1.

December 11, 1925

The Coconino Sun

Flagstaff, AZ

Click image to open full size in new tab

Article Text

H. R. WOOD RECEIVER FOR BANK OF JEROME Homer R. Wood, state fair commissioner and recently named to membership on the state industrial commission, has been appointed by Governor Hunt as receiver for the Bank of Jerome. He has accepted the appointment, he stated, and will begin his duties soon.

2.

January 8, 1926

The Winslow Mail

Winslow, AZ

Click image to open full size in new tab

Article Text

FIVE ARRESTS MADE IN BANK FAILURES OF AVAPAI CO. Felony warrants have been issued in Jerome in behalf of A. T. Hammons, state superintendent of banks, for the arrest of Paul H. Deming, cashier of the defunct Bank of Jerome, Ross and Earl Foreman, John A. Johnson, theatre owner, and A. E. Weidman, Jerome broker, who are charged with violations of the criminal part of the state banking code. Three felony charges already have been issued and other are expected to be issued. Weidman and Johnson were apprehended, but were released on bonds aggregating $6,700. Deming and the two Foremans, one assistant cashier and the other clerk in the closed bank, left immediately following the failure of the bank for California. The issuance of the warrants and the arrests are the first actions taken by the bank receiver since he ordered an audit of the affairs of the institution. Juggling of the bank's funds and making a number of false entries on the day the bank closed is said to be the reason for issuance of the warrants. A grand jury investigation of the bank business has been asked by members of the Jerome and Clarkdale posts of the American Legion. Under a writ of attachment issued by the receiver the sheriff's office took over the Golden Rule store in Jerome, the property of Peter Gordon and John D. Johnson, pending the payment of a note for several thousand dollars due the bank.

3.

