Article Text

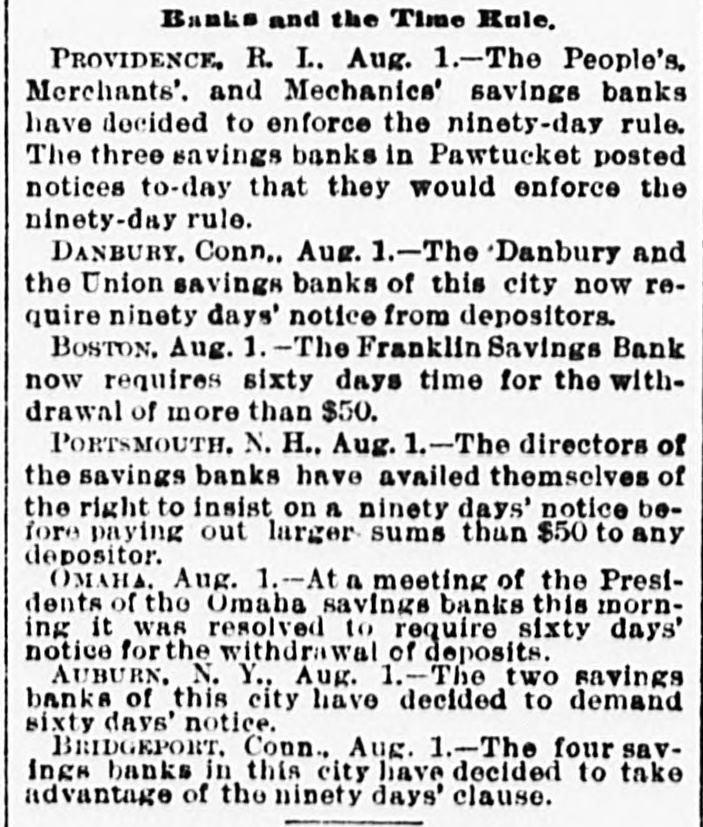

Banks and the Time Rule, PROVIDENCE, R. L. Aug. 1.-The People's. Merchants'. and Mechanics' savings banks have decided to enforce the ninety-day rule. The three savings banks in Pawtucket posted notices to-day that they would enforce the ninety-day rule. DANBURY. Conn.. Aug. 1.-The Danbury and the Union savings banks of this city now require ninety days' notice from depositors. BOSTON, Aug. 1.-The Franklin Savings Bank now requires sixty days time for the withdrawal of more than $50. PORTSMOUTH. N. H.. Aug. 1.-The directors of the savings banks have availed themselves of the right to insist on a ninety days' notice before paying out larger sums than $50 to any depositor. OMAHA. Aug. 1.-At a meeting of the Presidents of the Omaha savings banks this morning it was resolved to require sixty days' notice for the withdrawal of deposits. AUBURN. N. Y., Aug. 1.-The two savings banks of this city have decided to demand sixty days' notice. BRIDGEPORT. Conn., Aug. 1.-The four savings banks in this city have decided to take advantage of the ninety days' clause.