Article Text

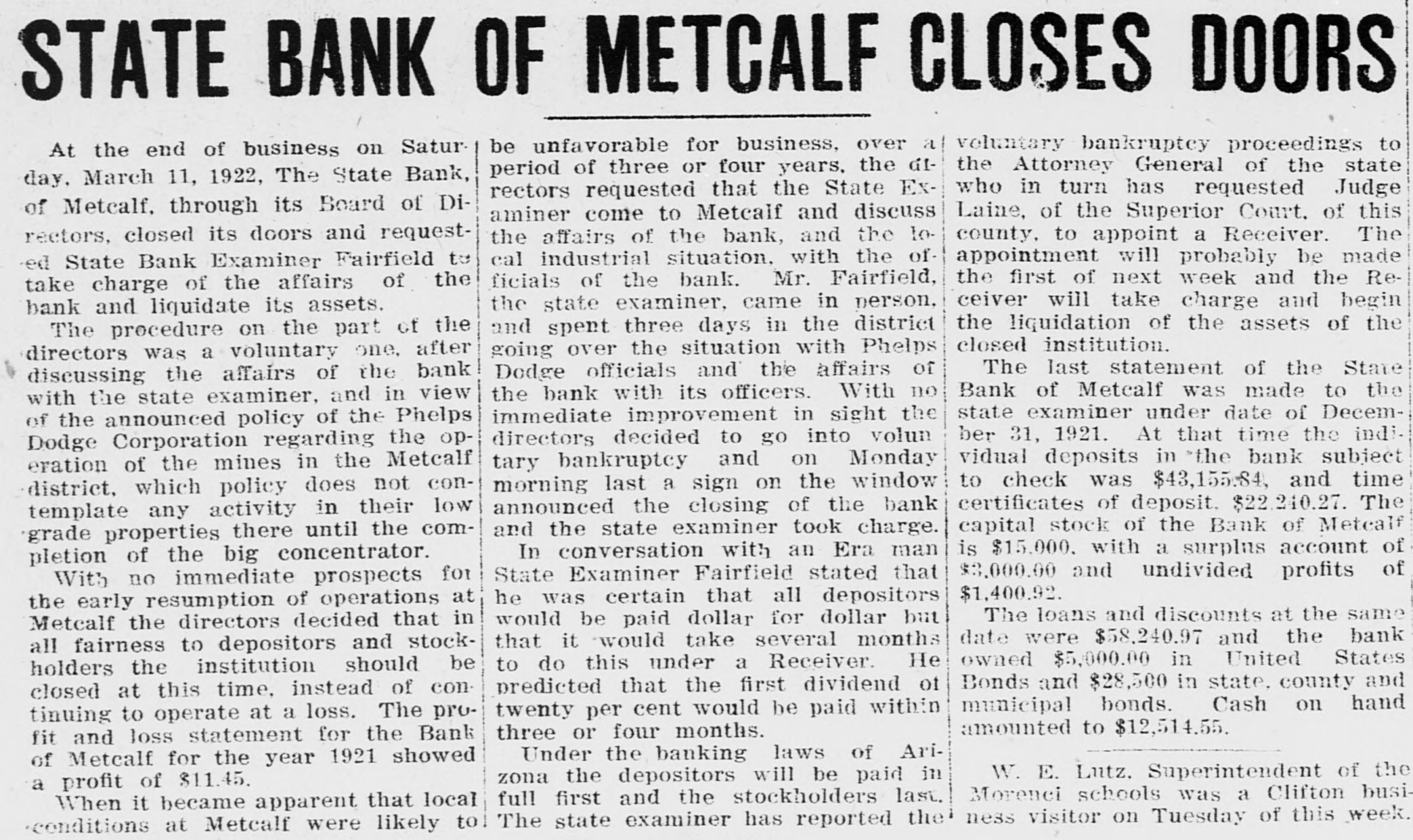

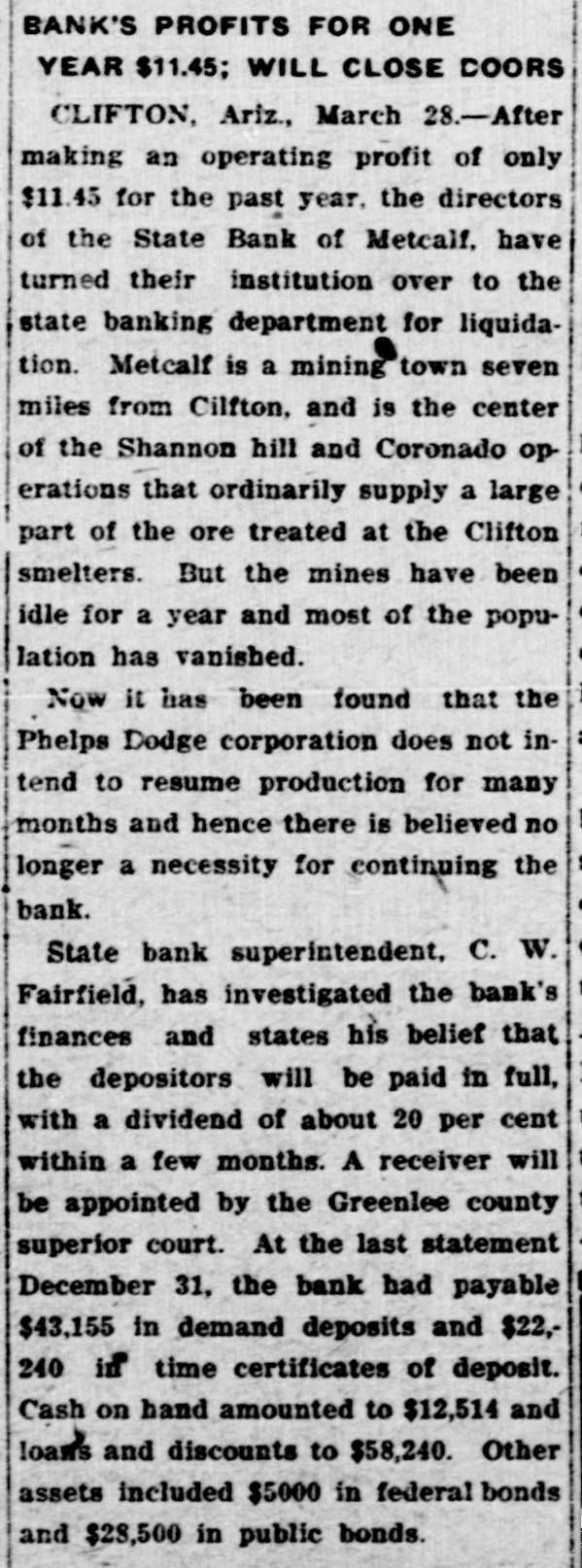

STATE BANK OF METCALF CLOSES DOORS be unfavorable for business, over a voluntary bankruptcy proceedings to At the end of business on Saturthe Attorney General of the state period of three or four years, the difday, March 11, 1922, The State Bank, who in turn has requested Judge rectors requested that the State Exof Metcalf, through its Board of DiLaine, of the Superior Court. of this aminer come to Metcalf and discuss county. to appoint a Receiver. The rectors, closed its doors and requestthe affairs of the bank, and the toappointment will probably be made cal industrial situation. with the of ed State Bank Examiner Fairfield to the first of next week and the Reficials of the bank. Mr. Fairfield, take charge of the affairs of the ceiver will take charge and begin the state examiner, came in person. bank and liquidate its assets. the liquidation of the assets of the and spent three days in the district The procedure on the part of the closed institution. going over the situation with Phelps directors was a voluntary one, after The last statement of the State Dodge officials and the affairs of discussing the affairs of the bank Bank of Metcalf was made to the the bank with its officers. With no with the state examiner, and in view state examiner under date of Decemimmediate improvement in sight the of the announced policy of the Phelps ber 31, 1921. At that time the indidirectors decided to go into volun Dodge Corporation regarding the opvidual deposits in the bank subject tary bankruptcy and on Monday