January 15, 1926

The Coconino Sun

Flagstaff, AZ

Click image to open full size in new tab

Article Text

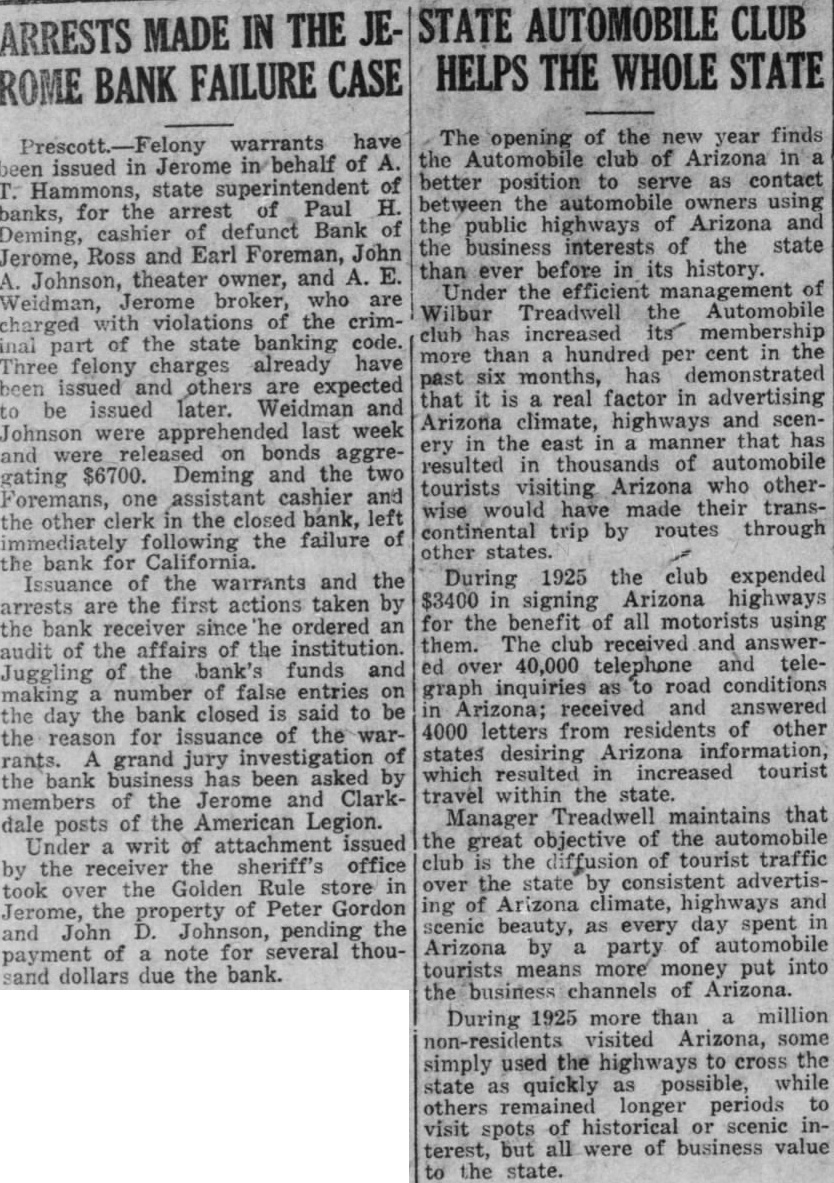

ARRESTS MADE IN THE JEROME BANK FAILURE CASE Prescott.-Felony warrants have been issued in Jerome in behalf of A. T. Hammons, state superintendent of banks, for the arrest of Paul H. Deming, cashier of defunct Bank of Jerome, Ross and Earl Foreman, John A. Johnson, theater owner, and A. E. Weidman, Jerome broker, who are charged with violations of the criminal part of the state banking code. Three felony charges already have been issued and others are expected to be issued later. Weidman and Johnson were apprehended last week and were released on bonds aggregating $6700. Deming and the two Foremans, one assistant cashier and the other clerk in the closed bank, left immediately following the failure of the bank for California. Issuance of the warrants and the arrests are the first actions taken by the bank receiver since 'he ordered an audit of the affairs of the institution. Juggling of the bank's funds and making a number of false entries on the day the bank closed is said to be the reason for issuance of the warrants. A grand jury investigation of the bank business has been asked by members of the Jerome and Clarkdale posts of the American Legion. Under a writ of attachment issued by the receiver the sheriff's office took over the Golden Rule store in Jerome, the property of Peter Gordon and John D. Johnson, pending the payment of a note for several thousand dollars due the bank.

4.

January 15, 1926

The Coconino Sun

Flagstaff, AZ

Click image to open full size in new tab

Article Text

JEROME BANK CASHIER GIVES HIMSELF UP

Paul H. Deming, cashier of the funct Bank of Jerome has been sought vain throughout southern California since last Thursday, when three warrants for arrest filed by Receiver Homer Wood, himself the sheriff's office Tuesday afternoon, returning from the coast on the 1:45 o'clock train. At the time his surrender to the officers, Weil Los Angeles acting in cooperation with the police of in search for turn within day bringing with him Earl and Ross Foreman, officers of the Jerome bank, are wanted on the same charges.

5.

January 15, 1926

The Coconino Sun

Flagstaff, AZ

Click image to open full size in new tab

Article Text

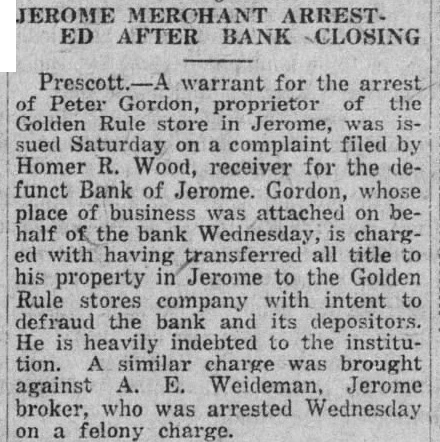

JEROME MERCHANT ARRESTED AFTER BANK CLOSING warrant for the arrest Peter Gordon, proprietor Golden Rule Jerome, sued on filed Homer R. Wood, receiver for the funct Bank of Jerome. Gordon, whose place of was attached on half the bank Wednesday, chargwith having transferred all title his property Jerome to the Golden Rule stores company with intent defraud the bank and its depositors. He heavily indebted to the institution. similar charge was brought against A. Weideman, Jerome broker, who was arrested Wednesday on felony charge.

6.

