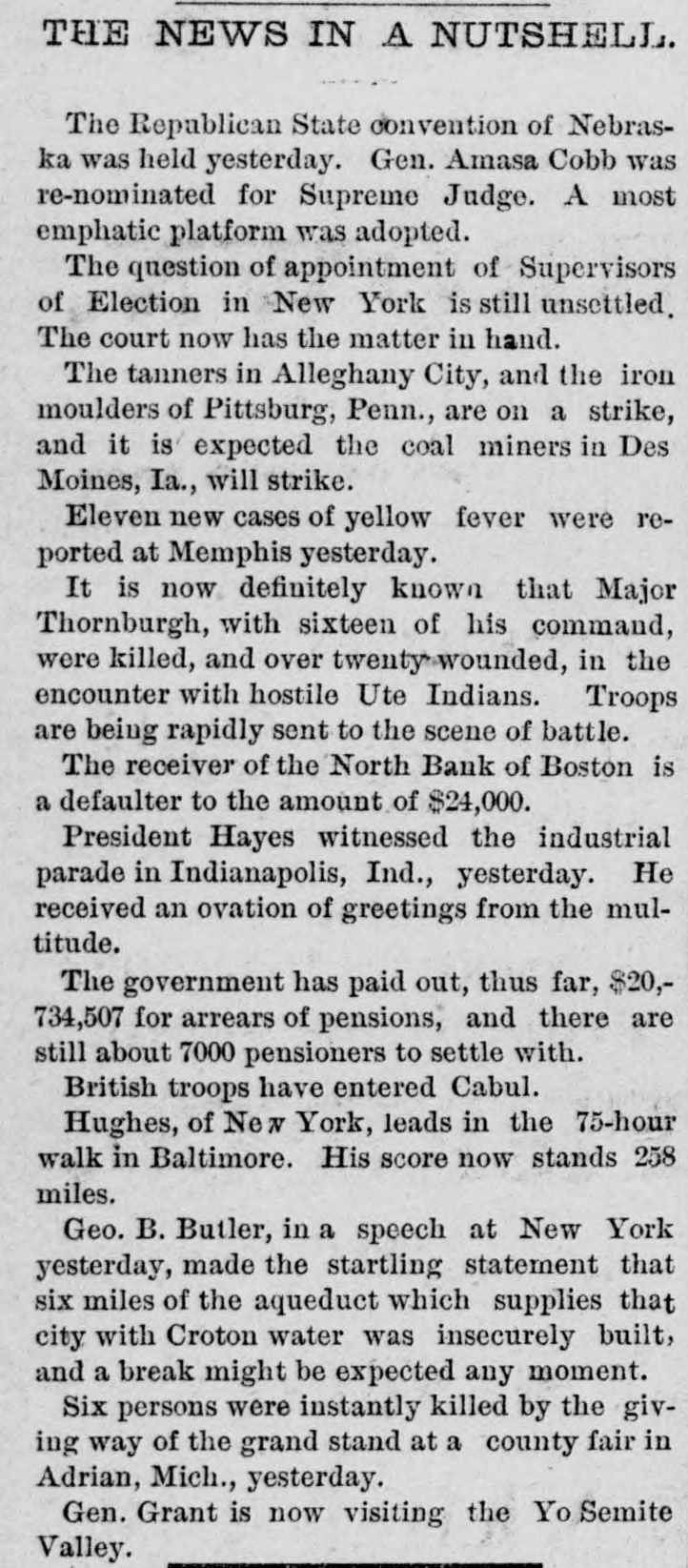

THE NEWS IN A NUTSHELL. The Republican State convention of Nebraska was held yesterday. Gen. Amasa Cobb was re-nominated for Supreme Judge. A most emphatic platform was adopted. The question of appointment of Supervisors of Election in New York is still unsettled. The court now has the matter in hand. The tanners in Alleghany City, and the iron moulders of Pittsburg, Penn., are on a strike, and it is expected the coal miners in Des Moines, Ia., will strike. Eleven new cases of yellow fever were reported at Memphis yesterday. It is now definitely known that Major Thornburgh, with sixteen of his command, were killed, and over twenty wounded, in the encounter with hostile Ute Indians. Troops are being rapidly sent to the scene of battle. The receiver of the North Bank of Boston is a defaulter to the amount of $24,000. President Hayes witnessed the industrial parade in Indianapolis, Ind., yesterday. He received an ovation of greetings from the multitude. The government has paid out, thus far, $20,734,507 for arrears of pensions, and there are still about 7000 pensioners to settle with. British troops have entered Cabul. Hughes, of New York, leads in the 75-hour walk in Baltimore. His score now stands 258 miles. Geo. B. Butler, in a speech at New York yesterday, made the startling statement that six miles of the aqueduct which supplies that city with Croton water was insecurely built, and a break might be expected any moment. Six persons were instantly killed by the giving way of the grand stand at a county fair in Adrian, Mich., yesterday. Gen. Grant is now visiting the Yo Semite Valley.