eration of the mines in the Metcalf to check was $43,155.84, and time morning last a sign on the window district, which policy does not concertificates of deposit. $22,240.27. The announced the closing of the bank template any activity in their low capital stock of the Bank of Metcalf and the state examiner took charge. grade properties there until the comis $15,000. with a surplus account of In conversation with an Era man pletion of the big concentrator. $3,000.00 and undivided profits of State Examiner Fairfield stated that With no immediate prospects for $1,400.92. he was certain that all depositors the early resumption of operations at The loans and discounts at the same would be paid dollar for dollar but Metcalf the directors decided that in date were $58,240.97 and the bank that it would take several months all fairness to depositors and stockowned $5,000.00 in United States to do this under a Receiver. He holders the institution should be Bonds and $28,500 in state. county and predicted that the first dividend of closed at this time. instead of conmunicipal bonds. Cash on hand twenty per cent would be paid within tinuing to operate at a loss. The proamounted to $12,514.55. three or four months. fit and loss statement for the Bank Under the banking laws of Ariof Metcalf for the year 1921 showed W. E. Lutz. Superintendent of the zona the depositors will be paid in a profit of $11.45. Morenci schools was a Clifton busifull first and the stockholders last. When it became apparent, that local ness visitor on Tuesday of this week The state examiner has reported the conditions at Metcalf were likely to