January 15, 1926

The Coconino Sun

Flagstaff, AZ

Click image to open full size in new tab

Article Text

JE- STATE AUTOMOBILE CLUB MADE IN THE ARRESTS HELPS THE WHOLE STATE ROME BANK FAILURE CASE warrants have been issued in Jerome in/behalf of A. T. Hammons, state superintendent of banks, for the arrest of Paul H. Deming, cashier of defunct Bank of Jerome, Ross and Earl Foreman, John A. Johnson, theater owner, and A. E. Weidman, Jerome broker, who are charged with violations of the criminal part of the state banking code. Three felony charges already have been issued and others are expected to be issued later. Weidman and Johnson were apprehended last week and were released on bonds aggregating $6700. Deming and the two Foremans, one assistant cashier and the other clerk in the closed bank, left immediately following the failure of the bank for California. Issuance of the warrants and the arrests are the first actions taken by the bank receiver since he ordered an audit of the affairs of the institution. Juggling of the bank's funds and making number of false entries on the day the bank closed is said to be the reason for issuance of the warrants. A grand jury investigation of the bank business has been asked by members of the Jerome and Clarkdale posts of the American Legion. Under a writ of attachment issued by the receiver the sheriff's office took over the Golden Rule store in Jerome, the property of Peter Gordon and John D. Johnson, pending the payment of a note for several thousand dollars due the bank.

The opening of the new year finds the Automobile club of Arizona in a better position to serve as contact between the automobile owners using the public highways of Arizona and the business interests of the state than ever before in its history. Under the efficient of Wilbur Treadwell the Automobile club has increased its membership more than hundred per cent in the past six months, has demonstrated that it is a real factor in advertising Arizona climate, highways and scenery in the east in a manner that has resulted in thousands of automobile tourists visiting Arizona who otherwise would have made their transcontinental trip by routes through other states. During 1925 the club expended $3400 in signing Arizona highways for the benefit of all motorists using them. The club received and answered over 40,000 telephone and telegraph inquiries as to road conditions in Arizona; received and answered 4000 letters from residents of other states desiring Arizona information, which resulted in increased tourist travel within the state Manager Treadwell maintains that the great objective of the automobile club is the diffusion of tourist traffic over the state by consistent advertising of Arizona climate, highways and scenic beauty, as every day spent in Arizona by a party of automobile tourists means more money put into the business channels of Arizona. During 1925 more than a million non-residents visited Arizona, some simply used the highways to cross the state as quickly as possible, while others remained longer periods to visit spots of historical or scenic interest, but all were of business value to the state.

7.

