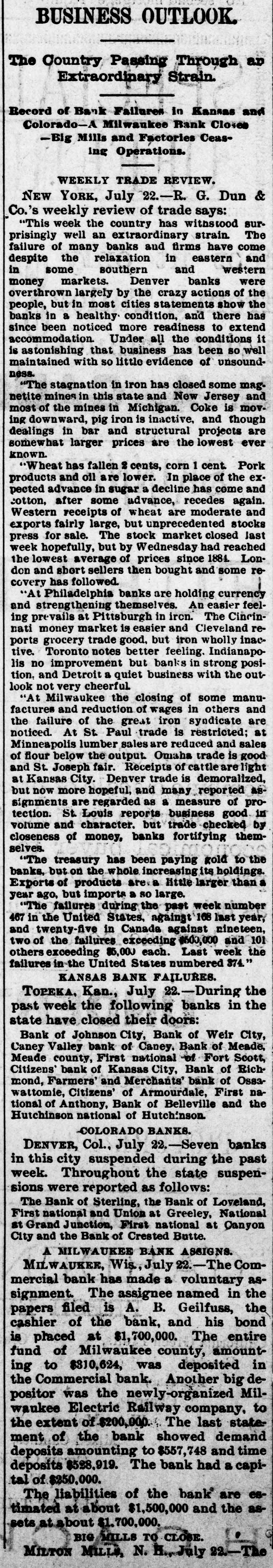

Article Text

PANIC ON IN DENVER. Four More Banks Close Their Doors To-Day. Runs Started on All the ClearingHouse Institutions. several Kansas Banks Go Down. with One in Ada. Ohio. DENVER, Col., July 18.-The Union National Bank, of which R. W. Woodbury is President, failed to open its doors this morning. The capital is $1,000,000. No statement can be had. A run is now being made on the City National, German National, First National. Colorado National and all the Clearing-House banks. The panic is on. LATER.-The Commercial National Bank has closed its doors. A notice says: "This bank has gone into liquidation by order of the Board of Directors." The National Bank of Commerce has also closed. Ex-Gov. Job A. Cooper is President of this bank. The Mercantile Bank. a private institution with a capital stock of $100,000, closed its doors at noon. The failure was caused by the failure of the Union National Bank, through which it cleared. C. C. Girda, the City Auditor, is President. W. F. Robinson formerly Treasurer of the Republican Publishing Company. one of the oldest and most respected individuals in the State, has been made assignee. President Woodbury is of the opinion that the Union National Bank will reopen and continue business as before. It is one of the oldest banks in Denver, and has always been regarded as one of its solid ones. The failure of the Chamberlin Investment Company a few days ago affected the Union National, the Company having become indebted to the bank about $50,000. The Commercial National Bank was in bad shape. It has a capital stock of $250,000. and only had $2,000 in cash in the bank. TOLEDO, July 18.-The Citizens' Bank of Ada, O., the most prominent one in Hardin County, failed to open its doors this morning. Its owner, Peter Ahifield, has controlled it for over a quarter of a century, and is one of the wealthiest men of that section. No statement of assets and liabilities, or the cause of failure, can be obtained. FORT SCOTT, Kan. July 18.-The First National Bank, of this city, the oldest financial institution in Southeastern Kansas, has suspended payment. TOPEKA. Kan., July 18.-State Bank Examiner Breidenthal this morning received notice of the failures of the Citizens' Bank, of Kansas City, Kan., of the Bank of Richmond and of the Farmers and Merchants' Bank. at Ossawattomie. The concerns all did a small business. Statements are unobtainable. The opinion is expressed that other institutions throughout the State will soon go under. The Denver bank failures reported above are in addition to the three reported in the same city yesterday, which were as follows: People's Savings Bank: assets, $1,125,667.55; liabilities, $966,996.88 Colora do Savings Bank: assets over liabilities, $73,063.62. Rocky Mountain Dime and Savings Bank: assets, $156,803.53; liabilities. $105, 654.32. The seriousness of the situation is quite evident from the collapse of all f these institutions.