January 22, 1926

The Coconino Sun

Flagstaff, AZ

Click image to open full size in new tab

Article Text

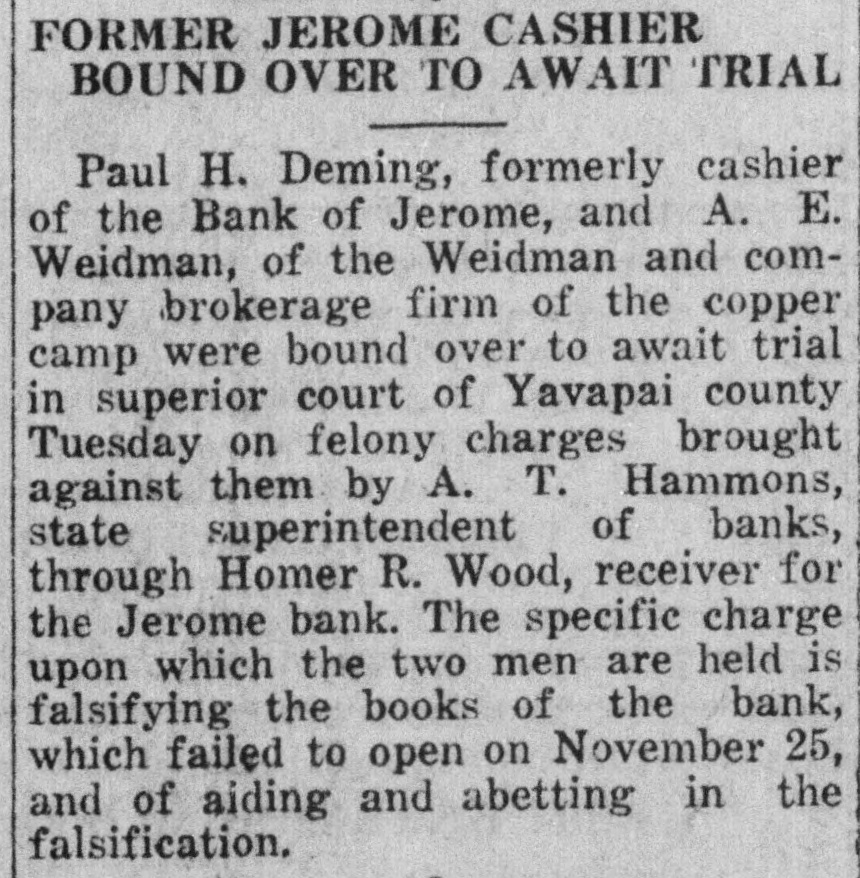

FORMER JEROME CASHIER BOUND OVER TO AWAIT TRIAL Paul H. Deming, formerly cashier of the Bank of Jerome, and A. E. Weidman, of the Weidman and company brokerage firm of the copper camp were bound over to await trial in superior court of Yavapai county Tuesday on felony charges brought against them by A. T. Hammons, state superintendent of banks, through Homer R. Wood, receiver for the Jerome bank. The specific charge upon which the two men are held is falsifying the books of the bank, which failed to open on November 25, and of aiding and abetting in the falsification.

8.

January 22, 1926

Douglas Daily Dispatch

Douglas, AZ

Click image to open full size in new tab

Article Text

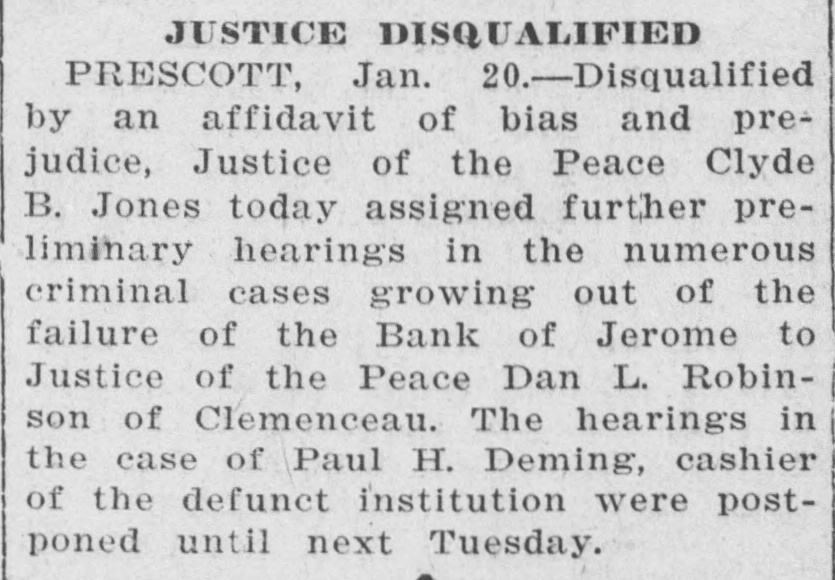

JUSTICE DISQUALIFIED PRESCOTT, Jan. 20.-Disqualified by an affidavit of bias and prejudice, Justice of the Peace Clyde B. Jones today assigned further preliminary hearings in the numerous criminal cases growing out of the failure of the Bank of Jerome to Justice of the Peace Dan L. Robinson of Clemenceau. The hearings in the case of Paul H. Deming, cashier of the defunct institution were postponed until next Tuesday.

9.

February 19, 1926

The Coconino Sun

Flagstaff, AZ

Click image to open full size in new tab

Article Text

PRESCOTT STATE BANK MAY STAND BIG LOSS The Prescott State bank, which failed to open its doors on November 25 of last year, faces a loss of $633,113.74, this figure being the most optimistic that possibly could be given, according to Receiver Homer R. Wood who took the stand in the superior court at Prescott Saturday when his petition to collect their liability on bank stock against the stockholders in the institution was heard. This figure, according to A. T. Hammons, state superintendent of banks, is far too optimistic, however, and the loss which the depositors and stockholders of the closed bank will face when the final reckoning is held will be closer to a million dollars, he has reported to Mr. Wood. Mr. Hammons' estimate of the bank affairs is that it would take that amount to put the bank on a going basis. Following the hearing of the petition, held before Judge Richard Lamson of division two of the superior court, an order was entered granting the petition. As the result, the receiver will make a demand upon the stockholders in the bank for the payment of their liability of the $100 par value of each share, which would net the bank $100,000. Should the stockholders fail to meet the demand of the receiver, suits will be instituted for the collection of the liability, according to Judge John A. Ellis, attorney for the receiver in connection with the affairs of the Prescott State bank. Some few of the stockholders already have met their liability Judge Ellis said Saturday, and little difficulty in collecting from the rest of them is anticipated. Only one of the stockholders in the Bank of Jerome, which was closed on the same day, has paid. A dividend on their deposits in the closed bank will be paid the depositors as soon after the first of May, when all the claims will have been filed, as is possible, the attorney said.

10.

April 17, 1926

Arizona State Miner

Wickenburg, AZ

Click image to open full size in new tab

Article Text

Interesting Happenings All Over the State LIABILITY STOCKHOLDER PAYS HIGHLINE PROJECT DISCUSSED IN TALKS BY MANY SPEAKERS ON HIS STOCK One of the most substantial paySaturday was a banner day for ments yet received on stockholders' members of the High Line Reclamaaccounts in the defunct Prescott State tion Association and their guests. bank and Bank of Jerome, was made The program of entertainment started at 10 o'clock in the morning and when T. G. Norris placed $12,500 in the hands of the receiver and arclosed late at night, following the annual ball. ranged to add a further sum on May The entertainment began with the 1 that would wipe out his obligations showing of the picture of La Rue's arising from ownership of stock. exploration of the Grand Canyon and Quite a number now have made remittances of the amounts recoverable. the Colorado River, accompanied by on stockholders' accounts, but in some Col. Birdseye. Senator Fred Colter, president of the association, gave a remaining cases, the decision of the court in a lawsuit will be necessary lecture, during the showing of the to exact the law's requirements. It picture, which took the audience, step is indicated that the principle of by step over the route covered by the stockholder liability will be carried expedition, The Columbia Theater was turned over to the visitors for clear to the supreme court in an effort to overthrow the law as it is this purpose. Several speakers, including Senasought to be applied to the Prescott tor Weatherford, discussed the progroup of banks on the theory that institutions chartered before the posed project. The crowd adjourned statute was enacted and even before at noon to the State Armory, where luncheon was served. the state constitution under which the law was passed cannot be held A vaudeville program was given in the same class with later banks. following the luncheon. It was diIt is to hold property in statu quo rected by Thomas Stuck, manager of the Hi Line Comedy company. The until these provisions can be determined that the receiver this week program was entertaining and was filed suit and attached real and perenjoyed by all. More vaudeville and speaking was sonal property of R. N. Fredericks, on the program for the evening. This president and principal stockholder in the Prescott State and the Bank performance started at 7:30 o'clock. of Jerome. Following the vaudeville numbers, the

11.

June 4, 1926

The Coconino Sun

Flagstaff, AZ

Click image to open full size in new tab

Article Text

PRESCOTT BANK WILL PAY FIRST DIVIDEND Approximately half a million dollars will be divided within the next few days among the 4,269 depositors in the three defunct banks of Yavapai county, according to orders entered in both divisions of the county superior court Wednesday morning when the petitions for permission to pay the dividends were presented by Homer R. Wood, ex-officio receiver for the three banks, through his attorneys. The largest dividend, which will reach a minimum of twenty-five cents on the dollar, will be paid in the Commercial Trust and Savings bank, while the Bank of Jerome will pay about a 20 per cent dividend. The Prescott State bank will pay only a trifle more than 15 cents.

12.

September 3, 1926

The Winslow Mail

Winslow, AZ

Click image to open full size in new tab

Article Text

What About Bank Failures. ? In a carefully worded letter E. A. Sawyer assails the State Banking Department for what he alleges to be non-enforcemnt of the State Banking Laws. E. A. Sawyer knew the officials of the Yavapai county banks to whom he referred, as well, or better, than the State Superintndent of Banks because he knew them longer. The people of Yavapai county had implicit confidence in the integrity of the bank officials. The Superintendent of Banks refleced the confidence of the community. The banks in Prescott and Jerome had frozen paper on some undetermined losses but when the Superintendent discovered the illegal status and fraudulent situation in the Bank of Jerome he closed all three banks. No Superintendent of Banks Can Protect Against Dishonesty Until it is Discovered Eight bankers have been convicted and are in the State Prison for violation of the Banking Laws. Mr. Sawyer says and repeats what has been said by the Ellinwood forces in this campaign: "That other states have had no bank failures because the laws are enforced." This statement is absolutely untrue. Only one state in the United States has been free from bank failures in the past two years. Over eleven hundrd banks-both State and National Banks-have failed in the United States in the past two years. The Hunt administration closed 13 banks. The depositors in four of these banks have been paid 100 cents on the dollar. Of the remaining 9 banks all but two will pay in excess of 50 cents on the dollar. At least two of these are expected to pay 100 cents on the dollar. The Governor recommended to the Legislature in 1923 and again in 1925 that the Banking Laws in the state be strengthened. The Legislature enacted no legislation. The Governor States: "If Elected Shall Again Recommend Banking Legislation and Will Sign Any Bill That Will Constructively Protect Bank Depositors" The criticism being hurled against the Governor because he did not close 26 of the 32 State Banks because of a technical provision of the law regarding excess loans, borders on lunacy. Would the people of Arizona prefer 26 gaunt wrecks in the hands of receivers, with bankrupt business houses and depositors' money lost, and the State plunged into bankruptcy, or the present condition, where 23 of the 26 banks affected are sound, safe, solvent banks today.

13.

March 25, 1927

The Coconino Sun

Flagstaff, AZ

Click image to open full size in new tab

Article Text

Prescott Man Gives His All to Defunct Banks An order entered by Judge Lamson of Prescott authorized Receiver H. R. Wood of the defunct banks to compromise two sets of claims of considerable moment in the liquidation of the institutions. Fred C. Brecht, one of the principal stockholders, by this order, has turned over all his*property, a considerable sum in cash and a complete release of further litigation in consideration of the discharge of his liability as a stockholder. The transfer of property and funds was evidently put through immediately after the order was made for a satisfaction of judgement was filed with the clerk of the court. Brecht was one of the pioneer citizens of the community and held considerable blocks of stock in the bank of Jerome and Commercial Trust. The settlement, while it does not produce the complete money value of the claim against Brecht, practically strips him of his holdings to satisfy the bank's claim. Moreover, he has agreed that in the event the stockholders' liability law is held invalid in its present form by appeal of other stockholders, who are fighting the bank claims, he will not seek reimbursement for his settlement. At the same time a hearing was held on a petition of Mr. Wood for authority to compromise the claim against J. E. Rudy, Mohave county rancher, who owes on notes, interest and overdrafts in the neighborhood of $$33,000. Rudy's ranch was permitted to be taken over with all its appurtenances, irons and stock in settlement of th claim. Carful management of the ranch until it can get on its feet is said to promise a greater return on the investment than could possibly be worked out under a foreclosure and forced sale.

14.

November 25, 1927

The Coconino Sun

Flagstaff, AZ

Click image to open full size in new tab

Article Text

PRESCOTT BANK MAY PAY IN FULL IS REPORT Under the receivership of Homer R. Wood affairs of the Commercial Trust & Savings bank are reported trending toward full repayments of the depositors and creditors, while something approaching a gross dividend of 75 percent is expected for the creditors of the Prescott State bank. Somewhat more involved are the affairs of the chain, the Bank of Jerome, from which a very small return may materialize. Paul Deming, who was cashier of the Jerome bank, returned from Pasadena, is to be tried, on change of venue, by a court in Phoenix, on a charge of receiving deposits for an insolvent institution.